Berkshire Hathaway Inc

BRKaToday

+0.66%

5 Days

+5.55%

1 Month

+2.36%

6 Months

+8.94%

Year to Date

+1.03%

1 Year

+7.57%

TradingKey Stock Score of Berkshire Hathaway Inc

Currency: USD Updated: 2026-02-06Key Insights

Berkshire Hathaway Inc's fundamentals are relatively healthy, with an industry-leading ESG disclosure.and its growth potential is high.Its valuation is considered fairly valued, ranking 4 out of 8 in the Consumer Goods Conglomerates industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Hold, with the highest price target at 769586.00.In the medium term, the stock price is expected to remain stable.Despite an average stock market performance over the past month, the company shows strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

Berkshire Hathaway Inc's Score

Support & Resistance

Score Analysis

Analyst Rating

Berkshire Hathaway Inc Highlights

Berkshire Hathaway Inc. is a renowned American multinational conglomerate holding firm with its headquarters situated in Omaha, Nebraska. Initially a textile manufacturer, the company began its transformation into a conglomerate in 1965, under the leadership of chairman and CEO Warren Buffett, along with vice chairman Charlie Munger. Greg Abel currently oversees the majority of the firm's investments and has been designated as Buffett's successor. Buffett personally holds 38.4% of Berkshire Hathaway's Class A voting shares, equating to a 15.1% overall economic stake in the organization.

Often likened to an investment fund, Berkshire Hathaway has delivered a remarkable compound annual growth rate (CAGR) of 19.8% in shareholder returns from 1965, the year Buffett took control, through to 2023, outperforming the S&P 500's 10.2% CAGR in the same period. Nevertheless, for the decade ending in 2023, Berkshire Hathaway's CAGR for shareholders was 11.8%, slightly trailing the S&P 500's 12.0% CAGR. Notably, from 1965 to 2023, the company's stock price exhibited negative performance in merely eleven years. In August 2024, Berkshire Hathaway achieved the distinction of becoming the eighth publicly traded company in the U.S. and the first non-technology firm valued at over $1 trillion based on market capitalization.

Berkshire Hathaway holds the 5th position in the Fortune 500 list of the largest corporations in the United States by total revenue and ranks 9th on the Fortune Global 500. It is one of the ten largest constituents of the S&P 500 and ranks among the largest employers across the nation. The Class A shares of Berkshire Hathaway command the highest per-share price of any public company globally, reaching $700,000 in August 2024, attributable to the board of directors' historical opposition to stock splits.

Berkshire Hathaway Inc News

End of an Era: Warren Buffett Hands Over the Reins of Berkshire Hathaway — Can the Trillion-Dollar Empire Sustain Its Brilliance?

TradingKey - On December 31, 2025, local time, 95-year-old investment guru Warren Buffett officially stepped down as CEO of Berkshire Hathaway, with Greg Abel, long considered his designated successor, formally taking over the CEO role. This massive holding conglomerate, with a market capitalization

