Meta Q4 Earnings Preview: Strong Advertising Growth, Heavy AI Investment Heightens Cost Pressures

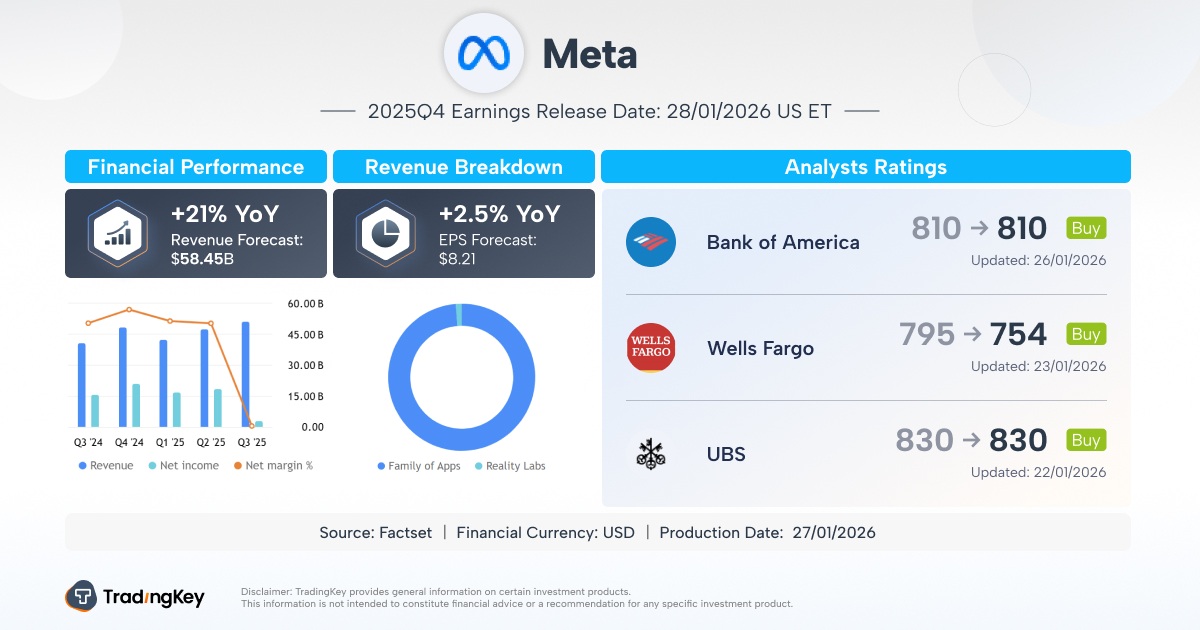

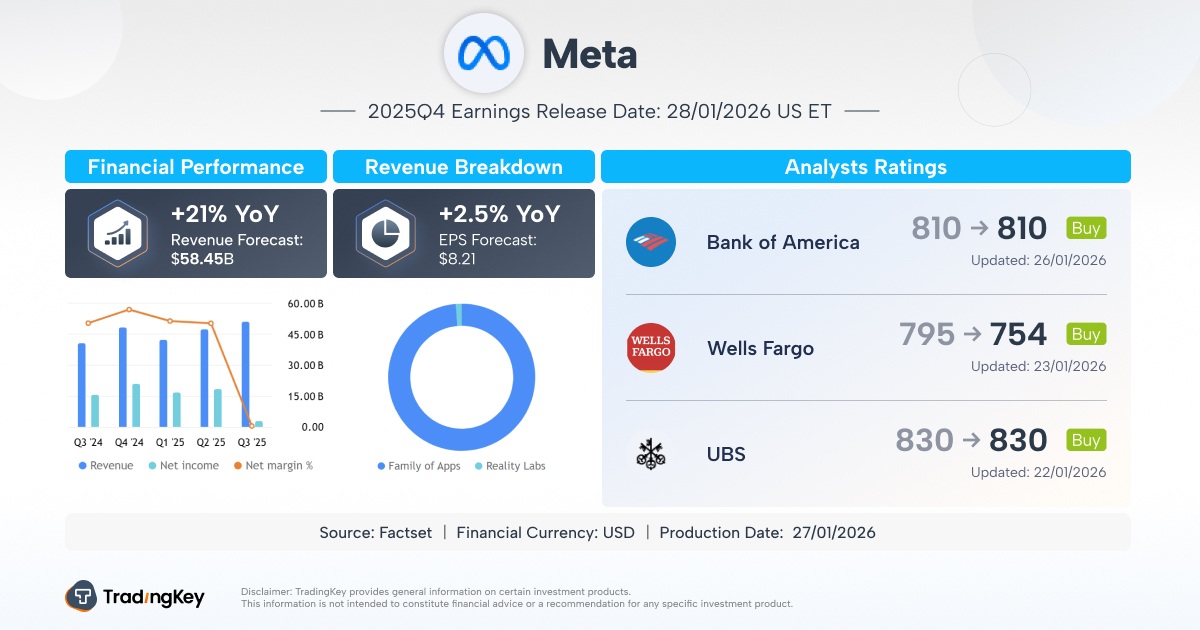

Meta Platforms is set to release its Q4 2025 earnings on January 28, 2026. Consensus estimates project $58.45 billion in revenue and $8.21 EPS, up 21% and 9% YoY respectively. The advertising business, fueled by AI advancements, is expected to drive growth. Despite a significant operating loss in Reality Labs ($4.43B in Q3), cost-saving measures and expected revenue decline in the segment for Q4 are noted. However, capital expenditures are projected to increase significantly in 2025 and 2026 due to AI infrastructure investments, with 2026 total spending anticipated between $153-$160 billion.

TradingKey - Meta Platforms (META) is scheduled to disclose its fourth-quarter 2025 financial report after the U.S. market close on Wednesday, January 28, 2026. As one of the "Magnificent Seven" tech giants, Meta's earnings report is drawing significant market attention. Although the stock price has experienced a notable correction since the release of the previous quarter's earnings at the end of last October, market sentiment has gradually recovered recently.

Data shows that as of the close on January 26, Meta's stock price has risen by more than 10% over the past five trading days. This rally partly reflects positive market expectations for its upcoming Q4 results and is also bolstered by the company's recent spending streamlining measures.

According to FactSet consensus estimates, revenue for the quarter is expected to reach approximately $58.45 billion, which, if achieved, would represent a year-over-year increase of about 21%; meanwhile, earnings per share (EPS) is estimated at $8.21.

Third-Quarter Results Review

Looking back at Meta's third quarter, earnings data showed the company achieved revenue of $51.24 billion, a 26% year-over-year increase, exceeding market expectations of $49.41 billion. Adjusted earnings per share (EPS) was $7.25, higher than the expected $6.67, reflecting sustained strong growth momentum in the company's core business.

