Exxon Mobil Corp

XOMToday

+2.03%

5 Days

+5.41%

1 Month

+23.13%

6 Months

+39.94%

Year to Date

+23.86%

1 Year

+37.46%

TradingKey Stock Score of Exxon Mobil Corp

Currency: USD Updated: 2026-02-06Key Insights

Exxon Mobil Corp's fundamentals are relatively healthy, with an industry-leading ESG disclosure.and its growth potential is significant.Its valuation is considered fairly valued, ranking 26 out of 119 in the Oil & Gas industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 139.54.In the medium term, the stock price is expected to trend up.The company has been performing strongly in the stock market over the past month, which is supported by its strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

Exxon Mobil Corp's Score

Support & Resistance

Score Analysis

Media Coverage

Exxon Mobil Corp Highlights

Exxon Mobil Corporation is an American multinational oil and gas company headquartered in Spring, Texas, a suburb of Houston. Established as the largest direct successor to John D. Rockefeller's Standard Oil, the contemporary company was created in 1999 through the merger of Exxon and Mobil. It is vertically integrated across the entire oil and gas sector, including its chemicals division, which manufactures plastics, synthetic rubber, and various other chemical products. As the largest oil and gas company based in the U.S., ExxonMobil ranks as the seventh-largest firm by revenue in the U.S. and the 13th-largest globally. Furthermore, it is recognized as the largest investor-owned oil company worldwide, with approximately 55.56% of its shares owned by institutions, the largest being The Vanguard Group, BlackRock, and State Street Corporation as of 2019.

Analyst Rating

Exxon Mobil Corp News

After the Shift in the World's No. 1 Oil Reserve Nation, Who Might Become the Biggest Winner in Venezuela's Oil Market?

TradingKey - US President Donald Trump stated late Tuesday that the interim Venezuelan authorities would deliver 30 to 50 million barrels of crude oil to the United States. The US is expected to restore deep connections with Venezuela's oil industry, which could be a "delayed dividend" for US refine

[Reuters Analysis] Record production at Exxon and Chevron humbles European rivals: Bousso

Exxon, Chevron oil and gas production hit record in Q2Shell production drops to lowest in at least 20 years, BP's drops from year agoEuropean majors hope to close a valuation gap with US rivalsBy Ron Bousso LONDON, Aug 5 - When playing catch up, picking up the pace may not be enough. One also...

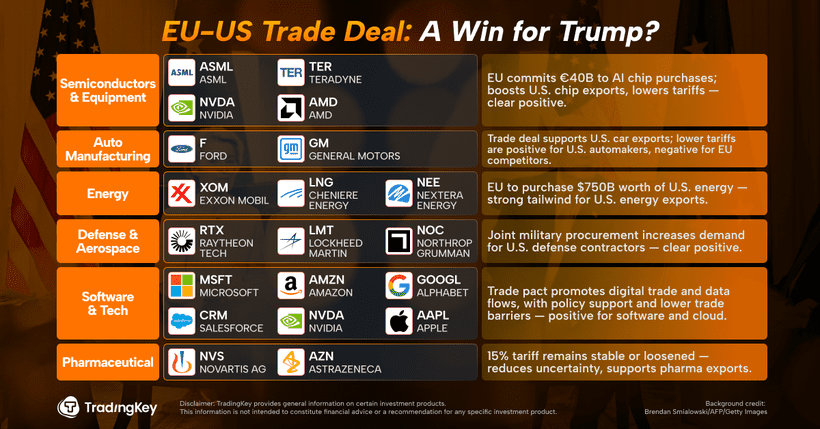

EU-US Trade Deal: A Win for Trump?

TradingKey - Markets have been buzzing this week around the new trade deal announced between the U.S. and the European Union. But while headlines touted a breakthrough, the details—and the politics—tell a more complicated story.

