Google Strikes Back: With Gemini 3 Dominating the Charts, Is Nvidia Still the Only Winner?

The article argues that the market has underestimated Google's AI capabilities, focusing on product launches rather than underlying infrastructure. Google's vertically integrated AI supply chain, from chips (TPUs) to data (YouTube), presents significant moats. Gemini 3's performance in benchmarks like ARC-AGI signals a breakthrough in reasoning. TPUs offer a cost advantage over GPUs, and Google's JAX software stack reduces reliance on CUDA. YouTube provides unique, uncopiable data for multimodal model training. While risks include technological rigidity, valuation, capital expenditure, and regulatory scrutiny, Google's robust cash flow and potential for AI-driven revenue expansion offer asymmetric investment potential.

In 2024, the most crowded and "no-brainer" trade in the capital markets was shockingly simple: "Long Microsoft, Short Google."

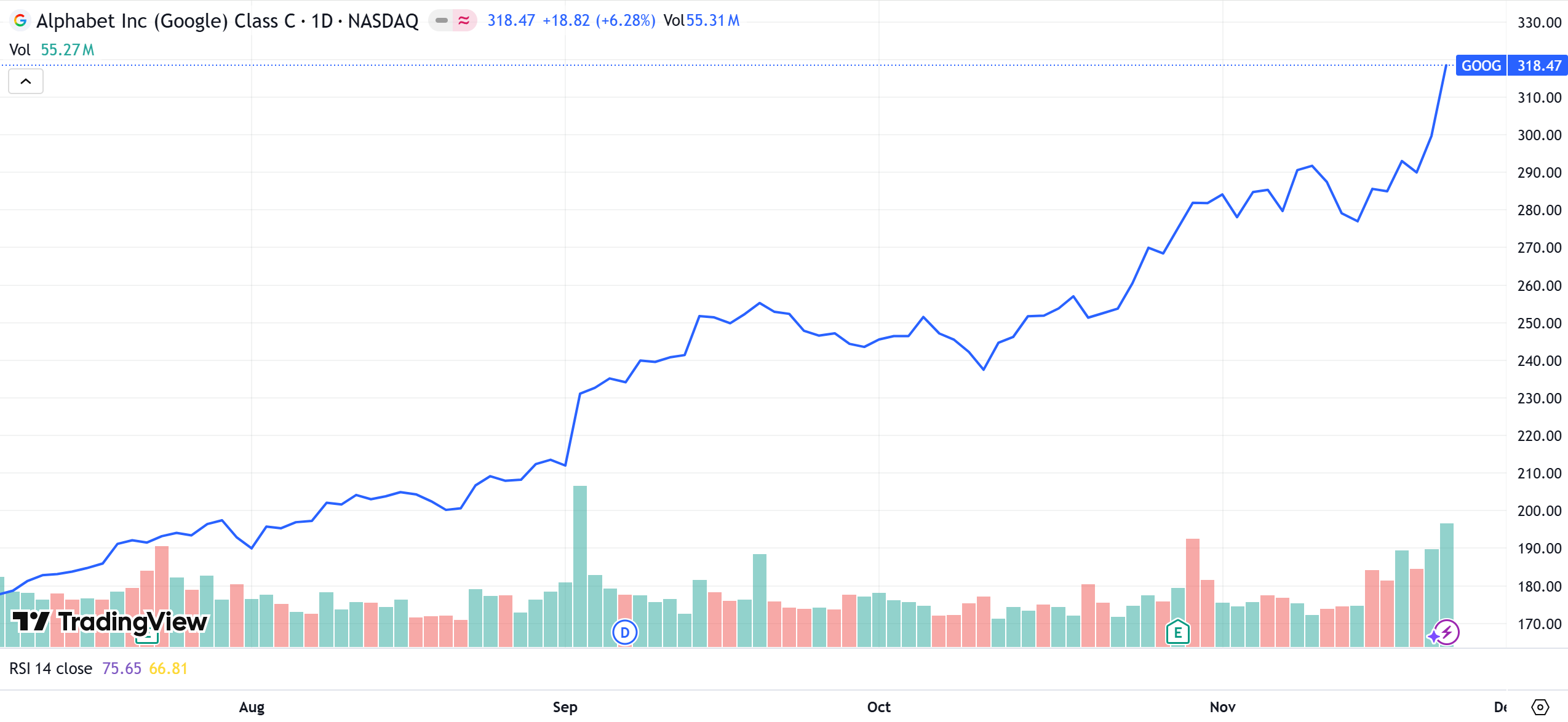

ChatGPT hit the search era like a meteorite. Meanwhile, Google seemed to be stumbling over its own feet in the AI race, suffering one PR disaster after another. To many, it looked like the next Yahoo or Nokia—a massive oil tanker too slow to turn, destined to be sunk by a speedboat. However, market sentiment is a pendulum that often swings too far. Just as everyone thought Google was "finished," it quietly drove its stock price to all-time highs, rebounding more than 40% from its lows and catching the market off guard. The once-ironclad narrative that "Google is doomed" is beginning to show visible cracks—cracks that are widening by the day.

Wall Street is committing a classic cognitive error: over-focusing on product launch formats while ignoring the differences in underlying infrastructure. With the release of Gemini 3, we are seeing not just the birth of a new model, but Google revealing its long-hidden "nuclear weapon"—a complete, vertically integrated AI industrial supply chain stretching from chips to cloud, and from data to distribution.

This analysis looks beyond short-term noise and stock volatility to dissect the three core moats of Google’s full-stack AI machinery:

- The Model: Gemini 3’s breakthrough in ARC-AGI, signaling the return of a technical premium.

- Infrastructure: The ultimate cost moat built by TPUs.

- Data Assets: The irreplicable strategic fuel possessed by YouTube.

This is not a story about how Google is playing catch-up; it is a story about how it is leveraging its unique physical laws and vertical integration to rewrite the endgame of AI competition.

