Three Charts That Explain Why Copper Is a Hold

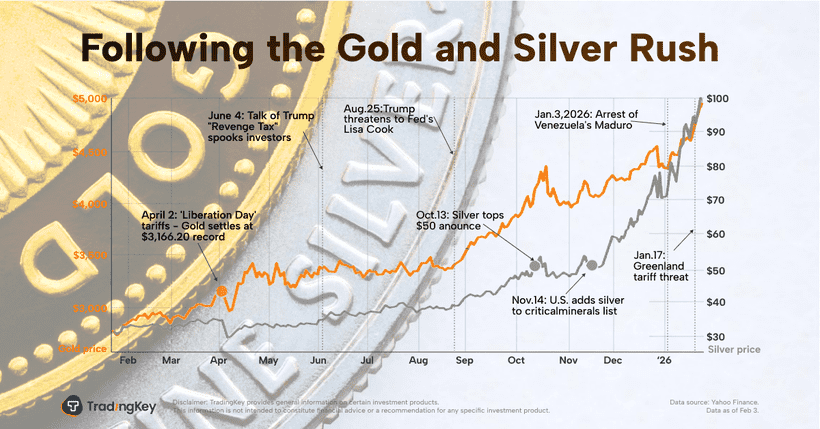

Copper's price appreciation, exceeding 60% over two years, is driven by structural demand from AI data centers and the energy transition, shifting it from a cyclical commodity to a structural asset. Despite lagging precious metals year-to-date, long-term prospects remain strong due to chronic under-investment in supply and burgeoning demand from electrification, decarbonization, and digitalization. Global copper supply is projected to face a widening gap from 2025. Copper now acts as an industrial hedge against duration and inflation, reflecting rising raw material costs and supply shocks.

TradingKey - Copper’s rally didn’t start this year — it began with the rise of AI data centers, where the metal became an essential building block in the infrastructure behind artificial intelligence. Over the past two years, copper has gained more than 60 per cent. Though its year‑to‑date performance has lagged precious metals, the underlying structural shifts in supply and demand suggest copper’s long‑term setup remains compelling.

From Cyclical Commodity to Structural Bottleneck

For decades, copper moved in step with the global business cycle. Prices rose and fell with manufacturing and real estate, earning the metal its “Dr. Copper” moniker. That framework is breaking apart. The world is now in the middle of three overlapping transitions—electrification, decarbonization, and supply‑chain de‑China‑fication—and copper’s role has fundamentally changed. While still sensitive to global growth, it is showing remarkable resilience. Even if macro conditions weaken temporarily, as long as the long arcs of EV production, solar expansion, grid renewal, and data‑center build‑out remain intact, copper is unlikely to revisit its historical lows. The metal has moved from a rate‑driven cyclical trade to an energy‑transition‑driven structural asset.

The Weakening of the Rate Lens

In theory, copper has always tracked two benchmarks — interest rates and the dollar. In practice, that linear relationship is fading. Under the weight of high debt and mounting energy‑security concerns, government spending on green investment and grid upgrades has become politically immovable. Even if a tighter Federal Reserve under Kevin Warsh curbs liquidity in 2026, such strategic outlays are unlikely to be dramatically cut. As gold evolved from an “interest‑cost” story to one of credit pricing, copper too is transitioning—from financial‑conditions‑sensitive to transition‑policy‑driven. The market’s pivotal variables are no longer front‑end rates but whether nations will keep paying up for energy security — and how aggressively they build the copper‑hungry data infrastructure of the AI age.

