Warren Buffett Q2 2025 13F Analysis: Betting on UnitedHealth Again After 14 Years

1. Introduction

TradingKey - Born in 1930, Warren Buffett began his investment journey at age 11, forging a legendary career in the history of investing. Since taking the helm of Berkshire Hathaway in 1965, he has served as CEO ever since. Over decades, guided by his distinctive investment philosophy, Buffett has amassed a personal fortune exceeding $100 billion, consistently ranking among the world’s wealthiest individuals. On 30 August 2025, Buffett will celebrate his 95th birthday. According to his succession plan, Greg Abel will assume the role of CEO on 1 January 2026, while Buffett will remain chairman. This timeline suggests that three more 13F filings under his leadership warrant close attention. This article will focus on analysing Buffett and Berkshire Hathaway’s Q2 2025 13F report.

2. Return Performance & Fund Size Changes

In Q2 2025, the value of Berkshire Hathaway’s investment portfolio declined from $259.8 billion in Q1 to $257.5 billion, a decrease of 0.89%. Analysis indicates that this drop is primarily driven by a net capital outflow of 0.78%. The outflow may be linked to changing market conditions, with U.S. stock valuations at historically high levels and weak employment reports heightening concerns about economic activity, prompting Berkshire to reduce equity holdings to mitigate risk.

Even excluding net capital outflows, Berkshire Hathaway’s Q2 2025 portfolio return was -0.11%. This was primarily due to underperformance in certain stock holdings, notably a significant decline in Apple’s and Chevron’s share prices during the quarter. Additionally, macroeconomic uncertainties and intensifying industry competition weakened the profitability of some investment holdings, dragging down overall returns and resulting in a negative return rate.

3. Industry Trends Analysis

In terms of sector allocation, Berkshire Hathaway’s largest holdings in Q2 2025 were in financials (41.4%), information technology (22.3%), and consumer staples (16.5%). Compared to Q1, the information technology sector saw a reduction of 3.4 percentage points. This reduction may signal several insights. It could indicate that Berkshire views the tech sector’s prior gains as having pushed valuations to elevated levels, potentially harbouring a bubble, prompting a reduction to lock in profits. Alternatively, it may reflect concerns about uncertainties in the tech industry’s future, such as rapid technological iteration, intensifying competition, or the potential for disruptive changes or shocks.

