Will Thanksgiving Spending Be the Catalyst the Market Needs?

TradingKey - Heading into the holiday stretch, the U.S. market is still limping. November—a month that typically brings seasonality-driven gains—has stalled out. The S&P 500 is down more than 4% month to date. If there’s any shot at a rebound into year-end, it may hinge on something simple: whether people still spend.

This week brings more than just a calendar quirk. Thanksgiving marks the beginning of peak holiday shopping season, with Black Friday and Cyber Monday kicking off what is traditionally the high point of retail sales. That would be notable any year—but in 2025, the setup feels more exposed than usual.

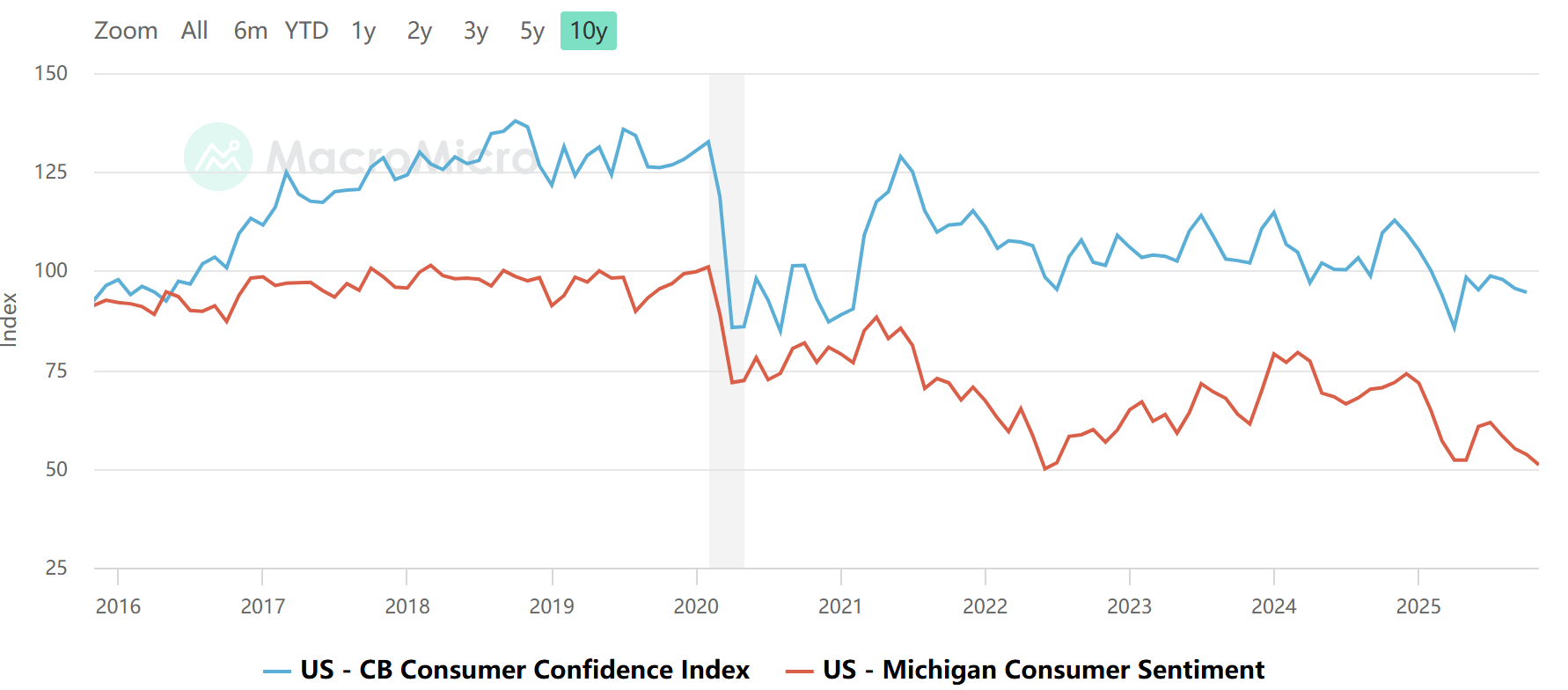

Confidence readings—like the University of Michigan’s latest November figure—are falling. But hard data has been missing too, thanks in part to the October government shutdown, which disrupted key surveys. Into that vacuum, markets are increasingly treating retail signals as real-time macro proxies.

