Think Roku Stock Is Expensive? This Chart Might Change Your Mind.

Key Points

Roku looks expensive on forward earnings and still lacks bottom-line profits.

Valuing Roku on sales growth suggests the stock deserves a higher multiple.

At first glance, media-streaming technology stock Roku (NASDAQ: ROKU) looks incredibly expensive. Shares are changing hands at 100 times forward earnings estimates, and the company isn't even profitable on the bottom line today. You could argue that Roku hasn't earned its $12.9 billion market cap, based on its sky-high valuation ratios.

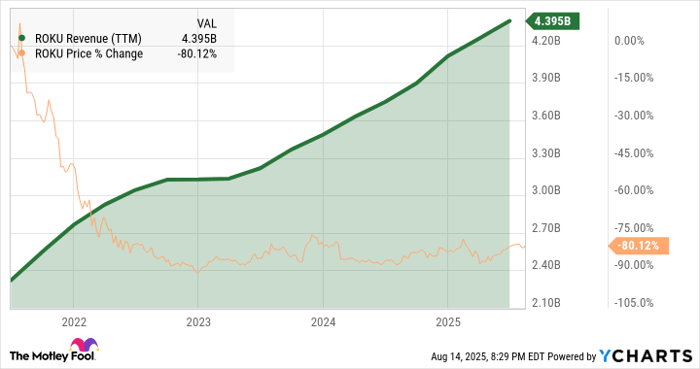

But that impression should fade away quickly when you also consider Roku's impressive business growth. This simple chart should do the trick:

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

ROKU Revenue (TTM) data by YCharts

Roku's price slipped, but the growth engine didn't

Roku's stock fell 81% over the last four years. At the same time, the company's top-line sales surged 89% higher. That's an average annual revenue increase of 17.3%, while the stock fell 34% per year.

I'll admit that Roku started that period at an unsustainably high plateau, riding high on the streaming-friendly effects of COVID-19 lockdowns. The stock was overdue for a correction in the summer of 2021.

Image source: Getty Images.

The price drop went too far, though. If you separate Roku from the ups and downs of the 2020 pandemic and the 2022 inflation crisis, you see a healthy company with robust growth in all the right places.

You've seen the revenue surge already. Here, Roku's growth is faster than market darlings such as Netflix (NASDAQ: NFLX) and Meta Platforms (NASDAQ: META). Yet, Netflix stock trades at 12.6 times sales, and Meta sports a price-to-sales ratio of 11. Roku is stuck with a meager 2.9 multiple in the same metric.

You should still measure Roku by its sales growth

I'm not saying that Roku should have a larger market value than Netflix or Meta. That's not the point. However, Roku's stock deserves a sales multiple in the same class, if not higher.

I have explored Roku's profit strategy and long-term market prospects in depth elsewhere, and this is not the place for another deep dive. Long story short, Roku's profit-based valuation doesn't tell the whole story. The stock looks deeply undervalued when you include its fundamental business growth in your analysis.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $663,630!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,115,695!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

Anders Bylund has positions in Netflix and Roku. The Motley Fool has positions in and recommends Meta Platforms, Netflix, and Roku. The Motley Fool has a disclosure policy.