Total 624 articles

‘One-Stop Shop’ SoFi Posts 129% Q3 Net Income Surge, Achieves Five New Records

TradingKey - SoFi Technologies (SOFI), a leading fintech company championing a “one-stop shop” strategy, delivered another strong earnings report on Tuesday, setting all-time highs across five core metrics: total revenue, net profit, fee-based income, membership, and product. SoFi shares rose about

Tue, Oct 28

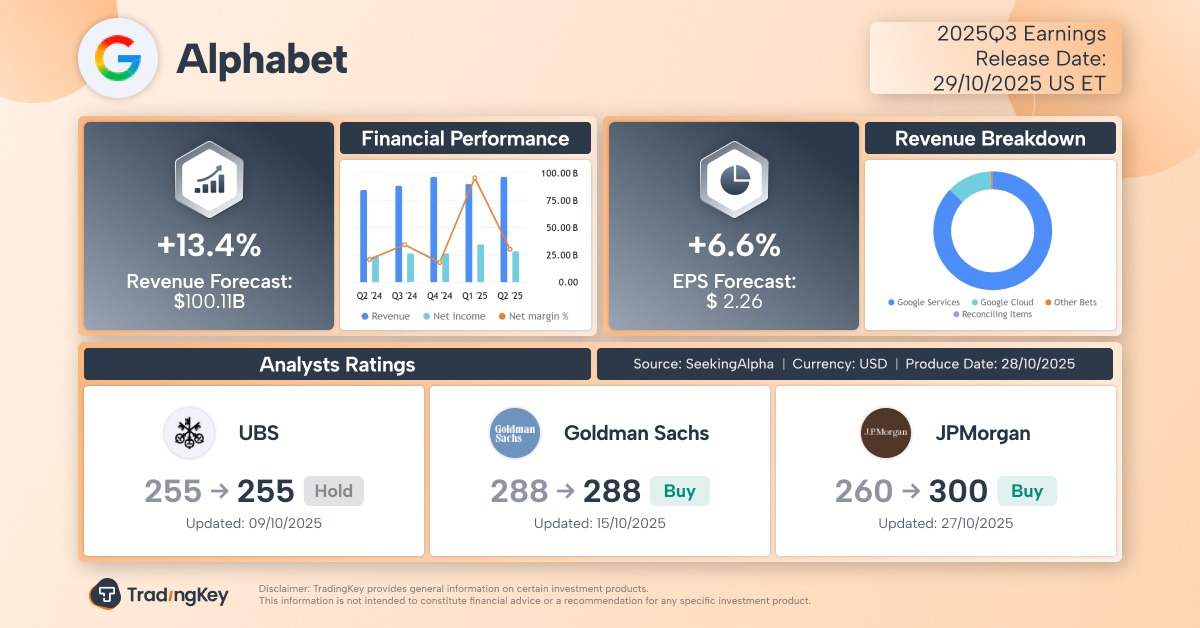

Google Q3 Earnings Preview: Ads as Foundation, AI as Sword — Can TPU Commercialization Drive a Re-Rating?

TradingKey - Alphabet (GOOG, GOOGL), the AI and cloud powerhouse, will report its Q3 2025 earnings after market close on Wednesday, October 29. Analysts expect another strong quarter driven by resilient core advertising growth, surging AI cloud demand, and the long-awaited commercialization of its

