Today’s Market Recap: Chip and Software Stocks Crater as AI Conviction Wavers, AMD Plunges 17%

TradingKey - On February 4, 2026, U.S. stocks declined, weighed down by renewed pressure on technology shares. The S&P 500 slipped 0.51% to 6,882, while the Nasdaq Composite fell 1.51% to 22,905, underperforming broader benchmarks as selling concentrated in growth and semiconductor stocks.

Within the chip sector, Intel (INTC) fell 1.32% to close at $48.60, while Nvidia (NVDA) declined 3.41% to $174.19. Both names posted smaller losses than Advanced Micro Devices (AMD), which faced heavier selling.

AMD, a leading producer of CPUs and GPUs for PCs, servers, and gaming consoles, ended the session down 17.31% at $200.19. Despite beating expectations in fiscal Q4 2025, shares dropped sharply after the company issued weaker-than-expected Q1 2026 revenue guidance. Investors were also concerned about margin pressures and the pace at which its AI-focused data center segment can scale to rival Nvidia’s growth.

Uber Technologies (UBER) declined 5.15% to $73.92 following the release of its latest earnings report. The company posted strong fourth-quarter revenue gains but missed consensus EPS estimates and delivered cautious guidance for Q1 2026. Investor attention is turning to Uber’s margin outlook and its progress on autonomous and robotaxi initiatives. Trading volume surged to 62.8 million shares—more than triple its three-month average of 20.4 million. Since its IPO in 2019, Uber has gained 78% in value.

Palantir Technologies (PLTR), a provider of enterprise and government-focused analytics platforms, dropped 11.62% to $139.54. Despite reporting solid Q4 results and receiving favorable analyst commentary earlier in the week, the stock faced renewed valuation concerns, prompting a broad pullback.

Cryptocurrencies extended recent declines, with Bitcoin (BTCUSD) tumbling more than 5% to trade near $72,000—its lowest level in several months. Ethereum also dropped over 5%, reaching a nine-month low, as sentiment across digital assets weakened further.

In commodities, spot gold (XAUUSD) briefly reclaimed the $5,000 threshold before paring gains, finishing up 0.3% on the day. Spot silver (XAGUSD) outperformed, rising 3%, as investors sought stability amid broader market volatility.

U.S. private-sector job growth slowed sharply in January, signaling early-year labor market weakness. According to ADP data, U.S. private payrolls rose by just 22,000 jobs in January, missing the consensus forecast of 45,000 by a wide margin. The report reflects a notable loss of momentum across key industries, with hiring gains concentrated solely in education and healthcare. In contrast, professional and business services, along with manufacturing, posted job losses—pointing to structural headwinds in core sectors. Wage growth held steady at 4.5% year-over-year. The subdued reading may reinforce the Federal Reserve’s cautious stance on the economy. Meanwhile, the official non-farm payrolls report has been delayed again due to the ongoing U.S. government shutdown.

Alphabet’s (GOOGL) aggressive AI investment strategy drives revenue growth—but triggers share volatility. Alphabet reported strong fourth-quarter results, with total revenue climbing 18% year-over-year to a record high. Google Cloud revenue surged 48%, beating expectations by more than 9%. Search revenue also exceeded estimates with a 17% increase. However, revenue from Waymo and other bets dropped 7.5%, missing forecasts. The company’s AI-led spending plans took center stage: R&D expenses jumped 42%, and 2026 capital expenditure guidance was raised to a median of $180 billion—over 50% higher than market consensus. Even after a $2.1 billion one-time charge related to Waymo, operating margin held above 30%. The stock experienced heavy after-hours volatility, initially plunging 7.5%, rebounding over 4%, and then retreating again.

SanDisk (SNDK) plunges 16%, leading a sharp pullback in AI-fueled memory chip stocks. Semiconductor names—particularly those tied to memory and storage—sold off heavily on Wednesday, deepening the broader tech retreat. SanDisk sank nearly 16%, marking one of the steepest declines in the sector, as investors rotated out of AI beneficiaries following months of parabolic gains. The stock had skyrocketed more than 1,100% over the past six months, including a 29% rally in just the three sessions following last week’s earnings beat. However, concerns over weakening fundamentals and profit-taking pressures triggered a swift reversal, underscoring market sensitivity to elevated valuations and shifting sentiment in AI-linked hardware names.

