Meta Platforms Inc

METAToday

-1.31%

5 Days

-7.68%

1 Month

+1.97%

6 Months

-13.17%

Year to Date

+0.21%

1 Year

-7.43%

TradingKey Stock Score of Meta Platforms Inc

Currency: USD Updated: 2026-02-06Key Insights

Meta Platforms Inc's fundamentals are relatively healthy, with an industry-leading ESG disclosure.and its growth potential is high.Its valuation is considered fairly valued, ranking 20 out of 482 in the Software & IT Services industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 852.14.In the medium term, the stock price is expected to remain stable.Despite an average stock market performance over the past month, the company shows strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

Meta Platforms Inc's Score

Support & Resistance

Score Analysis

Media Coverage

Meta Platforms Inc Highlights

Based in Menlo Park, California, Meta Platforms, Inc. functions as an American multinational tech entity. Several leading social media platforms and communication services, such as Facebook, Instagram, Threads, Messenger, and WhatsApp, fall under Meta’s ownership and operation. The firm also manages an advertising network for its own domains and external partners; as of 2023, advertising constituted 97.8% of its total revenue.

Originally founded in 2004 as TheFacebook, Inc., the company underwent a renaming to Facebook, Inc. in 2005. Its rebranding to Meta Platforms, Inc. in 2021 signaled a strategic pivot toward the metaverse—an interconnected digital ecosystem integrating virtual and augmented reality technologies.

Recognized as one of the Big Five U.S. tech giants alongside Alphabet, Amazon, Apple, and Microsoft, Meta secured the 31st rank on the 2023 Forbes Global 2000. As of 2022, it stood as the world’s third-largest investor in research and development, with R&D expenditures totaling US$35.3 billion.

Analyst Rating

Meta Platforms Inc News

$660B Capex Bill Triggers $900B Wipeout: Why Apple Shares Outperform Amazon and Google Despite AI Lag

Based on financial disclosures, the combined 2026 capital expenditure forecasts for Meta, Amazon, Google, and Microsoft are projected to reach $660 billion. This figure is not only significantly higher than the $410 billion forecast for 2025 and $245 billion for 2024, but even surpasses the GDP of I

Meta Reports Strong Earnings. Betting the Entire Cash Flow — $169 Billion for an AI-Powered Future?

TradingKey - Meta (META) demonstrated robust momentum in its post-market earnings report on Wednesday. Driven by sustained growth in advertising revenue, both its fourth-quarter results and first-quarter revenue guidance surpassed Wall Street expectations. Simultaneously, the company announced that

Why Google is the Premier MAG 7 Investment in 2026

Alphabet is much stronger than Microsoft (MSFT) or Amazon (AMZN) due to its unparalleled data advantage and better valuation when comparing how retail investors are viewing these companies for the foreseeable future.

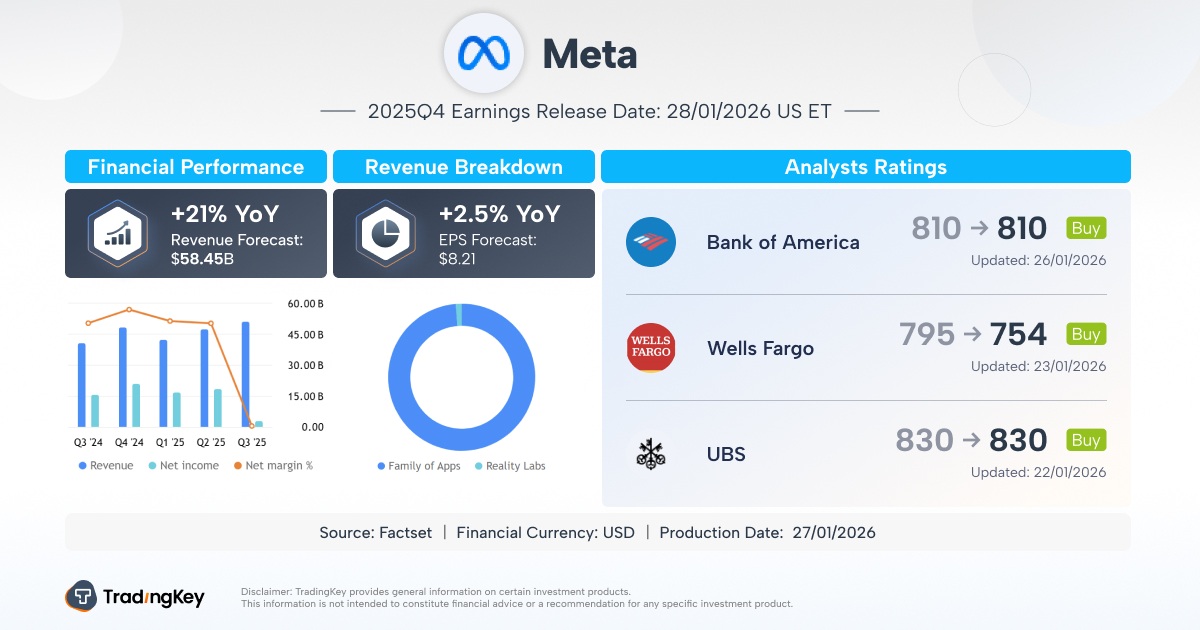

Meta Q4 Earnings Preview: Strong Advertising Growth, Heavy AI Investment Heightens Cost Pressures

TradingKey - Meta Platforms (META) is scheduled to release its fourth-quarter 2025 financial results after the U.S. market close on Wednesday, January 28, 2026. As one of the "Magnificent Seven" tech giants, Meta’s upcoming earnings report is under close market scrutiny. Although the stock has under

Fed Rate Decision Looms as Apple, Microsoft, Meta and Tesla Q4 Earnings Draw Attention (The week ahead)

TradingKey - This week, investor attention will shift back to macroeconomics, monetary policy, and corporate earnings, with the Federal Reserve's interest rate decision taking center stage. In US equities, tech giants including Apple (AAPL), Microsoft (MSFT), Meta (META), and Tesla (TSLA) are schedu

Private Credit Funding for AI Data Centers

The largest tech companies are increasingly relying on private credit to finance their AI ambitions, but is this a prelude to a bubble?

Financial Indicators

EPS

Total revenue

Meta Platforms Inc Info

Based in Menlo Park, California, Meta Platforms, Inc. functions as an American multinational tech entity. Several leading social media platforms and communication services, such as Facebook, Instagram, Threads, Messenger, and WhatsApp, fall under Meta’s ownership and operation. The firm also manages an advertising network for its own domains and external partners; as of 2023, advertising constituted 97.8% of its total revenue.

Originally founded in 2004 as TheFacebook, Inc., the company underwent a renaming to Facebook, Inc. in 2005. Its rebranding to Meta Platforms, Inc. in 2021 signaled a strategic pivot toward the metaverse—an interconnected digital ecosystem integrating virtual and augmented reality technologies.

Recognized as one of the Big Five U.S. tech giants alongside Alphabet, Amazon, Apple, and Microsoft, Meta secured the 31st rank on the 2023 Forbes Global 2000. As of 2022, it stood as the world’s third-largest investor in research and development, with R&D expenditures totaling US$35.3 billion.

Related Instruments

Popular Symbols