U.S. July CPI Commentary: Obstacles Cleared, Where Will U.S. Stocks Go Next?

TradingKey - On 12 August 2025, the United States released its Consumer Price Index (CPI) data for July. In terms of headline inflation, the CPI rose by 2.7% year-on-year in the month, slightly lower than the expected 2.8%. However, core CPI climbed 3.1% year-on-year, edging past the projected 3.0%. This CPI report, which largely aligned with expectations, cleared the way for the Federal Reserve to implement an interest rate cut in September. Following the data release, all three major U.S. stock indices moved higher collectively.

Specifically, the month-on-month decline in overall inflation was primarily driven by stable food and energy prices. Conversely, the month-on-month uptick in core inflation stemmed from contributions from housing and transportation service prices within the service sector inflation.

Looking ahead, as the intensity of Trump’s tariffs has proven more moderate than previously anticipated, the pace at which U.S. businesses pass on tariff costs to households will slow. This may lead to a more gradual upward pressure of tariffs on prices. Meanwhile, the rising rental vacancy rate and softness in the labour market reinforce our continued optimism about the outlook for U.S. inflation.

Given the low risk of a substantial rebound in inflation, we judge that the Federal Reserve will resume its rate-cutting cycle in September, with three 25-basis-point cuts to be carried out within the year. From the fiscal policy perspective, the “One Big Beautiful Bill Act” – especially its tax-cutting provisions – will offer positive support to the U.S. stock market. Taking these factors together, the combined driving effect of the rate-cut and tax-reduction policies leads us to hold a bullish view on U.S. stocks over the next 12 months.

Source: Mitrade

Main Body

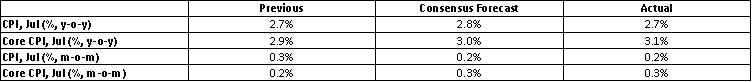

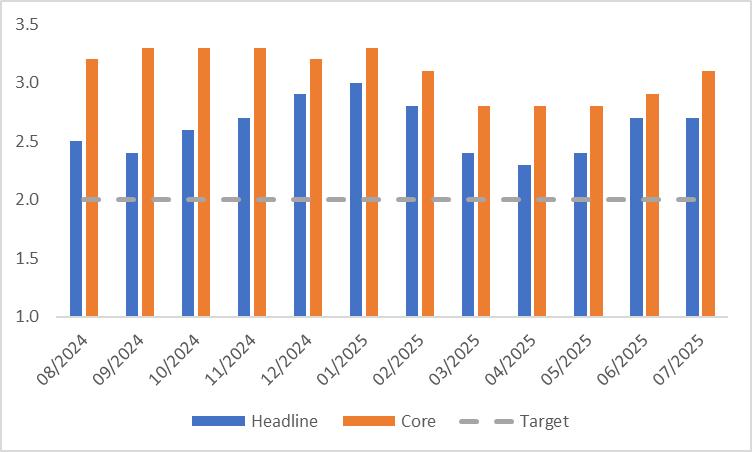

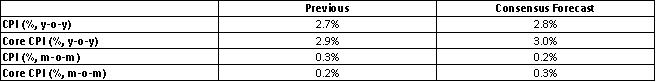

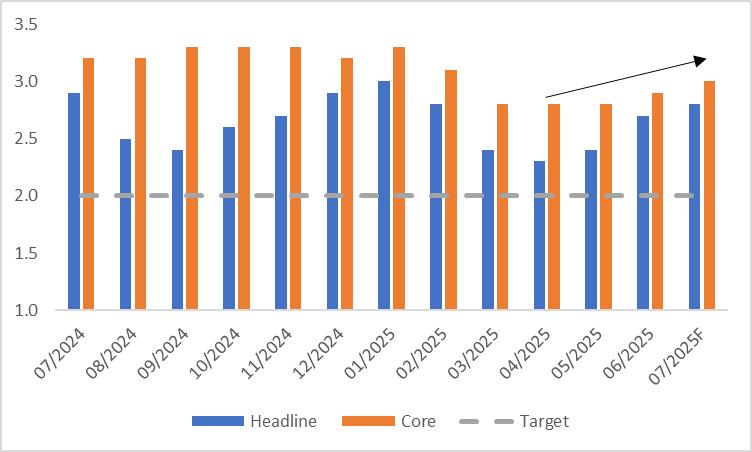

On 12 August 2025, the United States released the Consumer Price Index (CPI) data for July, which was broadly in line with the market's general expectations. Breaking down the specific figures, at the headline inflation level, the CPI rose by 2.7% year-on-year in July, unchanged from the June increase and slightly below the expected 2.8%; on a month-on-month basis, it increased by 0.2%, matching expectations and edging down by 0.1 percentage points from June's monthly gain. Meanwhile, the core CPI climbed by 3.1% year-on-year in July, surpassing both the anticipated 3% and June's 2.9% rise, marking the highest year-on-year increase since February; on a monthly basis, the core CPI rose by 0.3%, in line with expectations, compared to a 0.2% uptick in June (Figures 1 and 2).