Eli Lilly (LLY) tops expectations on strong weight-loss drug sales, raises 2026 outlook. Eli Lilly delivered fourth-quarter revenue that grew 43% year-over-year, with net income increasing 50%, driven by accelerating sales of its GLP-1 weight-loss therapy. For fiscal year 2026, the company issued revenue guidance of $80–83 billion, surpassing consensus. The results suggest that Eli Lilly is gaining ground in the intensifying battle for weight-loss market share. In contrast, rival Novo Nordisk has warned of a potential 13% revenue decline this year due to pricing pressures, while Eli Lilly forecasts up to 27% growth.

Novo Nordisk (NVO) slumps on profit pressure, pledges buybacks to reassure investors. Shares of Novo Nordisk fell 18% in European trading after the company acknowledged that it faces “unprecedented pricing pressure” in 2026. CEO Lars Fruergaard Jørgensen admitted the financial strain from steep price reductions for Wegovy, its blockbuster weight-loss drug, but said the strategy aims to capture volume and defend market share. To stabilize sentiment, Novo Nordisk announced a DKK 3.8 billion share repurchase program and a dividend payout. The company is also banking on its upcoming oral version of Wegovy to offset headwinds.

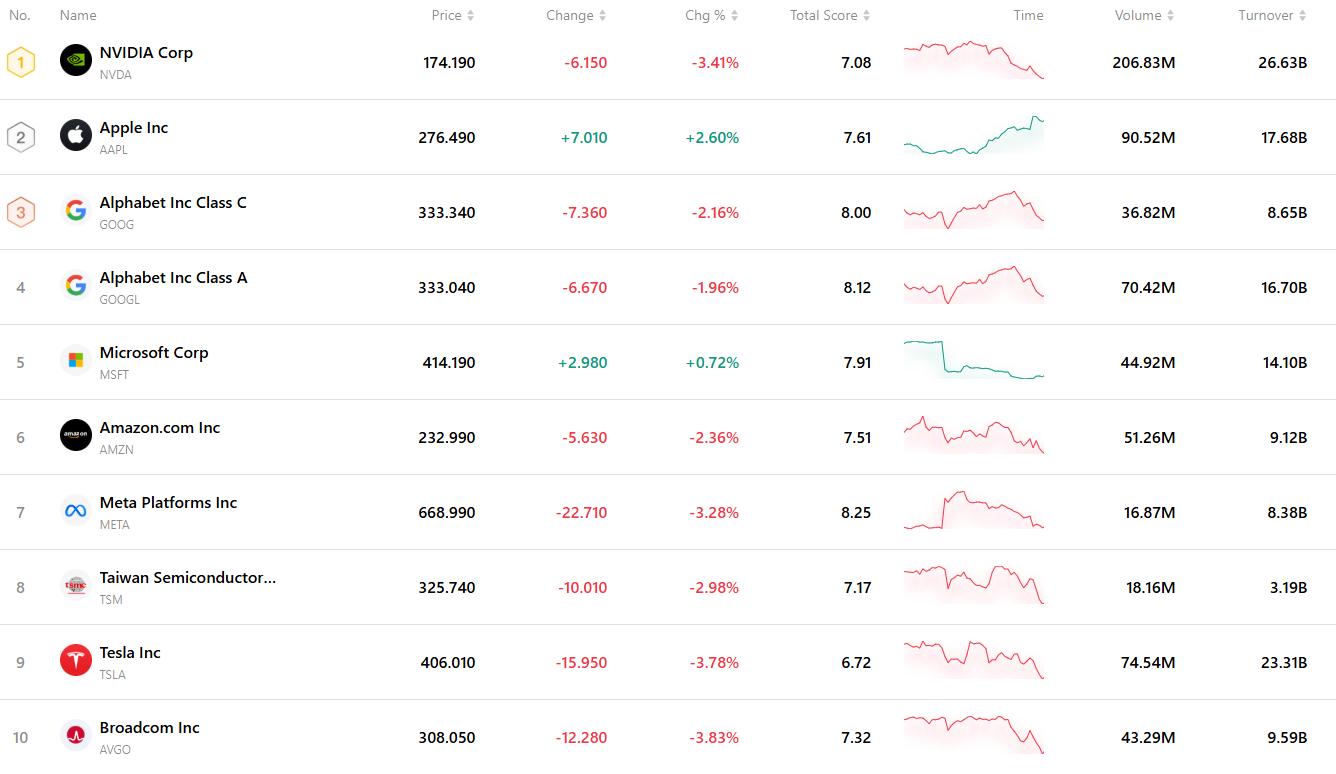

The chart below highlights the ten most actively traded stocks in the current market. With their substantial trading volumes and high liquidity, these names serve as key benchmarks for tracking global market dynamics.