Tue, Oct 28

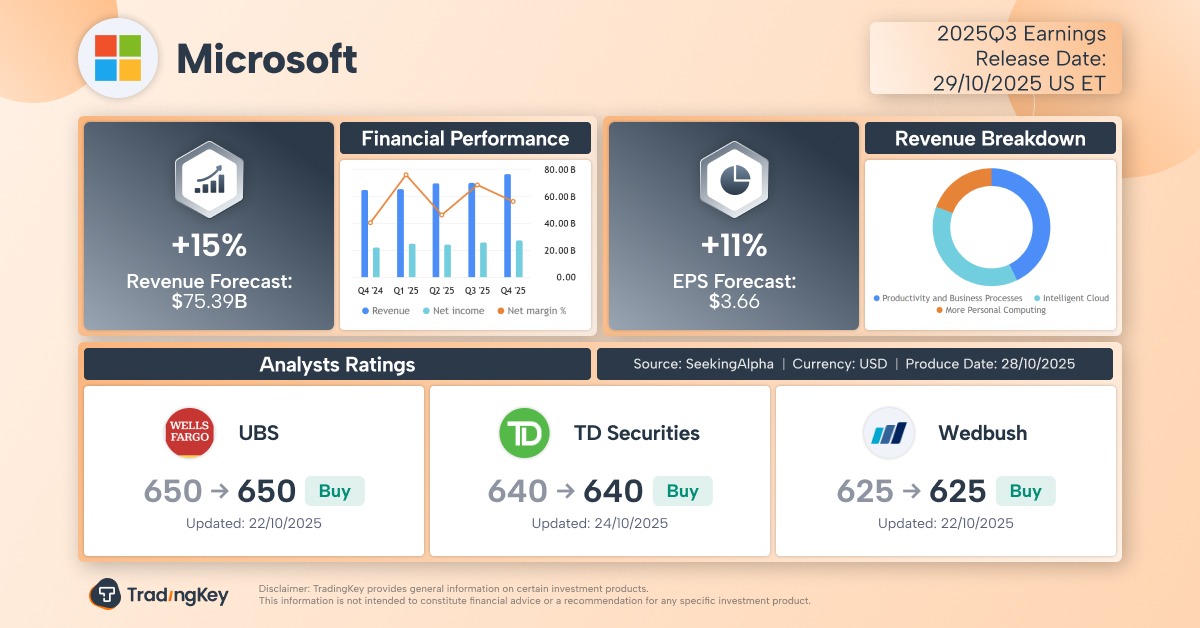

Microsoft Q1 Earnings Preview: AI-Powered Cloud Growth Fuels Wall Street’s “Zero Sell” Consensus

TradingKey - AI giant Microsoft (MSFT) will report its Q1 FY2026 earnings (natural Q3 2025) on October 29. While Microsoft’s stock has shown little movement since its last strong earnings beat, Wall Street analysts expect another quarter of AI-driven cloud growth outpacing peers, with EPS

Tue, Oct 28

Fed October Meeting Preview: Rate Cuts to Break 4% and an Earlier End to QT

TradingKey - At the Federal Reserve meeting ending Wednesday, October 29, policymakers are widely expected to follow through on the rate-cutting path outlined in the September Summary of Economic Projections — delivering a 25-basis-point rate cut, the second of 2025. Simultaneously, with bank

Mon, Oct 27

US-China Summit: 5 Key Issues to Watch in First Trump-Xi Meeting in Six Years

TradingKey - The high-stakes meeting between U.S. President Donald Trump and Chinese President Xi Jinping on Thursday, October 30, stands as the cornerstone of Trump's ongoing five-day Asia trip after returning to the White House. This summit follows a constructive round of trade negotiations, which

Mon, Oct 27

The Complex Balance of the Takaichi Trade: Japanese Stocks Rise, Yen Weakens, But Flattening JGB Yield Curve Gains Favor

The successful appointment of Sanae Takaichi as Japan’s first female prime minister has reignited the “Takaichi trade,” fueling a rally in Japanese equities and further weakening the yen. However, the outlook for Japanese government bonds (JGBs) has become more uncertain.

Mon, Oct 27

“Cockroach Hunt” Over? After Loan Portfolio Reviews, U.S. Regional Banks Say: This Isn’t 2023

TradingKey - Recent failures at smaller financial institutions and loan write-offs over the past month have raised fears of a repeat of the 2023 regional banking crisis. However, based on Q3 earnings reports and internal credit portfolio reviews, recent bad debt incidents may not signal systemic

Fri, Oct 24

Gold’s Nine-Week Rally Ends Amid Dollar Strength — But the Bull Market Isn’t Over

TradingKey - After nine consecutive weeks of gains, gold prices may be ending their strong rally this week, pressured by easing trade tensions and investor profit-taking. The recent sell-off stemmed from position unwinding in speculative portfolios and spillover effects from silver markets ...

