XRP price holds $3 level as focus shifts to SEC resolving Ripple lawsuit

- XRP delicately holds above $3.00 as positive sentiment remains largely suppressed in the broader crypto market.

- The XRP community is focusing on the SEC, which is expected to update the appellate court by August 15.

- The slight recovery in XRP futures Open Interest and funding rate indicates gradual but steady speculative demand.

Ripple (XRP) holds at the edge of a tall cliff, with support at $3.00 on Tuesday. The cross-border money remittance token adopted for Ripple's payment platform printed a steady recovery on Sunday and Monday, but resistance at $3.10 limited price movement.

If support at $3.00 remains intact in upcoming sessions, investor confidence could improve, boosting the chances of XRP steadying the uptrend toward its record high of $3.66.

Can the SEC resolve the legal standoff with Ripple?

The United States (US) Securities & Exchange Commission (SEC) lawsuit against Ripple is approaching its final resolution. However, some caveats must first be cleared to end the five-year court battle.

Ripple recently took a bold step by withdrawing its appeal, but the SEC's appeal remains, leaving the case in temporary limbo. Legal expert Bill Morgan argues that the SEC has no set time within which it is required to withdraw its appeal. Nevertheless, the SEC is expected to submit a status report to the Court of Appeals by August 15. Key developments could emerge over the next week, with the XRP community and legal observers closely watching the deadline.

The SEC sued Ripple in 2020, alleging that the company sold unregistered securities in violation of US securities laws. A landmark ruling in 2023 found that the programmatic sale of XRP on third-party platforms like crypto exchanges did not constitute unregistered securities, but direct sales to institutions did.

In recent months, Ripple and the SEC have explored settlement paths, especially after the blockchain startup was penalized $125 million, currently in an interest-earning escrow account.

A $50 million settlement was signed by both parties this year. However, the court rejected the joint motion seeking to end the lawsuit, citing an incomplete legal process. The August 15 deadline could provide insight into the direction of the lawsuit.

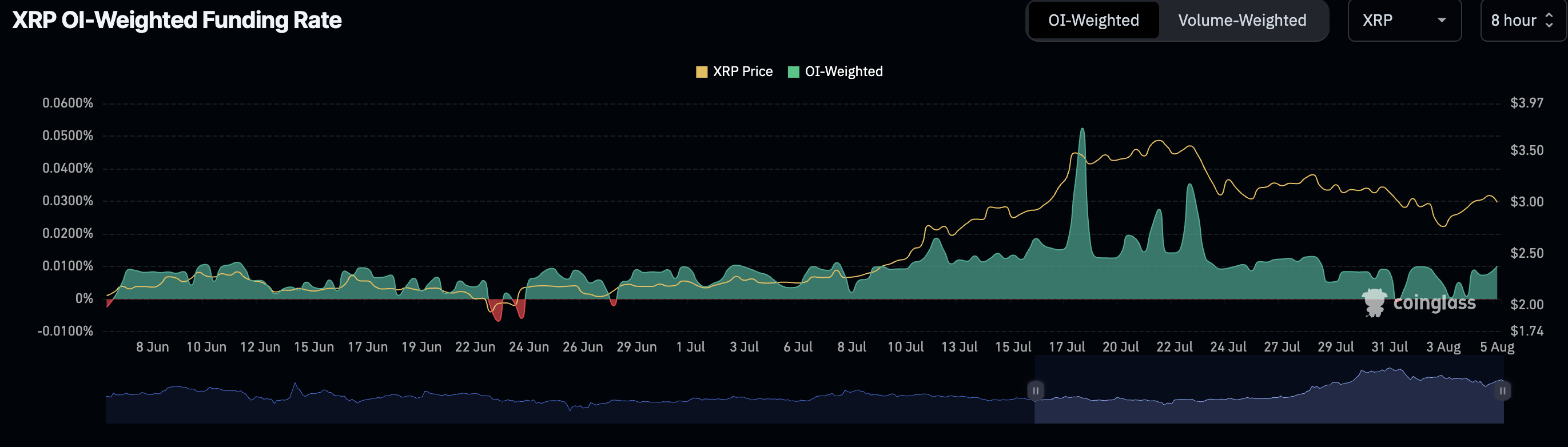

Meanwhile, interest in XRP is improving following the sell-off last week. According to CoinGlass data, the XRP Futures weighted funding rate has inched higher, holding at 0.0101 on Tuesday after dropping to 0.0004% on Sunday. A steady increase in funding rates indicates that traders are increasingly seeking exposure to long positions, anticipating a breakout in the XRP price.