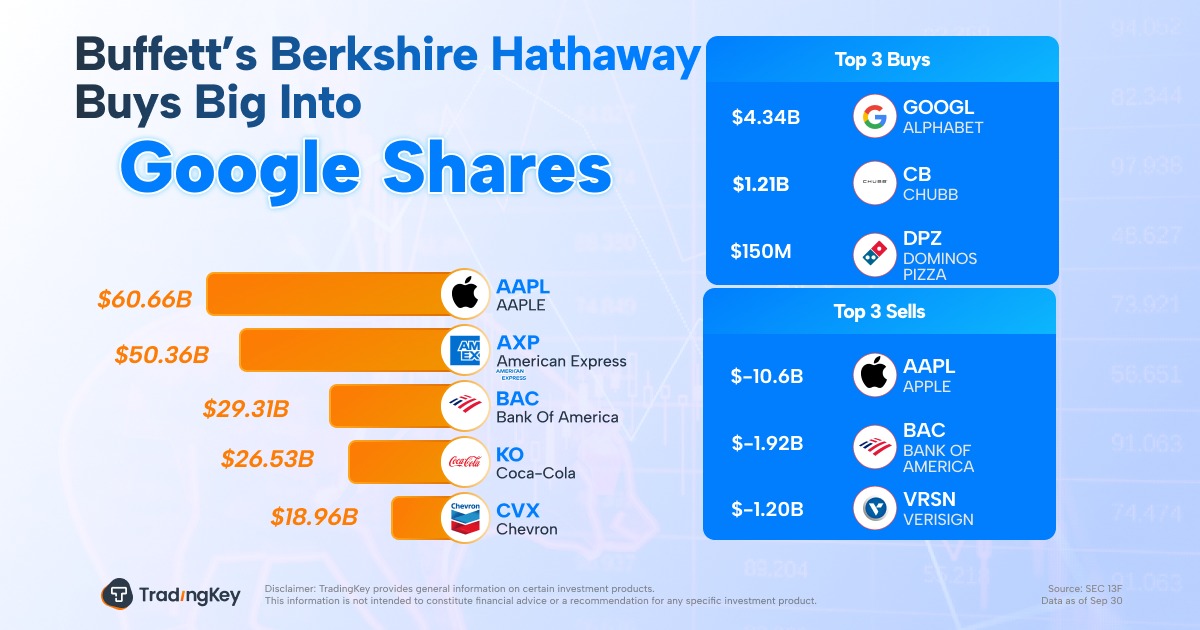

Berkshire's Q3 13F Holdings Shine: Is 'Buy Google' Now the Institutional Tech Play?

This article reviews Berkshire Hathaway's $4.3 billion investment in Alphabet, marking its first purchase of Google stock. With Q3 revenues surpassing $100 billion and growing support from institutional investors, we explore whether Google has won the AI race.

US 13F Filings Flood In: 'Smart Money' Shifts Could Deepen Equity Correction

TradingKey - As US tech stocks grapple with AI bubble concerns and faltering performance, quarterly 13F filings from investment institutions are entering a heavy disclosure period. These reports will unveil "smart money" strategies and could influence future market direction. However, given recent

Buffett Pens Last Letter: What Value Does Berkshire Hathaway Hold Without Him?

TradingKey - Berkshire Hathaway is nearing the end of its 'Buffett Era' as Warren Buffett, the 'Oracle of Omaha,' previews his departure as CEO by the end of 2025 and recently released his 'final letter to shareholders.' After leading Berkshire, home to the world's most expensive stock, for 60 years

Warren Buffett Q2 2025 13F Analysis: Betting on UnitedHealth Again After 14 Years

TradingKey - In Q2 2025, the value of Berkshire Hathaway’s investment portfolio declined from $259.8 billion in Q1 to $257.5 billion, a decrease of 0.89%. Analysis indicates that this drop is primarily driven by a net capital outflow of 0.78%. The outflow may be linked to changing market conditions

Berkshire Hathaway FY2025 Second Quarter Earnings Comments

TradingKey - Revenue: In Q2 2025, Berkshire's total revenue was $92.515 billion, slightly down from $93.653 billion in the same period last year, falling short of market expectations.

Financial Indicators

EPS

Total revenue

Berkshire Hathaway Inc Info

Berkshire Hathaway Inc. is a renowned American multinational conglomerate holding firm with its headquarters situated in Omaha, Nebraska. Initially a textile manufacturer, the company began its transformation into a conglomerate in 1965, under the leadership of chairman and CEO Warren Buffett, along with vice chairman Charlie Munger. Greg Abel currently oversees the majority of the firm's investments and has been designated as Buffett's successor. Buffett personally holds 38.4% of Berkshire Hathaway's Class A voting shares, equating to a 15.1% overall economic stake in the organization.

Often likened to an investment fund, Berkshire Hathaway has delivered a remarkable compound annual growth rate (CAGR) of 19.8% in shareholder returns from 1965, the year Buffett took control, through to 2023, outperforming the S&P 500's 10.2% CAGR in the same period. Nevertheless, for the decade ending in 2023, Berkshire Hathaway's CAGR for shareholders was 11.8%, slightly trailing the S&P 500's 12.0% CAGR. Notably, from 1965 to 2023, the company's stock price exhibited negative performance in merely eleven years. In August 2024, Berkshire Hathaway achieved the distinction of becoming the eighth publicly traded company in the U.S. and the first non-technology firm valued at over $1 trillion based on market capitalization.

Berkshire Hathaway holds the 5th position in the Fortune 500 list of the largest corporations in the United States by total revenue and ranks 9th on the Fortune Global 500. It is one of the ten largest constituents of the S&P 500 and ranks among the largest employers across the nation. The Class A shares of Berkshire Hathaway command the highest per-share price of any public company globally, reaching $700,000 in August 2024, attributable to the board of directors' historical opposition to stock splits.

Related Instruments

Popular Symbols