Nvidia Q3 Earnings: A Short-Term Fix or Long-Term Solution for 60%+ Growth?

TradingKey - For over two weeks, Wall Street has been grappling with concerns about an AI stock market bubble. However, Nvidia's Q3 fiscal 2026 earnings report, which comfortably beat market expectations for both revenue and EPS, provided a much-needed reprieve for a fragile U.S. stock market. While CEO Jensen Huang directly countered the AI bubble narrative, analysts remain cautious, questioning whether Nvidia's robust results represent a temporary relief or a sustainable new growth paradigm.

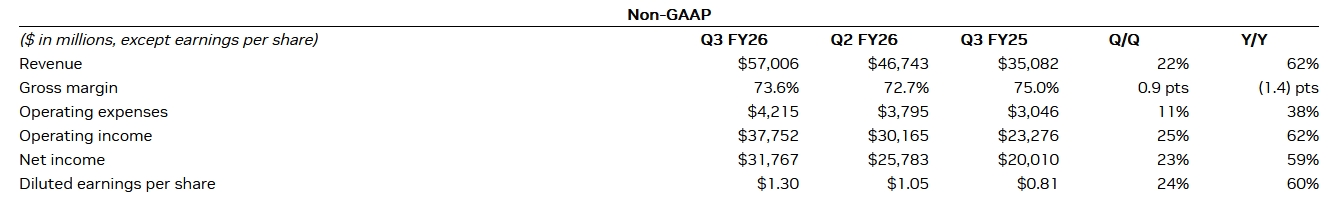

As a central player in the AI bull market, Nvidia delivered an even more impressive earnings report on November 19 than Wall Street analysts had anticipated. For the third fiscal quarter of 2026, ended October 26, 2025, Nvidia's revenue surged 62% year-over-year to $57.01 billion, surpassing both the estimated $55.19 billion and its own high-end guidance of $55.08 billion. Earnings per share (EPS) also climbed 60% year-over-year to $1.30, beating the $1.26 projection.

