Best Stock to Buy Right Now: Coca-Cola vs. PepsiCo

Key Points

Coca-Cola shares have climbed 14% in 2025, while PepsiCo’s have dropped 3%.

Both companies have paid and raised their dividends for at least 50 consecutive years.

PepsiCo carries more debt and has a higher payout ratio than Coca-Cola.

Beverage giants Coca‑Cola (NYSE: KO) and PepsiCo (NASDAQ: PEP) continue to reward investors with dividends, but their stocks have both underperformed the market benchmark S&P 500 over the past decade. As consumers gradually drink less soda -- a long-term trend driven by health concerns -- both companies have leaned heavily on acquisitions to diversify offerings and spark growth.

Let's unpack how they both stack up today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here's the latest on Coca-Cola and PepsiCo

Coca-Cola and PepsiCo have long relied on their core beverage lines, but slowing soda consumption in the U.S. has pushed them to diversify through acquisitions. Coca-Cola's somewhat recent moves include buying BodyArmor for $5.6 billion in 2021 and Costa Coffee for $4.9 billion in 2019, expanding into sports drinks and coffee.

PepsiCo has targeted faster-growing categories, acquiring Rockstar Energy for $3.85 billion in 2020, taking a $550 million stake in Celsius Holdings in 2022, and purchasing Poppi, a prebiotic soda brand, for $1.95 billion in 2025. These deals have broadened portfolios, increased debt levels, and delivered uneven returns.

The mixed track record showed up in Q2 2025 results. Coca-Cola's revenue rose 1% year over year to $12.5 billion despite a 1% drop in global unit case volume. Similarly, PepsiCo's revenue grew 1% year over year to $22.7 billion despite an overall volume decline of 1.5%.

As for the bottom line, Coca-Cola's net income jumped 58% to $3.8 billion, helped by the absence of a $760 million impairment charge on the BodyArmor trademark that weighed on last year's profit. Meanwhile, PepsiCo's net income dropped 59% to $1.26 billion, driven largely by $1.86 billion in impairments tied to its Rockstar and Be & Cheery brands.

These charges highlight the risks of acquisition-driven growth -- while some brands strengthen market position, others may fail to meet expectations, ultimately pressuring balance sheets and earnings.

A glimpse into Coca-Cola and PepsiCo's valuation

Coca-Cola's market capitalization stands at $304 billion, well ahead of PepsiCo's $200 billion, even though PepsiCo generates nearly twice as much revenue. The gap comes down to profitability and balance sheet strength. As outlined, Coca-Cola operates a more profitable business and carries $35.2 billion in net debt, compared to PepsiCo's $43.4 billion.

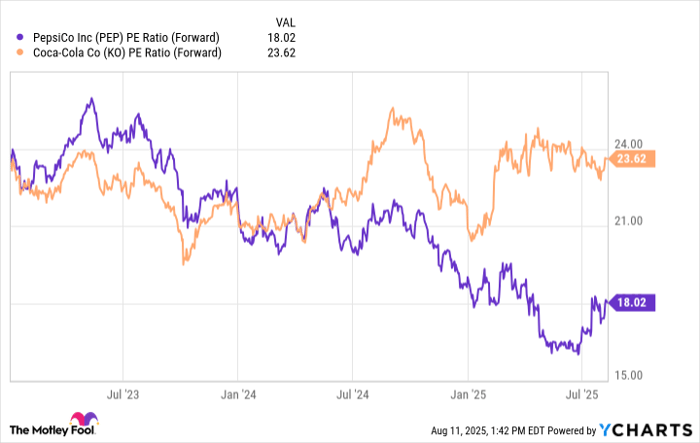

Coca-Cola's 14% year-to-date gain has pushed its valuation higher, with shares now trading roughly 24 times forward earnings. Comparatively, PepsiCo's 3% decline over the same period has had the opposite effect, bringing its valuation down to about 18 times forward earnings, making it the comparatively cheaper stock. Still, like revenue and earnings, valuation is just one piece of the puzzle when weighing potential investments.

PEP PE Ratio (Forward) data by YCharts

Both Coca-Cola and PepsiCo prioritize dividends

Coca-Cola offers a dividend yield of 2.9% and has raised its payout for 63 consecutive years, earning its place among the elite group of Dividend Kings -- companies that have increased their dividends for at least 50 straight years. PepsiCo also holds this distinction, offering a higher 3.9% yield and a 53-year streak of annual dividend increases.

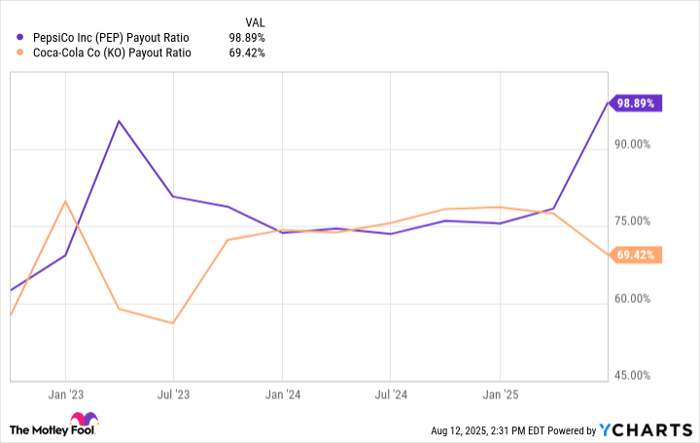

For dividend-paying stocks, the payout ratio -- the percentage of earnings distributed as dividends -- is a key measure of dividend sustainability and growth potential. Coca-Cola's payout ratio is manageable at 69%, providing room to raise its payout without overextending its finances. PepsiCo sits at a much higher 99%, inflated by a $1.9 billion impairment tied to its Rockstar and Be & Cheery brands. Even without that charge, the ratio would be 79%, a level that, if maintained, could eventually force management to slow dividend growth or consider cuts.

PEP Payout Ratio data by YCharts

Another method of returning capital to shareholders is through share repurchases. Both companies have repurchased minimal shares in recent years, both reducing shares outstanding by about 0.6% over the last three years, making dividends the real attraction for investors.

Image source: Getty Images.

Is Coca-Cola or PepsiCo the better buy?

Coca-Cola and PepsiCo are primarily income-oriented investments, unlikely to outpace the S&P 500 over the long run, barring a significant market downturn. For dividend-focused investors, Coca-Cola's stronger balance sheet and more sustainable payout ratio make it the steadier option, even if its yield falls short of PepsiCo's.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

Collin Brantmeyer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius. The Motley Fool has a disclosure policy.