Fri, Oct 24

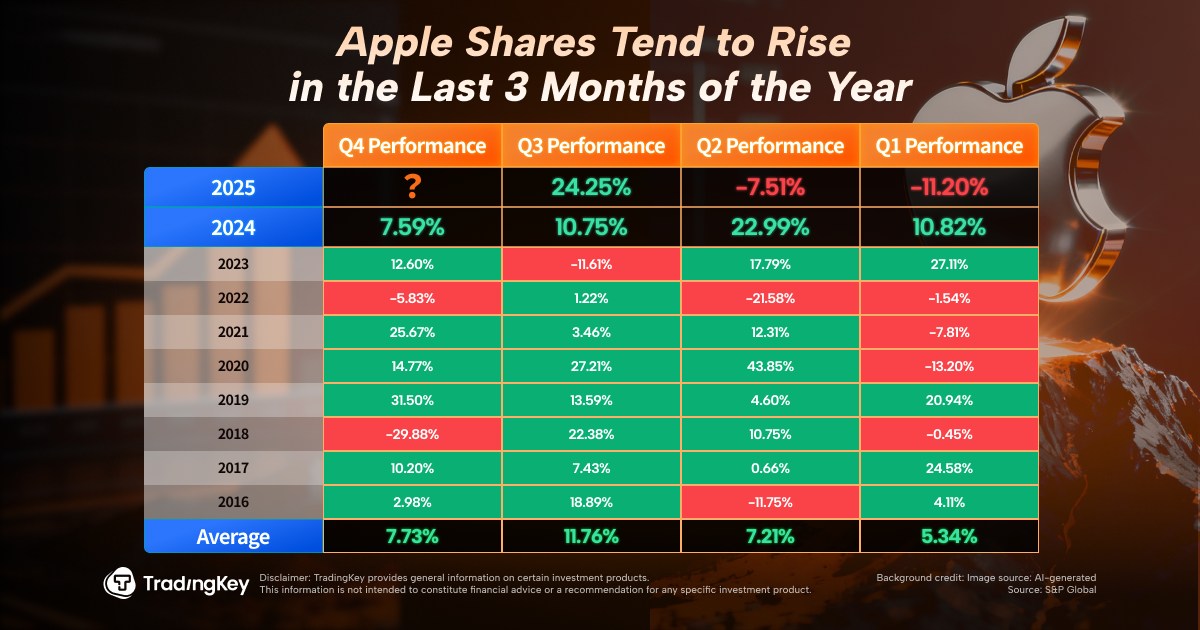

Apple’s Seasonal Q4 Rally Kicks In — Will iPhone 17 Break the Upgrade Cycle and Add More Fuel?

TradingKey - Historical data over the past decade shows a clear seasonal trend in Apple’s stock price: consistent gains in Q3 and Q4. While not guaranteed, unexpectedly strong demand for the iPhone 17 series is now reinforcing confidence in Apple’s solid performance, sharply reversing earlier

Fri, Oct 24

Coffee Prices Hit Record High on Brazil’s Tariffs and Critical Supply Shortages

TradingKey - Driven by U.S. tariffs of up to 50% on Brazil and persistent drought conditions in Brazil, coffee prices have surged over 55% since their July lows, reaching a new all-time high on October 23. The sustained surge in coffee prices is primarily driven by mounting challenges in Brazil ...

Thu, Oct 23

Intel Q3 Earnings Preview: Surge in Partnerships and Investments — Should You Bet Against a Turnaround?

TradingKey - Semiconductor chip manufacturer Intel (INTC) will report its Q3 2025 earnings after market close on Thursday, October 23, with investors watching closely to see if the company can finally prove it’s on a credible path to profitability. This quarter could mark a turning point, driven by