However, on a reported GAAP basis, Meta's diluted EPS for the quarter was only $1.05, a sharp decline from $6.03 in the same period in 2024. This change was primarily due to the "One Big Beautiful Bill Act," which required the company to record a one-time non-cash income tax expense of $15.93 billion, significantly weighing down overall profits.

Another area of concern is Reality Labs, the core department of its "metaverse" strategy. Although the division achieved $470 million in revenue this quarter, a 74% year-over-year increase—primarily driven by inventory pull-forward of Quest headsets and early market response to the AR smart glasses launched in collaboration with Ray-Ban—the division's operating loss remained high at $4.43 billion, continuing its previous trend. Since 2021, Reality Labs has recorded cumulative losses of over $70 billion.

At the same time, reports indicate that Meta has recently announced layoffs of over 1,000 employees at Reality Labs, aimed at optimizing organizational structure and controlling related investments. The market responded positively to this decision, with external observers generally believing the move will help improve the cost structure and provide a positive boost to the stock price in the short term.

Regarding fourth-quarter expectations, management explicitly stated during the earnings call that Reality Labs' revenue is expected to face a year-over-year decline, primarily because no new virtual reality devices will be launched in the fourth quarter of 2025, whereas the Quest 3S was released in the same period last year.

Advertising Remains the Growth Engine

As the fourth-quarter 2025 earnings report approaches, the market generally expects Meta to benefit once again from its strong advertising business. Despite ongoing global macroeconomic uncertainties, advertisers are increasing their spending within the Meta ecosystem, primarily due to the continuous strengthening of the company's AI technology.

