JD.Com Inc

JDToday

+1.63%

5 Days

+4.25%

1 Month

-1.93%

6 Months

-18.90%

Year to Date

-4.29%

1 Year

-35.04%

TradingKey Stock Score of JD.Com Inc

Currency: USD Updated: 2026-03-09Key Insights

JD.Com Inc's fundamentals are relatively very healthy, with an industry-leading ESG disclosure.and its growth potential is high.Its valuation is considered fairly valued, ranking 11 out of 27 in the Diversified Retail industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 38.86.In the medium term, the stock price is expected to remain stable.Despite an average stock market performance over the past month, the company shows strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

JD.Com Inc's Score

Support & Resistance

Score Analysis

Media Coverage

JD.Com Inc Highlights

Analyst Rating

JD.Com Inc News

JD.com (JD) Q3 Results: Huge Investment Return Potential but Only the Patient Ones will be Rewarded

JD remains one of the few Chinese tech giants that has not experienced a significant stock rally this year.

US-China Summit: 5 Key Issues to Watch in First Trump-Xi Meeting in Six Years

TradingKey - The high-stakes meeting between U.S. President Donald Trump and Chinese President Xi Jinping on Thursday, October 30, stands as the cornerstone of Trump's ongoing five-day Asia trip after returning to the White House. This summit follows a constructive round of trade negotiations, which

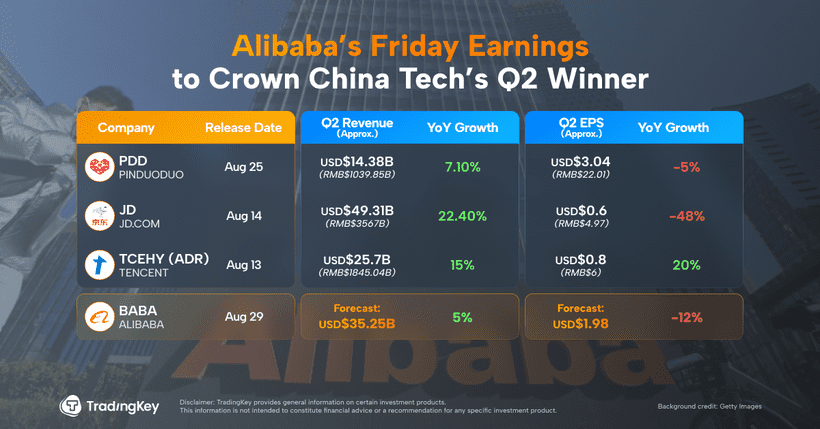

Alibaba’s Friday Earnings to Crown China Tech’s Q2 Winner

TradingKey - Names like JD.com, Pinduoduo, Tencent, and Alibaba represent the top-tier of Chinese tech stocks trading in the U.S. But their FY2025 Q2 earnings paint very different pictures.

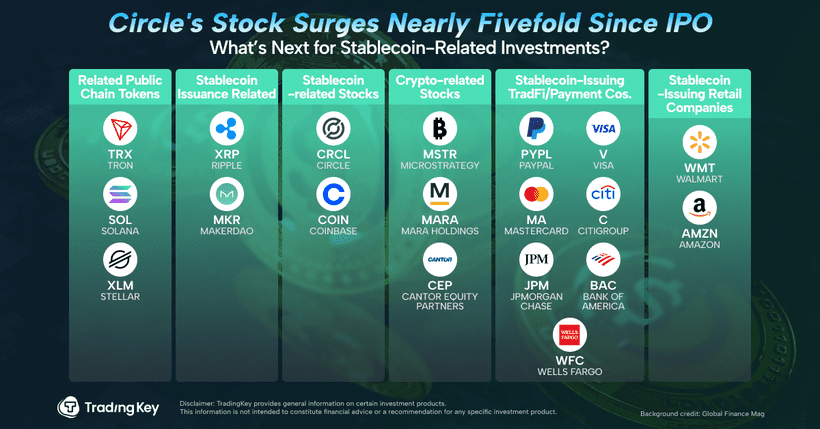

Circle Rallies 34% on GENIUS Act Tailwinds — What’s Next for Stablecoin Investors?

TradingKey - In a major milestone for crypto regulation, the U.S. Senate on Tuesday passed the GENIUS Act — a landmark bill that lays the groundwork for federal oversight of U.S. dollar-pegged stablecoins.

PDD’s Next Growth Engine: Trading Profit for Ecosystem, Technology for Efficiency

TradingKey - Pinduoduo (PDD) Q1 2025 results don’t look good. The stock fell for several days after earnings, with market sentiment taking a visible hit.

Alibaba (BABA) Q4 2024 Earnings Preview: Will the Chinese Tech Rally Continue?

Alibaba will report its fourth quarterly earnings for this fiscal year on Thursday, after the bell. The stock has been performing solidly in the past twelve months with 55% increase, mostly driven by the company’s AI initiatives and recovery in the consumer sentiment in China. Tomorrow we will...

Financial Indicators

EPS

Total revenue

JD.Com Inc Info

Related Instruments

Popular Symbols