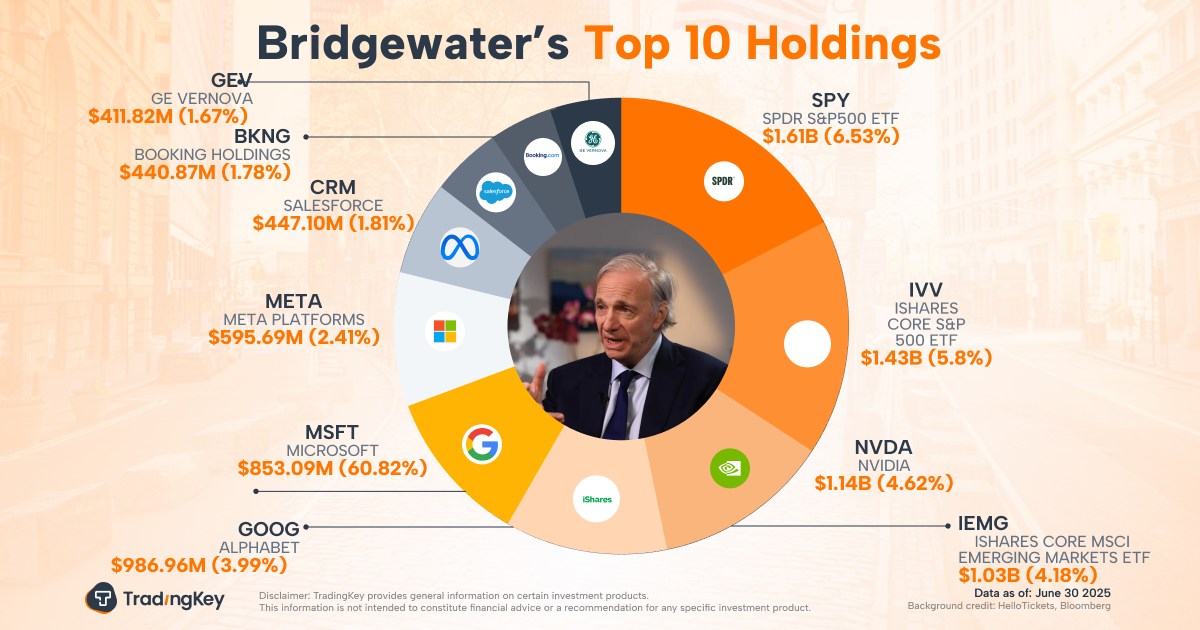

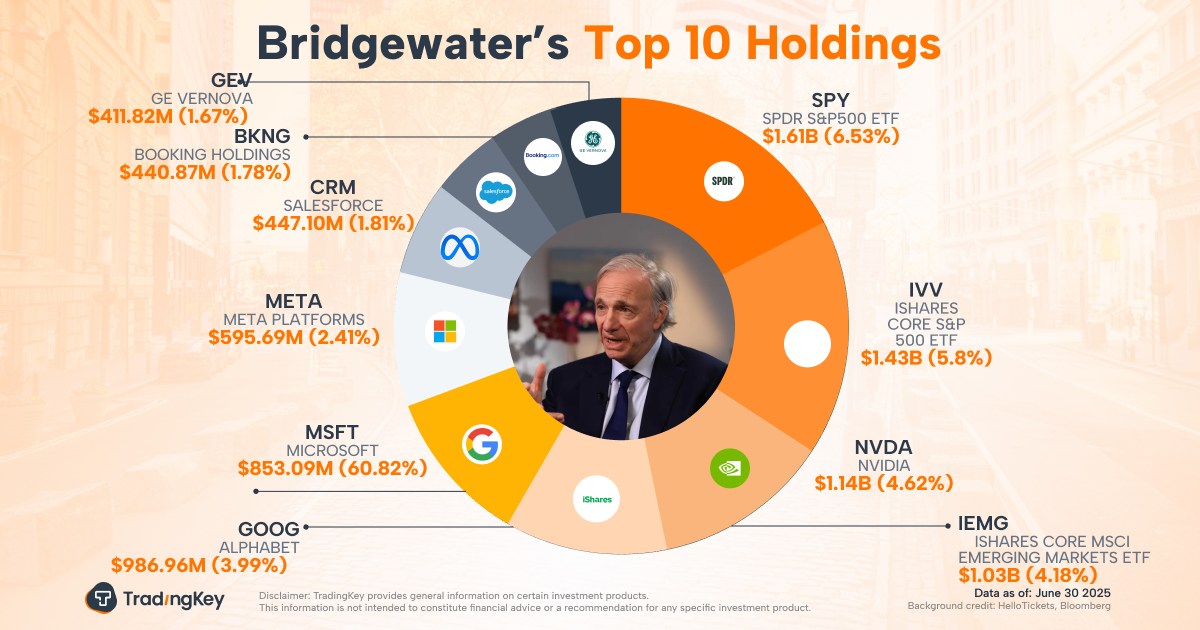

Bridgewater Associates Q2 2025 13F Analysis: Founder Ray Dalio’s Final Act

1. Introduction

TradingKey - Bridgewater Associates, the world’s largest hedge fund and renowned for its macroeconomic analysis, continues to command market respect with its “risk parity” strategy and precise economic cycle timing.

In Q2 2025, global asset classes underwent pronounced, but ultimately contained, volatility. Amid lingering uncertainties from the Trump-era tariff conflicts, markets endured a rare “triple test” with simultaneous shocks across equities, bonds, and currencies. Meanwhile, the world faces a critical juncture: debt levels have breached key thresholds, inflation remains sticky, and economic growth is slowing. Bridgewater’s portfolio adjustments this quarter reflect a blend of long-term risk diversification and nimble responses to short-term cycles.

Notably, August 1 marked the official exit of Ray Dalio, Bridgewater’s founder, making this quarter his final tenure at the helm. How he evaluates risk and translates that into portfolio action is a key focus. This report leverages the latest 13F filings to dissect Bridgewater’s asset allocation philosophy, sector outlook, and core holdings—offering insights for investors navigating the evolving macro landscape.

2. Performance and Fund Size Dynamics

Bridgewater’s flagship “Pure Alpha” fund returned 9.81% in Q2 2025, slightly underperforming the S&P 500’s 10.57% gain by 0.76 percentage points.

