Why Ethereum could be entering a "2017 Bitcoin moment"

- Ethereum hits $4,300, getting closer to its all-time high above $4,800 seen in November 2021.

- Fundstrat's founder Tom Lee says Ethereum is entering a "2017 Bitcoin moment," when the king crypto's price rallied 120x.

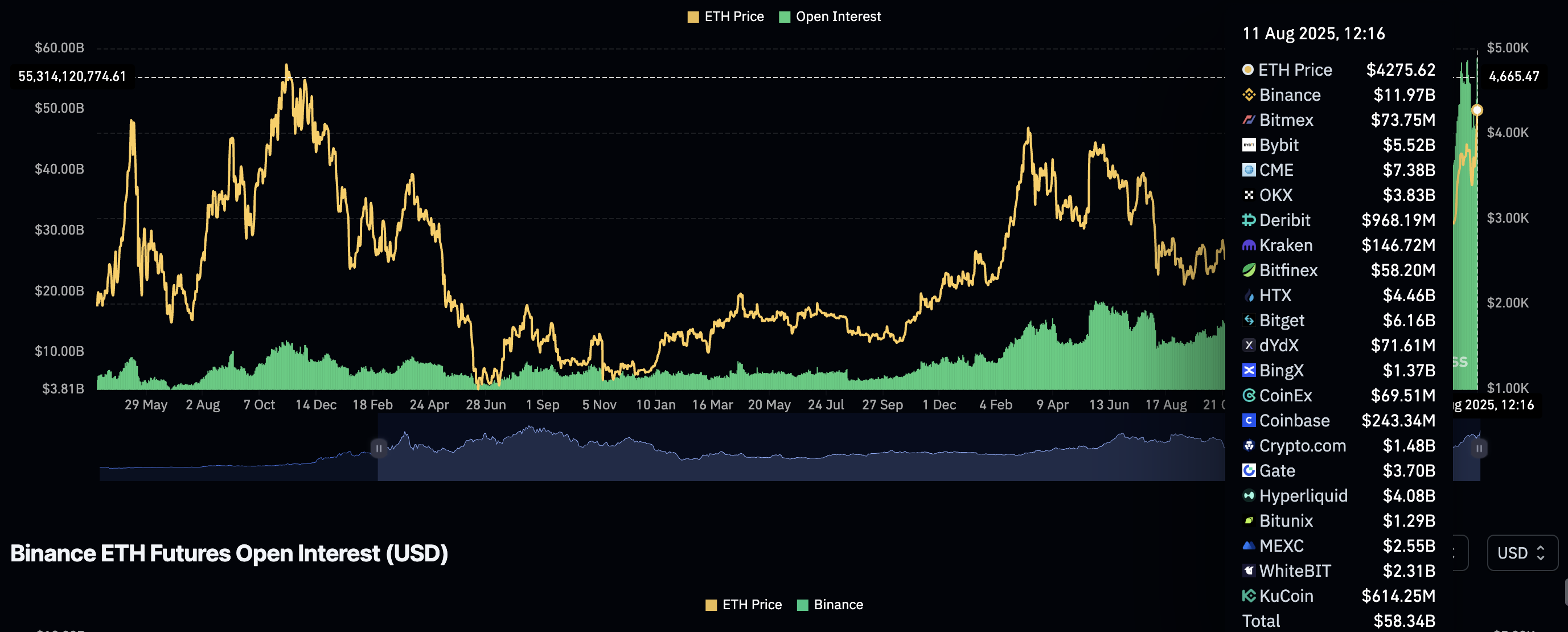

- Ethereum futures Open Interest hits $58 billion, the highest level ever recorded.

Ethereum (ETH) is clawing back some of the gains accrued since last week's breakout from support at $3,500 after tagging an intraday high of $4,349 on Monday.

The upswing, which broke the four-year hurdle at $4,000 for the first time in four years, can be attributed to bullish market sentiment and an increase in speculative demand from both institutional and retail investors.

