SanDisk Delivers US Stocks’ ‘Most Explosive’ Earnings Report, Storage Business Demand Surges.

SanDisk reported strong FY2026 second-quarter results, with revenue at $3.025 billion, up 61% year-over-year, and GAAP diluted EPS at $5.15, up 615%. Both significantly surpassed analyst expectations and the company's guidance. The company projects third-quarter revenue between $4.4 billion and $4.8 billion, with gross margins rising to 66.0%. The strong outlook, attributed to AI demand and high-value product momentum, suggests a sustainable upswing in the storage chip industry, alleviating concerns about cyclical volatility. SanDisk's stock rose nearly 15% in after-hours trading.

TradingKey - Memory Manufacturing Giant SanDisk(SNDK) Reported its FY2026 second-quarter financial results after the market close on Thursday, with both earnings and revenue growing significantly. The performance substantially exceeded Wall Street's consensus expectations and was notably higher than the company's previous performance guidance. Following the announcement, SanDisk's stock price rose nearly 15% in after-hours trading.

SanDisk's after-hours stock price trend following its earnings release, Source: Google Finance

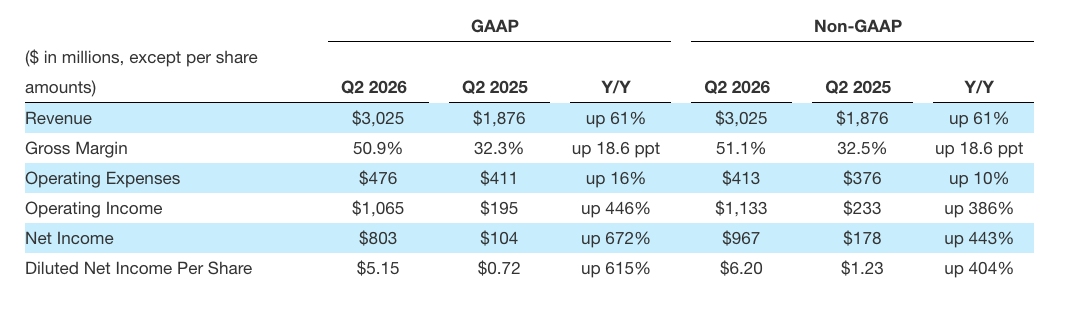

According to the financial data, revenue for the second quarter of fiscal 2026 was $3.025 billion, surpassing analyst expectations of $2.69 billion and the company's own guidance range of $2.55 billion to $2.65 billion. This compares to $1.876 billion in the same period of fiscal 2025, representing a 61% year-over-year increase.

GAAP gross margin was 50.9%, up 18.6 percentage points from 32.3% in the same period of fiscal 2025.

GAAP operating profit was $1.065 billion, compared to $195 million in the same period of fiscal 2025, a year-over-year increase of 446%.

Net Profit: GAAP net profit was $803 million, up 672% year-over-year from $104 million in the same period of fiscal 2025.

Earnings Per Share: GAAP diluted EPS was $5.15, up 615% year-over-year from $0.72 in the same period of fiscal 2025. Non-GAAP diluted EPS was $6.20, exceeding the analyst expectation of $3.62 and the company's previous adjusted EPS guidance range of $3.00 to $3.40. This represents a 404% increase from $1.23 in the same period of fiscal 2025.

FY2026 Third Quarter Outlook

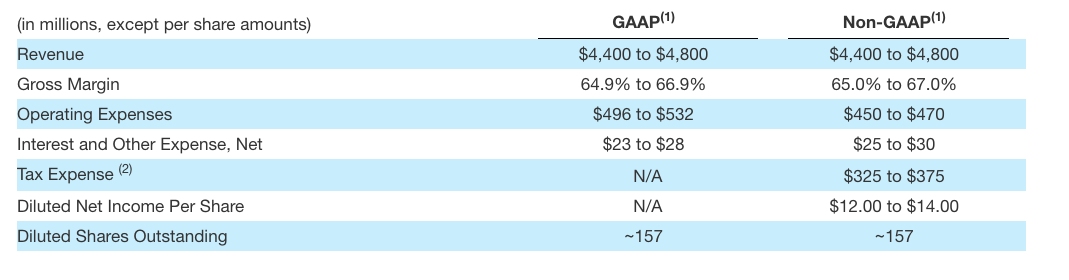

SanDisk provided an outlook for further accelerated growth. The company expects third-quarter revenue to reach $4.4 billion to $4.8 billion, which is not only higher than this quarter's performance,

Gross margin is expected to climb further to 66.0%, exceeding Goldman Sachs' forecast of 44.0% and Wall Street's expectation of 47.2%. This indicates SanDisk's exceptionally strong pricing power.

The company's EPS guidance range is $12.00 to $14.00, with a midpoint of $13.00. This is more than double the Wall Street consensus of $5.11, demonstrating that management has high visibility into short-term profitability.

This highlights management's assessment that storage demand continues to heat up and that the shipping momentum for high-value products is expected to further strengthen.

Such strong forward guidance has largely alleviated previous market concerns regarding the cyclical volatility of the storage industry. Investors generally interpret this to mean that SanDisk is well-positioned in the current recovery phase, with an increasing proportion of high-margin products rapidly translating into actual profits as the company enters a stage of accelerated earnings realization.

SanDisk CEO David Goeckeler stated:

"This quarter's performance highlights our execution capabilities in optimizing product mix, accelerating enterprise SSD deployment, and strengthening market demand momentum. At the same time, the market is increasingly recognizing the critical role our products play in supporting AI and the operation of the global technology ecosystem. By making structural adjustments to align supply with attractive and sustainable demand, we have been able to achieve disciplined growth and deliver industry-leading financial results."

With both results and guidance exceeding expectations, SanDisk indicates that the storage chip industry's cycle may have entered a more sustainable upswing phase.

This content was translated using AI and reviewed for clarity. It is for informational purposes only.