Total 327 articles

Gold Prices Fall to $5,160, Silver Prices Fall to $106

Gold prices pulled back below $5,182 per ounce, erasing gains made since Wednesday. Silver prices retraced below $106 per ounce, wiping out Wednesday's gains and eroding a portion of Tuesday’s advance. Beyond the apparent cooling of sentiment, this downward trend is driven by multiple factors: polic

Fri, Jan 30

SanDisk Delivers US Stocks’ ‘Most Explosive’ Earnings Report, Storage Business Demand Surges.

TradingKey - Memory giant SanDisk released its FY2026 second-quarter financial results after the market close on Thursday, reporting sharp growth in both earnings and revenue.

Fri, Jan 30

SpaceX Plots Dual-Track Merger: Tesla or xAI? IPO Countdown Triggers Capital Speculation

TradingKey — On Thursday, Eastern Time, SpaceX is simultaneously advancing two major integrations: evaluating a potential merger with Tesla while accelerating negotiations with xAI, aiming for a mega-IPO later this year. During Thursday's U.S. intraday trading session, Tesla shares reversed gains to

Fri, Jan 30

Opendoor Stock After a Wild Ride: What’s Next for the Real Estate Tech Name?

TradingKey - The emergence of open-door real estate technology has now evolved from being a niche iBuyer concept, to an incredibly volatile, contentious name in the marketplace, as demonstrated by Opendoor stock(NASDAQ: OPEN) having both speculative excitement and serious structural concerns about i

Thu, Jan 29

Review of Tesla’s Top 3 Gain and Loss Events Since 2020: Driving Logic Behind Volatility and What Insights Can We Gain?

TradingKey - A clear understanding of Tesla's price performance since 2020 helps investors grasp its volatility range as a high-growth stock and effectively assists in risk mitigation for future market movements.

Thu, Jan 29

UnitedHealth Shares Slump Again. Double Headwinds Hit, Where Can the Insurance Giant Find Relief?

TradingKey - The U.S. Centers for Medicare & Medicaid Services (CMS) announced on Monday that Medicare Advantage payment rates for 2027 will increase by just 0.09%, far below analyst expectations of up to 6%.

Wed, Jan 28

Nio Stock under $5: Is It a Good Investment Or a Potential Loss?

TradingKey - The global electric vehicle (EV) market has matured, and competition is increasing. As Nio's stock (NYSE: NIO) price continues to trade below $5 per share after hitting $8 earlier this year, it has become an important indicator of how investors feel about Chinese EV manufacturers.

Wed, Jan 28

Plug Power Stock: Hydrogen Hype, Hard Reality, or Hidden Upside?

TradingKey - Plug Power (NASDAQ: PLUG) is a company that has been extremely popular for many years in the clean energy industry, in particular hydrogen.

Wed, Jan 28

Why Every SpaceX Success Quietly Raises Tesla’s “Faith Ceiling”

TradingKey - If Tesla (TSLA) is viewed solely through the valuation framework of traditional automakers, many investors would consider it detached from its fundamentals. Its sales growth has slowed, price wars are eroding margins, and it will still take time before autonomous driving and robotics co

Wed, Jan 28

Burry Bullish on Meme Stocks, GameStop Shares Surge Again. Is It Still the Time to Buy?

TradingKey - Shares of quintessential meme stock GameStop (GME) surged more than 8% intraday on Monday after Michael Burry, the fund manager renowned for "The Big Short," revealed in a post that he has been buying the stock.