Although sentiment remains bullish, backed by rising futures Open Interest (OI), bulls must defend support at $4,000, especially if profit-taking takes center stage in upcoming sessions. According to CoinGlass data, Ethereum futures OI has peaked at $58 million, the highest level on record, suggesting that investor interest in the token remains elevated even as the price nears the all-time high.

Ethereum futures Open Interest | Source: CoinGlass

Assessing Ethereum's "2017 Bitcoin" moment

Interest in Ethereum has been steadily rising over the last few weeks, driven by institutions buying spot ETFs. But the retail market has also been active as evidenced by the increase in the derivatives market Open Interest (OI).

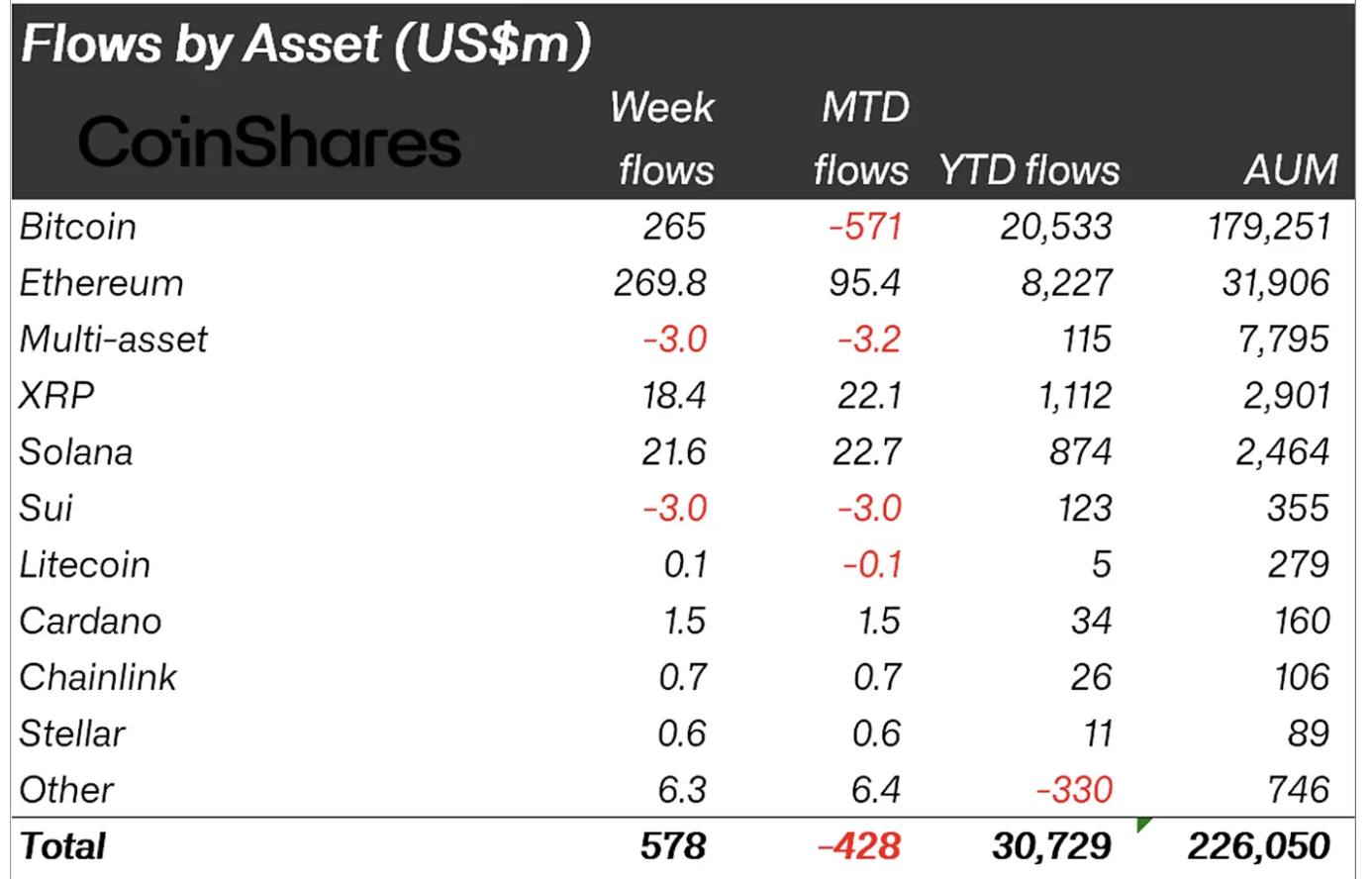

Ethereum spot ETFs in the US saw the highest weekly inflow on record of $2.18 billion for the week ending July 18, as highlighted by SoSoValue data. While the inflows slowed in the following weeks, interest remains steady, with CoinShares reporting approximately $270 million in related investment products on Monday.

"Ethereum ETPs led with US$268m in inflows, driving YTD inflows to a record $8.2 billion and pushing assets under management (AUM) to an all-time high of US$31.9 billion, up 82% in 2025," the CoinShares report highlights.

Digital investment products flows | Source: CoinShares

If capital inflow holds steady in the upcoming weeks, speculative demand could propel Ethereum toward its all-time high of $4,878, reached in November 2021.

Tom Lee, the founder of Fundstrat, one of the companies exploring Ethereum as a corporate treasury asset, said during a recent interview with CNBC that Ethereum could be entering a "2017 Bitcoin" moment backed by institutional interest and an improving regulatory environment in the United States (US).

"Ethereum is having its Bitcoin 2017 momentum again… in 2027 Bitcoin was under $1,000, but that was the year when Wall Street discovered the narrative of 'Bitcoin is digital Gold', and Bitcoin has gone to $120,000 now, so 120x increase," Lee told CNBC.

Bitcoin price renewed the bid for its record high of $123,218 over the weekend, reaching an intraday high of $122,335 on Monday.

"In 2025, a couple of things are happening around Ethereum; the first is the GENIUS Act which is making stablecoins green-lighted, which is the ChatGPT moment for crypto, but it needs a smart contract," Lee added.