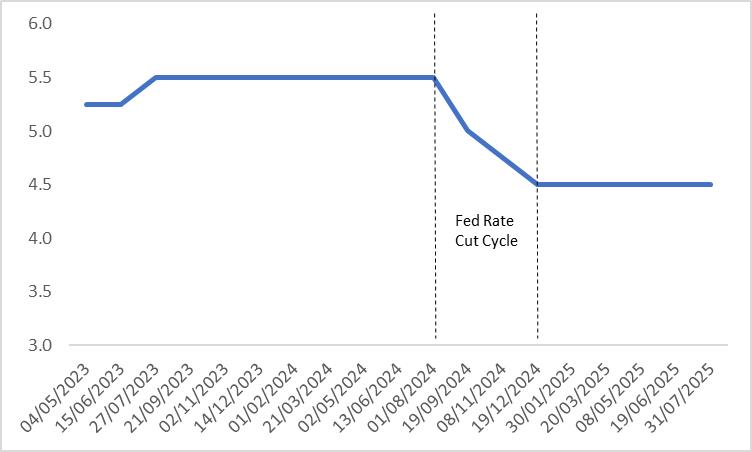

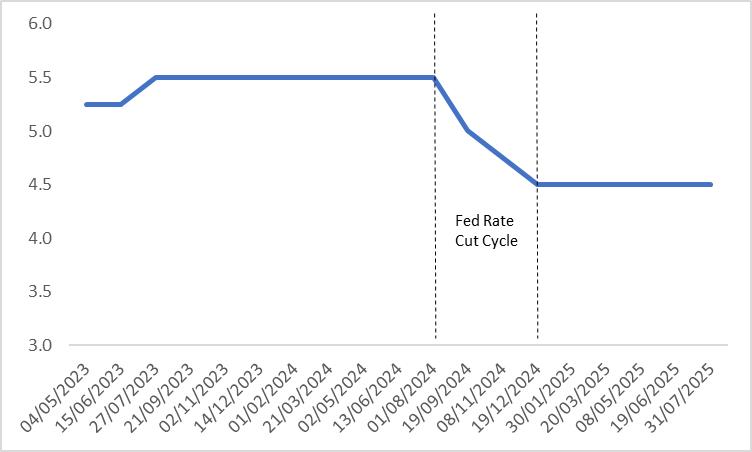

The CPI data, which came in line with expectations, has removed obstacles for the Federal Reserve to implement an interest rate cut in September. Currently, the market's expected probability of a Fed rate cut in September has climbed to around 95%. Driven by this news, all three major U.S. stock indices showed a collective upward trend after the data was released.

Figure 1: Market Consensus Forecasts vs. Actual Data

Source: Refinitiv, TradingKey

Figure 2: US CPI (%, y-o-y)

Source: Refinitiv, TradingKey

Headline inflation saw a month-on-month decline compared to the previous period, primarily driven by the stable performance of food and energy prices — food prices remained unchanged month-on-month, while energy prices dropped by 1.1% month-on-month. In contrast, core inflation edged up from June, mainly due to the recovery in service-sector inflation. Specifically, within service inflation, the housing category (e.g., the month-on-month decline in prices for away-from-home accommodation narrowed to 1%) and transportation services (e.g., airfare prices rose by 4% month-on-month) contributed 2.5 basis points and 4.9 basis points to the month-on-month growth of core CPI, respectively.