In terms of product coverage, Meta's Family of Apps—including Facebook, Instagram, WhatsApp, Messenger, and Threads—currently serves over 3 billion daily users.

Against the backdrop of a continuously expanding user base and ad impression volume, the company has become the world's third-largest digital advertising platform, trailing only Alphabet (GOOGL) and Amazon (AMZN). Industry forecasts suggest that the three giants will collectively account for over 50% of global advertising spend in 2025, with that share potentially rising to 56.2% in 2026.

Currently, Meta is continuously optimizing the advertising experience through enhanced AI capabilities. Personalized content distribution driven by its AI recommendation engine has not only improved ad accuracy but also increased user stickiness and time spent on the platform. Meta AI products now have over 1 billion active users, becoming a key infrastructure supporting its core monetization capabilities.

Meanwhile, the company is accelerating the rollout of its AI tool product matrix, including the Vibes content creation platform, to continuously strengthen its commercialization vehicles. Monthly active interactions between users and businesses on messaging platforms like WhatsApp and Messenger have also exceeded 1 billion, demonstrating the potential growth space for AI in business messaging applications.

Trend-wise, the rapid adoption of short-form video content like Reels, coupled with the sophisticated development of AI advertising algorithms, is expected to further improve ad load and conversion efficiency. This is particularly true during the year-end holiday shopping season, providing strong revenue support for Meta this quarter.

Notably, if Meta can continue to achieve breakthroughs in advertising precision and return on investment (ROI), it will help enhance advertiser budget stickiness and mitigate potential macroeconomic shocks. However, short-term industry risks remain a concern, including a slowdown in ad spending, declining monetization efficiency per ad, and intense peer competition.

Rothschild & Co Redburn upgraded Meta's stock rating from "Neutral" to "Buy" on Monday, explicitly stating that strong demand for Meta's advertising engine is sufficient to offset market concerns regarding the company's spending expansion, a move that also drove the stock price higher.

In his report, James Cordwell, an analyst at the firm, referred to Meta's advertising business as a "demand machine" and noted that with the further expansion of AI model platforms such as Andromeda, GEM, and Lattice, the company's advertising business will accelerate its growth. He advised long-term investors to continue holding Meta stock and stated that Meta's newly appointed AI head, Alexandr Wang, has "demonstrated execution capabilities that exceed expectations."

High Capital Expenditures

To seize the lead in AI technology and products, Meta is continuously increasing its resource investment. With its Family of Apps reaching over 3.54 billion active users daily, Meta possesses one of the world's largest consumer-grade data assets, providing a solid foundation for its large model training, AI recommendation optimization, and sophisticated commercial advertising operations.

However, the acceleration of its AI strategy has also brought significant pressure from rising capital and operating costs. Meta currently expects full-year 2025 capital expenditures to be between $70 billion and $72 billion, an upward revision from its previous guidance of $66 billion to $72 billion. This increase primarily reflects the company's ongoing investment in AI infrastructure, including data center construction, custom hardware deployment, and cloud service expansion.

In the company's latest communications, management hinted that capital expenditures for 2026 "will increase significantly in dollar terms," and operating expenses are also trending upward due to multiple factors, including infrastructure expansion and rising salaries. Overall, the pace and scale of spending will be a crucial variable for future profitability prospects.

Bank of America (BAC) Securities analyst Justin Post reiterated a "Buy" rating on Meta stock in a client note released Monday. He believes Meta could exceed market expectations in its upcoming fourth-quarter 2025 earnings report, but investor focus is gradually shifting toward 2026 spending plans, particularly the pace of investment in artificial intelligence infrastructure.

Post expects Meta's total spending for 2026 to range between $153 billion and $160 billion, representing an increase of approximately 30% to 36% over the current year; of this, capital expenditures are projected to grow 58% year-over-year to $113 billion.

He noted: "Concerns regarding Meta's spending path have risen significantly over the past five months. If 2026 spending growth is contained at around 30%, it may be viewed favorably; conversely, if growth exceeds 35%, it could trigger a negative reaction from investors."

This content was translated using AI and reviewed for clarity. It is for informational purposes only.