SanDisk Corporation

SNDKToday

+3.77%

5 Days

+3.77%

1 Month

+69.12%

6 Months

+1369.53%

Year to Date

+151.90%

1 Year

0.00%

TradingKey Stock Score of SanDisk Corporation

Currency: USD Updated: 2026-02-06Key Insights

SanDisk Corporation's fundamentals are relatively healthy, with an industry-leading ESG disclosure.and its growth potential is significant.Its valuation is considered fairly valued, ranking 11 out of 34 in the Computers, Phones & Household Electronics industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 661.54.In the medium term, the stock price is expected to trend up.The company has been performing strongly in the stock market over the past month, which is supported by its strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

SanDisk Corporation's Score

Support & Resistance

Score Analysis

Media Coverage

SanDisk Corporation Highlights

Analyst Rating

SanDisk Corporation News

SanDisk Delivers US Stocks’ ‘Most Explosive’ Earnings Report, Storage Business Demand Surges.

TradingKey - Memory giant SanDisk released its FY2026 second-quarter financial results after the market close on Thursday, reporting sharp growth in both earnings and revenue.

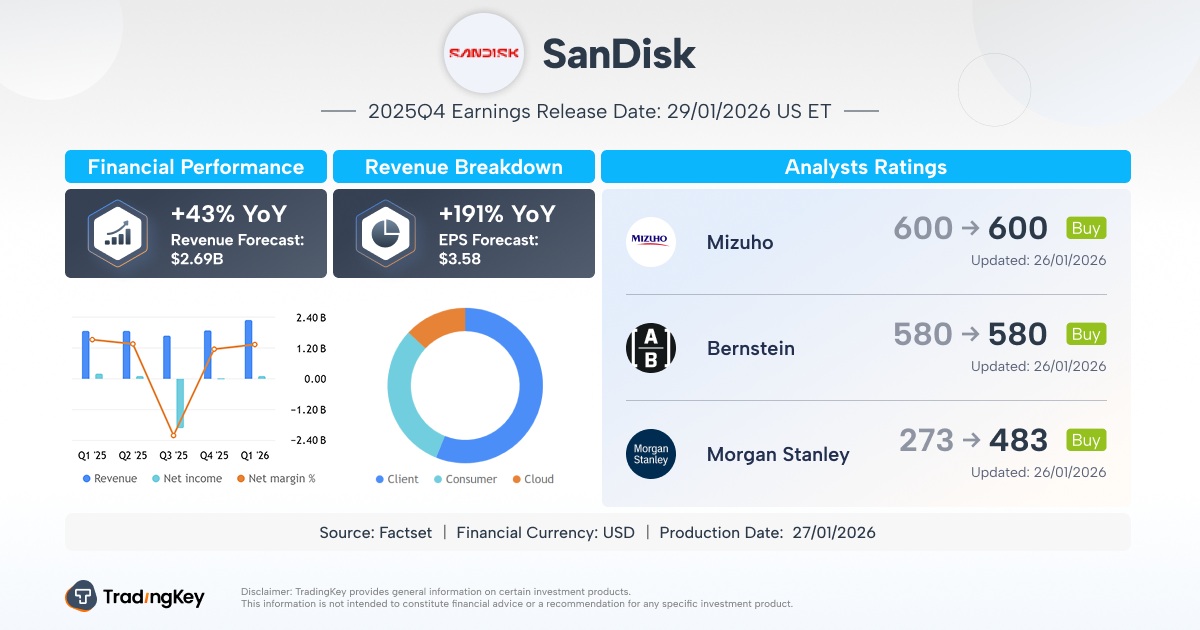

SanDisk FY2026 Q2 Earnings Preview: Explosive Demand for AI Storage Drives Accelerat

TradingKey - Against the backdrop of a structural recovery in the global storage industry, data storage leader SanDisk Corp (SNDK) will release its fiscal second quarter 2026 financial results (corresponding to approximately calendar Q4 2025) after the U.S. market close on January 29, 2026.

SanDisk Stock Deep Dive: What's Fueling Flash Memory Giant SNDK's Rally, and Is It Still a Buy?

TradingKey - We remain bullish on SanDisk(SNDK.US)'s long-term growth potential. However, we believe current stock price expectations are too optimistic, with future upside significantly decelerating.

Financial Indicators

EPS

Total revenue

SanDisk Corporation Info

Related Instruments

Popular Symbols