TradingKey

3135 Articles

TradingKey is a comprehensive financial education and news analysis website, providing real-time market data, financial news coverage across forex, commodities, cryptocurrencies and more, as well as professional trading courses.

Federal Reserve's December Rate Cut: Inevitable? Bitcoin's Next Move: $100K or New Low?

While a 25-basis point Federal Reserve rate cut in December is widely anticipated, market sentiment remains split on Bitcoin's future price trajectory.

Mon, Dec 8

Fed's December Rate Cut Almost Certain, But Santa Claus Rally Unlikely

As the U.S. stock market heads into the final month of 2025, investors are beginning to anticipate a "Santa Claus Rally." However, whether this year's rally will materialize remains uncertain, as the Federal Reserve's December FOMC meeting could dictate the direction of U.S. equities.

Mon, Dec 8

Will the Federal Reserve cut interest rates by 25 basis points? Will Oracle and Broadcom's earnings reports boost their stock prices? [Weekly Preview]

The Federal Reserve's rate decision will dominate markets this week, as investors widely expect a 25 basis point cut. This follows the S&P 500's modest 0.31% gain over four sessions last week. Meanwhile, streaming giant Netflix's rumored $72 billion acquisition of Warner Bros.

Mon, Dec 8

China Adds Eli Lilly and Pfizer to Its First Private Insurance List — Is This a Buying Opportunity for Biotech Investors?

TradingKey - China officially unveiled its first list of innovative drugs covered by commercial health insurance on December 7, greenlighting 19 high-priced therapies previously excluded from the National Reimbursement Drug List (NRDL).

Mon, Dec 8

Intel Stock Rally Explained: What’s Driving INTC Higher and Should You Buy It Now?

TradingKey - Intel (NASDAQ: INTC) shares have surged strongly from multi-year lows, prompting significant investor attention: What's driving this rare rally—fundamentals or market sentiment? Is there further upside, and is now the optimal time to invest?

Mon, Dec 8

Bitcoin Cash Unveiled: Why Did BCH Price Surpass BTC? Can it Soar to $1,000 in the Future?

Bitcoin Cash (BCH) is poised for a 2025 resurgence, fueled by marginal fundamental improvements, market rotation, and speculative interest. Significant whale capital inflows are also expected to drive this rally. However, while BCH may outperform Bitcoin (BTC) in the near term, a sustained breakthro

Fri, Dec 5

GameStop: From Epic Short Squeeze to Q3 Earnings, Where Does This Meme Stock Go Next?

TradingKey – GameStop 2021 epic short squeeze to today’s earnings recovery, this legacy game retailer is betting on collectibles and geek-culture transformation while, before its Q3 report, options flows and sentiment once again push Gamestop’s meme premium into spotlight.

Fri, Dec 5

After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

TradingKey - The crypto market remains unsettled two months after the October 10 liquidation wave, one of its largest ever. Bitcoin's price has erased all its year-to-date gains, quieting predictions of a 2025 bull run. Amid Bitcoin's struggles and weakening year-end liquidity, calls for an altcoin

Fri, Dec 5

Bubble Burst? MSTR: A Liquidity Crisis More Brutal Than Bitcoin’s Crash

MSTR stock crash analysis: Premium bubble burst and convertible debt mechanics drove losses beyond BTC's drop. Examines MSTR's debt defense and concludes it's a valuation reset, not a crisis.

Fri, Dec 5

U.S. Consumers Downshift: Dollar Stores Boom While Big Retailers Falter, With Black Friday Showing Weakness

The creeping impact of tariff policies on households now highlights a stark "K-shaped divergence" in retail performance. Dollar stores are gaining traction, challenging traditional large-scale retailers' growth, and even record online Black Friday sales hint at a trend of consumer down-trading.

Fri, Dec 5

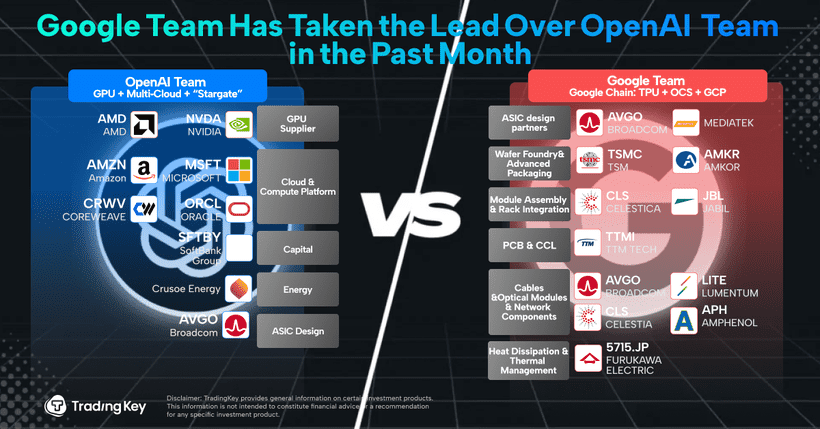

Team Google Beats Team OpenAI This Round—What It Means for Your Portfolio

TradingKey - Over the past month, AI-related market flows have diverged. Since the launch of Gemini 3, Alphabet’s stock has rallied sharply—while names tied to OpenAI’s ecosystem have come under pressure. Investors are shifting exposure toward companies aligned with Google, especially Broadcom (AVGO

Fri, Dec 5

Rivian Stock Analysis: Q3 Earnings Exceed Expectations – Is Now the Time to Buy RIVN Stock?