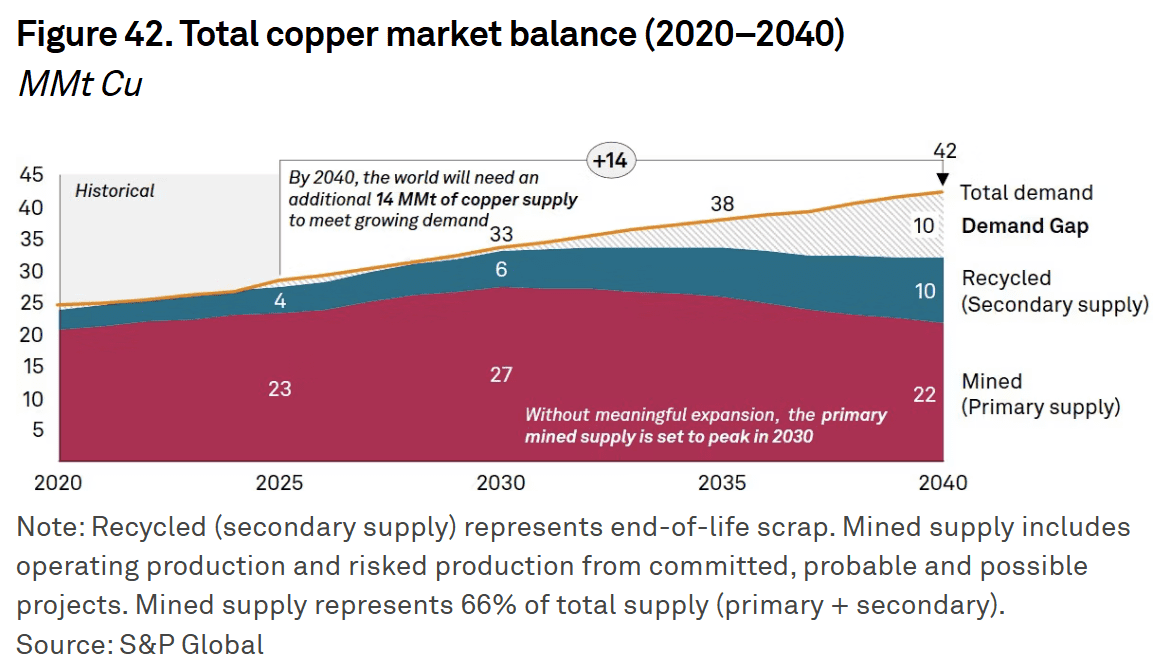

Supply: Chronic Under‑Investment and a Permanent Geopolitical Premium

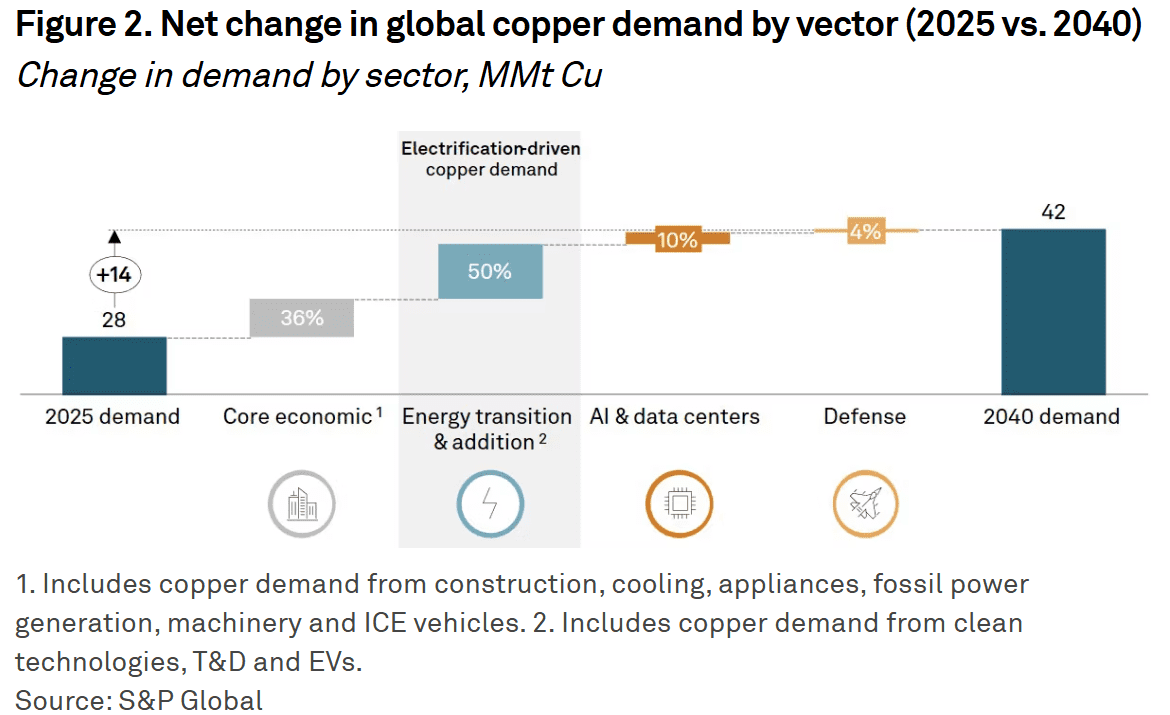

Like gold, copper faces formidable supply constraints. Exploration‑to‑production cycles typically span seven to ten years, and a decade of under‑investment has left the global project pipeline thin. Meanwhile, resource nationalism is spreading across South America and Africa. In the second half of 2025, shifts in tax regimes and recurring labor strikes caused repeated mine disruptions. The result is a structural imbalance: high prices no longer guarantee new supply.According to S&P Global, starting in 2025, the global copper supply gap is projected to widen each year. By 2040, the world will need over 14 million metric tons of additional copper beyond current capacity just to meet demand.

