Investing in Data Centers

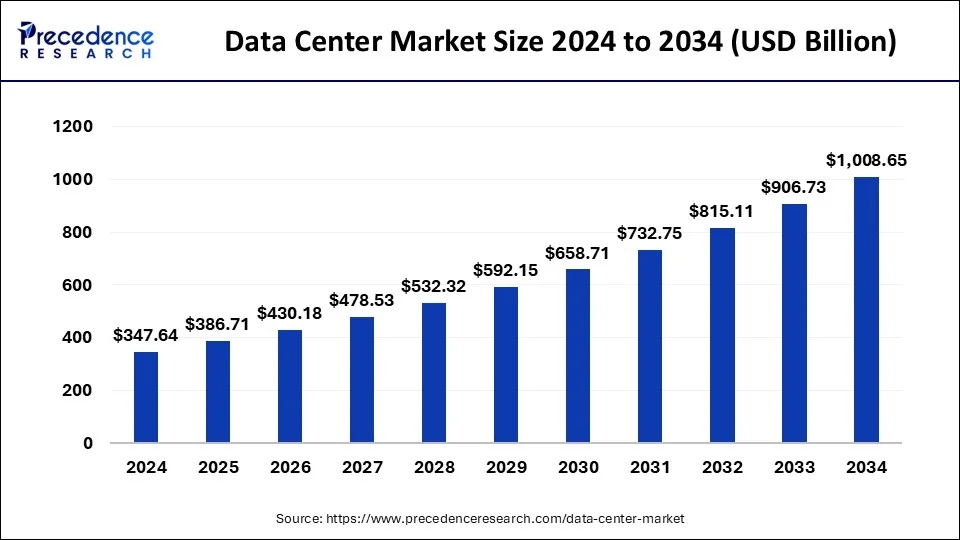

- Global data center demand is set to more than triple by 2030, driven by AI workloads, cloud adoption, and digital economy growth.

- Supply constraints, particularly in power availability, are creating pricing power for incumbents with existing capacity in prime markets.

- Institutional investors, including REITs, private equity, and sovereign funds, are increasing exposure due to stable returns and inflation-linked contracts.

- AI adoption is amplifying monetization per square foot and reducing churn, creating long-term revenue visibility for operators.

The world data center sector is having its golden period with the perfect blend of technological innovation, expansion by clouds, and revamp being led by AI. The digital economy, with increasing intensity of data, has its underlying infrastructure, namely, their data centers, being indispensable and, on top of it, an overlooked but enticing sector for investments.

At its core, though, is an absolute surge in demand for computing capacity. From social media, shopping online, enterprise SaaS, research sciences, to most recently, AI generative algorithms, it all relies upon vast quantities of information that must be stored, processed, and transmitted securely. No longer are the data center storage warehouses, but smart, high-efficiency compute centers.

That older story of keeping them in the technology boom's shadow starts to recede. The spotlight today shines brightly on the data center, driving all the way from ChatGPT, to Netflix, Tesla's autonomic networks, all the way to cloud-delivered enterprise software.

An Increasing Market Powered by AI and Cloud

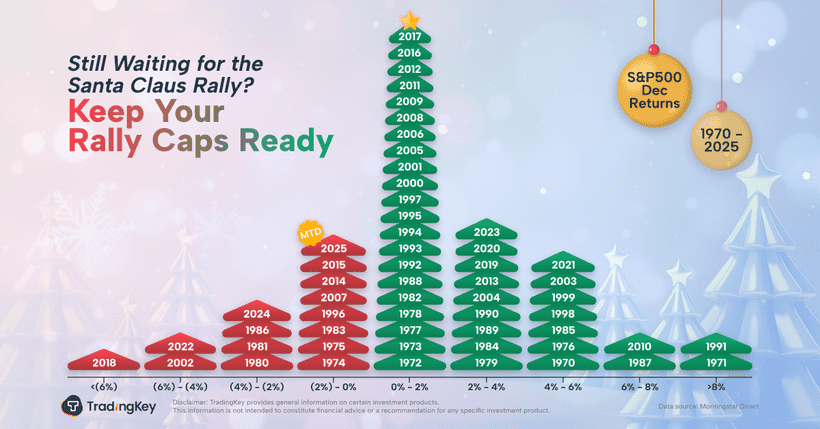

With multiple industry prognoses, the worldwide market for data centers could expand past $1 trillion by 2034. Much of this growth is catalyzed by artificial intelligence. AI-centered workloads need dense GPU servers, sophisticated coolants, and ultra-low latency networks, each fast redefining the shape of the modern-day data center. Hyperscalers such as Google, Microsoft, and Amazon are in a capex arms race with AI needs both within and beyond their walls, spending tens of billions in new-gen facilities.

