Total 276 articles

Today’s Market Recap: Microsoft’s AI Spending Sparks Concerns, 10% Plunge Weighs on U.S. Markets

TradingKey - On January 29, 2026, the S&P 500 Index ended lower by 9.02 points, or 0.13%, at 6,969.01. The Dow Jones Industrial Average rose 55.96 points, or 0.11%, to close at 49,071.56. The Nasdaq Composite fell 172.33 points, or 0.72%, to close at 23,685.12.

Fri, Jan 30

Gold Just Hit a Record $5,600, What's Driving the Surge?

TradingKey - Gold prices have surged once again, breaking through the $5,600 threshold to hit a new all-time high. Following a massive 64% rally in 2025, gold has recorded a year-to-date gain of over 27%.

Thu, Jan 29

Meta Reports Strong Earnings. Betting the Entire Cash Flow — $169 Billion for an AI-Powered Future?

TradingKey - Meta (META) demonstrated robust momentum in its post-market earnings report on Wednesday. Driven by sustained growth in advertising revenue, both its fourth-quarter results and first-quarter revenue guidance surpassed Wall Street expectations. Simultaneously, the company announced that

Thu, Jan 29

Powell Urges ‘Staying Away From Politics,’ What Signals Did This Fed Pause Send?

TradingKey - On Wednesday, January 28, 2026, local time, the Federal Reserve announced it would maintain the federal funds rate target range at 3.50%–3.75%, in line with market expectations. This marks the first time the central bank has chosen to stay on hold following three consecutive rate cuts since September 2025.

Thu, Jan 29

Today’s Market Recap: Fed Patience Meets Tech Optimism as AI Demand Reignites Markets

TradingKey - On January 28, 2026, U.S. equity markets posted modest moves following the Federal Reserve’s widely expected policy decision.

Thu, Jan 29

Best Silver Stocks to Watch in 2026

TradingKey - Silver has a uniquely dual nature that is reflected in its use in the modern world through both the use of silver as a resource for manufacturing and through its application to technology due to its superior properties of electrical and thermal conductivity compared to all other metals

Wed, Jan 28

Dollar Slumps to Four-Year Low, Trump Still Says ‘Dollar Is Doing Great’?

TradingKey - The U.S. dollar is facing its most intense wave of selling in nearly four years, with the Bloomberg Dollar Spot Index falling to its lowest level since March 2022 on Tuesday. Despite this, U.S. President Donald Trump appeared exceptionally optimistic during an event in Iowa. When asked

Wed, Jan 28

Today’s Market Recap: Tech Stocks Rally Amid AI Infrastructure Expansion

TradingKey - On January 27, 2026, the S&P 500 rose 0.41% to close at 6,979. The Nasdaq Composite advanced 0.91% to 23,817.

Wed, Jan 28

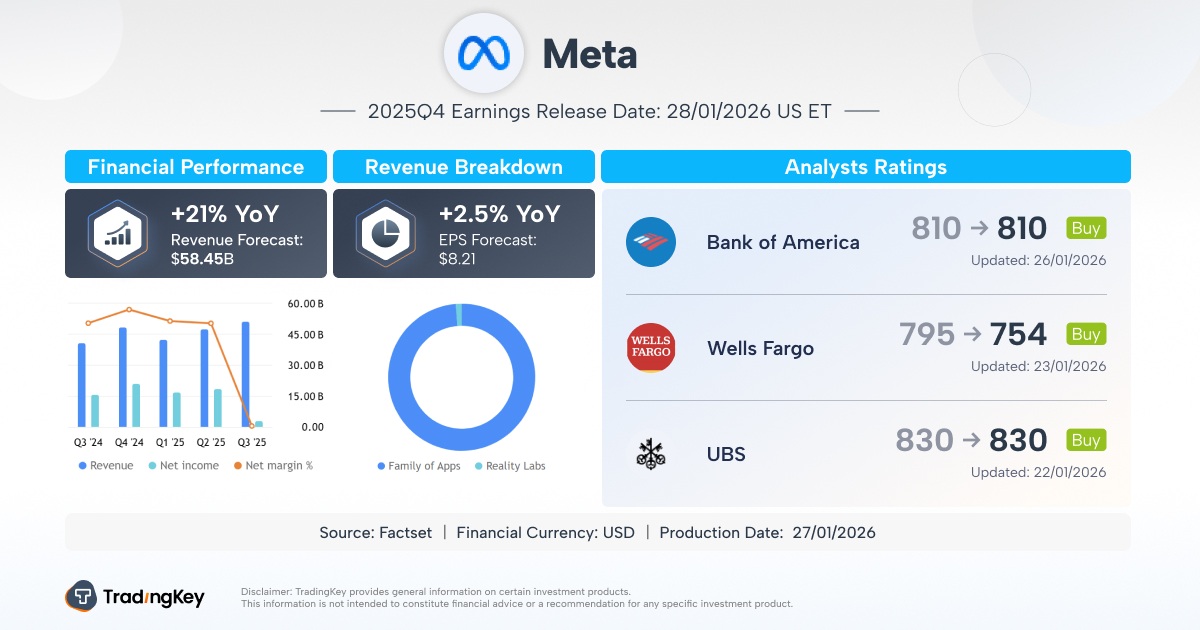

Meta Q4 Earnings Preview: Strong Advertising Growth, Heavy AI Investment Heightens Cost Pressures

TradingKey - Meta Platforms (META) is scheduled to release its fourth-quarter 2025 financial results after the U.S. market close on Wednesday, January 28, 2026. As one of the "Magnificent Seven" tech giants, Meta’s upcoming earnings report is under close market scrutiny. Although the stock has under

Tue, Jan 27

Is Silver’s ‘Meme Moment’ Arriving? Surging Prices Mask Momentum Bubble Concerns

TradingKey - The silver market is witnessing an unprecedented "rally." As futures prices recorded their largest single-day gain in nearly 40 years, retail investors have flocked to the market, with the frenzy even being compared to the "meme stock" phenomenon. This round of silver trading heat has far exceeded market expectations, as several key indicators approach historical extremes.