“Morale is clearly softening,” noted David Kelly, Chief Global Strategist at JPMorgan Asset Management. “But emotion doesn’t always translate into behavior. Disappointment doesn’t mean disengagement.” From the market’s perspective, what matters most now isn’t how people feel—it’s what they do. That includes whether holiday promotions drive real conversion, especially among mid-to-low income brackets, where inflation and tariff-related costs remain sticky.

Investors, as usual, are hoping for a strong showing. A solid retail season tends to anchor fourth-quarter equity strength, bolstering the so-called Santa Rally narrative. Black Friday sales, while less of a single-day event than in years past, still serve as a litmus test for full-season demand. If the early read disappoints, bets on consumer-led growth could unwind fast—pulling down not just retailers, but the broader tape with them.

Signals from the C-suite have been cautious. Target CBO Rick Gomez told analysts the company is “aware that consumers are still being selective heading into the holidays.” Walmart executives echoed similar views, suggesting households remain “deliberate in how they allocate around the season.”

That tone speaks volumes. Retailers are rolling out deep discounting, trying to draw in dollars—but they know confidence hasn’t fully returned, and consumers remain price-sensitive. Even so, with unit volumes and comps still relatively stable.

Thanksgiving isn’t just about turkey and e-commerce. It also has structural effects on trading mechanics.

U.S. markets will close Thursday, and Friday will be a half-day—typically with volumes closer to 45% of usual levels. The Wednesday before Thanksgiving also tends to be light, running around 80% of average turnover. That kind of illiquidity tends to amplify intraday moves, especially if headlines skew unexpectedly positive or negative.

And because the U.S. makes up nearly 50% of global equity volumes, these shifts bleed into other regions, too—often pulling European and Asian flows down by 10% to 25%.

Still, the flip side matters just as much: the rebound effect. Market turnover typically picks up sharply early the following week—especially in T+2 through T+5 windows—as post-holiday capital rotates back in.

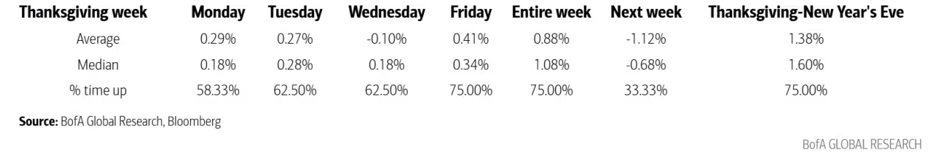

If history’s any guide, this isn’t the worst time to look higher. According to Bank of America, Thanksgiving and the week after tend to post notably better equity outcomes than average. Since 1985, the S&P has gained during Thanksgiving Friday about 75% of the time. Entire weeks around the holiday also outperform typical five-day stretches.

However, Monday after Thanksgiving frequently brings what traders call “event unwind.” Once early optimism around foot traffic and weekend sales is priced in, profit-taking tends to follow.

From a sector standpoint, the usual seasonal playbook still applies. Amazon, Walmart, and Target are front and center. Payments and logistics also tend to catch a bid as volumes surge—names like Visa, Mastercard, Booking, and Expedia often ride the tailwinds. Select leisure and travel tickers may also benefit, depending on how mobility and discretionary categories fare.

Index ETFs, particularly the S&P 500 and Nasdaq 100, also tend to perform well coming into year-end. Historical positioning setups suggest moderate long exposure into the holiday week can be rewarded—but that sizing should be re-evaluated heading into the first full week of December, when reversal risk rises.