Thu, Oct 23

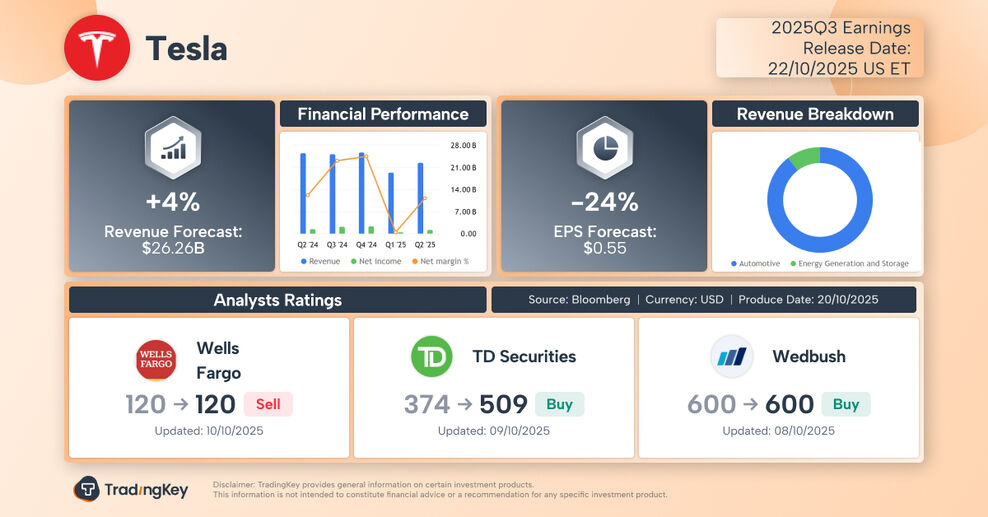

As Tesla Q3 Profits Plunge 31%, Musk Warns: No Mega Pay Package, No Full Commitment

TradingKey - CEO Elon Musk is using the Q3 earnings window to pressure shareholders ahead of a crucial vote on his proposed $1 trillion pay plan, suggesting he needs greater stock control to drive Tesla’s next phase of growth.

Thu, Oct 23

From AI to Qubits: Why Trump Is Positioning Quantum Computing as a Strategic Imperative

TradingKey - Following its investment in Intel, the Trump administration is now setting its sights on quantum computing — a field Wall Street has hailed as the greatest revolutionary breakthrough since humanity discovered fire. Given quantum computing’s immense strategic advantages in technology

Thu, Oct 23

Despite Historic AWS Crash, Analysts See Only Modest Boost to Multi-Cloud Adoption

TradingKey - A major outage at Amazon Web Services (AWS) on Monday disrupted operations for businesses and organizations worldwide that rely on the platform, prompting customers to reconsider whether they should diversify data storage or adopt a “multi-cloud strategy.”

Wed, Oct 22

Breaking Free from Labubu Dependence? Pop Mart’s Q3 Growth Accelerates as IP Diversification Pays Off

TradingKey - After peaking in August, shares of Pop Mart, the maker of the wildly popular Labubu collectible figures, have fallen over 20%, amid concerns that reliance on a single IP cannot justify its high valuation. Now, the world’s leading blind box company is trying to dispel those fears with

Wed, Oct 22

OpenAI Launches ChatGPT Atlas Browser — How Big a Threat to Google’s Dominance?

TradingKey - Following AI-powered browsers like Perplexity’s Comet, Brave Browser, and Opera’s Neon, the AI browser race has welcomed a heavyweight entrant: OpenAI. The launch of its first AI-driven browser, ChatGPT Atlas, marks a new front in the AI arms race — and a direct challenge to established

Wed, Oct 22

Netflix Q3 Earnings: Brazil Tax Hit vs. Ad Revenue Growth Engine — A Mixed Report

TradingKey - Global streaming giant Netflix (NFLX) delivered a mixed third-quarter earnings report: revenue continued strong double-digit growth and accelerated from Q2, with record user engagement, content viewership, and ad sales — but a profit shortfall driven by a tax dispute in Brazil triggered

Wed, Oct 22

Tesla Q3 Earnings Preview: Record Deliveries “Burn Out,” Growth Path Filled With Uncertainty

TradingKey - Riding on improved market sentiment and Elon Musk’s renewed focus on his role as Tesla CEO, Tesla’s stock has rebounded over 85% in the past six months — the strongest recovery among the Magnificent Seven. Tesla is set to report its Q3 2025 earnings after market close on October 22

Tue, Oct 21

Gold and Stocks Rise in Tandem — It’s Not Inflation or Risk, It’s Liquidity

TradingKey - Since 2025, both gold and equities have continued to hit new all-time highs — a rare phenomenon in financial history. Conventional explanations such as dollar depreciation, inflation hedging, and safe-haven demand struggle to explain this simultaneous rally. The true force behind the

Tue, Oct 21

Japanese Stocks Hit Record Highs — But This Time, the ‘Takaichi Trade’ Has a New Twist

Japanese equities continue hitting record highs on the back of fiscal stimulus and monetary easing expectations — the so-called “Takaichi trade.” But this time, the trade is evolving due to the inclusion of Ishin.

Tue, Oct 21