Memory Stocks Stay Resilient Despite Broader Tech Pullback

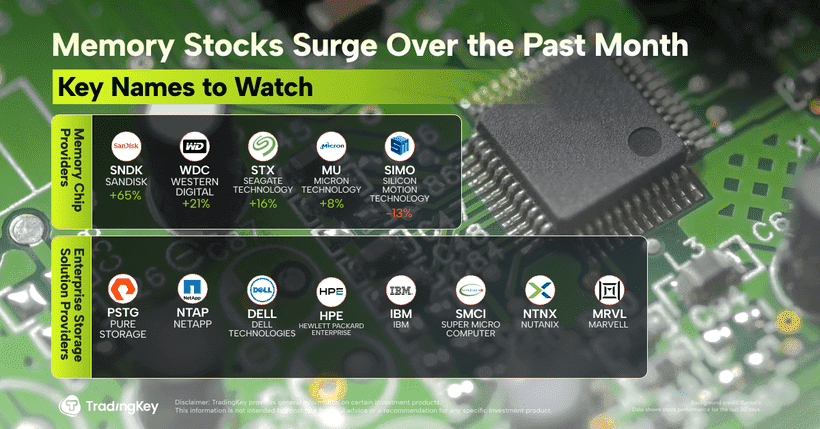

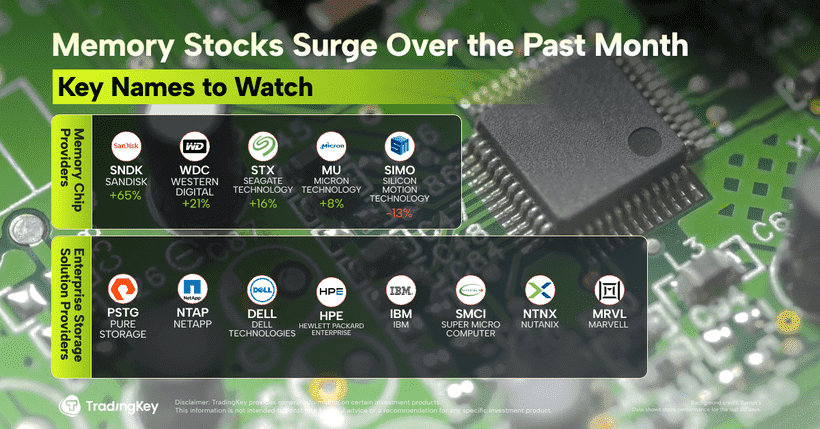

TradingKey - Investors worried about an “AI bubble” have already seen that fear show up in prices — U.S. tech stocks have slipped for several sessions in a row. But one corner of the market is holding up surprisingly well. Memory and data‑storage names, riding a fresh wave of AI‑driven demand, have shown impressive resilience over the past month.

Why Memory Prices Are Exploding

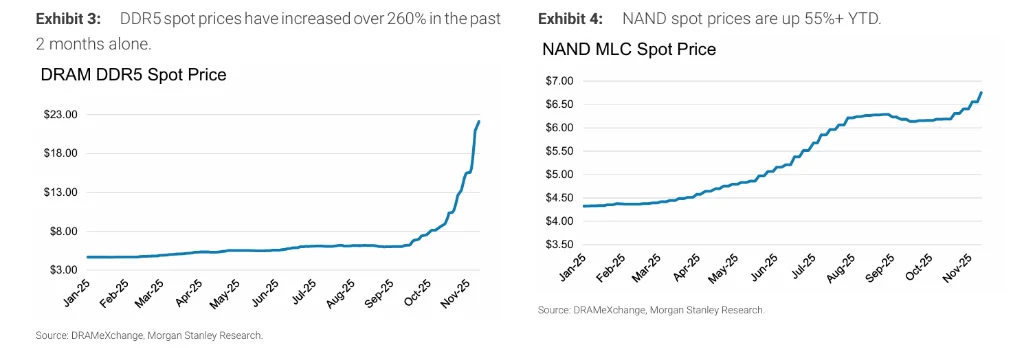

The memory market is going through what analysts call an unprecedented cycle. Morgan Stanley’s latest data show that DRAM prices have jumped around 160% in just a month, while NAND flash prices are up roughly 50% since April 2025.

