TradingKey

3135 Articles

TradingKey is a comprehensive financial education and news analysis website, providing real-time market data, financial news coverage across forex, commodities, cryptocurrencies and more, as well as professional trading courses.

Applied Materials Q3 Earnings: AI Demand Soars, but Cautious Guidance Triggers After-Hours Selloff

TradingKey - Applied Materials, Inc. (NASDAQ: AMAT) announced its Q3 FY2025 earnings on August 14, 2025, after market close, reporting strong revenue fueled by AI-related semiconductor demand, which beat expectations. However, cautious Q4 guidance, including EPS below analyst estimates

Fri, Aug 15

.jpg)

SEC Chair Unveils ProjectCrypto — Which Blockchain Sectors Could Benefit Most?

On Friday, August 15 at 11:00 a.m. ET, SEC Chairman Paul Atkins delivered a major policy speech outlining the agency’s new initiative: ProjectCrypto.

Fri, Aug 15

Japan’s Q2 GDP Doubles Expectations on Strong Domestic Demand and Net Exports Rebound

TradingKey - According to data released by Japan’s Cabinet Office on August 15, Japan’s real GDP in Q2 2025 grew 0.3% quarter-on-quarter, marking the fifth consecutive quarter of expansion. Year-on-year growth reached 1.0%, far exceeding the expected 0.4%, signaling that the Japanese economy is firm

Fri, Aug 15

Trump Backs Intel with Surprise Stake; World's Largest Ohio Chip Plant Resurrected

TradingKey - Multiple authoritative reports indicate the Trump administration is in negotiations with chip giant Intel Corporation to provide critical support for the company’s U.S. manufacturing expansion through a potential government equity stake.

Fri, Aug 15

U.S. July PPI Surprises to the Upside — Crypto Rally Stalls as Rate Cut Doubts Emerge

With rate cut expectations now in flux, crypto assets may struggle to regain momentum. Analysts warn that Bitcoin could retest the $110,000 support zone, which held firm during early August despite heavy selling pressure.

Fri, Aug 15

Buffett’s “Mystery Holdings” Revealed in Q2: Are Nucor, Lennar, and D.R. Horton Really His Bets?

TradingKey - In its latest 13F filing, Berkshire Hathaway, led by “the Oracle of Omaha” Warren Buffett, finally disclosed the “mystery holdings” it deliberately concealed in the first quarter: Nucor (NUE), Lennar (LEN), and D.R. Horton (DHI) — a move that may reflect a strategic bet on the recovery

Fri, Aug 15

UnitedHealth’s Turnaround Story? Buffett and David Tepper Both “Buy the Dip” in Q2 on This Retail Favorite

TradingKey - A series of setbacks — executive turmoil, rising medical costs, and cyberattacks — have halved the stock price of UnitedHealth (UNH), the U.S. health insurance leader, in 2025. Yet Wall Street’s most legendary investors see a “buying opportunity”: In their Q2 13F filings, Berkshire

Fri, Aug 15

Double Reversal? U.S. PPI Soars Beyond Expectations — Is a Fed rate cut still a done deal?

TradingKey - On Wednesday morning (U.S. Eastern Time), the U.S. Bureau of Labor Statistics released the latest Producer Price Index (PPI) data:

July PPI rose 3.3% year-over-year, far exceeding the expected 2.5% and marking the highest level since February.

Thu, Aug 14

Foxconn Q2 Profit Surges 27% as Server Earnings Surpass iPhone Assembly

TradingKey - Foxconn (also known as Hon Hai Precision Industry), the world's largest electronics contract manufacturer, released its second-quarter earnings report on August 14, revealing a 27% year-over-year rise in profit that exceeded expectations. For the first time, quarterly revenue from its c

Thu, Aug 14

The Market Game of the Quantitative King: How Renaissance Technologies Locks in Excess Returns Amid the 2025 Turmoil

TradingKey - Founded by mathematician James Simons, Renaissance Technologies LLC is a global leader in quantitative investing, renowned for its data-driven, innovative approach. The firm eschews traditional fundamental analysis, relying instead on advanced mathematical models

