[Crypto IPO] Bullish Surges Then Slumps on IPO Debut — Cathie Wood Buys 2.5M Shares, Faces Potential Losses

Bullish Surges Then Slumps on IPO Debut — Cathie Wood Buys 2.5M Shares, Faces Potential Losses

TradingKey – On Wednesday, August 14, crypto exchange Bullish (NYSE: BLSH) made its highly anticipated debut on the New York Stock Exchange, opening at $90, soaring to an intraday high of $118, and then sharply reversing to close at $68.

While the stock still ended the day 83% above its IPO price of $37, the steep drop from its opening price has raised concerns for early buyers — including Cathie Wood’s Ark Invest, which made a sizable bet on day one.

According to Ark Invest Daily, Ark Invest purchased 2.53 million shares of Bullish across three of its ETFs:

- ARKK: 1.7 million shares

- ARKW: 545,000 shares

- ARKF: 273,000 shares

The total investment was valued at approximately $172 million, based on average prices during the trading session.

If Ark’s purchases occurred after the $90 opening, the fund may already be facing unrealized losses of up to 24%, with a maximum drawdown of 42% from the intraday peak of $118. Despite the strong IPO performance relative to the issue price, the sharp reversal highlights the risks of chasing momentum in newly listed crypto stocks.

Bullish Debuts on NYSE Today — Could It Be the Next Circle?

On Wednesday, August 13, crypto exchange Bullish officially begins trading on the New York Stock Exchange (NYSE) under the ticker BLSH. Investors are watching closely to see whether Bullish can replicate the explosive success of Circle (CRCL), whose stock surged over 330% after its IPO in June.

Institutional Backing and Market Momentum

Bullish is backed by billionaire Peter Thiel and has already attracted interest from major institutions. According to its SEC filing, BlackRock (BLK) and Cathie Wood’s ARK Invest have committed to purchasing up to $200 million in shares.

On August 11, Bullish increased the size of its IPO from a projected $4.2 billion to $4.8 billion, reflecting strong investor demand. The company is offering 30 million shares priced between $32 and $33, aiming to raise $990 million.

Bullish’s Crypto Holdings and Financial Position

According to its prospectus, Bullish holds:

As of this morning, Bitcoin is up nearly 1%, trading at $119,000, while Ethereum has surged over 8%, breaking $4,600 — its highest level since November 2021.

Why Bullish Could Outperform

Bullish isn’t just a trading platform — it also owns CoinDesk, a leading crypto media outlet, and has processed over $1.25 trillion in trading volume since launch. Its institutional-grade infrastructure and regulatory-first approach make it a strong contender for long-term growth.

With a diversified product suite, high-value crypto reserves, and backing from top-tier investors, Bullish could attract significant market interest and potentially outperform Circle in post-IPO performance.

Crypto IPO Boom Returns! Bullish Files for IPO, Vaulta Soars 18%!

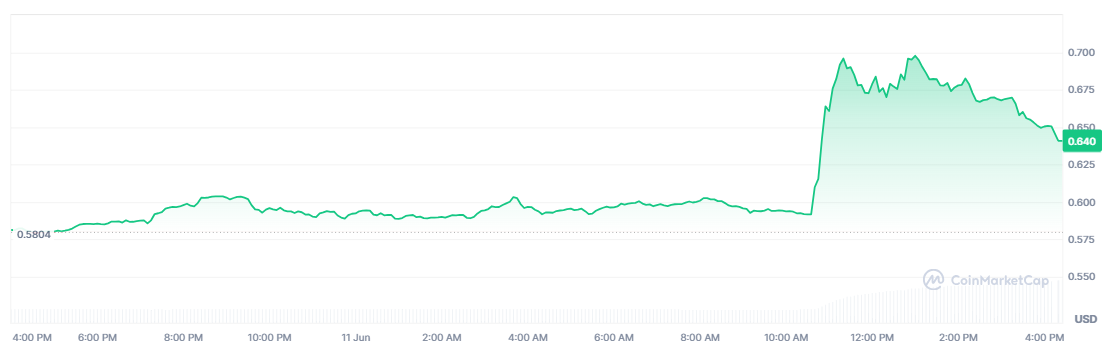

On Wednesday, June 11, Vaulta (formerly EOS) saw a sharp price increase of 18%, climbing from a low of $0.58 to a peak of $0.69, before settling at $0.64.

Vaulta Price Chart – Source: CoinMarketCap.

According to the Financial Times, Bullish, a crypto exchange under Block.one, has submitted confidential IPO filings to the U.S. SEC. This announcement triggered an immediate price spike for Vaulta.

EOS Network, once a highly sought-after blockchain project that raised over $4 billion in 2017, underwent a brand transformation in March. The EOS Network Foundation rebranded the project to Vaulta (A), shifting its focus to Web3 banking. While Vaulta is not directly linked to Bullish, both are products of Block.one, and Bullish’s IPO could help promote Vaulta and provide additional resources.

Similar to Circle, the first stablecoin company to go public, Bullish previously attempted an IPO but failed. However, with the Trump administration’s favorable stance on crypto and Circle’s successful listing, market conditions now appear more supportive for Bullish’s IPO.