1. Rejecting the "Value Trap": How Gemini 3 Crushes the Bear Case

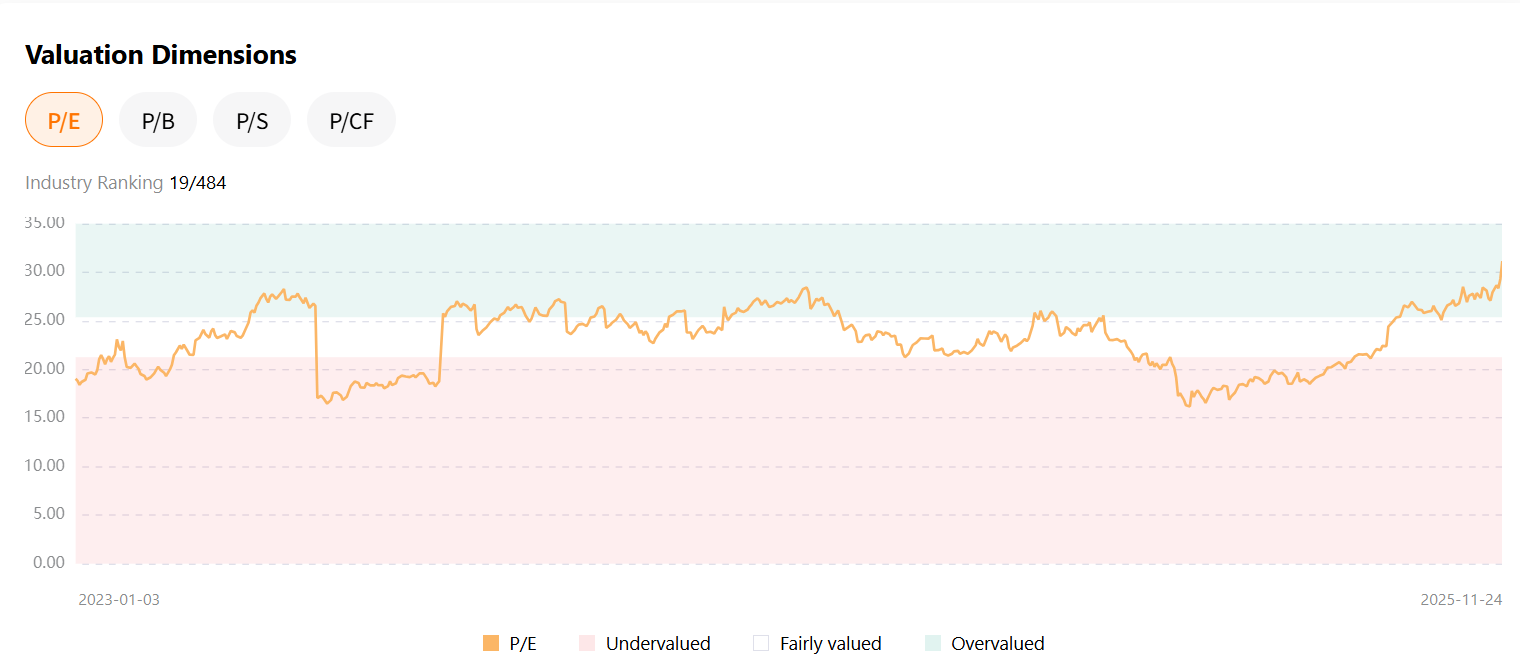

In tech investing, few words are more lethal than "technological obsolescence." Once the market decides a tech giant no longer defines the frontier, its valuation framework instantly switches from "Growth Stock" to "Value Trap." Over the past year, Google’s P/E ratio was compressed to 18-19x—significantly lower than the ~30x levels of Microsoft and Amazon—primarily due to the discount applied to its perceived loss of technical leadership.

Last week, the fundamental basis for that discount was shattered. While mass media focuses on the LMSYS Chatbot Arena’s ELO leaderboard, institutional investors