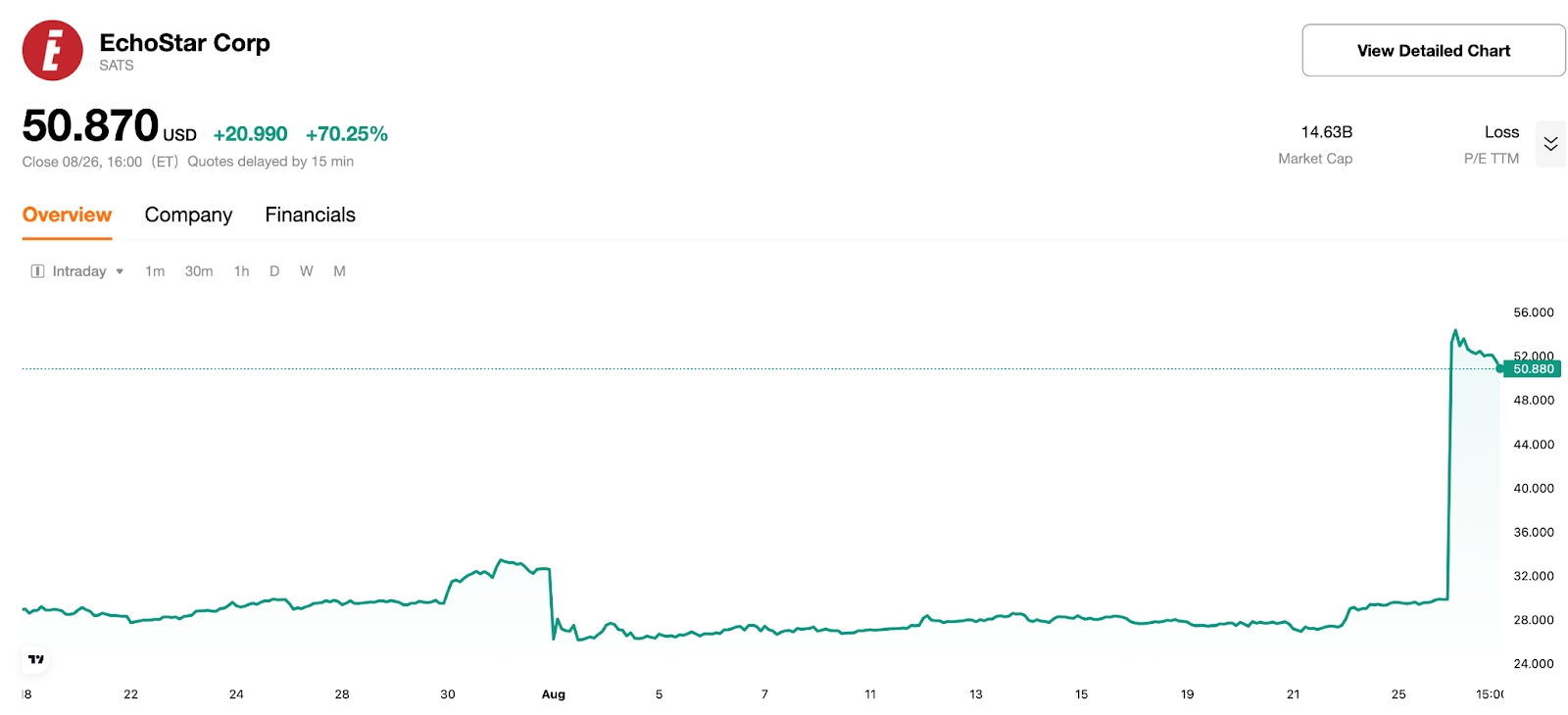

EchoStar Soars Over 70% — $23 Billion Deal Turns the Tide

TradingKey - U.S. communications company EchoStar (SATS) surged more than 70% at Tuesday’s open (U.S. Eastern Time), sending its market value sharply higher. The dramatic rally followed the company’s announcement of a $23 billion spectrum deal with AT&T, in which EchoStar will sell its nationwide 50MHz of 3.45GHz and 600MHz spectrum licenses. The transaction is seen as a pivotal turnaround, pulling the company back from the brink of regulatory and financial crisis.

[Source: Tradingkey]

In May, SpaceX filed a complaint with the Federal Communications Commission (FCC), accusing EchoStar of long-term “warehousing” of mid-band spectrum — underutilizing valuable public resources. The FCC launched an investigation, triggering a chain reaction: EchoStar defaulted on its bonds and, in June, was rumored to be preparing for bankruptcy protection to avoid having its spectrum licenses revoked.

The turning point came in June, when EchoStar CEO Charlie Ergen met with former President Donald Trump. Shortly after, Trump personally pressured FCC Chair Brendan Carr to pursue a “friendly resolution.” Under this political intervention, the FCC suspended its investigation, giving EchoStar critical breathing room — and paving the way for the landmark deal with AT&T.

Market analysts note that the $23 billion price tag significantly exceeds EchoStar’s original acquisition cost and even surpasses prior asset-backed valuations — a clear signal of the growing scarcity and strategic value of mid-band spectrum. AT&T plans to use the spectrum to expand its 5G network capacity, with the deal expected to close in mid-2026.

Notably, while Ergen is known for donating to Democratic causes, he maintains close ties with conservative media outlet Newsmax. Its owner, Chris Ruddy, is a longtime friend and confidant of Trump — a personal connection widely seen as instrumental in securing presidential support.

This episode underscores the complex interplay between politics and business in the U.S. EchoStar joins a growing list of companies — including Intel — that have seen their fortunes shift due to political intervention. Analysts warn that such involvement can lead to extreme stock volatility, urging investors to closely monitor the risks and ripple effects following high-level political engagement.