XRP Futures Weighted Funding Rate | Source| CoinGlass

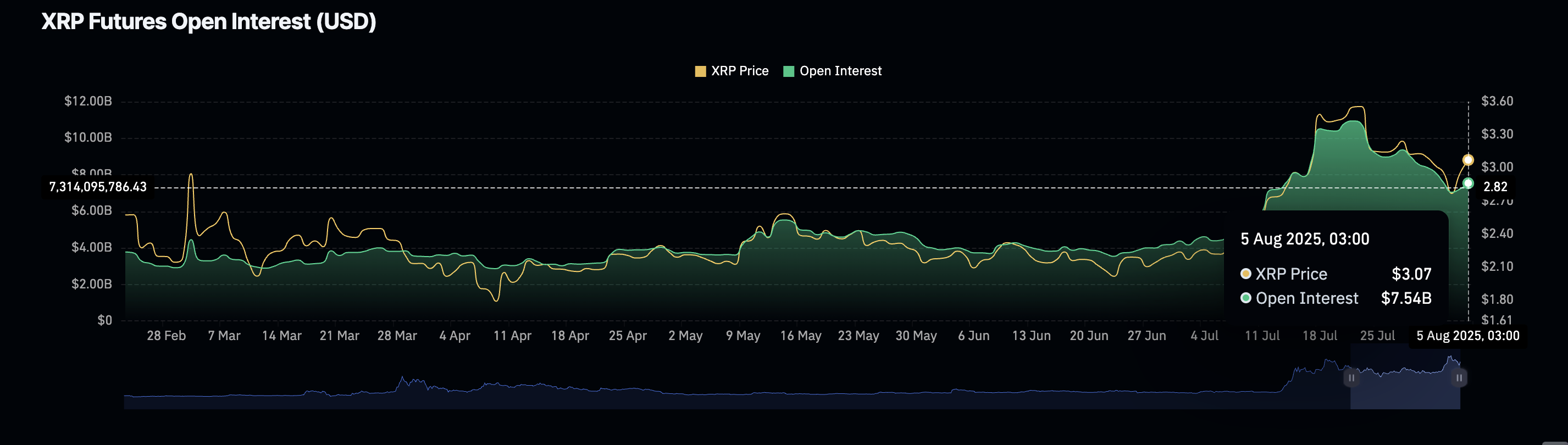

A similar recovery is reflected by the futures Open Interest (OI), which after plummeting to $7.05 billion on Sunday has rebounded to average at $7.54 billion on Monday. Amidst the run-up to the record high, the OI peaked at $10.94 billion on July 22, underpinning the strong investor conviction in the uptrend.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP offers bearish signals

XRP price shows signs of extending the decline below support at $3.00, underpinned by a sell signal from the Moving Average Convergence Divergence (MACD) indicator. Traders will likely continue to reduce exposure as long as the sell signal, triggered on July 25, holds. The red histogram bars extending below the mean line underscore the bearish outlook.

A daily close on either side of the $3.00 support could provide insight into the direction the XRP price would take in the short term. On the upside, key milestones include the resistance around $3.33, which was tested on July 28 and the all-time high of $3.66.

Below the immediate support, the 50-day Exponential Moving Average (EMA) at $2.80 and the 100-day EMA at $2.59 stand as potential support levels if the decline accelerates.

XRP/USDT daily chart

The SuperTrend indicator offers another sell signal on the daily chart after flipping above the price of XRP. This trend-following tool also functions as dynamic support or resistance. If the SuperTrend line holds above the XRP price, the path of least resistance will remain downward.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.