Tue, Jan 27

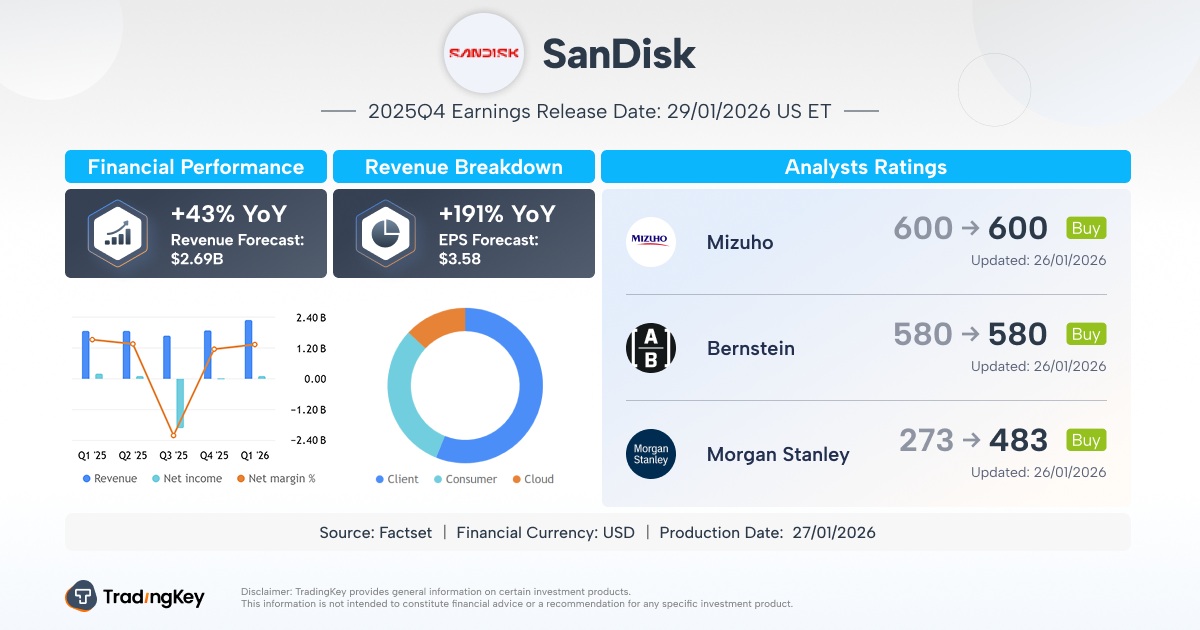

SanDisk FY2026 Q2 Earnings Preview: Explosive Demand for AI Storage Drives Accelerat

TradingKey - Against the backdrop of a structural recovery in the global storage industry, data storage leader SanDisk Corp (SNDK) will release its fiscal second quarter 2026 financial results (corresponding to approximately calendar Q4 2025) after the U.S. market close on January 29, 2026.

Tue, Jan 27

MP Materials: The Rare Earths Are Hot! But Is This a Mistake?

TradingKey - MP Materials(NYSE:MP) is one of the most talked about rare earth resources over the past year.

Tue, Jan 27

Apple Stock: Valuation, Growth Catalysts, and What Buffett’s Moves Mean for 2026?

TradingKey - Investors are talking about Apple Inc.(AAPL) today more than any other time due to its changing Leadership and Market; this is also a result of Apple Inc.'s earnings being lower than expected and the Demand Cycle Level declining.

Mon, Jan 26

Why Waymo Autonomous Driving Has Already Succeeded, But Smart Money Still Bets All Its Chips on Tesla?

TradingKey - As a high-certainty pioneer in the Robotaxi sector, Waymo’s mature autonomous driving technology has long been recognized by the market. However, this does not necessarily translate into favor from market capital. Given its clear growth prospects and largely established macro narrative,

Mon, Jan 26

What Are Costco’s Stock Prospects Today into 2026?

TradingKey - Despite a rare year of underperformance (2019), Costco Wholesale (COST) has always been one of the most closely followed consumer retail stocks.

Fri, Jan 23

Tesla's Optimus vs NEO – The Battle for the Future of Robots

TradingKey - As one of Tesla's (TSLA) most strategically ambitious projects, the humanoid robot Optimus has yet to contribute actual revenue, but its long-term potential has been widely priced in by the market.

Fri, Jan 23

Musk “Endorsement” of Ryanair Just a Gimmick? Investors Actually More Worried About Musk’s Focus on Tesla

TradingKey - On January 14 local time, Ryanair (RYAAY) CEO Michael O'Leary stated that the airline will not install SpaceX’s Starlink satellite Wi-Fi technology on its fleet, citing concerns over increased drag and the resulting rise in fuel costs.

Thu, Jan 22

Tesla Earnings Preview: With EV Sales Slowing, Can Tesla's Energy Storage Business Boost Its Earnings?

TradingKey - We previously noted a slowdown in growth for Tesla's EV business, with year-over-year sales declines reported in certain regions. Although Tesla's energy storage business is experiencing rapid growth, it is unlikely to displace the revenue dominance of the EV segment in the short term.

Thu, Jan 22

Why Broadcom Stock Is at the Center of the AI Chiplandscape in 2026

TradingKey - Broadcom Stock (AVGO) has become the most discussed semiconductor stock among smart money in 2026. With the rise of Artificial Intelligence (AI) technology, many investors are now reevaluating which semiconductor companies will be most successful moving forward.

Wed, Jan 21

Navitas Stock: Will the AI Shift Be Enough to Propel the Stock after the Hefty Drop-Off?

TradingKey - Navitas Semiconductor has risen to become one of 2023's hottest small cap semiconductor companies, reaching a more than double increase by the end of 2025

Wed, Jan 21