- AI infrastructure demand is fueling exponential growth across the semiconductor and equipment supply chain.

- Key players like ASML, TSMC, Broadcom, and Applied Materials offer margin strength and durable competitive moats.

- Entry timing hinges on technical setups, macro positioning, and supply-led CapEx signals.

- Smart screening includes earnings consistency, AI-related revenue exposure, and geopolitical diversification.

TradingKey - Investors' initial thoughts around AI are high-shine software platforms, chatbots spread virally, or AI products aimed at consumers. But lurking underneath here is an enormously under-valued layer of value, a base upon which all this functions. It's those supply chain companies making wide-scale AI training and inference possible at all.

In this secretive goldmine, corporations such as ASML, TSMC, Broadcom, and Applied Materials have transformed themselves from bit players to lead actors in this industrial renaissance narrative. They design the chips, they manufacture the wafers, they build the packaging equipment, and they provide the backend networking that comprises the digital spine of AI. Not only this, but what they offer can’t be replaced. The majority of them possess oligopolies or outright monopolies, with multi-year agreements and pricing latitude that render them necessary choke points for the entire system.

In short, while OpenAI and Nvidia are the race cars, corporations like TSMC and ASML are the racetrack. Whoever dominates the AI-model war, the highway will never stop needing maintenance, and the toll booths get collected first.

Structural Demand, Sticky Economics

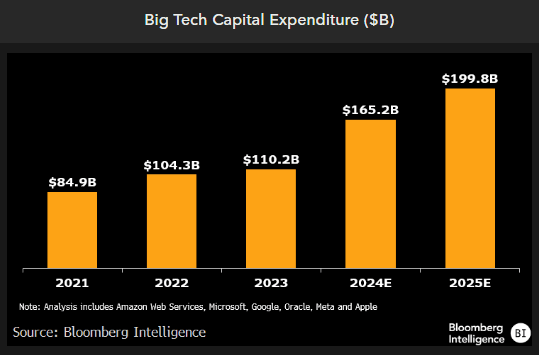

Among the strongest predictors of opportunity for the AI supply chain is demand persistence. We’re no longer in an era of cyclic semiconductor demand and PC-correlated demand. AI has placed a structural compute intensity overlay upon us that mandates uninterrupted investment in silicon, packaging, cool-ing, and network performance. This demand has become mission-critical to establishing sovereign AI capability, hyperscale cloud services, and national security.

This change is shifting the suppliers' economics. Their gross margins, once in the mid-40% range, now go into the high-50% or low 60% range as scarcity, complexity, and lead time give those suppliers negotiating power. The majority also have front-end CapEx from hyperscale and government partnerships, so their future growth isn't just robust, but pre-funded.

In addition, as AI adoption extends from the edge to the cloud, from inferences to real-time robots, demand will not plateau, it will spread and multiply. Fast-moving suppliers, suppliers who can integrate at multiple supply chain levels, or suppliers who own key process steps will benefit immensely.

Source: https://www.bloomberg.com

Screening Long-Term Winners at the Stack Level

Investors go giddy over thematic growth but also lose perspective over the fact all players under a theme won't equally participate in the spoils. In AI supply chains, this remains especially the case. Weeding out enduring winners means separating the necessary from the expedient, the ingrained from the peripheral.

Start with business quality. This means looking for businesses with entry barriers of a structural kind, such as ASML's monopoly of the EUV lithography or TSMC's scale leadership in high-end node manufacturing. Look for high returns on capital employed, building blocks of recurring revenue, and indications of long-term pricing power. These businesses are usually players at the "utility" level of tech infrastructure with stronger economic moats than the changeable software layer.

Next there's AI exposure. This isn’t necessarily transparent. A firm may not be positioning as an “AI-native” business but will nonetheless be taking home an ever-growing-sized percentage of its revenues from AI-enabled orders. Applied ships the gear that assists at making the chips going into Nvidia’s accelerators. Custom ASICs for hyperscale inference systems are made by Broadcom. Even from behind the curtain, they’re collecting rents from AI’s explosive growth.

And last, screen by capital stewardship. Good balance sheets, regularly occurring free cash flow, and history of shareholder-friendly capital allocation (buybacks, dividends, reinvesting) can be the tiebreaker between compounders and boom-bust stories.

.jpg)

Source: https://www.ai-supremacy.com

Timing Entry: The Sentiment-Fundamentals Disconnect

Investing in the AI supply chain isn’t just name selection. It also involves savvy timing of entries, especially since we are dealing with an industry equated with volatility and sentiment swings.

Best points of entry most commonly occur outside of hype cycles, yet dislocations, regular macro concerns or supply chain adjustments reducing valuations as the long-term thesis strengthens, create the best opportunities. For instance, if GPU lead times are lengthened and memory suppliers promise supply-demand disconnects, panic will ensue. But for experienced investors, this is where cash-rich, strategically important suppliers are undervalued.

Here, one valuable tool is sentiment analysis. Pay attention to situations where analyst downgrades or short interest contradict order book strength or guidance from CapEx. Pay attention to management tone through earnings calls , if CEOs are guiding conservatively but the backlog is soaring, then that becomes your green light. It’s what they’re saying and what they’re building towards.

Briefly speaking, ideal entries are made not at points of ultimate optimism, but at bottoms of confusion.

Managing Geopolitical Risks Amidst a Geopolitically Volatile Supply Chain

No supply chain escapes geopolitics, least of all the AI stack, at the focal point of the U.S.–China tech rivalry. Export controls, tariffs, blacklists, and region-based supply chain reorganization all inject volatility and uncertainty into the investment calculus.

Clever investors must consider geopolitical resilience as part of the screen. Is the business over-reliant on Chinese revenues? Is it exposed to critical components from sanctioned countries? Does it manufacture from vulnerable countries exposed to regulatory shock or war?

Others with nearshoring strategies, CHIPS Act recipients (sovereign-compatible finance), or multi-region redundancy may emerge as winners. Those like TSMC opening up a factory in Arizona or Samsung constructing in Texas are not just logistics decisions, they are veiled strategic moats.

Managing those risks means being adaptable and avoiding overexposure to a single customer, geography, or regulator. AI supply chain investment entails thinking global, and clear-eyed recognition of policy risk as a variable.

.jpg)

Source: https://www.ai-supremacy.com

Conclusion: Follow the Infrastructure, Not the Hype

AI is the buzzword, yet the business model remains infrastructure. Long-term compounding investors should be looking where economic leverage lies, and that is not at the interfaces at the front-end, but at the machinery at the back-end making them viable. By filtering for quality businesses, testing entry points against sentiment, and managing geopolitical risks on purpose, you can build exposure to the AI theme for the long haul. We like these as mission-critical picks and shovels, not moonshot bets. As the world rewires for AI-driven economies, the companies selling the tools, chips, and systems behind the scenes may be the most enduring winners of all.