[Reuters Analysis] Investors look for signs European earnings can defy tariff turmoil

- STOXX 600 earnings forecast to fall 0.2%

- Tariff impact starting to be felt, focus on guidance

- Euro strength a possible headwind

By Samuel Indyk and Lucy Raitano

LONDON, July 10 (Reuters) - European investors are bracing for a pivotal second-quarter earnings season, which could offer the first meaningful insight into how companies are navigating a new era of trade volatility and, crucially, how resilient their share prices remain.

Markets staged a textbook V-shaped recovery to hit record highs after April's tariff-driven selloff after U.S. President Donald Trump announced sweeping tariffs, which he then paused for 90 days, effectively covering the entire second quarter.

Europe's STOXX 600 .STOXX is hovering near record highs, yet earnings for its constituents are expected to contract 0.2% in Q2, LSEG I/B/E/S said, from 2.2% growth in the last quarter.

"Q2 data will be difficult to read," said Mohit Kumar, Chief Financial Economist for Europe at Jefferies.

"The question is: what about the guidance? That is much more important than the earnings amount."

Last quarter, a higher than usual number of companies withdrew their forecasts, given Trump's on-again-off-again trade policy. Analysis from Barclays found guidance sentiment was at its weakest since the COVID-19 pandemic.

"There are tariff-related implications that I don't think the market fully contextualises," said Luke Barrs, head of fundamental equity client portfolio management at Goldman Sachs Asset Management.

"We can understand conceptually what it means, we can understand the challenges it creates, but I don't think we've seen yet how it will feed through into the market."

With the 90-day reprieve now expired, uncertainty has resurfaced. Trump has notified 14 countries, including key exporters Japan and South Korea, of impending tariffs unless agreements are reached by August 1.

He has also escalated trade tensions by targeting copper, semiconductors, and pharmaceuticals. Europe, so far, has been spared.

The STOXX has gained 8% so far in 2025, compared with around 6% in the S&P 500, marking its second-best performance against the U.S. index at this point in the year in 20 years - aside from 2022, when it fell less than the S&P.

Increased capital flows into European assets from the U.S. have been a contributing factor. Defence companies such as Rheinmetall RHMG.DE and software company SAP SAPG.DE have helped drive the rally, along with European banks, now nearing pre-2008 crisis levels .SX7P.

DOWNGRADES PICK UP PACE

Analysts have been steadily revising down 2025 earnings forecasts for 55 consecutive weeks, although the pace of downgrades has eased since May. Full-year earnings growth for Europe is now expected at 3%, down from 8% at the start of the year.

"The vast majority of regions and sectors are seeing more downgrades than upgrades," said Dennis Jose, chief equity strategist at BNP Paribas CIB.

EPS downgrades ahead of earnings often mean that stocks can perform well through reporting season as the bar to beat expectations is lower.

Deutsche Bank chief strategist Binky Chadha said lighter positioning in equities this time around could amplify that effect.

"The magnitude of gains was tied inversely to positioning going in, which at slightly below neutral this time, is supportive of another rally," he said.

Valuations reflect this optimism. The STOXX 600 trades at 14.2 times forward earnings, close to its highest in three years, although some way behind the S&P 500, at21.9.

FEELING THE FX

The euro's strength is another emerging issue. The dollar has weakened sharply under Trump's tariff regime, pushing the euro up more than 13% so far this year. Some analysts think it could hit $1.20 in the coming months, from around $1.17 now.

This poses a problem for the STOXX 600's export-focused constituents, which derive just 40% of revenue from within Europe, compared with 70% for S&P 500 members.

UBS analysts say the impact will be sector specific, with currency fluctuations more likely to weigh on margins rather than sales.

"For the most part, especially in the larger-cap space (in Europe), companies have pretty good controls and understand their revenue exposure," GSAM's Barrs said.

"There are always going to be scenarios where companies with significant external revenues that are printing earnings in euros haven't managed that well and will surprise the market, but these will be the exception not the norm."

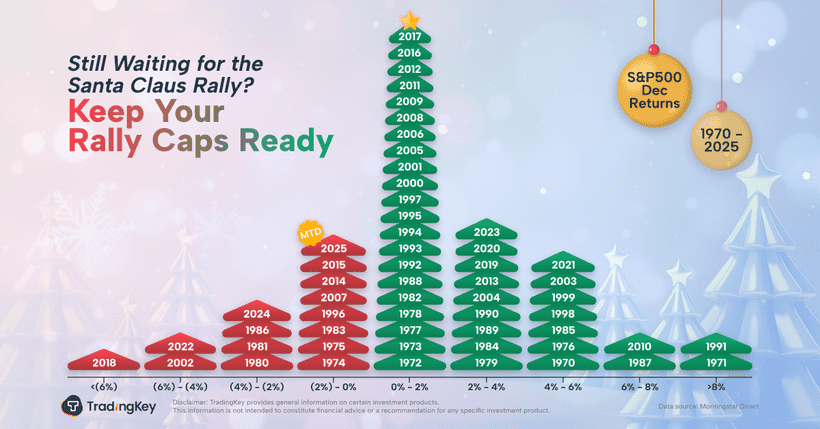

Europe profit forecasts

STOXX 600 Earnings Growth Rates