What’s behind the surge?

AI data‑center buildouts. Hyperscalers are racing to expand infrastructure for generative AI and massive training workloads. That’s driving record orders for HBM (high‑bandwidth memory), mainstream DRAM, and high‑capacity NAND chips. And AI isn’t just about how many chips a model needs — it’s about how much data they have to handle. The larger the model and dataset, the faster “cold” data must be re‑activated and moved between the edge and the cloud.

HBM is eating into DRAM capacity. HBM is a premium type of DRAM that’s directly packaged with GPUs and other AI chips. With demand for these accelerators surging, manufacturers are reallocating their most advanced wafers, packaging, and test lines from normal DRAM to HBM production. That’s squeezing standard DRAM supply worldwide. At the same time, companies like Micron Technology are pouring capital into HBM and advanced processes, leaving less for traditional DRAM — effectively changing the structure of the industry but hastening HBM innovation.

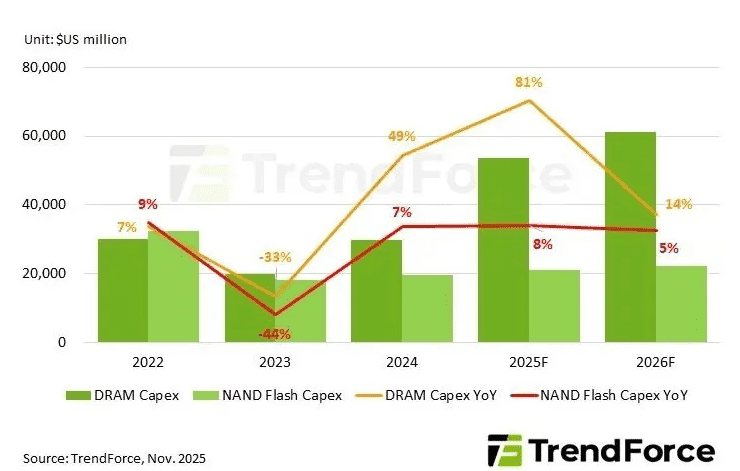

Chronic under‑investment in NAND. Flash suppliers haven’t built enough capacity for years. After multiple boom‑bust cycles, they’ve grown cautious about CapEx. Most producers are spending on process upgrades and wafer‑level efficiency gains, not on new fabs, leaving little room for actual capacity expansion. TrendForce expects NAND shortages to persist through 2026, with chip order‑fulfillment rates possibly dipping to around 40% over the next few quarters.

