Why Can't the U.S. Break Free from Its Dependence on Chinese Rare Earths? 4 Rare Earth Stocks to Watch

TradingKey - As the Trump 2.0 administration reignites global trade wars, China has demonstrated a firm stance that challenges U.S. political and economic ambitions. Behind China’s confidence lies a powerful card: its dominance in rare earth resources.

China nearly monopolizes the global supply and market for rare earths — critical mineral resources essential to industries such as automotive manufacturing, robotics, aerospace, and national defense.

The U.S. government considers these materials vital to both economic and national security. Some U.S. officials have even described the "rare earth shortage" as a “fatal weakness” not only for America but for the world at large.

Rare Earth Elements and Their Key Applications

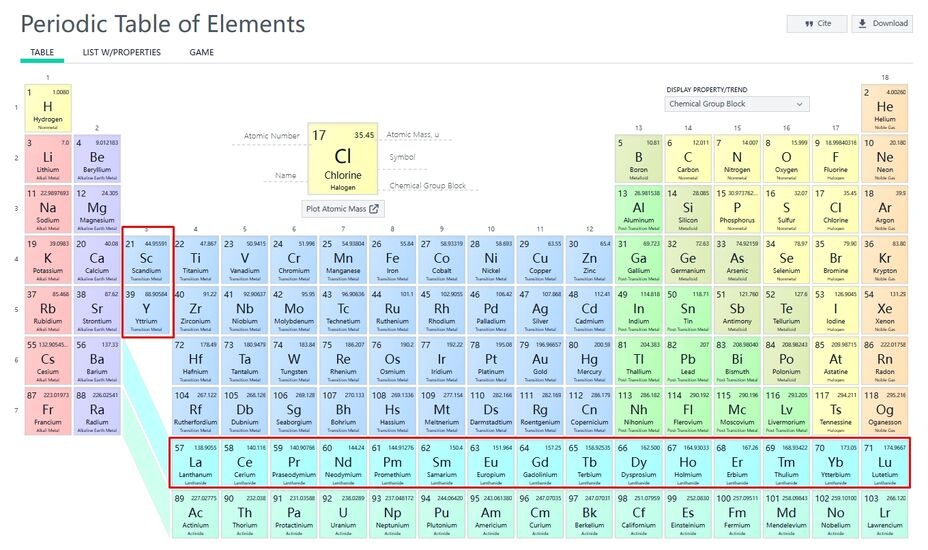

Rare earth elements (REEs) refer to the 15 lanthanide elements on the periodic table, along with yttrium and scandium, which share similar chemical properties.

Despite their name, these elements are not actually rare in terms of abundance in the Earth’s crust — they are more plentiful than gold. However, they typically occur in highly dispersed forms, making them difficult to mine and refine in concentrated quantities.

Periodic Table of Elements - Rare Earths, Source: NIH

The strategic importance of rare earths stems from two key factors: their irreplaceability and the concentration of global supply chains, with China controlling over 90% of global rare earth production capacity. They are considered pillars of military supremacy, levers for energy revolutions, and critical assets for economic security.

Research shows no other material can currently fully replace rare earths in high-tech industries. Due to their unique electronic structure and magnetic, optical, and catalytic properties, rare earths play an irreplaceable role in modern technology and green industries, particularly in electric vehicles, wind power, 5G communications, AI hardware, military equipment, and consumer electronics.

Major Applications of Rare Earth Elements:

- Permanent Magnets

Key Elements : Neodymium (Nd), Samarium (Sm), Dysprosium (Dy)

Applications : Electric vehicles, wind turbines, smartphones, hard drives, missile guidance systems - Catalysts

Key Elements : Cerium (Ce), Lanthanum (La)

Applications : Automotive catalytic converters, crude oil cracking, hydrogen energy production - Optical & Fluorescent Materials

Key Elements : Europium (Eu), Erbium (Er), Yttrium (Y)

Applications: LED lighting, fluorescent lamps, medical lasers, MRI machines - Nuclear Energy & Electronics

Key Elements : Gadolinium (Gd), Terbium (Tb)

Applications : Nuclear reactor control rods, solid-state storage devices (SSDs) - High-Temperature Superconductors & Special Alloys

Key Elements : Yttrium (Y), Terbium (Tb)

Applications : Maglev train superconducting wires, heat-resistant turbine blades for jet engines

Rare earth elements are often called the "gold of the 21st century," especially due to their strategic significance in magnet production. According to Ginger International Trade & Investment, “Everything you can switch on or off likely runs on rare earths.”

