Today’s Market Recap: Nasdaq Leads Gains Amid Economic Strength

On January 22, 2026, U.S. equities closed higher across the board, with the Nasdaq Composite (+0.91%) leading the day’s rally and finishing at 23,436.02. Other major indexes followed suit: the Russell 2000 added 0.76% to finish at 2,718.77, the Dow Jones Industrial Average gained 0.63% to close at 49,384.01, and the S&P 500 rose 0.55% to end the session at 6,913.35, extending gains from the prior trading day.

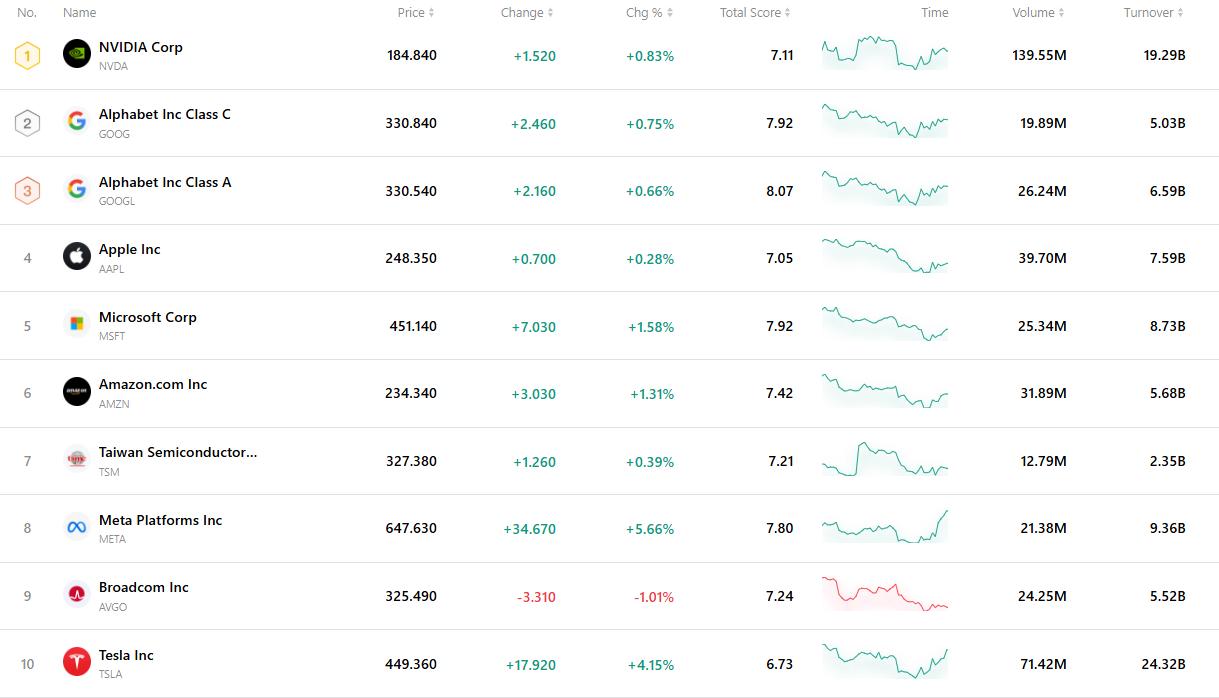

Geopolitical tensions eased and stronger-than-expected U.S. economic data helped boost investor risk appetite, pushing major U.S. stock indexes higher for a second consecutive session and fully recovering losses from earlier in the week. Small-cap stocks extended their outperformance over large caps for the 15th straight day, setting another new high. Mega-cap tech stocks advanced broadly, with Meta surging 5.6% and Tesla (TSLA) jumping more than 4%.

Robust economic indicators dampened expectations for a near-term rate cut, sending the U.S. 2-year Treasury yield up by 2.5 basis points, while the 10-year yield remained flat compared to the previous day's close.

In the face of a weakening U.S. dollar, precious metals delivered standout gains. Spot gold rallied 1.8%, breaking above the $4,900 mark for the first time. New York-traded silver futures rose 4%, and spot platinum soared more than 6.3%, both notching fresh all-time highs.

Chipmaker Intel (INTC) saw its stock tumble 11.91% in after-hours trading, falling to $47.84 following a weaker-than-expected quarterly outlook. The company recently hit a 52-week high of $54.60 amid optimism tied to U.S. government investment, but those hopes took a hit today.