care about the hard-core benchmarks that truly reflect AGI (Artificial General Intelligence) capabilities. Among these, ARC-AGI is widely considered the closest thing to the "Holy Grail" of AI testing. It assesses not knowledge retention, but the model's ability to perform abstract reasoning and draw analogies when facing completely novel, untrained problems.

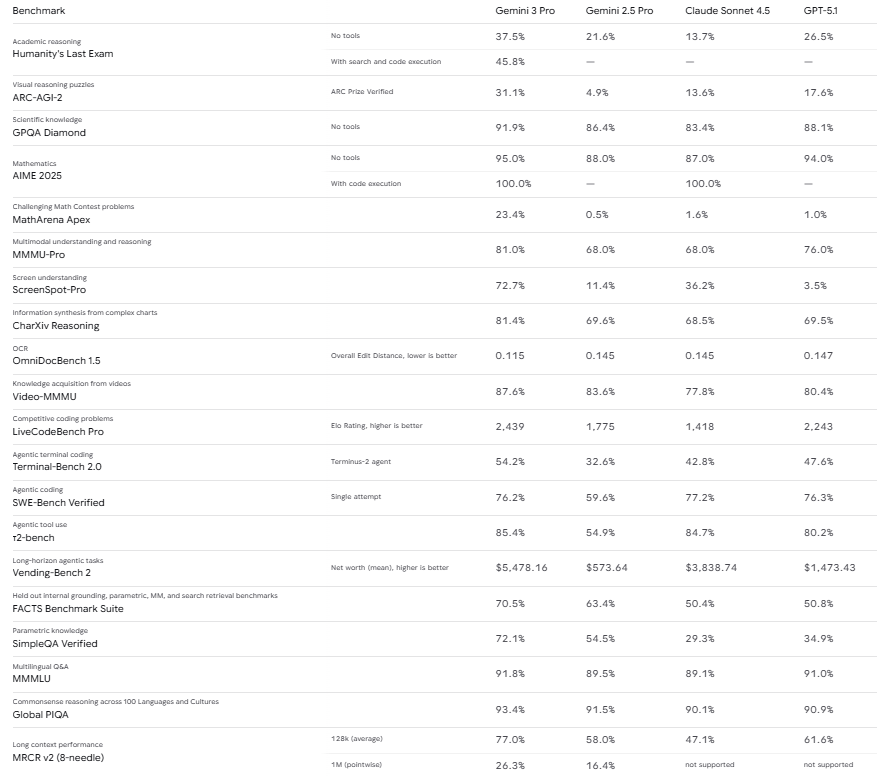

According to the latest benchmark data, Gemini 3 Pro has displayed dominant performance:

- ARC-AGI-2 (Visual Reasoning): Gemini 3 Pro achieved a 31.1% pass rate, nearly double that of GPT-5.1 (17.6%) and significantly ahead of Claude Sonnet 4.5 (13.6%). This isn't just a lead; it is a generational gap.