According to U.S. government reports, processing critical minerals and their derivatives is a foundational component of manufacturing, underpinning industries ranging from transportation and energy to telecommunications and advanced manufacturing — all essential to U.S. national security.

Furthermore, rare earth mining is crucial to the defense industrial base, being indispensable for jet engines, missile guidance systems, advanced computing, radar systems, advanced optics, and secure communication equipment.

In 2023, EU Commission President Ursula von der Leyen stated in the European Critical Raw Materials Act that lithium and rare earths will soon become more important than oil and gas. Europe’s transition to green and digital technologies hinges on resilient supply chains for these critical materials.

China's Global Position in the Rare Earth Industry

In the new round of U.S.-China trade tensions, advanced semiconductor chips and design software tools represent American leverage, while rare earths are China’s trump card.

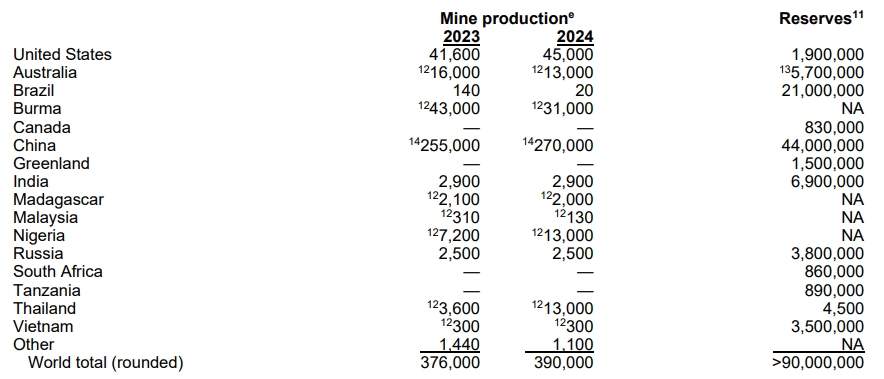

China holds significant advantages in both resource endowment and technological development, especially in heavy rare earth elements. According to the U.S. Geological Survey (USGS), China accounts for over 40% of global rare earth reserves, followed by Brazil.

Global Distribution of Rare Earth Resources Source: USGS

While the U.S. and European countries avoid developing rare earth industries due to high costs and environmental pollution, China has built an efficient, low-cost, full-industry-chain system through natural resources, policy support, technological accumulation, and industrial integration.

According to the International Energy Agency (IEA), 61% of global rare earth ore production comes from China, and China controls 92% of global refining capacity.

From 2020 to 2023, 70% of U.S. rare earth compound and metal imports came from China. Additionally, 90% of the world’s rare earth magnets are produced in China.

The U.S. currently lacks the capability to separate heavy rare earth elements after extraction. The Center for Strategic and International Studies (CSIS) notes that until early 2025, all heavy rare earths mined in California will need to be sent to China for separation.

Nazak Nikakhtar, former Assistant Secretary for Export Administration under Trump 1.0, said dependence on Chinese rare earths is a “fatal flaw” for the U.S. and the world, with China leveraging this advantage.

Economist analysts at Capital Economics note that restrictions on rare earths and critical minerals have become part of China’s counter-strategy against the U.S.

On April 4, 2025, China announced it would suspend exports of seven rare earth metals and powerful magnets made from three of them unless exporters obtain special licenses. CSIS warns that the U.S. is particularly vulnerable to such supply chain disruptions; if China halts exports of medium- and heavy-rare earths entirely, the U.S. would be unable to fill the gap physically.

According to a survey conducted in late May, over three-quarters of affected companies could only sustain operations for up to three months before facing shutdowns due to inventory shortages.

Why Can’t the U.S. Break Free from Its Dependence on Chinese Rare Earths?

