“Price Alliance”: How Memory Makers Are Locking In Profitability

Leading memory chip manufacturers have shifted strategy from maximizing market share to prioritizing profitability, deliberately tightening supply against surging AI demand. This consensus involves active production cuts and delayed capacity expansions, creating conditions for price rebounds. Companies are redirecting wafer capacity towards higher-margin products like HBM and server-grade DDR5, while constraining supply for lower-end consumer devices. This structural shift has transformed the market into a soft oligopoly, likely leading to underestimated profit ceilings and extended cycle durations. Notable investments are being made by Micron, SanDisk, Western Digital, and Seagate in advanced memory and storage technologies.

TradingKey - The surge in demand for memory chips driven by AI servers and data centers is no longer fresh news. What continues to excite investors—and keeps Wall Street raising its price targets—is the behavior of the leading manufacturers. The industry’s titans have quietly reached a consensus: protect price, not volume. They would rather cut output and limit supply than repeat the mistake of flooding the market, all in an effort to pull prices out of the trough and back into a high‑margin zone.

In the previous cycle, DRAM and NAND producers waged brutal price wars to defend market share. Companies ran their fabs at full capacity, slashed quotes, and tried to squeeze out weaker rivals. The result was predictable. During 2022–2023, memory prices collapsed to near cash costs, sending operating losses soaring and forcing widespread write‑downs and capex cuts. That painful reset reshaped the industry’s collective mindset. Firms learned that chasing volume and share without regard for price or margin destroys the entire supply chain during downturns.

From 2024 through 2026, the three major producers—Samsung, SK Hynix, and Micron (MU) —gradually established a new kind of unspoken pact. They no longer rush to expand wafer starts, nor do they sacrifice pricing to win incremental orders. Production growth is kept deliberately tight; some orders are willingly left on the table. Strategy has shifted from “maximize share” to “maximize profitability and keep the cycle sustainable.”

On one front, active production cuts and postponed capacity additions have created the conditions for a price rebound against the backdrop of accelerating AI demand. Channel checks show that since late 2023, the big three have been running their DRAM and NAND fabs below nameplate capacity, with cutbacks in certain product lines reaching double‑digit percentages.

At the same time, new or expanded production lines—particularly those related to legacy DDR4 and lower‑end NAND—have been delayed or scaled back, tightening the growth of effective supply. On another front, there is a move toward structural supply control: engineering shortages where they are most profitable. Wafer capacity and advanced process nodes are being redirected toward HBM, server‑grade DDR5, high‑performance LPDDR5, and enterprise SSD products, which carry higher margins and stronger pricing power. In contrast, supply for PC and smartphone DRAM as well as consumer NAND is being squeezed, setting up a structural shortfall. As end‑demand revives, the scarcity pushes prices higher almost automatically.

Because advanced memory like HBM consumes far more wafer area per bit than conventional DRAM, the same fab capacity migrated to HBM yields fewer units of standard memory. The physical mix shift itself lifts the market’s overall price floor.

In this new upcycle, the real story is the transformation of industry structure. The memory market has effectively become a soft oligopoly. Leading players are behaving less like competitors and more like members of a price alliance. As a result, the profit ceiling and duration of this memory cycle are likely being systematically underestimated by the market.

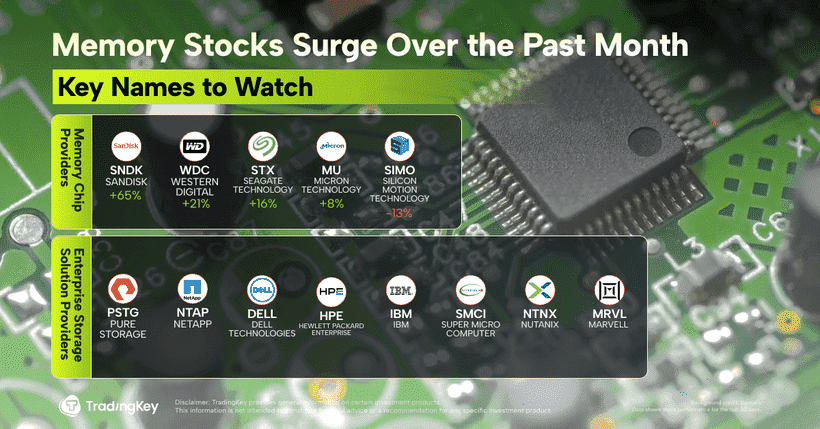

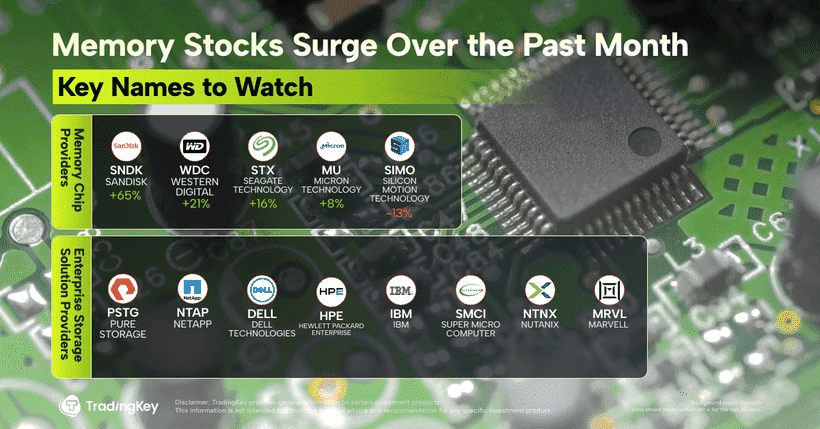

Companies to Watch in the Memory Supply Chain

Micron Technology remains at the forefront of DRAM investment. The company plans US $13.5 billion in capital spending for 2026, up 23 per cent year on year, largely directed toward new fabs and HBM capacity. With the ramp‑up of advanced 1‑gamma DRAM and next‑generation G8/G9 NAND nodes, total capex could climb toward US $18 billion.

In NAND flash, SanDisk (SNDK) has adopted the most aggressive stance. With no DRAM business to balance, it is doubling down on flash memory, budgeting US $4.5 billion — a 41 per cent increase — to boost BiCS8 output and accelerate BiCS9 development with partner Kioxia.

Western Digital (WDC) is likewise optimistic. It has issued earnings guidance above market expectations and secured multiple long‑term supply contracts extending through 2026—and in some cases 2027. The company is investing heavily in next‑generation NAND and hard‑disk upgrades to reinforce its position across both storage segments.

Seagate Technology (STX) has delivered a similarly upbeat outlook, projecting growth momentum through 2026 on the back of its HAMR (heat‑assisted magnetic recording) drives. HAMR technology enables higher‑capacity hard disks at lower cost per bit, giving HDDs a way to defend profitability against SSD competition and providing a fresh engine for margin expansion.

Enterprise Storage Ecosystem

At the systems level, Dell Technologies (DELL) continues to supply an extensive enterprise‑grade storage portfolio centered on PowerMax systems, while Hewlett Packard Enterprise (HPE) integrates 3PAR and Nimble technologies into its modular storage and cloud platforms. IBM (IBM) remains a heavyweight through its flash‑storage hardware and enterprise data‑management services. Super Micro Computer (SMCI) leverages a broad range of storage servers and data‑center platforms tailored for AI workloads. Nutanix (NTNX) pushes the envelope in hyper‑converged and software‑defined storage, bridging on‑premises and multi‑cloud environments. And Marvell Technology (MRVL) continues to dominate the component layer with NVMe/SAS/SATA controllers, storage accelerators, and AI‑optimized interconnect chips.