Is Rivian still a good investment now? Can Rivian's stock reclaim its previous highs?

Thu, Dec 4

Novo Nordisk (NVO) : From Market Darling to Selloff Target — Should You Buy the Dip?

TradingKey - We've recently observed that,Novo Nordisk A/S, impacted by intensifying competition in weight-loss drugs (such as from U.S.Eli Lilly and Company) and weaker-than-expected earnings reports, has seen its stock price continually decline, falling over 70% from its peak of 143.54.

Thu, Dec 4

The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

TradingKey - Kevin Hassett, White House National Economic Council Director, is poised to succeed Jerome Powell as the next Federal Reserve Chair. This development signals a potentially more dovish monetary policy. Beyond Wall Street's focus on this outlook, the Fed's independence is also under

Thu, Dec 4

Why Did Strategy's Stock Price Plummet? Can MSTR Reach $1,000?

MicroStrategy (MSTR) stock, despite pressures from Bitcoin volatility and its weak core business, represents the most leveraged investment in a Bitcoin bull market. The company's stock path to $1,000 largely depends on Bitcoin's market performance. Major institutions, including Standard Chartered an

Thu, Dec 4

OpenAI on ‘Code Red’ Amid Crisis, But Altman Remains Its Ultimate Trump Card

TradingKey - Google's powerful AI model, Gemini 3, has delivered a significant blow to OpenAI, forcing Sam Altman's company to declare an urgent "Code Red" amid a brewing technical and brand crisis. OpenAI indeed faces immense pressure, though its vast user base may yet prove a formidable moat.

Thu, Dec 4

Hassett as Potential Fed Chair: Why He Could Be the Best Choice for U.S. Stocks and the Dollar

Why would Hassett be the best choice for US stocks and the US dollar if he were to become the Federal Reserve Chairman?

Wed, Dec 3

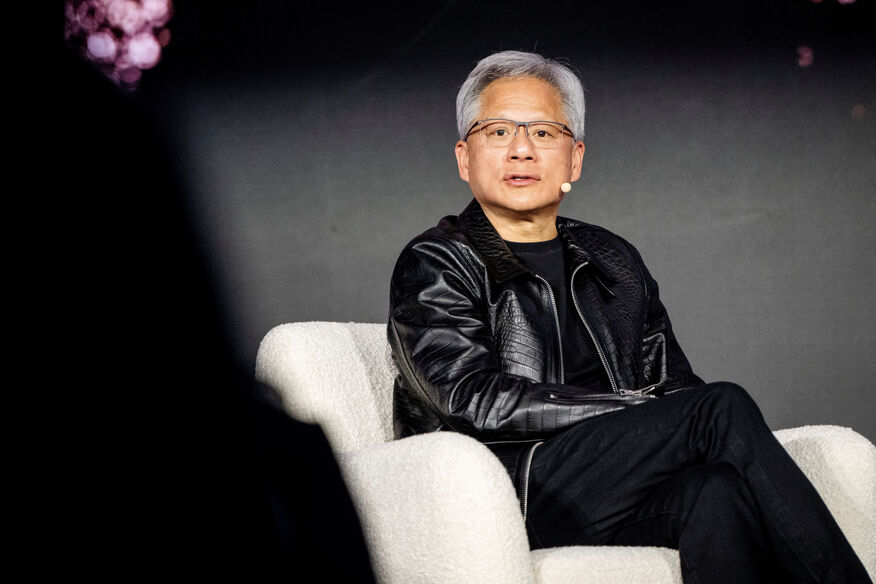

The Closed Loop of the GPU Empire: Analyzing NVIDIA's Investment in Synopsys and Its Implications for Your AI Asset Allocation

NVIDIA invests $2B in Synopsys (Dec 2025), taking 2.6% stake and integrating CUDA GPU acceleration into EDA tools. Deal unlocks trillion-dollar industrial simulation market and cements NVIDIA's AI empire closed loop. Synopsys gains high-margin GPU subscription revenue and valuation re-rating.

Wed, Dec 3

"Buying the Nvidia Dip" Is On the Table as Valuation Nears Historic Lows

TradingKey - Nvidia's stock appears to have fallen from grace in Q4 amid tech valuation fears and rival advancements, despite robust fundamentals and near-historic low valuation levels. Nvidia, the world's highest market capitalization company, faces such concerns head-on. Optimistically, Nvidia's

Wed, Dec 3

Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

TradingKey - If Kevin Hassett — the front-runner with a nomination probability exceeding 70% — is successfully appointed..., U.S. stocks are expected to continue hitting record highs, supported by a significantly accommodative monetary policy environment of interest rate cuts.

Tue, Dec 2