Cathie Wood’s ARKK Surges 54% in 3 Months — Is Crypto the Main Investment Theme of 2025?

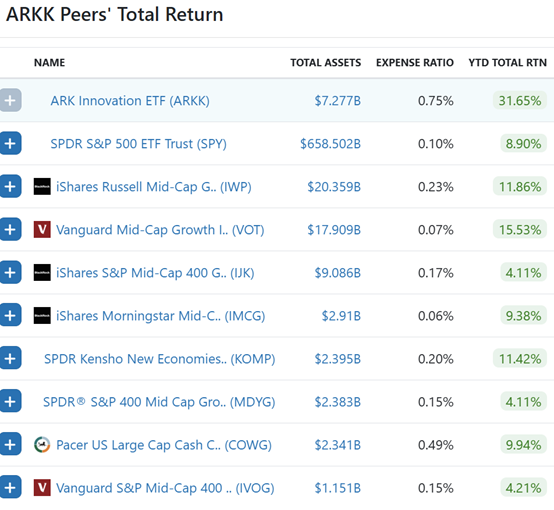

TradingKey - Crypto stocks are getting their groove back, and Cathie Wood isn’t missing a beat. Over the past three months, ARK Innovation ETF (ARKK), ARK Invest’s flagship fund, has surged more than 54%. In June alone, it gained a whopping 23%, making it one of the best-performing U.S. growth ETFs in the market right now. But what’s driving the returns isn’t just a general tech rally — it's the fund’s increasing exposure to next-gen crypto plays, especially those tied to Ethereum and its staking economy.

Just one week after investing 182 million into BitMine—a company pivoting to become one of the biggest holders of Ether (ETH) —ARK Invest has gone back for more. This week, ARK bought another 35.3 million worth of BitMine shares across three of its ETFs, clearly signaling it sees long-term value in the company’s ETH-backed treasury strategy.

BitMine isn’t just speculating on ETH’s price going up. It’s building something much bigger: a corporate treasury anchored in Ethereum. According to a statement released this week, the firm will use the newly raised funds to purchase more ETH, with plans to lock tokens into staking protocols that generate yield. The company’s chairman, Thomas Lee, said BitMine’s ETH holdings have already passed 2billion—just 16 days after it closed a 250 million private placement. He added that the goal is to eventually own and stake 5% of all ETH in circulation.

For years, Ethereum has played second fiddle to Bitcoin. But that’s quickly changing as institutional interest grows. With ETH now offering real-world utility, Ethereum is developing its own investment narrative — one grounded in fundamentals, not hype.

