MP Materials Corp

MPToday

+8.33%

5 Days

+4.24%

1 Month

+2.41%

6 Months

-9.26%

Year to Date

+21.26%

1 Year

+154.09%

TradingKey Stock Score of MP Materials Corp

Currency: USD Updated: 2026-02-06Key Insights

MP Materials Corp's fundamentals are relatively very healthy, with an industry-leading ESG disclosure.and its growth potential is good.Its valuation is considered fairly valued, ranking 58 out of 119 in the Metals & Mining industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 78.33.In the medium term, the stock price is expected to remain stable.Despite an average stock market performance over the past month, the company shows strong technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

MP Materials Corp's Score

Support & Resistance

Score Analysis

Media Coverage

MP Materials Corp Highlights

Analyst Rating

MP Materials Corp News

MP Materials: The Rare Earths Are Hot! But Is This a Mistake?

TradingKey - MP Materials(NYSE:MP) is one of the most talked about rare earth resources over the past year.

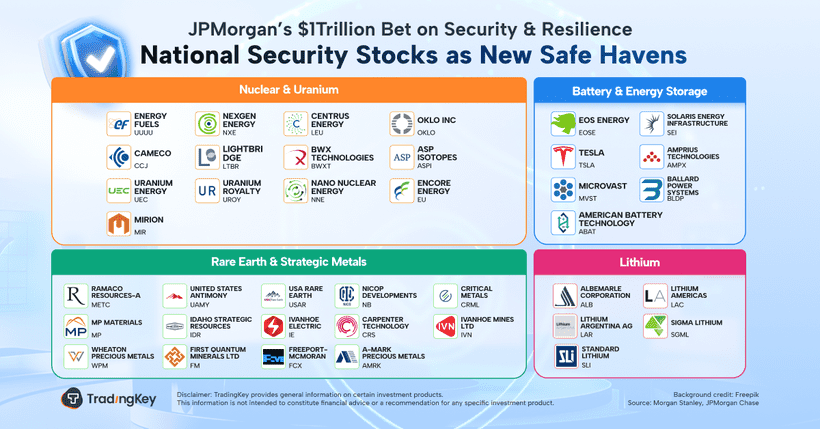

JPMorgan’s $1Trillion Bet on Security & Resilience: National Security Stocks as New Safe Havens

TradingKey - On Monday, JPMorgan announced a sweeping 10-year strategic investment plan under the theme of “Security & Resilience”—an initiative that could involve up to $1 trillion in capital deployment across four high-priority sectors.

MP Materials 2Q25 Earnings Comment: Going up the Value Chain

TradingKey - MP Materials released its earnings for the second quarter of the fiscal 2025 on August 7th after the bell.The smaller loss and the better revenue were surely welcomed by investors, and the stock is up 8.50% in the post-bell session.

Why MP Materials Skyrocketed This Week

Key PointsThe Department of Justice announced a $400 billion investment in MP to fund a huge rare earths processing plant expansion. In conjunction, the DoD agreed to a long-term purchase agreement with a minimum price and volume commitments. The deal is momentous for MP and significantly...

Financial Indicators

EPS

Total revenue

MP Materials Corp Info

Related Instruments

Popular Symbols