Assets under management climbed from 21.6 billion by 25Q1 to 24.7 billion by 25Q2—an impressive 14.4% sequential increase. This growth largely stemmed from positive fund performance coupled with fresh institutional inflows.

Key drivers of performance included:

1、Rebalancing U.S. Equity Exposure: Significant overweight positions in tech giants such as Nvidia and Alphabet boosted excess returns, while trimming holdings in Amazon and reducing exposure to the S&P 500 ETF helped fine-tune risk.

2、Global Regional Adjustments: Bridgewater pared back emerging market ETFs and liquidated many China-centric stocks—including Alibaba and Baidu—while doubling down on U.S. equities.

3、Commodity Positioning: Maintaining allocations to gold and industrial metals provided effective hedges amid escalating geopolitical tensions and a weakening dollar, contributing positively to portfolio resilience.

3. Industry Trends Analysis

Sector Allocation Shifts (Based on Equity Holdings in 13F Filings):

Data Sources: TradingKey As of: August 14, 2025

Trend Analysis:

Increased Exposure to Technology and Healthcare: In response to sharp declines in U.S. equities triggered by trade tensions, Bridgewater significantly boosted positions in marquee tech stocks. This move signals confidence in AI’s transformative impact on tech firms’ profitability and underscores the U.S.’s continued leadership in the China-U.S. technology race. Additionally, the fund raised allocations in healthcare—particularly innovative pharmaceuticals and medical devices—reflecting expectations of slower economic growth. These sectors benefit from robust, inelastic demand and exhibit strong defensive qualities during downturns.