Tue, Jan 27

Today’s Market Recap: Silver Spikes, Gold Breaks $5,000 as U.S. Stocks Edge Higher

TradingKey - On January 26, 2026, U.S. equities advanced across major benchmarks on the back of solid macroeconomic data, helping offset market unease ahead of the upcoming Fed policy meeting and a packed earnings calendar.

Tue, Jan 27

Gold Hits $5,000, Silver Soars Past $100, Who Is Behind the ‘Buying Frenzy’?

TradingKey — In early Monday trading, spot gold historically breached the $5,000 per ounce mark, an achievement coming just over three months after prices first surpassed $4,000 on October 8, 2025. During the same period, spot silver also rallied strongly to reach a new high of $107 per ounce.

Mon, Jan 26

TradingKey’s The Week on Wall Street: Resilient Economy Meets Geopolitical Headwinds

Macroeconomic Landscape: The week of January 19-25, 2026, commenced with US markets closed on Monday for Martin Luther King Jr. Day, resulting in a holiday-shortened trading week.

Mon, Jan 26

Today’s Market Recap: Precious Metals Soar as U.S. Equities Hold Steady

TradingKey - On January 23, 2026, the S&P 500 edged up 0.03% to finish at 6,915, while the Nasdaq Composite rose 0.28%, closing at 23,501—reflecting relatively flat movement across major equity indexes.

Mon, Jan 26

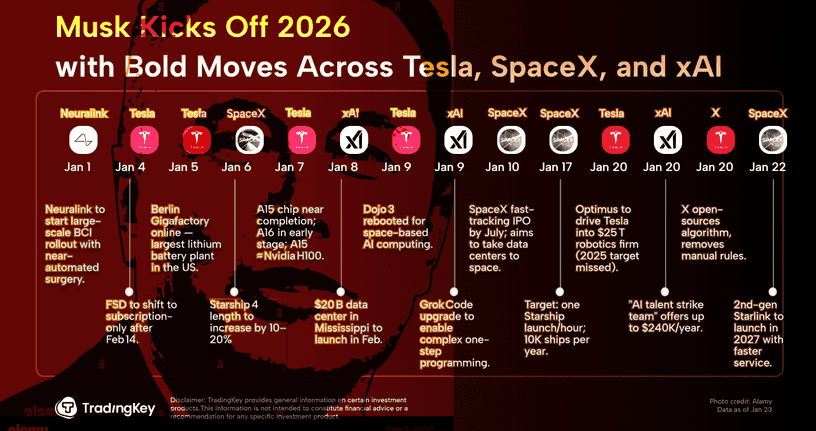

World’s Richest Man Arrives at Davos. Musk Talks AI, Optimus, Life’s Ultimate Questions: The Next 10 Years Will Change Everything

TradingKey - At this year's World Economic Forum in Davos, the arrival of an "unexpected guest" sparked heated discussion—the world's richest person, CEO of Tesla ( TSLA) and SpaceX, Elon Musk, suddenly appeared on the official schedule and confirmed he would deliver a speech.

Fri, Jan 23

Today’s Market Recap: Nasdaq Leads Gains Amid Economic Strength

On January 22, 2026, U.S. equities closed higher across the board, with the Nasdaq Composite (+0.91%) leading the day’s rally and finishing at 23,436.02.

Fri, Jan 23

Will Gold Rise Further? Goldman Sachs Targets $5,400, and Another Institution Boldly Forecasts $7,000.

TradingKey - The rules of the game in the gold market are being rapidly rewritten. The buying structure once dominated by central banks is now being redefined by private institutional investors, family offices, and high-net-worth individuals. In its latest research report, Goldman Sachs significantl

Thu, Jan 22

Japan’s ‘Truss Moment’ Is Here. Bond Market Slumps, Japan’s Second-Largest Bank to Double Down?

TradingKey - At the start of 2026, Japan experienced its own "Truss moment." On January 19, Japan’s newly appointed Prime Minister Sanae Takaichi announced the imminent end of long-standing fiscal austerity policies and plans to dissolve the House of Representatives this week, ahead of a snap genera

Wed, Jan 21

'Tax It If You Can't Buy It'? Trump’s Greenland Tariff Threats Reignite ‘Sell America’ Concerns

TradingKey - Recent remarks by U.S. President Trump regarding Greenland have reignited trade tensions. His threats to impose import tariffs on several European allies quickly triggered market volatility and reignited debate over whether global investors will reassess their allocation to U.S. assets.

Tue, Jan 20

AGI Approaches: 2026 May Be Artificial Intelligence Turning Point, Musk Warns White-Collar Class Will Bear the Brunt

TradingKey — Have you noticed that the pace of artificial intelligence evolution is exceeding the limits of human intuitive perception? From the debut of ChatGPT to the rapid rise of multimodal AI systems, the development of AI technology has demonstrated a non-linear, exponential acceleration in ju

Mon, Jan 19