Taiwan Semiconductor Manufacturing Co Ltd

TSMToday

+5.48%

5 Days

+5.53%

1 Month

+6.54%

6 Months

+50.78%

Year to Date

+14.79%

1 Year

+65.72%

TradingKey Stock Score of Taiwan Semiconductor Manufacturing Co Ltd

Currency: USD Updated: 2026-02-06Key Insights

Taiwan Semiconductor Manufacturing Co Ltd's fundamentals are relatively healthy, with an industry-leading ESG disclosure.and its growth potential is high.Its valuation is considered fairly valued, ranking 44 out of 104 in the Semiconductors & Semiconductor Equipment industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 407.86.In the medium term, the stock price is expected to trend up.The company has been performing well in the stock market over the past month, which is supported by its strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

Taiwan Semiconductor Manufacturing Co Ltd's Score

Support & Resistance

Score Analysis

Media Coverage

Taiwan Semiconductor Manufacturing Co Ltd Highlights

Taiwan Semiconductor Manufacturing Company Limited is a leading Taiwanese multinational firm specializing in semiconductor contract manufacturing and design services. Recognized as one of the most valuable semiconductor firms globally, it stands as the largest dedicated independent semiconductor foundry and is considered Taiwan's most significant company, with its headquarters and primary operations situated in the Hsinchu Science Park in Hsinchu, Taiwan. While the Taiwanese government remains the largest single shareholder, a substantial portion of TSMC is owned by international investors. In 2023, the company secured the 44th position on the Forbes Global 2000 list. Taiwan's exports of integrated circuits reached $184 billion in 2022, contributing nearly 25 percent to the nation's GDP. TSMC accounts for roughly 30 percent of the main index of the Taiwan Stock Exchange.

Established in 1987 by Morris Chang, TSMC became the world's first dedicated semiconductor foundry and has consistently led the industry ever since. Upon Chang’s retirement in 2018 after three decades of leadership, Mark Liu assumed the role of chairman, while C. C. Wei became the Chief Executive Officer. The company has been publicly traded on the Taiwan Stock Exchange since 1993 and was the first Taiwanese entity listed on the New York Stock Exchange in 1997. TSMC has recorded a compound annual growth rate (CAGR) of 17.4 percent in revenue and 16.1 percent in earnings since 1994.

Numerous fabless semiconductor companies, including AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Qualcomm, and Nvidia, rely on TSMC for their production needs, alongside up-and-coming firms such as Allwinner Technology, HiSilicon, Spectra7, and UNISOC. Companies specializing in programmable logic devices, Xilinx and previously Altera, also utilize TSMC's foundry services. Additionally, several integrated device manufacturers with their own fabrication plants, including Intel, NXP, STMicroelectronics, and Texas Instruments, outsource part of their production to TSMC. In fact, semiconductor company LSI re-sells TSMC wafers through its ASIC design services and design IP portfolio.

TSMC pioneered the market in 7-nanometer and 5-nanometer production capabilities and was the first to commercially implement extreme ultraviolet lithography technology developed by ASML at high volumes.