Nvidia Q3 FY2026 Earnings Report, Source: Nvidia

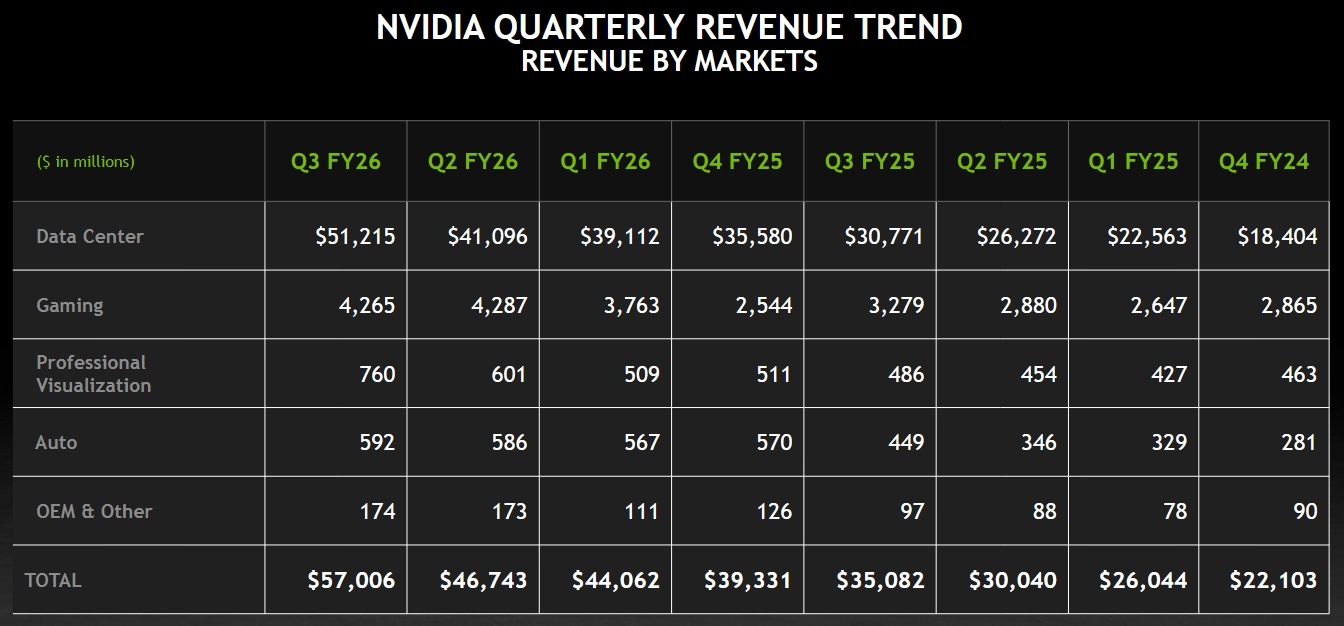

Maintaining over 60% revenue growth is rare for a large company with annual revenues approaching $200 billion (based on the past four quarters), especially as all four of its business segments recorded double-digit percentage growth.

Nvidia Revenue Trends by Business Segment, Source: Nvidia

As widely anticipated, surging shipments of Blackwell-architecture products drove a reversal in Nvidia's revenue growth, following six quarters of deceleration, with the Q2 growth rate of 55.60% marking a two-year low. Furthermore, Nvidia has delivered upside EPS surprises to analysts for 12 consecutive quarters since the January 2023 quarter.

Key financial highlights, including record-breaking and better-than-expected quarterly revenue, accelerating growth in its data center business, more optimistic gross margin guidance (projected to climb to 75% in Q4), and $500 billion in order visibility, provided Jensen Huang with ammunition to counter the AI bubble narrative.

Huang stated that while there's much discussion about an AI bubble, Nvidia observes a vastly different landscape—this includes a fundamental shift in computing from CPU-based general computation to GPU-accelerated computing, the AI inflection point driven by generative AI replacing traditional machine learning, and the emergence of new waves of agentic AI and physical AI.

For investors who have endured more than two weeks of declines in tech stocks, Nvidia's earnings report undoubtedly offered a much-needed respite. As of Wednesday, the Nasdaq Index had fallen approximately 5% in November, with Nvidia's stock down about 8%, before surging 6% in after-hours trading on Wednesday.

Brian Mulberrry, Senior Portfolio Manager at Zacks, noted that demand for Nvidia's hardware solutions remains robust, and the market reacted very positively to the news that AI momentum shows no signs of slowing.

The Futurum Group pointed out that Nvidia's earnings report demonstrates the continued momentum of AI. While it's challenging to believe such stable and massive demand, skeptics will eventually have to come around.

Notably, Nvidia's Q4 revenue guidance of $65 billion does not include revenue from data center computing in China. Concurrently, positive news emerged from the Trump administration that could accelerate Nvidia's performance: key White House officials are reportedly pressuring Congress to exclude a new bill restricting AI chip exports from the annual defense budget.

This move could provide greater clarity for overseas sales by semiconductor companies, including Nvidia.

Nvidia's earnings report, often dubbed the "financial Super Bowl," certainly offered solace to uneasy investors. However, the critical question remains: will this effect be long-lasting?

Wilson Asset Management believes"relief" is likely the most fitting description. In periods when market sentiment turns pessimistic, investors seek a circuit breaker to halt a stock market sell-off, and Nvidia delivered strong results.

Industry insiders suggest that while Nvidia's performance remains exceptionally strong, the market inevitably questions whether it has already peaked in terms of growth rates and market share.

This concern partly stems from the reality that chip competitors are fiercely catching up. For instance, AMD, Broadcom, and Qualcomm are all forging partnerships with Nvidia's key customers, while Google and Amazon are making commendable progress in developing their own proprietary chips.

The Financial Times noted that the genuine demand for Nvidia's products does not negate the existence of a bubble, as its true value hinges on the market landscape several years down the line. Supply and demand dynamics could differ vastly from the current situation, raising questions such as how many data centers will be under construction in a decade, which chips will be used, and what profit margins will prevail.

eMarketer analysts indicated that despite immense GPU demand, investors are increasingly focused on whether hyperscale companies can rapidly leverage these capabilities. The core issue is whether physical bottlenecks in power supply, land resources, and grid access will constrain the pace at which this demand translates into revenue growth in 2026 and beyond.

These factors, largely outside Nvidia's control, could hinder future growth.

Indeed, Jensen Huang himself has previously mentioned that Nvidia's greatest growth obstacles are the sheer scale, newness, and complexity of the AI industry. Such a transformative shift necessitates coordinated efforts across the supply chain, infrastructure, and financing.

This content was translated using AI and reviewed for clarity. It is for informational purposes only.