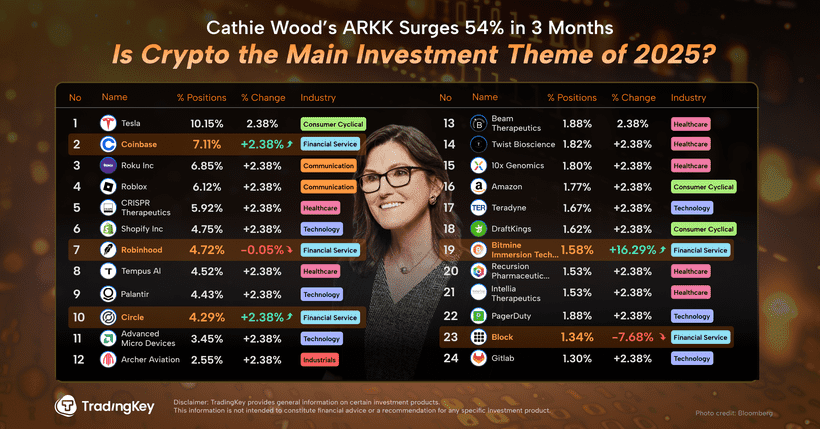

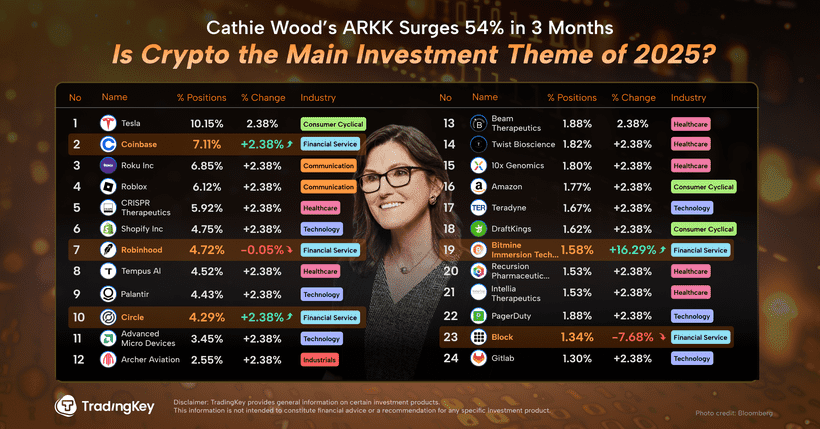

Crypto-Themed Stocks Behind ARKK

Cathie Wood isn’t new to digital assets. Back in March, ARK Invest reiterated its ultra-bullish forecast that Bitcoin could reach $1.5 million by 2030. ARK has been positioning for this moment since at least 2021, when it began building sizable positions in Robinhood and Coinbase. Robinhood gave retail investors access to crypto, while Coinbase remained the go-to U.S. exchange for serious buyers. Both fit neatly into ARK’s broader “disruptive innovation” theme.

ARKK has been one of the hottest growth ETFs in the U.S. market this year. Since early April, the fund has climbed over 54% in just three months — with a standout 23% gain in June alone. A big part of that rally has been driven by the comeback in crypto-related stocks, which have seen renewed momentum as digital assets return to the spotlight.

The Stablecoin Angle: Big Bet on Circle

Another big moment came in early June when Circle — the company behind the USDC stablecoin — went public. On day one, ARK aggressively snapped up 4.45 million shares, investing roughly $373 million and becoming one of the project’s biggest institutional backers.

The move paid off quickly. As Circle's stock surged following its debut, ARK began selling portions of its stake in batches, offloading more than 1.5 million shares in just two weeks and generating $333 million in proceeds. Yet despite trimming the position, Circle remains a top 10 holding in ARKK, and at one point this summer, accounted for close to 5% of the ETF’s total assets. The message is clear: Wood still sees stablecoins — especially U.S.-regulated ones — as a cornerstone of the future financial system.

Shifting Gears Before Earnings Season

As Q2 earnings approaches, it looks like ARK is rebalancing some of its existing crypto bets. This week alone, the firm sold around 7million worth of Coinbase stock, divested nearly 15 million from Jack Dorsey’s Block, and trimmed its Robinhood stake. The timing has raised eyebrows — and for good reason.

Analysts interpret the move as part of a broader pivot away from centralized, off-chain crypto players (think exchanges and payment apps) and toward “on-chain” infrastructure plays like BitMine.

While companies like Coinbase facilitate trading, BitMine represents a long-term hold on ETH’s yield-bearing potential and the infrastructure of Layer 1 staking. With Ethereum ETFs on the horizon and staking yields stabilizing, Wood seems to be moving up the stack — from merely betting on users trading crypto to betting on the rails themselves.

Wood’s public comments support this strategy shift. Earlier this year, she reaffirmed her belief in not just Bitcoin but Ethereum and Solana too, emphasizing how real-use cases and institutional demand are scaling fast across all three protocols. This week, ARK revealed another move in that direction: a new partnership with SOL Strategies to expand into the Solana ecosystem through validator staking and infrastructure development.

The Rise of Crypto Treasury Companies

Wood’s investment strategy goes far beyond simply betting on rising crypto prices. She’s focused on a broader structural shift — the emergence of crypto assets as components of corporate-style balance sheets.

An increasing number of publicly listed companies have begun to follow the playbook of Strategy (MSTR), allocating large portions of their cash reserves into on-chain digital treasuries, including core assets like ETH, BTC, and SOL.

This strategy involves not only buying and holding digital assets, but also amplifying exposure through instruments like convertible bond issuances, repo-style financing, and even open-market share buybacks — applying corporate finance tools to build high-leverage crypto positions.

On-chain corporate treasuries are emerging, offering fresh opportunities for retail investors. Here are some notable blockchain-linked public companies gaining attention.

Bitcoin Treasury-Type Companies:

- CEP (Cantor Equity Partners Inc)

- GLYX (Galaxy Digital)

- DJT (Trump Media & Technology Group)

- GME (GameStop)

- RUM (Rumble Inc.)

- NAKA (Kindly MD)

- NXTT (Next Technology)

- SMLR (Semler Scientific)

- RITR (Ritter Logistics Technology)

Ethereum Treasury-Type Companies (ETH Treasury):

- SBET (Sharplink Gaming)

- BTCS (BTCS Inc)

- METWO (Mi Global Inc)

- BGL (Bionex Gene Lab)

Solana Treasury-Type Companies:

- DFDV (DFiV Divo)

- UPXI (Upexi)

Ripple (XRP) Treasury-Type Companies:

- WGRX (Wellistics Health)

- VVPR (VivoPower)

BNB Treasury-Type Company:

- NA (Nano Labs)

TRX (TRON) Treasury-Type Company:

- SRM (SRM Entertainment)