US President Donald Trump signed the GENIUS Act into law in July following its passing in the House of Representatives. Two other bills were passed in Congress, including the CLARITY ACT and the Anti-CBDC Act, which will be discussed in the Senate.

If they pass the Senate vote, the bills will head to the President's desk for signing, marking another significant moment for crypto regulations in the US.

"The second is the Securities & Exchange Commission (SEC) pushing forward with Project Crypto, which is actually asking Wall Street to move the entire financial system onto the blockchain. Ethereum is the preferred choice for Wall Street, because its had zero downtimes since inception, matching what the banks want, 100% uptime. It's also the most legally compliant and secure blockchain," Lee explained further.

Lee is also the Board Chairman of Bitmine, a company that is actively building an Ethereum strategy. Bitmine holds roughly 833,133 ETH, according to data shared by CNBC.

Like Strategy, which is the largest corporate holder of Bitcoin, Bitmine is the largest corporate holder of Ethereum. The company aims to hold at least 5% of Ethereum, or eventually 6 million ETH.

Lee predicts that Ethereum could break out to $30,000 as more companies seek exposure, building strategic treasuries.

Technical outlook: Can Ethereum defend higher support?

Ethereum price is retreating from its intraday high of $4,349 following the much-anticipated breakout above the four-year resistance at $4,000. The largest smart contracts token is trading at $4,184 at the time of writing, reflecting potential profit-taking and changing dynamics in the broader crypto market.

A buy signal from the MACD indicator affirms the bullish technical structure. The green histogram bars expanding above the zero line reinforce the bullish grip, thus increasing the chance of Ethereum tagging its record high above $4,800.

ETH/USDT daily chart

Still, traders should consider tempering their bullish expectations, especially with the RSI declining into overbought territory. Higher RSI readings are often a precursor to price corrections, suggesting overheated market conditions.

Traders would be concerned by the possibility of support at $4,000, but if push comes to shove and the overhead pressure overshadows demand, other key levels to keep in mind include $3,935, which was tested as resistance on July 28 and $3,500 tested as support on August 3.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.