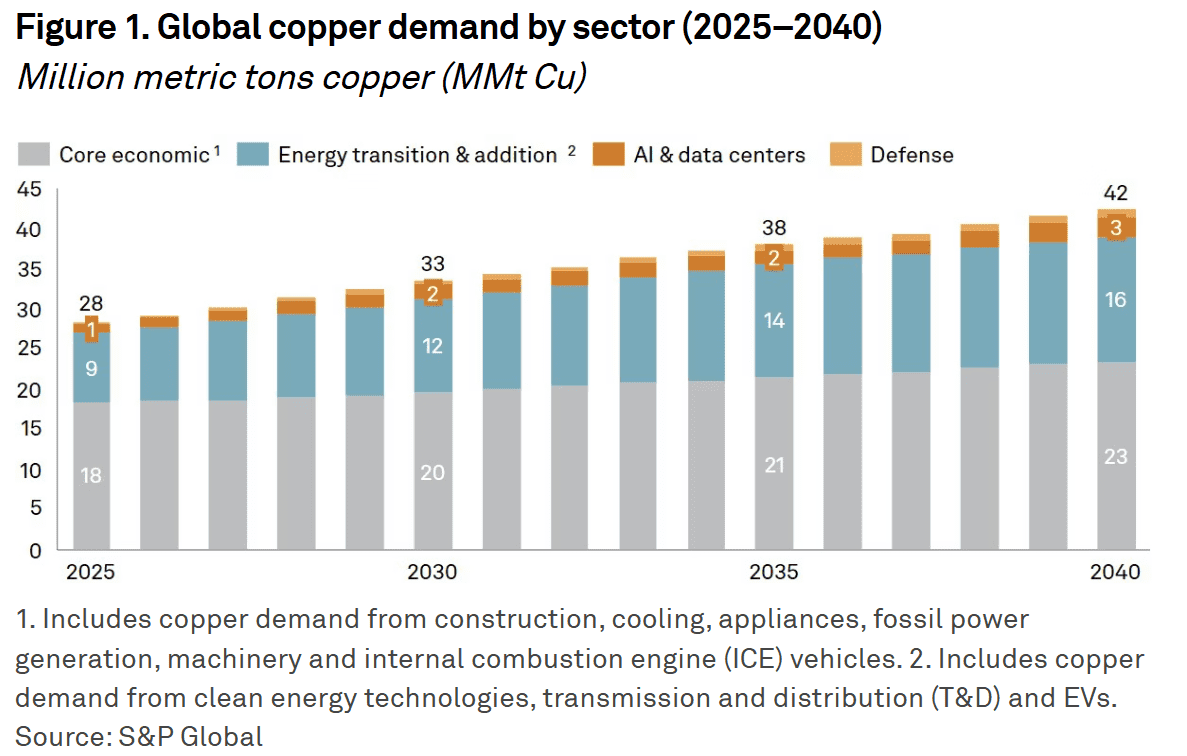

Demand: From Construction Cycle to Electrification Supercycle

The demand engine is being rebuilt from the ground up. The old world of property and traditional manufacturing is flattening, but the new world of electrification more than offsets that slowdown. A single pure EV uses several times more copper than an internal‑combustion vehicle. Across the globe, power grids are being reinforced to handle distributed energy generation and the surging load of AI computing clusters. Within this electrification + decarbonization + digitalization trifecta, copper has become more than a construction material — it is now the circulatory system of new energy networks and the neural wiring of digital infrastructure.

The Portfolio Case: An Industrial Hedge Against Duration and Inflation

As discussed in gold’s framework, institutions are building a “third pillar” to hedge duration risk. Copper serves as the industrial counterpart—an active hedge against transition costs and inflation expectations. In a high‑debt environment, headline inflation often lags the true rise in embedded costs; copper prices, by contrast, tend to reveal those pressures early, reflecting years of under‑investment in productive capacity.

For investors, owning copper is no longer simply a cyclical beta bet on global growth. It’s a strategic position—a way to hedge against the outlay of the energy transition, rising raw‑material costs, and supply shocks born of geopolitical friction. In the new capital cycle, Dr. Copper no longer just diagnoses the economy—it defines the next industrial era.