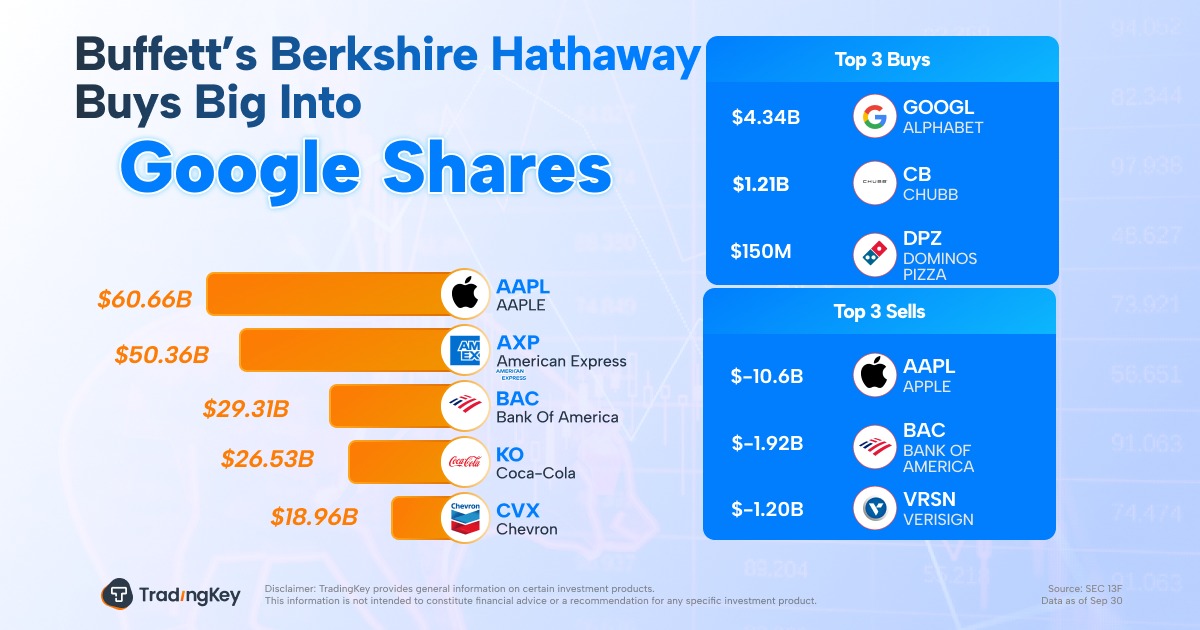

4. Top Five Holdings Changes

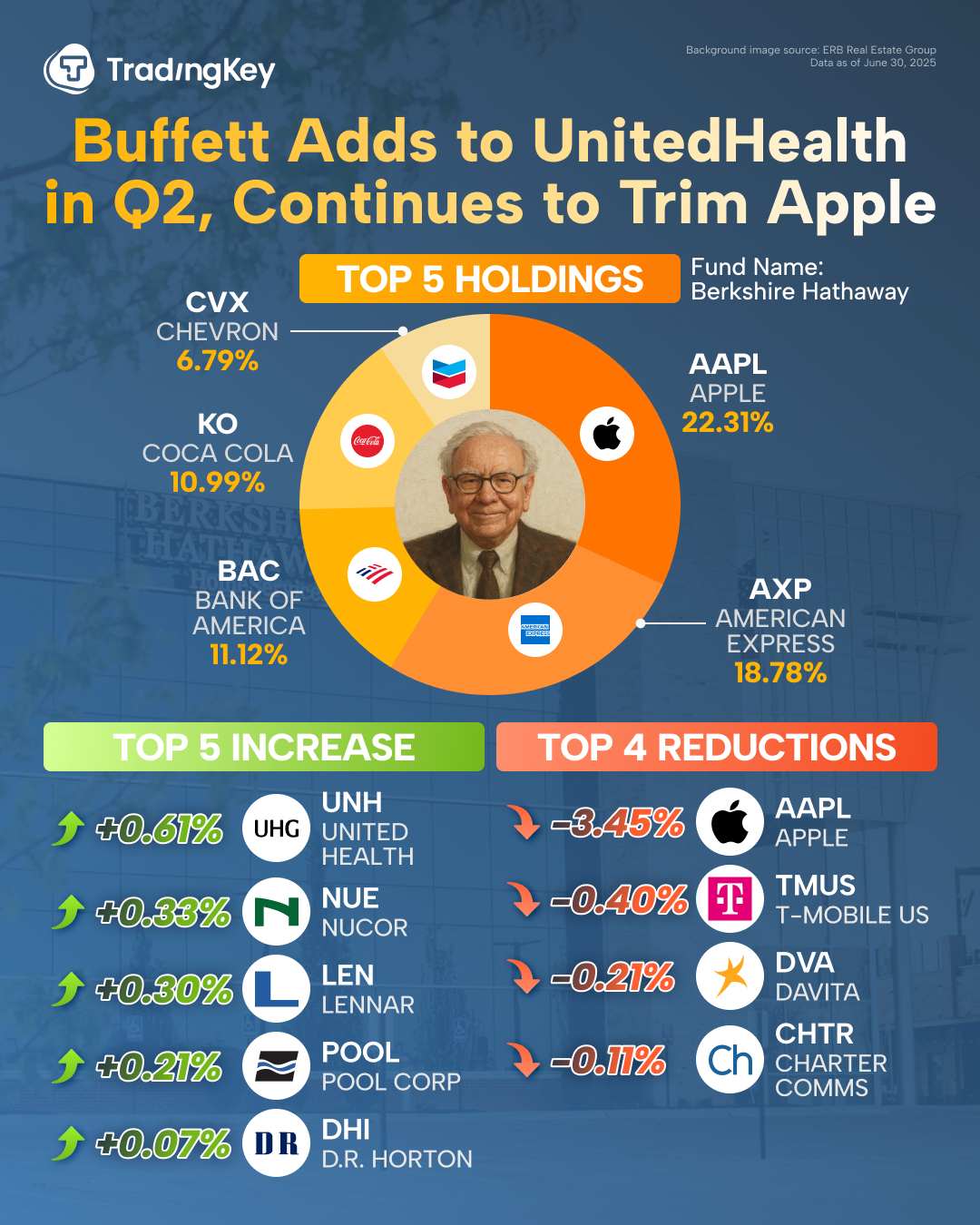

Berkshire Hathaway’s top five holdings are Apple (22.3%), American Express (18.8%), Bank of America (11.1%), Coca-Cola (11%), and Chevron (6.8%). This portfolio structure underscores Berkshire’s core investment philosophy: focusing on industry-leading companies with strong economic moats. Apple and American Express, collectively accounting for over 40% of the portfolio, reflect a preference for high-profitability, stable technology and financial assets. Coca-Cola, a long-term holding, demonstrates Berkshire’s commitment to essential consumer goods. Bank of America and Chevron cover key financial and energy sectors, balancing defensive and cyclical exposures. Notably, while Berkshire reduced its stakes in Apple and Bank of America in Q2, these companies continue to rank among the top three holdings.

5. Top Buy and Sell

In Q2 2025, Berkshire Hathaway made significant adjustments to its investment portfolio, with a key move being the acquisition of 5.04 million shares in UnitedHealth Group, valued at approximately $1.57 billion based on June-end prices. This marks Berkshire’s first investment in the company since exiting its position in 2010. UnitedHealth’s stock has faced pressure due to rising medical costs, an ongoing U.S. Department of Justice investigation, a cyberattack in the previous year, and the tragic shooting of former executive Brian Thompson in December 2024, contributing to a nearly 50% year-to-date decline in its share price. Berkshire’s decision to initiate a position at this juncture may be driven by several factors: UnitedHealth’s currently low valuation, the increasing demand for healthcare services fuelled by an ageing U.S. population, and the company’s leadership in the industry, which