- Humanity's Last Exam (Top-tier Academic Reasoning): In this test designed to evaluate frontier academic reasoning, Gemini 3 Pro reached 37.5%, again substantially leading GPT-5.1’s 26.5%. With search augmentation, Gemini 3 Pro’s score jumps to 45.8%.

These are not just cold numbers; they send an expensive signal to the capital markets: Google has achieved a critical breakthrough in complex logical reasoning, bridging the gap from "Knowledge Retrieval" to "Advanced Intelligence." When a super-platform with 2 billion DAUs (Daily Active Users), abundant cash flow, and deep data moats proves it still holds the world’s top model R&D capabilities, there is no reason for the market to continue assigning it a "disruption risk" premium. That 18-19x valuation ceiling deserves to be dismantled.

2. Rejecting the "Nvidia Tax": The Asymmetric War of TPUs

While the market fixates on Nvidia’s 75% gross margins and the scramble for Blackwell chips, they often miss a fatal detail: Google is the only player in this arms race with a complete, independent hardware-software stack that does not need to pay "protection money" to the shovel seller.

The Achilles' heel of the AI business model is inference cost. Relying on general-purpose GPUs means paying a high premium (CapEx) for redundant functions and enduring massive energy consumption (OpEx). To break this physical constraint, Google stuck to the ASIC route, building an irreplicable moat through vertical integration.

2.1 Hardware Sovereignty: The Battle of ASIC vs. GPU

To understand Google’s moat, one must understand the essential difference between the two technical paths:

- GPU (The Swiss Army Knife): Designed originally for graphics rendering, GPUs retain massive amounts of general-purpose control units and cache architectures to handle varied tasks. The advantage is versatility; the cost is wasted silicon area and power.

- ASIC/TPU (The Scalpel): Google’s custom silicon for AI. Its design philosophy is minimalist. The strongest AI models today (Gemini, ChatGPT, Claude) are bottlenecked by massive amounts of "multiply-accumulate" operations. The TPU dedicates over 90% of its transistors and power to this single task, cutting out everything else (graphics rendering, branch prediction, complex scheduling). The result: For the same surface area and electricity bill, TPUs perform the exact math AI needs with breakthrough efficiency.

This "scalpel" strategy allows Google to avoid queuing for Nvidia allocations like Meta or OpenAI. Its massive projected 2025 CapEx of $93 billion is largely flowing into its proprietary TPU supply chain. The latest Ironwood TPUv7 marks the maturity of this route:

- Performance Leap: Peak performance is 10x that of TPUv5 and 3x that of TPUv6.

- Efficiency Revolution: Combined with proprietary Optical Circuit Switches (OCS) and liquid cooling, TPUv7 doubles performance-per-watt. In an era where power is the biggest data center constraint, this means Google generates double the compute for the same electric bill.

2.2 Software Breakout: JAX Cracks the CUDA Trap

Nvidia’s deepest moat is not its chips, but the CUDA software ecosystem. Most companies are locked in by migration costs, but Google has broken out via its JAX/XLA full-stack software system.

Both Gemini and Anthropic’s models are trained based on JAX, realizing complete autonomy from the underlying code to the top-level model. Anthropic’s recent purchase order for an additional 1 million TPU units powerfully proves that the TPU+JAX ecosystem already possesses top-tier commercial competitiveness capable of challenging CUDA.