Reduced Weighting in Traditional Energy, Industrials, and Other Sectors: Bridgewater passively trimmed cyclical sectors such as energy, industrials, and financials this quarter, largely through selling S&P 500 index shares. This cautious stance highlights concerns over the soaring U.S. debt burden and risks of stagflation.

Maintained Commodity Positions: Allocations to gold, copper, and other resource-linked assets remained stable, serving as both an inflation hedge and protection against escalating geopolitical risks.

4. Top Five Holdings Changes

Top Five Holdings and Recent Changes (Primarily ETFs and Large-Cap Stocks Reflecting Diversification):

.jpg)

Data Sources: TradingKey As of: August 14, 2025

Increased Stakes in Nvidia (NVDA) and Alphabet (GOOGL): The massive NVDA build-up reflects its irreplaceable role in the global AI landscape and strong downstream demand visibility. Bridgewater also trimmed AMD exposure accordingly. The upsizing in Alphabet stems from expectations of robust growth in AI-driven advertising revenue and cloud services. Notably, after 25Q2 earnings released, Alphabet trades at a forward P/E of around 20X, making it the most attractively valued technology stock among the M7 group.

Reduced Holdings in SPY and IEMG ETFs: Substantial cuts in these ETFs mainly reflect growing wariness over the debt cycle and slowing economic momentum. The strategic shift from broad U.S. equity ETFs in favor of targeted tech exposure underscores a preference for companies with durable technological moats and strong cash flow generation.

5. Top Buy and Sell

Largest Buy: Nvidia (NVDA), Significant Increase

The fund’s largest purchase this quarter was a substantial addition to Nvidia. As previously noted, Nvidia’s near-monopoly in AI chips and its dominant ecosystem position have cemented its role as the “picks-and-shovels” stock of the AI revolution. Despite stringent U.S. export restrictions, global downstream demand for Nvidia’s chips remains unabated.

Largest Sale: Alibaba (BABA), Full Exit

Bridgewater executed a complete exit from Alibaba. China’s largest e-commerce giant continues to face intensified competitive pressures, with the battleground extending beyond e-commerce into food delivery. The platform’s aggressive subsidy strategy to retain users is significantly eroding profit margins. Additionally, Alibaba’s highly anticipated AI initiatives have stalled, hampered by chip shortages and related capital expenditure constraints, causing a slowdown in AI development progress.

6. Investment Strategy Analysis

Style Summary: Bridgewater’s hallmark strategy combines macro-driven insights with robust risk diversification. By allocating across asset classes—equities, bonds, commodities—and geographies spanning developed and emerging markets, the fund aims for consistent positive returns through varying economic cycles.

The portfolio moves in Q2 2025 elucidate several clear strategic themes:

1、Selective Differentiation Within U.S. Tech: With global growth showing signs of deceleration, tech companies continue heavy investments in AI, but face inevitable downturns in traditional businesses and intensified competition. This dynamic is evident in shifting market shares within cloud services, where Amazon and Alphabet display a “zero-sum” landscape in Q2.

2、Mounting U.S. Debt Burden and Slowing Economy: Dalio has repeatedly sounded alarm bells over America’s swelling debt and deficits—most recently through speeches and his book — “How Countries Go Broke”. Interest payments are crowding out fiscal budgets, edging the country toward a “debt death spiral.” Against this backdrop, systemic risk is elevated. Consequently, Bridgewater has reduced exposure to overvalued equities, favoring short-term Treasuries and inflation-protected assets as defensive hedges.

3、Tech Innovation as a Productivity Catalyst: Dalio identifies three major economic drivers: productivity growth, the short-term debt cycle, and the long-term debt cycle. He views the AI revolution as a transformative force on par with, or even surpassing, the Industrial Revolution in reshaping human society and powering future productivity gains.