combines the stability of its insurance business with the advantages of its healthcare network. These qualities align closely with Berkshire’s preference for companies with strong “moats” capable of weathering economic cycles. Additionally, Berkshire significantly increased its holdings in steel manufacturer Nucor and homebuilder Lennar, moves interpreted as bets on the growth potential of U.S. infrastructure and real estate markets.

On the sell side, Berkshire Hathaway reduced its stake in Apple by 20 million shares, possibly due to intensifying competition in the consumer electronics market and pressures on growth. Additionally, Berkshire trimmed its position in Bank of America by 26.3 million shares, likely influenced by factors such as interest rate volatility and adjustments to earnings expectations in the banking sector. This reduction aligns with Berkshire’s investment strategy of mitigating cyclical risks.

6. Investment Strategy Analysis

Warren Buffett’s investment strategy can be distilled into four key principles. First, value investing: He emphasises fundamental analysis, seeking companies whose market price is below their intrinsic value. Second, long-term investing: As a value investor, Buffett believes in the importance of holding investments over the long haul, trusting that markets will eventually reflect fair pricing. This perspective fosters his contrarian approach, remaining unfazed by short-term volatility. Third, economic moats: As a long-term investor, he prioritises companies with strong, sustainable competitive advantages and robust growth potential. Finally, investing in businesses, not stocks: Guided by this philosophy, Buffett dives deeply into understanding a company’s operations, products, and unique strengths. These four principles likely underpin his success as an investor.