2.3 The Cost Endgame: Asymmetric TCO

This "hardware-software integration" translates into crushing unit economics:

- CapEx: When mainstream competitors (like Microsoft, Meta) purchase H100/B200s, they must pay a brand premium that includes Nvidia’s roughly 75% high gross margin. By developing TPUs in-house and going directly to foundries, Google saves about 50% of the initial hardware investment, completely skipping the middleman markup.

- OpEx: As electricity costs continue to climb, the specialized architecture of the TPU shows a decisive advantage. By stripping away graphics processing redundancies, the TPU achieves a significant increase in compute output per watt. Combined with self-developed Optical Circuit Switches (OCS) and liquid cooling technology, Google has built a long-term barrier in power and cooling costs.

- Total Cost of Ownership (TCO): Combining hardware depreciation, power consumption, and network interconnection costs, according to SemiAnalysis data, the TCO per unit of compute for a Google TPU cluster is only 65% of an Nvidia H100 cluster. This means that at the same AI service pricing, Google possesses a potential profit margin 35% higher than its competitors.

Google has an innate home-field advantage in this battle. As AI competition enters the second half—the stage of scaled application—this asymmetric cost structure will translate into a massive net margin advantage. Competitors may struggle for thin profits, while Google enjoys a higher profit buffer.

3. Beyond Text: Why Only Google Can Read the "Physical World"

If compute is the engine, then data is the fuel. In a world where text data has been "scraped clean from even the corners of the internet" by major model vendors, large models based on text training are facing a bottleneck of diminishing returns. However, Gemini 3’s core architecture—Native Multimodality—has unexpectedly activated a dormant, trillion-dollar asset for Google.

3.1 What is "Native Multimodal"?

It is not just "able to see pictures." Gemini 3 Pro differs fundamentally from most models on the market (like the early GPT-4V):

- Stitched Architecture (Old Era): The traditional approach is to train a powerful LLM (Brain) and then bolt on a visual encoder (Eyes). Under this architecture, the model first "translates" the image into a text description before thinking. This leads to the loss of massive amounts of non-verbal information (such as emotional tone, micro-expressions, video timing/rhythm).

- Native Architecture (Gemini 3): From day one of training, Gemini 3 was trained jointly on text, image, audio, and video data. In its neural network, a segment of Beethoven audio, a picture of a cat, and a video of a soccer tactical run are all mapped to the same vector space. Gemini 3 can directly "hear" the rhythm of Beethoven and directly "know" the soccer tactic, without needing to convert it to text.

What does this architecture bring? It means Gemini 3 can perform deep cross-modal reasoning. It does not need to convert video to text first; it can directly "understand" the trajectory of objects in a video and the synchronization between sound and image. It can understand precise tactical runs in a soccer match and understand causal relationships in complex mechanical repair videos. This ability to understand temporal dynamics is the prerequisite for achieving high-level autonomous driving and precise video content recommendation.

3.2 YouTube: The Uncopiable Data Moat

With the strongest engine (Native Architecture), you still need the strongest fuel. This is the strategic value of YouTube. YouTube owns the world's largest video database, with over 500 hours of content uploaded every minute. The even more critical data point is: YouTube possesses over 10 billion video fragments covering almost all human behavior patterns.

To train a native model that truly understands the physical world, you need massive amounts of legal video data. OpenAI and Meta lack such data sources and face huge copyright legal risks. Google, however, possesses full training rights to the data on YouTube. This capability will vastly expand the monetization boundaries of Gemini 3. For example, Waymo’s current lead in the autonomous driving field is precisely a benefit of this spillover of visual data processing capability. YouTube is no longer just an advertising platform; it has become the scarcest strategic resource library in the AI era—an asset whose value is currently almost unpriced in Google’s stock.

4. Commercial Validation: From "Disrupted" to "New Flywheel"

Short-sellers argue that "AI Search will cannibalize Google’s ad revenue." However, data shows Google is using Gemini 3 to build a more diversified monetization flywheel.