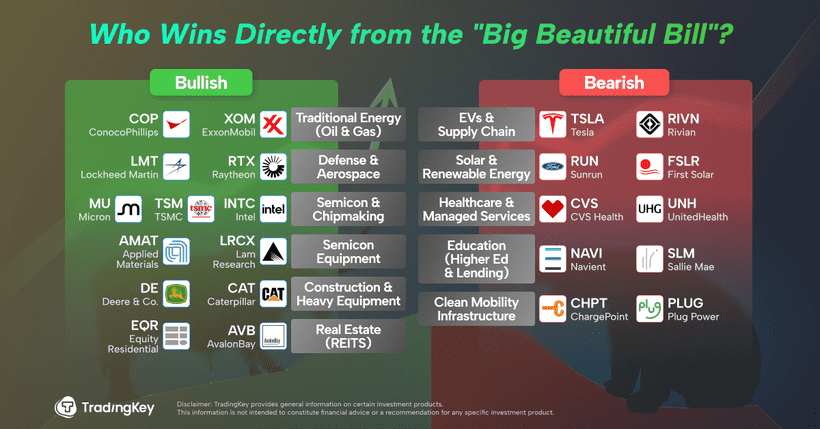

Who Wins Directly from the "Big Beautiful Bill"?

TradingKey - Last Friday, U.S. Congress passed what Donald Trump proudly calls the “Big Beautiful Bill.” The legislation has already given U.S. markets a short-term lift—by unlocking new liquidity and opening the door to valuation re-rating in select sectors. Expect winners in energy, defense, and m

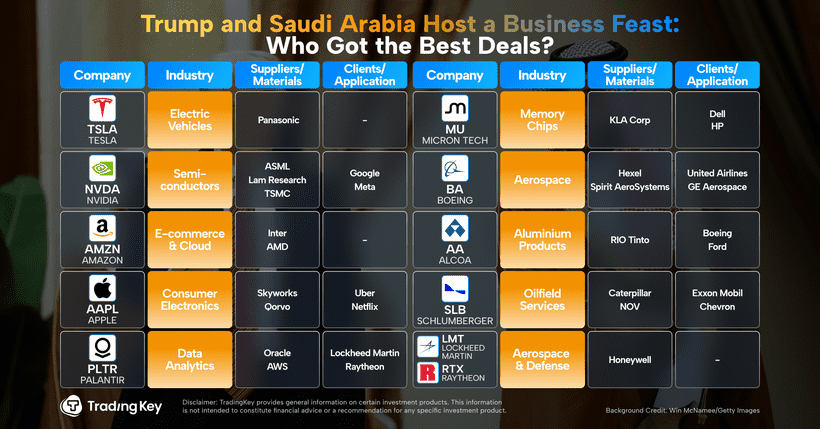

Trump and the Middle East Host a Business Feast—Who Cut the Best Deals?

TradingKey - US President Donald Trump has embarked on his first official visit to the Middle East during his term in office this week, traveling to Saudi Arabia, Qatar, and the United Arab Emirates.

ExxonMobil Built Its Business to Thrive in Volatile Oil Markets

Turbulence has returned to the oil market this year. Oil prices have tumbled more than 15%, weighed down by the uncertain impact of tariffs and other factors. As a result, the price of the global oil benchmark Brent, which spent much of the past couple of years bouncing around in the range of $75...

Financial Indicators

EPS

Total revenue

Exxon Mobil Corp Info

Exxon Mobil Corporation is an American multinational oil and gas company headquartered in Spring, Texas, a suburb of Houston. Established as the largest direct successor to John D. Rockefeller's Standard Oil, the contemporary company was created in 1999 through the merger of Exxon and Mobil. It is vertically integrated across the entire oil and gas sector, including its chemicals division, which manufactures plastics, synthetic rubber, and various other chemical products. As the largest oil and gas company based in the U.S., ExxonMobil ranks as the seventh-largest firm by revenue in the U.S. and the 13th-largest globally. Furthermore, it is recognized as the largest investor-owned oil company worldwide, with approximately 55.56% of its shares owned by institutions, the largest being The Vanguard Group, BlackRock, and State Street Corporation as of 2019.

Related Instruments

Popular Symbols