NVIDIA Q1 Beats Earnings for 10 Consecutive Quarters — Survived H20 Ban, But China Risks Remain

TradingKey - Despite the Trump administration’s new export ban on its China-specific H20 AI chip, NVIDIA (NVDA) delivered better-than-expected revenue and earnings in Q1 of fiscal 2026 — underscoring the strength of global demand for AI infrastructure. However, CEO Jensen Huang warned that regulatory pressures from both the U.S. and China still pose significant risks to its business in the world’s largest AI market.

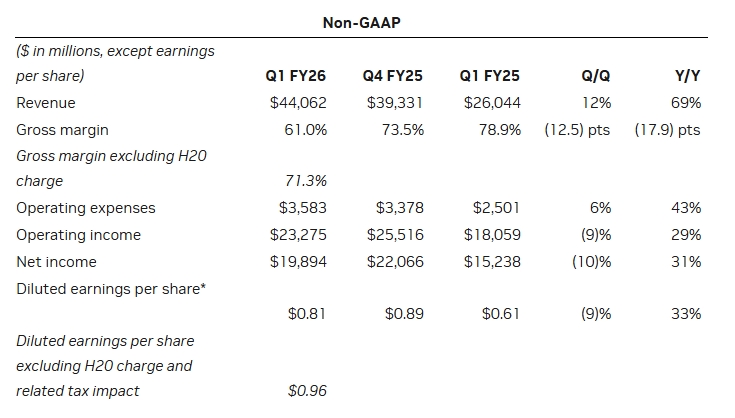

On Tuesday, May 28, after U.S. markets closed, NVIDIA released its Q1 2026 earnings report (covering the period ended April 2025):

- Revenue reached $44.06 billion, up 69% year-over-year, and beating estimates of $43.3 billion

- Non-GAAP EPS rose 33% to $0.81, with adjusted EPS at $0.96 after excluding H20-related costs and tariff impacts — exceeding the expected $0.93

FY2026 Q1 Earnings Highlights, Source: NVIDIA

According to TipRanks, this marks the tenth consecutive quarter that NVIDIA has exceeded earnings expectations — a rare consistency in today’s volatile tech environment.

Following the release, NVIDIA shares surged over 5% in after-hours trading. Over the past month, the stock has rallied nearly 24%, signaling strong investor confidence.

H20 Ban Costs NVIDIA $4.5 Billion

The Trump administration’s new export restrictions on the H20 chip forced NVIDIA to take a $4.5 billion charge in Q1 due to excess inventory and purchase obligations — slightly lower than the previously estimated $5.5 billion by CEO Huang.

The ban caused $2.5 billion in lost sales during the first quarter alone.

For Q2, NVIDIA expects revenue of $45 billion, below the LSEG consensus estimate of $45.9 billion. The H20 export restrictions are projected to cause an additional $8 billion in sales losses in Q2.

“Thinking Machine” Blackwell Enters Full Production

Huang said in a statement, “Our breakthrough Blackwell NVL72 AI supercomputer — a ‘thinking machine’ designed for reasoning— is now in full-scale production across system makers and cloud service providers.”

He emphasized that global demand for NVIDIA’s AI infrastructure is incredibly strong, with China being one of the world's largest markets, and a key launchpad for global success.

Double Trouble in China

However, NVIDIA’s efforts to regain its foothold in the Chinese AI chip market face dual regulatory challenges from both Washington and Beijing.

NVIDIA revealed that Chinese regulators are investigating whether the company’s compliance with U.S. export controls led to unfair treatment of local clients. If authorities conclude that NVIDIA failed to meet commitments or violated local laws, the company could face financial penalties and restrictions on future operations in China.

This adds another layer of uncertainty to NVIDIA’s already complex position in the region — where its market share has fallen from 95% under the Biden administration to just 50% today.