4.1 Search: Video-to-Commerce

Google AI Overview’s monthly active users have reached 2 billion, but this is just the beginning. Gemini 3’s multimodal capabilities are opening a new era of "Visual Search." Users no longer need to type keywords; instead, they film a video of a car breakdown. Gemini 3 diagnoses the problem and directly recommends a purchase link for the repair part. This type of search based on complex problem-solving has a conversion rate far higher than traditional keyword search. It upgrades search from "Information Distribution" to "Service Delivery," vastly elevating the value of ad inventory.

4.2 Advertising Business: The Productivity Revolution of AI Max

Google’s newly launched AI ad tool suite, AI Max, is not only optimizing placement but also reshaping creative production. Leveraging Imagen 3 and Gemini 3, AI Max can automatically generate thousands of image and copy variants for advertisers and test their effectiveness in real-time. According to advertiser feedback, conversion value increased by 14% while keeping Cost Per Action (CPA) or Return on Ad Spend (ROAS) similar. This effectively lowers the entry barrier and production costs for advertisers, attracting more budget from small and medium-sized enterprises (SMEs).

4.3 Office Suite: The Workspace Subscription Goldmine

Often overlooked is Google Workspace (Gmail, Docs, Drive), a B-side goldmine. Google is upselling Gemini add-on packages ($20-$30/month/person) to its 3 billion users and 10 million paying enterprise customers. Combined with the security of the Google Cloud Platform, this brings Google massive, high-margin SaaS recurring revenue. This is a crucial stabilizer against fluctuations in the advertising cycle.

4.4 Cloud Business: The Reliability Dividend

Against the backdrop of recent consecutive outage events by competitors (Microsoft Azure, AWS), Google Cloud has become the core beneficiary of Multi-cloud strategies, thanks to the stability of its TPU clusters.

5. Risk Factors

Although Google’s investment logic is strong overall, with the stock price approaching historical highs, market sentiment has rapidly switched from "extreme pessimism" to "extreme optimism." For mature investors, this is the moment to be even more vigilant about structural risks that could break the "perfect pricing."

- Technological Rigidity: GPUs remain the "Greatest Common Divisor" of the AI world, occupying 95% of the R&D ecosystem. While TPUs are efficient, they are essentially ASICs customized for large model architectures. Once the underlying architecture of AI undergoes a mutation, the lack of flexibility in TPUs could lead to huge hardware depreciation risks and ecosystem isolation.

- Valuation Error Margin Drops to Zero: A 40% rebound in Google’s stock means the market has already priced in all the positives of Gemini’s success and Cloud acceleration. At high valuation levels, any minor negative news could trigger a violent valuation correction.

- Depreciation Pressure of the $93 Billion Gamble: The record-breaking capital expenditure in 2025 is a double-edged sword. If enterprise-side monetization speed falls short of expectations, massive depreciation and amortization will severely erode operating margins over the next two years.

- Regulatory Tail Risks: The DOJ’s antitrust lawsuit regarding the breakup of search and ad businesses has not yet concluded. Although the probability of a breakup is low, continued regulatory pressure limits Google’s ability to acquire new technologies through large-scale M&A, which is a long-term hidden danger that cannot be ignored.

6. Conclusion

The release of Gemini 3 marks the end of the narrative that "Google is an AI laggard," but it does not mean Google can rest easy. We must admit: No moat is permanent. The cost advantage of the TPU is built on the dominance of large model architectures; the data advantage of YouTube is built on the current status of copyright legal systems; and the profits of the search business are exposed to the regulatory firepower of the DOJ. A "Black Swan" event in any of these variables could severely damage the investment logic.

However, the essence of investing is not finding the perfect target, but finding probabilities that are mispriced. The current Google still offers asymmetric odds rarely seen among tech giants:

- Downside Direction: Massive cash buybacks, rigid demand for cloud computing, and the still-robust search cash cow provide solid bottom support for the stock price.

- Upside Direction: Once Gemini 3 successfully transforms search into higher-ARPU AI Agent services, or achieves an industry-level cost monopoly through TPUs, the story of its margin expansion will have only just begun.

Google may not be able to "coast and win" in the search field as it did in the past decade, but in the brutal shuffle of the AI era, relying on its vertically integrated compute and data, it has already secured the highest probability of survival in the entire industry.