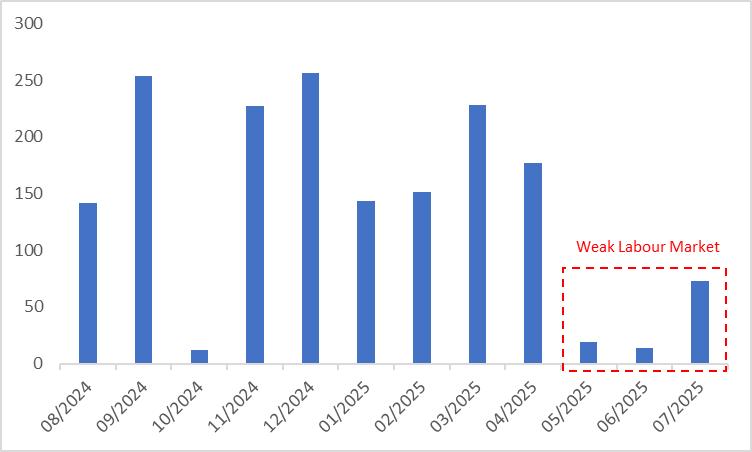

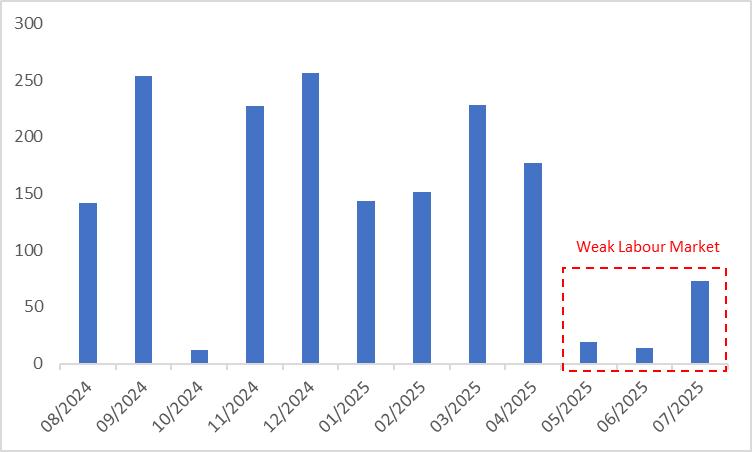

Looking ahead, while U.S. enterprises will pass on tariff costs to residents, the impact of tariffs on price hikes is likely to be more moderate due to the slower pace of cost pass-through—largely because the intensity of Trump's tariff measures has turned out to be milder than previously expected. Meanwhile, the rising housing vacancy rate and the softening labour market (Figure 3) further reinforce our optimistic outlook on the prospect of U.S. inflation.

Figure 3: US-Nonfarm-Payrolls (000)

Source: Refinitiv, TradingKey

With little risk of a substantial inflation rebound, we anticipate the Federal Reserve will resume its rate-cutting cycle in September (Figure 4), implementing three 25-basis-point cuts within the year. From a fiscal policy perspective, the “One Big Beautiful Bill Act” – especially its tax-cutting provisions – will offer favourable support to U.S. equities. Given these combined factors, the joint driving force of rate cuts and tax reductions leads us to hold a bullish view on U.S. stocks over the next 12 months.

Figure 4: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

U.S. CPI Preview: Bullish Outlook for U.S. Stocks Continues

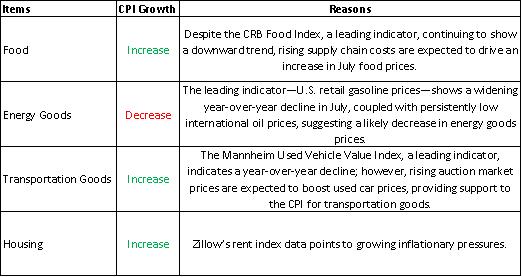

TradingKey - On 12 August 2025, the U.S. will release its July CPI data. Market consensus forecasts a year-over-year headline CPI increase of 2.8% and a core CPI rise of 3%, both up 0.1 percentage points from June. We align with these widely held market expectations. Breaking it down by category: rising supply chain costs are expected to drive food prices higher; falling U.S. retail gasoline prices, combined with persistently low international oil prices, may lead to a decline in energy goods prices; rising used car prices are likely to support the CPI for transportation goods; and Zillow’s rent index data points to ongoing housing inflation pressures. Overall, the likelihood of higher U.S. inflation in July is significant.

Moving forward, a weakening U.S. labour market could slow economic expansion. Despite signs of inflation picking up recently, reduced economic growth should limit demand-driven inflation increases. As a result, we anticipate inflation will steadily decrease in the coming months. In this context of subdued growth and falling inflation, the Federal Reserve is likely to restart rate cuts in September. For equities, supportive monetary policy alongside tax cuts from the “One Big Beautiful Bill Act” should outpace the adverse effects of economic softness. Thus, we remain bullish on the U.S. stock market outlook for the next 12 months.

Source: Mitrade

Main Body

On 12 August 2025, the U.S. will release its July CPI data. Market consensus projects a year-over-year headline CPI increase of 2.8% and a core CPI rise of 3%, both up by 0.1 percentage points from June (Figure 1). We concur with these broadly shared market expectations.

Figure 1: Consensus Forecasts

Source: Refinitiv, TradingKey

The breakdown analysis of the CPI is as follows:

Taken together, these category dynamics suggest a high likelihood of elevated U.S. inflation in July. If this expectation holds, it would mark the third consecutive month of rising U.S. CPI since its low in April (Figure 2).

Figure 2: U.S. CPI (%, y-o-y)

Source: Refinitiv, TradingKey

Moving ahead, the softening U.S. labour market (Figure 3) could create uncertainty for the economic landscape. Market consensus projections indicate U.S. real GDP growth will drop to 1.3% year-over-year in Q3 and 1% in Q4 of 2025, reflecting significantly stronger economic headwinds in the latter half of the year. Despite recent signs of resurgent inflation, slower economic expansion is likely to curb demand-driven inflation pressures. As a result, we expect inflation to steadily decrease in the months ahead.

Figure 3: U.S. Nonfarm Payrolls (000)

Source: Refinitiv, TradingKey

With low economic growth and easing inflation, the Federal Reserve is likely to restart interest rate reductions in September (Figure 4). On the fiscal side, the “One Big Beautiful Act”—especially its tax cut measures—is expected to bolster U.S. equities in the near to medium term. Together, the combined impact of lower rates and tax relief should outpace the adverse effects of a sluggish economy. As a result, we remain bullish on the U.S. stock market’s performance over the next 12 months.

Figure 4: Fed Policy Rate (%)

Source: Refinitiv, TradingKey