AI Is Rewriting the Storage‑Industry Playbook

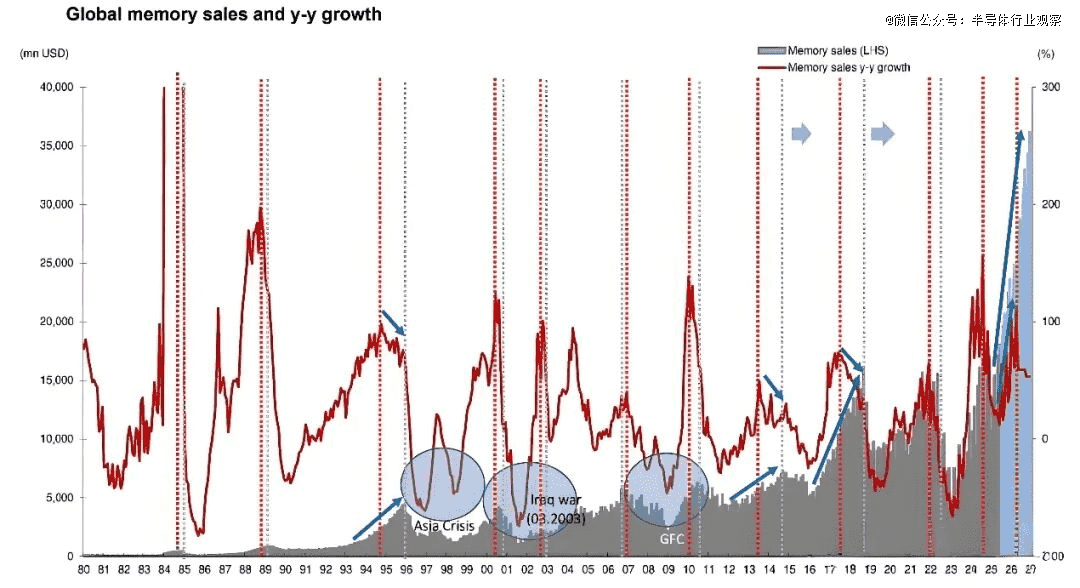

Nomura Securities notes that storage has historically moved in three‑ to four‑year cycles, each powered by a new demand driver or tech transition:

- 2016 – 2019: DDR4 upgrades and mobile‑gaming growth lifted prices by over 100%.

- 2020 – 2023: Pandemic‑driven remote‑work and data‑center demand first pushed prices higher, then a supply glut and weak device sales sent them down more than 50%.

- 2024 – present: AI compute infrastructure and HBM are rewriting the rulebook.

This time, the upswing isn’t coming from consumers — it’s coming from enterprise AI spending. Massive compute budgets are pushing up prices across the board: consumer and enterprise‑grade NAND SSD, DDR4/DDR5 DRAM, and even large‑capacity HDDs. Compared with prior cycles, prices are rising faster and could stay elevated longer. During the last “memory super‑cycle” (2016‑2018), DRAM spot prices rose 80‑90% over a year; today’s climb has already surpassed that.

Bottom line: a new memory‑chip cycle is underway — with bigger demand, higher prices, and structurally fatter margins.

Who’s Spending Big

Micron Technology (MU) is leading the DRAM spending rush. Its 2026 CapEx is expected to hit US $13.5 billion, up 23% year on year, aimed at new fabs and HBM‑related production lines. CapEx could rise to roughly US $18 billion as Micron scales advanced nodes such as 1‑gamma DRAM and G8/G9 NAND.

In NAND Flash, SanDisk (SNDK) stands out as the most aggressive player. With no DRAM business to balance, it’s doubling down on flash — planning to invest US $4.5 billion (a 41% increase YoY) to ramp up BiCS8 output and push ahead with BiCS9 R&D, the 3D NAND jointly developed with Kioxia.

Western Digital (WDC) is also upbeat. It recently guided above‑consensus results and secured long‑term contracts stretching to 2026 — some even through 2027. The company is investing heavily in NAND and HDD upgrades and next‑gen technologies.

Peer Seagate (STX) gave similarly strong guidance and expects momentum to continue into 2026, thanks to its HAMR (Heat‑Assisted Magnetic Recording) drives. HAMR boosts capacity at lower costs and is seen as the HDD industry’s key weapon against SSD competition — and a driver of higher margins.

Enterprise Storage Rides the Same Wave

AI and big‑data workloads aren’t just lifting chipmakers. They’re also fueling interest in enterprise‑storage companies that can handle AI‑era data demands for massive throughput, concurrency, and low latency. Vendors are responding with distributed, AI‑native, and fully integrated storage architectures.

Two names stand out. Pure Storage and NetApp have seen diverging stock performances: Pure’s surged over 50% since August, while NetApp’s gained only about 5%. Pure has grown R&D spending by 123% in five years and launched its GenAI Pod cloud‑native platform, strengthening its edge in all‑flash arrays. NetApp’s R&D budget rose just 19% over the same period.

Other enterprise‑storage players worth watching:

- Dell Technologies (DELL) — broad enterprise‑storage lineup and PowerMax systems

- Hewlett Packard Enterprise (HPE) — 3PAR, Nimble, and integrated storage solutions

- IBM (IBM) — FlashSystem hardware and enterprise data‑management services

- Super Micro Computer (SMCI) — storage servers and data‑center platforms

- Nutanix (NTNX) — hyper‑converged, software‑defined storage and cloud services

- Marvell Technology (MRVL) — storage controllers, NVMe/SAS/SATA chips, and AI accelerators