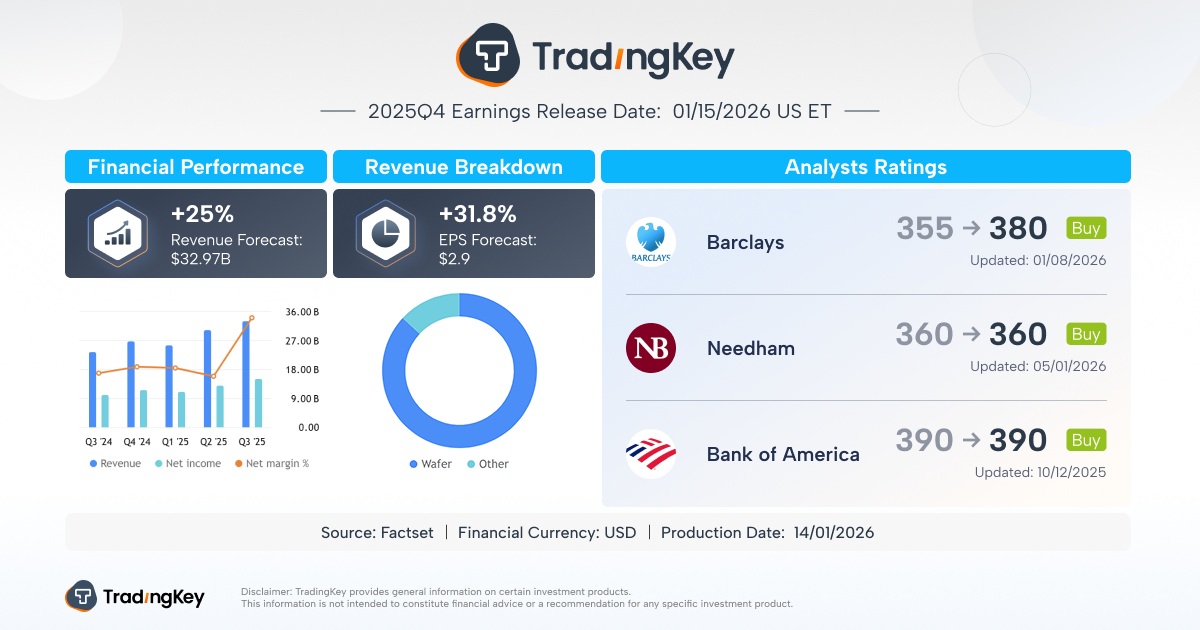

Analyst Rating

Taiwan Semiconductor Manufacturing Co Ltd News

ASML Stock Split Coming? What AI Investors Should Know in 2026

TradingKey - ASML's (ASML) share price has soared above $1300 per share, which often causes investors to ask the question about a stock split when such a high stock price is reached.

Apple’s Open Strategy Under the Storage Crisis: Completing Industry Class Liquidation Through Cost Surges

An in-depth breakdown of Apple’s FY2026 EPS growth logic, revealing how TSMC’s 2nm advanced process and memory supply chain dominance construct a gross margin moat. This analysis dissects the marginal contribution of the Apple Intelligence+ subscription model to high-margin services and details the truth behind the "digital class" reckoning underlying Goldman Sachs’ $320 price target.

Greenland Storm Hits. US Stocks Erase Over $1 Trillion in a Single Day, Bitcoin Drops Below $90,000 Mark

The escalation of the Greenland tariff war has hit U.S. stocks and the crypto market hard, but Fundstrat expects a rebound by the end of the year.

AI Chip Tariffs and TSMC’s Earnings Beat Fuel 2026’s Hardest-Hitting Semiconductor Rally

TradingKey - TSMC’s (TSM) latest quarterly earnings report shows that profit grew sharply, significantly exceeding market expectations on the back of robust demand for AI hardware, propelling its share price up by more than 4% in overnight trading.

TSMC 2025 Q4 Earnings Coming Up — NT$2,000 Target Price: Dream or Reality?

TradingKey - TradingKey - Can TSMC’s Q4 earnings, powered by AI packaging, 2nm volume production and a reshuffled customer mix, support the next leg of its rally?

TSMC Q4 Earnings Preview: AI Demand Ignites Earnings Expectations, Wall Street Bullish Sentiment Heats Up

TradingKey - TSMC, the world's leading chip foundry, is set to release its fourth-quarter financial results for fiscal year 2025 this Thursday. In recent years, while the consumer electronics market experienced a downturn due to the pandemic, the rapid surge in demand for AI chips has effectively of

Financial Indicators

EPS

Total revenue

Taiwan Semiconductor Manufacturing Co Ltd Info

Taiwan Semiconductor Manufacturing Company Limited is a leading Taiwanese multinational firm specializing in semiconductor contract manufacturing and design services. Recognized as one of the most valuable semiconductor firms globally, it stands as the largest dedicated independent semiconductor foundry and is considered Taiwan's most significant company, with its headquarters and primary operations situated in the Hsinchu Science Park in Hsinchu, Taiwan. While the Taiwanese government remains the largest single shareholder, a substantial portion of TSMC is owned by international investors. In 2023, the company secured the 44th position on the Forbes Global 2000 list. Taiwan's exports of integrated circuits reached $184 billion in 2022, contributing nearly 25 percent to the nation's GDP. TSMC accounts for roughly 30 percent of the main index of the Taiwan Stock Exchange.

Established in 1987 by Morris Chang, TSMC became the world's first dedicated semiconductor foundry and has consistently led the industry ever since. Upon Chang’s retirement in 2018 after three decades of leadership, Mark Liu assumed the role of chairman, while C. C. Wei became the Chief Executive Officer. The company has been publicly traded on the Taiwan Stock Exchange since 1993 and was the first Taiwanese entity listed on the New York Stock Exchange in 1997. TSMC has recorded a compound annual growth rate (CAGR) of 17.4 percent in revenue and 16.1 percent in earnings since 1994.

Numerous fabless semiconductor companies, including AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Qualcomm, and Nvidia, rely on TSMC for their production needs, alongside up-and-coming firms such as Allwinner Technology, HiSilicon, Spectra7, and UNISOC. Companies specializing in programmable logic devices, Xilinx and previously Altera, also utilize TSMC's foundry services. Additionally, several integrated device manufacturers with their own fabrication plants, including Intel, NXP, STMicroelectronics, and Texas Instruments, outsource part of their production to TSMC. In fact, semiconductor company LSI re-sells TSMC wafers through its ASIC design services and design IP portfolio.

TSMC pioneered the market in 7-nanometer and 5-nanometer production capabilities and was the first to commercially implement extreme ultraviolet lithography technology developed by ASML at high volumes.

Related Instruments

Popular Symbols