Today’s Market Recap: Nonfarm Payrolls Significantly Beat Expectations, Three Major US Stock Indices All Fall

TradingKey - On February 12, 2026, the S&P 500 edged lower to 6,941.47. The Dow fell 0.13% to 50,121.40, and the Nasdaq declined 0.16% to 23,066.467.

U.S. stocks opened higher but gave back gains as weakness in megacap tech shares led the three major benchmarks to close slightly lower. Concerns over AI disruption continued to simmer, triggering another sell-off in software stocks, while real estate services also plummeted on AI fears, recording their largest single-day decline since the pandemic, CBRE Group (CBRE) and Jones Lang LaSalle (JLL) plunged 12%.

Apple (AAPL) The launch of the new Siri may be delayed again as testing reportedly exposed performance issues, with some features potentially pushed back to September. Reports indicate that until last month, Apple still intended to release the new Siri with iOS 26.4 in March. However, testing revealed problems with query processing, excessive response times, and insufficient accuracy. Apple is now considering rolling out some features in later iOS updates in May or even September, with personal data features particularly likely to be delayed. Apple shares pared an intraday gain of over 2% to finish up 0.67%.

Storage stocks rebounded on Wednesday after being oversold recently, as investors moved to pick up names that were unfairly caught in the sell-off, SanDisk (SNDK) surged 10.65%, Micron Technology (MU) jumped 9.94%.

Bitcoin (BTCUSD) trended lower throughout the session, briefly falling below the $66,000 level for a 24-hour loss of 2.3%, as cryptocurrency stocks also retreated, MicroStrategy (MSTR) tumbled 5.2%.

U.S. nonfarm payrolls added 130,000 jobs in January, the largest gain since last April, as the unemployment rate fell to 4.3% and the annual figure was revised downward by 862,000. Wall Street expects the first rate cut to be delayed until July, while the 'Fed Whisperer' anticipates a longer pause.

The U.S. budget deficit narrowed by 17% in the first four months of fiscal 2026 as tariff revenue surged. The Congressional Budget Office stated that Trump’s fiscal path is unsustainable, raising the U.S. deficit projection by $1.4 trillion over the next decade.

Oil prices rose more than 2% on reports that Trump is privately weighing a withdrawal from the USMCA. In a new challenge for Trump, Republican leaders failed to block a House vote on whether to overturn tariffs on Canada.

Trump said reaching a deal with Iran would be his 'preferred' choice, while an advisor to Iran’s Supreme Leader remarked that the U.S. is becoming more rational.

The release of Apple’s new Siri may face another delay as testing reportedly exposed issues, with some features potentially pushed back to a September launch.

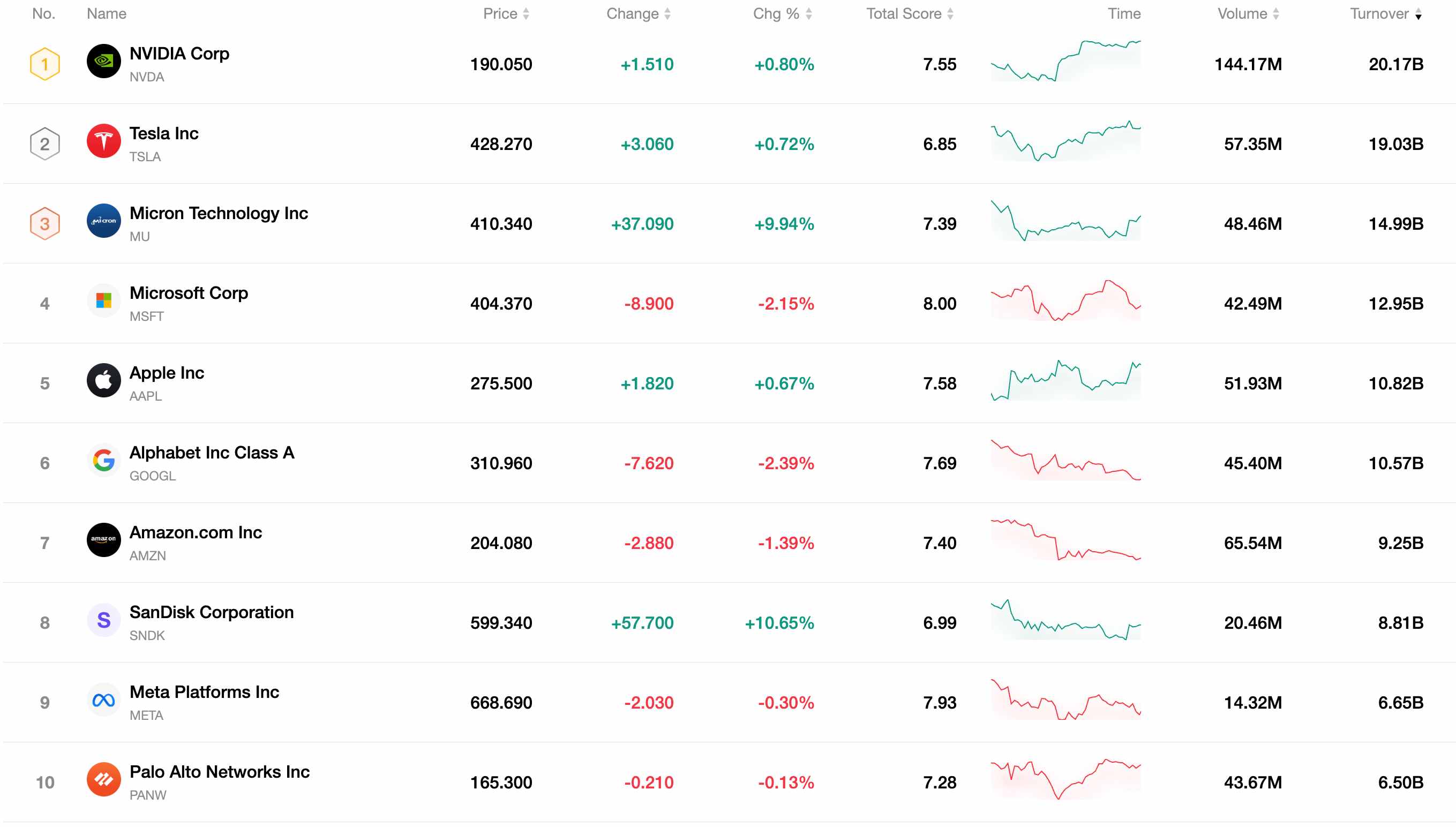

The chart below lists the ten most actively traded stocks in the market today. Due to their immense trading volume and high liquidity, these equities serve as key benchmarks for tracking global market dynamics.

This content was translated using AI and reviewed for clarity. It is for informational purposes only.