Thu, Aug 14

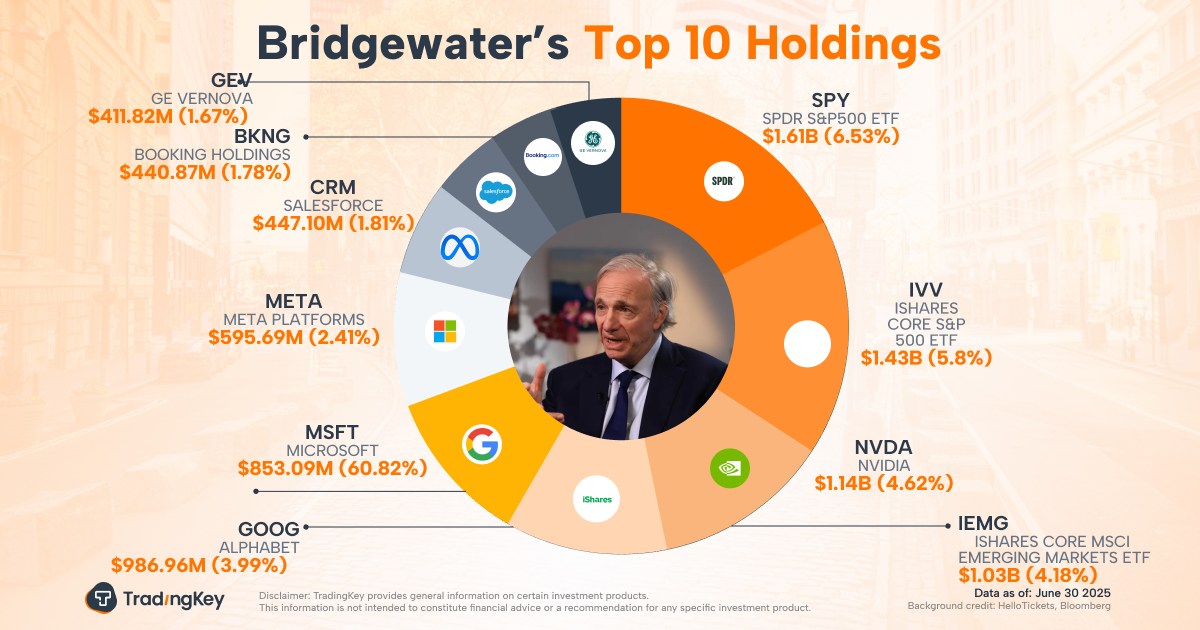

Bridgewater Associates Q2 2025 13F Analysis: Founder Ray Dalio’s Final Act

TradingKey - Bridgewater Associates, the world’s largest hedge fund and renowned for its macroeconomic analysis, continues to command market respect with its “risk parity” strategy and precise economic cycle timing.

Thu, Aug 14

Ethereum Inches Within $100 of All-Time High — Standard Chartered Raises Year-End Target to $7,500

Standard Chartered Bank has revised its year-end ETH price target from $4,000 to $7,500.

Thu, Aug 14

China's AI Chip Leader Cambricon Hits Third Straight Record High, Edging Closer to 1,000 Yuan

TradingKey - On August 14, Cambricon, a Chinese AI chip manufacturer, saw its stock rise over 14% intraday to once reach 985 yuan.This marked the third consecutive day of record highs as the stock edged towards the 1,000 yuan milestone. Its market capitalization briefly surpassed 400 billion yuan wi

Thu, Aug 14

Crypto Stocks Ignite ARKK’s Q2 NAV Surge of 46.96%

ARK Innovation ETF (ARKK), managed by Cathie Wood, delivered a stellar performance in Q2 2025, with its net asset value (NAV) soaring by 46.96%, reaffirming Wood’s reputation as one of Wall Street’s most polarizing yet influential fund managers.

Thu, Aug 14

Grocery Stocks Sink as Amazon Expands Same-Day Delivery to 1,000 Cities

TradingKey - E-commerce giant Amazon formally announced on August 13 a major expansion into U.S. fresh grocery delivery, launching same-day service covering over 1,000 cities and towns for perishable categories including seafood, meat, and frozen foods. The company plans to extend coverage to...

Thu, Aug 14

Why a 50-Basis-Point Rate Cut in September Should Worry Investors? Risks and Fed Independence Loom Large

TradingKey - After the release of the July nonfarm payrolls and CPI reports, markets have all but locked in expectations for the Federal Reserve to restart rate cuts in September, but the magnitude of the cut remains uncertain. U.S. Treasury Secretary Scott Bessent has called for a 50-basis-point

Thu, Aug 14

Cisco Q4 Slightly Beats Expectations — Strong AI Orders, But Lackluster Full-Year Guidance Raises Concerns?

TradingKey - Cisco Systems (CSCO.US) released its fiscal fourth-quarter 2025 results (ended July 26) after the market close on Wednesday. The company delivered a modest beat, but its underwhelming full-year outlook for fiscal 2026 led to a decline in after-hours trading.

Thu, Aug 14

Bridgewater’s Q2 Portfolio: Masterful “Sell High, Buy Low” — Exits Re-rated Chinese Stocks, Doubles Down on U.S. Tech and AI

TradingKey - After the U.S. market close on August 13, Bridgewater Associates, the world’s largest hedge fund, filed its 13F regulatory report with the U.S. Securities and Exchange Commission. The fund made significant changes to its U.S. equity portfolio in the second quarter of 2025: doubling down

Thu, Aug 14

[Crypto IPO] Bullish Surges Then Slumps on IPO Debut — Cathie Wood Buys 2.5M Shares, Faces Potential Losses

With a diversified product suite, high-value crypto reserves, and backing from top-tier investors, Bullish could attract significant market interest and potentially outperform Circle in post-IPO performance.

Thu, Aug 14

“Optical Giant” Coherent Beats Earnings but Misses Guidance, Shares Plunge 19% After Hours

TradingKey - After U.S. markets closed on Wednesday, optical components leader Coherent (COHR) saw its stock plunge 19% in extended trading. Despite delivering a fourth-quarter earnings beat, the company’s weaker-than-expected guidance for the current quarter raised concerns about the sustainability

Thu, Aug 14