At the same time, a new generation of AI-native dedicated cloud companies appears, CoreWeave, Lambda Labs, etc., that only specialize in leasing large numbers of high-speed GPUs that are required for machine learning inference, training, etc. The new competitors are growing rapidly, attracting institutional funds, and opening new investment opportunities like those in cloud computing in the early 2010s.

Source: https://www.precedenceresearch.com

Supply Shortage Intersects with Rising Demand

With demand within the market still robust, the supply cannot catch up with high-quality space within the data centers. Vacancy within Tier 1 cities like Northern Virginia, Dallas, and Singapore continues to be at historic low levels, occasionally sub 1%. The scarcity has ominous impacts on leverage for pricing and return on payback for invested capital. Well-seasoned incumbents with favorable land and adjacency to power are best-suited, enabling them to command high rents with long-term, inflation-adjusted contracts.

Among the largest inhibitors of new supply is electricity. Most areas are getting up to the capacity limit of their electrical networks, with the utilities not being able to keep up with the sheer volume and momentum of demand. It takes years to obtain permission to build new substations or energy supply. It has created market segmentation: incumbents with existing capacity for electricity get richly rewarded, while new entrants get blocked on the margins of entry. It's supply-side economics creating a structural barrier moat.

Public REITs such as Equinix and Digital Realty have shown stable AFFO (adjusted funds from operations) growth, with high occupancy showing rising tendencies for per-rack pricing. At the same time, margins expand with the aid of higher operational efficiency, often with AI-enabled cooling, predictive maintenance, and power solutions.

Apart from the public exchanges, the private equity and infrastructure funds are entering the sector aggressively. The purchase by Blackstone of QTS Realty Trust for $10 billion supplied the catalyst, mirroring the wider consensus that the digital infrastructure has become a prime asset class along with roads, rail, and transmission networks.

Even pension funds and sovereign funds are committing further, tempted by the sector's stable return payouts and inflation-hedge structure of prices. With the increasing global consumption of data, the need for the capacity of a data center will rise by more than triple by 2030. Such historic expansion will build the generation-long infrastructure, energy, along with the AI/compute enablers, the investment opportunity, with the data centers being the centrepiece of the digital economy's future narrative.

.jpg)

Source: https://www.mckinsey.com

The AI Multiplier Effect

It's not just about some kind of demand factor, but it's redefining the economics of the data center. Frontier-level training requires hyperscale compute, but what happens at inference goes off the charts, scale-wise. All AI-enabled products, all conversations, all assistants going into the market today are driving higher frequency use by the user in the data center. Contrast that with some run-of-mill SaaS app with pretty consistent compute requirements, AI brings with it an unpredictable use pattern, driving it exponentially.

It creates an inherent growth cycle for data centers. The more AI models go into use, the more inference capacity is needed. That means longer leases, increased power-dense deployments, and higher monetization per square foot. And because AI workloads are normally 'sticky' with custom hardware and software optimization, churn is less, providing better longer-term revenue visibility for operators.

Risks and Considerations

No investment is risk-free, and data centers are no exception. The industry is capital-intensive, involving heavy upfront costs and continuing upkeep. Technological obsolescence is an issue, particularly with the advancement of liquid cooling and chip designs. Moreover, energy consumption continues to be in the crosshairs among regulators and green groups, forcing operators into renewable energy use or better efficiency metrics.

There's also geopolitical risk. Ongoing tensions between the US and China and increased worries about data sovereignty are seeing regions create digital walls where the storage as well as processing takes place locally. This could isolate global expansion plans among multinationals and necessitate expensive compromises.

Another key issue is interest rates. While data centres offer predictable cash flows, they are capex-intensive assets where higher rates affect their multiples in valuation as well as cost of capital. The investor has to match the yield with other plays within the infrastructure sector and monitor macro policy changes.

Strategic Positioning under a Digital Economy

Despite all these risks, the strategic value of the data center continues to accrue. We’re moving from the era of digital enablement to digital dependence. It's enabling the metaverse, autonomous transport, AI agents, or remote working infra, the quiet engines in the background are the data centers.

Why the sector becomes so attractive at this moment, though, is the diversification of entry points. There are publicly traded REITs you can enter into for liquidity and cash flow, private equity or infra funds for longer-duration returns, or even pursue niche startups developing around AI GPU rentals, liquid cooler technology, or edge computing. There are even ETFs tracking digital infrastructure as somewhat of a wider thematic investment.

For the longer term investor, the data center market presents an unusual combination of secular growth, pricing power, and infrastructure-like durability. As the digital world continues its trajectory toward deeper immersion, greater intelligence, and increased interconnection, the need for compute infrastructure will continue to expand.

In several respects, data centers are coming to be like the new 21st-century real estate, not literally square footage, but valuable ground in the digital arena. In an increasingly algorithmic, latency-, and compute-thruput-defined world, the brightest real estate investors may not be thinking about oceanfront property or downtown skyscrapers, they're thinking about megawatts, megabits, and server stacks.

.png)