In fact, the U.S. was once the world’s largest producer of rare earths from the 1920s to the 1980s. As China developed scale and cost advantages in the rare earth industry, U.S. miners exited the market. Today, the U.S. operates only one major rare earth mine — Mountain Pass in California — which accounts for about 15% of global output.

America’s reliance on China for rare earths is the result of multiple factors across supply chains, technology, economics, and policy.

1. China Dominates the Global Rare Earth Supply Chain

- Monopoly in Mining and Separation: China provides most of the world’s rare earth ores and refining capacity, with mature and cost-effective separation technology.

- Magnet Manufacturing Control: Over 90% of rare earth permanent magnets (e.g., neodymium-iron-boron) depend on Chinese exports. Less than 1% is produced domestically in the U.S.

2. High Costs and Environmental Pressures in the U.S.

- Economic Challenges: China possesses efficient and low-cost solvent extraction technology, giving it a competitive edge. Establishing a rare earth separation plant in the U.S. often takes 5–10 years and lacks commercial viability.

- Environmental Regulations: Rare earth mining and refining produce radioactive waste and toxic chemicals. Strict regulations make such projects unattractive to investors.

3. China’s “Rare Earth Diplomacy” vs. U.S. De-Strategization

- U.S. Policy Shift: After the 1990s, the U.S. no longer viewed rare earths as strategically important and gradually abandoned domestic production in favor of imports.

- China’s Strategic Moves: Following the 2010 export ban on Japan, China centralized control of heavy rare earth resources in Jiangxi from local governments to Beijing.

- Experts from the Carnegie Endowment for International Peace note that for nearly 15 years, U.S. policymakers have taken little action to address dependency risks on rare earths, especially rare earth magnets.

4. Immature Alternatives and Recycling Technologies

- Although alternatives like ferrite magnets are being explored, performance gaps remain significant, making them unsuitable for high-end applications.

- Recycling is also limited due to low concentrations of rare earths in electronics and technical challenges in recovery.

Efforts by the U.S. to Reduce Rare Earth Dependency

As U.S. recognizes the strategic value of rare earths, efforts have intensified to enhance supply autonomy and reduce reliance on China.

Soon after returning to the White House, President Trump pursued mineral agreements with Ukraine, integrated Canada into the supply chain, and sought control over Greenland (which hosts the world’s 8th-largest rare earth reserves) — all part of broader efforts to reclaim influence in the global rare earth industry.

In mid-April, Trump signed an executive order requiring the Commerce Department to conduct a Section 232 investigation into imported rare earth materials, potentially paving the way for tariffs.

The U.S. Department of Defense’s 2024 Defense Industrial Strategy set a goal of establishing a complete rare earth supply chain capable of meeting all U.S. defense needs by 2027. Since 2020, the DoD has invested over $439 million.

However, CSIS noted that even after these investments, production capacity remains far below the level required to meet independent supply goals.

Experts say that while the U.S. is collaborating with Australian rare earth producers and expanding capacities in Brazil, South Africa, Japan, and Vietnam, none of these sources can yet serve as viable substitutes for China.

Rare Earth Stocks to Watch

- MP Materials (MP): Currently, the only U.S. company with capabilities spanning rare earth mining, separation, smelting, and magnet production. While still technologically behind Chinese peers, MP is the closest competitor.

- The Mountain Pass mine, once shut down in 1998, was reactivated in 2018 after being acquired by MP Materials. However, high production costs led to a net loss of $22.6 million in Q1 2025.

- Morgan Stanley upgraded MP Materials to “Buy” in June, citing rising geopolitical tensions and MP’s strategic value as the most vertically integrated non-Chinese rare earth company.

- Energy Fuels (UUUU): A leading U.S. uranium and rare earth supplier. After expanding into rare earths, it became the second-largest U.S. and fifth-largest global rare earth producer. In June 2024, its Utah White Mesa refinery achieved commercial production of praseodymium-neodymium separation.

- NioCorp Developments (NB): Another player in the U.S. rare earth space, with potential for future development.

- USA Rare Earth (USAR): A key participant in the revival of the U.S. rare earth industry, aiming to challenge MP Materials.