JPMorgan Chase & Co. 2025 Second Quarter Earnings Comments

Earnings Highlight

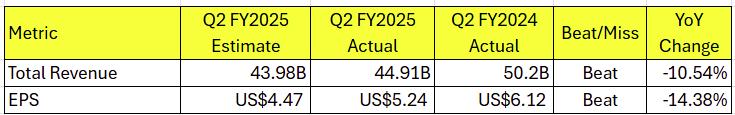

TradingKey - Revenue: Q2 revenue reached $44.91 billion, surpassing market expectations of $43.98 billion. Despite a 10.5% year-over-year decline, revenue exceeded expectations due to strong capital markets performance, demonstrating the company's robust operational capabilities in a complex market environment.

Earnings Per Share (EPS): Q2 EPS was $5.24, exceeding market expectations of $4.47. A $774 million tax benefit contributed $0.28 to EPS. Even excluding this impact, adjusted EPS was $4.96, still surpassing expectations, reflecting the resilience of the company’s profitability.

Net Interest Income (NII): Q2 NII was $23.3 billion, slightly below market expectations of $23.59 billion but up 2% year-over-year. Notably, the company raised its full-year NII guidance to approximately $95.5 billion, a $1 billion increase from prior estimates, signaling confidence in future performance.

Credit Loss Provisions: Q2 provisions for credit losses were $2.8 billion, below market expectations of $3.14 billion and down 7% year-over-year, indicating the resilience of the bank’s loan portfolio amid economic uncertainty. This is a positive signal of strong risk management.

Strong Capital Markets Performance:All business segments delivered robust revenue performance, with capital markets standing out, particularly amid heightened global market volatility:

· Fixed Income Trading Revenue: $5.7 billion, exceeding market expectations of $5.2 billion, up 14% year-over-year.

· Equity Trading Revenue: $3.2 billion, meeting market expectations, up 15% year-over-year.

· Investment Banking Fees: $2.5 billion, surpassing market expectations of $2.05 billion, up 7% year-over-year.

Future Outlook

First, JPMorgan Chase expects full-year 2025 NII to reach approximately $95.5 billion, up $1 billion from prior guidance, including market-related NII of about $3.5 billion. This guidance reflects optimism about the interest rate environment and loan growth, demonstrating confidence in economic stability. Second, adjusted expenses are projected at approximately $95.5 billion, impacted by a weaker USD but neutral to net income, indicating precise cost management despite currency fluctuations. Third, the credit card net charge-off rate is expected to be around 3.6%, reflecting stable consumer credit.

In the recent earnings call, JPMorgan Chase CEO Jamie Dimon expressed cautious optimism about the U.S. economy. He noted that tax reforms and potential easing of capital regulations could stimulate economic activity, with consumer confidence remaining robust and consumer spending continuing to drive revenue growth in credit card and deposit businesses. In the first half of 2025, real consumer spending slightly declined compared to the second half of 2024 but remained positive, while nominal spending rose modestly. The labor market remained resilient, with unemployment stable at 4.1%.

However, Dimon also cautioned that escalating tariffs and geopolitical uncertainties could trigger market volatility. This may boost trading revenue in the short term but could also increase credit risks and provisioning needs. Management further disclosed that the company is actively exploring innovative initiatives such as tokenized deposits and stablecoins (e.g., JPMD) to counter competitive pressures from fintech. This reflects JPMorgan’s strategic focus on the potential of digital assets and blockchain technology to create new revenue streams and adapt to the rapidly evolving fintech ecosystem.

In Summary: JPMorgan Chase’s optimistic guidance amid economic uncertainty underscores its market leadership and operational resilience. The upward revision of NII reflects precise judgment on interest rates and loan growth, while expense control highlights exceptional cost management. The JPMD-related strategy is not only a defensive response to fintech challenges but also has the potential to reshape payment and settlement businesses through blockchain innovation, enhancing long-term competitiveness. Stable consumer credit and diversified revenue sources provide a buffer to navigate external risks effectively.

JPMorgan Chase & Co. 2025 Second Quarter Earnings Preview

[JPMorgan Chase & Co. (JPM) stock price trend, source: TradingKey]

Market Expectations

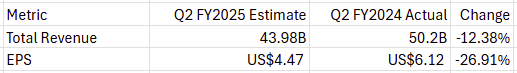

JPMorgan Chase & Co. (JPM) is scheduled to release its 2025 second quarter earnings report before the market opens on Tuesday, July 15, 2025, at 7:00 AM Eastern Time, with a subsequent earnings conference call at 8:30 AM. As one of the world’s leading financial institutions, JPMorgan’s quarterly earnings are closely watched by the market. In Q2 2025, global economic challenges such as interest rate fluctuations, trade policy uncertainties, and geopolitical risks are expected to significantly impact its performance. Below are the market’s expectations for JPMorgan’s Q2 revenue and earnings per share (EPS), along with five key areas of focus for investors.

[Expected performance of JPMorgan Chase & Co.]

Key Investor Focus Areas

- Impact of Interest Rate Expectations on Net Interest Income (NII): Net interest income (NII) is a cornerstone of JPMorgan’s profitability and is directly influenced by the Federal Reserve’s interest rate policies. Amid heightened uncertainty in the global economic environment in 2025, investors will closely monitor how changes in interest rate expectations affect NII. Adjustments in the Fed’s monetary policy could either widen or narrow the spread between lending and deposit rates, impacting the bank’s NII performance.

- Loan Demand and Credit Quality: Against the backdrop of a potential global economic slowdown, loan demand and credit quality are critical areas of focus for investors. Key metrics such as net charge-off rates and allowance for credit losses will provide insight into JPMorgan’s ability to manage risks associated with potential bad loans. Investors will evaluate the resilience of the bank’s loan portfolio under economic uncertainty and its ability to effectively balance growth with risk management.

- Investment Banking and Trading Revenue: JPMorgan’s investment banking and trading operations are significant revenue contributors but are highly sensitive to market volatility and economic conditions. In Q2 2025, heightened global market fluctuations may present opportunities for trading businesses while also carrying risks. Investors will focus on the bank’s performance in capital markets activities, particularly in equities, fixed income, and M&A advisory, to gauge its profitability in turbulent markets.

- Management’s Economic Outlook: JPMorgan Chase CEO Jamie Dimon’s economic outlook during earnings calls has always garnered significant attention. Investors anticipate his insights on interest rate trends, inflationary pressures, geopolitical risks, and global economic prospects. Additionally, the recently launched JPMD project may be a point of discussion, with investors keen to hear more about its strategic significance and future development plans.