Regencell Bioscience Holdings (RGC) surged 40.44%, continuing its streak of high-volatility breakouts. Momentum also returned to industrials and materials companies, with notable gains from Critical Metals Corp (CRMLW, +26.38%), Americas Gold and Silver Corp (USAS, +19.28%), and USA Rare Earth (+19%). A resurgence in biotech stocks was evident as well, with Corcept Therapeutics (CORT, +13.74%), Beam Therapeutics (BEAM, +10.09%), and Denali Therapeutics (DNLI, +12.53%) all extending recent upward trends.

Meanwhile, AST SpaceMobile (ASTS) bounced back with a 12.43% gain after landing in the laggards' list yesterday.

On the downside, Inspire Medical Systems (INSP) dropped 16.0%, taking the lead among today’s worst performers. Medical device peer Abbott Laboratories (ABT) also fell sharply, down nearly 10.03% after a weaker-than-expected earnings release. Declines were also seen in crypto-related stocks such as Figure Technologies (-8.1%) and Hut 8 Corp (HUT, -6.48%), as well as in retail names like Buckle (BKE, -4.73%) and Boot Barn (BOOT, -5.19%). Losses appeared broad and scattered across sectors without a clear unifying narrative.

The Federal Reserve's preferred gauge of inflation aligned with expectations in November, reinforcing confidence in the strength of the U.S. economy. The personal consumption expenditures (PCE) price index rose 2.8% year-over-year and 0.2% month-over-month, while the core PCE—excluding food and energy—remained elevated at an annualized 2.9%. Supported by resilient consumer spending, the report also reflected a continued decline in the personal savings rate, pointing to sustained household activity despite tighter financial conditions.

U.S. economic growth in the third quarter was slightly stronger than previously estimated. Real GDP was revised up to an annualized pace of 4.4%, the fastest expansion in two years. The upward revision was driven by firm consumer demand, stronger exports, and a reduced drag from inventory adjustments. Combined with still-elevated inflation, the data strengthen the case for the Fed to maintain its current policy stance at the upcoming FOMC meeting.

In Europe, concern is growing over renewed volatility in transatlantic relations after Donald Trump reversed course on a proposed tariff package aimed at the EU. The sudden shift caught many European policymakers off guard, fueling anxiety over Trump's erratic policy style and its implications. Some EU officials warned that the gesture could be a strategic attempt to divide allies. As distrust deepens, fears of a widening rift between Washington and Brussels are becoming more pronounced.

Intel shares plunged more than 11% in after-hours trading after the company issued disappointing first-quarter guidance. While fourth-quarter results came in ahead of expectations—helped by a 9% increase in AI and data center revenues and a $5 billion sale of Nvidia shares—investors were unsettled by the company's warning that supply constraints would intensify in Q1. Management cited below-target manufacturing yields and acknowledged that ramping up the company’s foundry operations will take time. The CFO noted that limited inventory and production issues had already constrained seasonal demand fulfillment.

A wave of capital flight from U.S. assets is gaining momentum among Nordic pension funds. Denmark’s AkademikerPension announced a full exit from U.S. Treasuries by the end of January, while Sweden’s Alecta has liquidated most of its $11 billion worth of U.S. holdings. Greenland’s SISA Pension Fund is also weighing a sharp reduction in U.S. equities, which currently account for around half of its portfolio. The moves reflect growing concern among European long-term investors about exposure to U.S. fiscal pressures and heightened geopolitical risk.

Donald Trump has filed a lawsuit against JPMorgan Chase and CEO Jamie Dimon, seeking at least $5 billion in damages over alleged political bias. The president claims the bank engaged in "debanking" by cutting off financial services to him and his businesses due to ideological reasons. The case follows multiple public remarks by Trump accusing major banks of discriminating against clients based on political affiliation.

At the 2026 Davos Forum, Elon Musk unveiled plans to begin public sales of Tesla’s humanoid robot, Optimus, by the end of next year. Musk said the robot is being designed to handle a wide range of user-driven tasks and could perform "almost anything you ask" with sufficient reliability and safety. He revealed that fully autonomous Robotaxi service is already underway in Austin, Texas, without human safety supervisors on board. According to Musk, artificial general intelligence (AGI) could surpass human-level capabilities as soon as late 2026.

Top 10 Most Traded Stocks