Investing in Semiconductor Equipment Manufacturing

- Semiconductor equipment makers are the backbone of chip production, with high entry barriers, pricing power, and outsized leverage to secular demand from AI, 5G, cloud computing, and the edge.

- Fabrication depends on specialized tools across lithography, deposition, etch, clean, test, and packaging—highlighted by ASML’s EUV near-monopoly and the sector’s strategic importance.

- Growth is driven by relentless compute needs, onshoring/sovereignty (CHIPS Acts), expanding specialty chips, and recurring upgrades/service contracts.

- Key risks include export controls, industry cyclicality, valuation, and tech execution. Investors can utilize a diversified sleeve (ASML, AMAT, LRCX, KLA, TEL) or a broad semiconductor ETF with a long-term horizon.

The Backbone of the Digital Economy

TradingKey - All digital gadgets, from smartphones to AI supercomputers, rely on semiconductors. But behind the chipsets themselves lies another supporting swath of critical infrastructure: equipment dedicated to their creation, design, etching, and testing. Semiconductor equipment makers are the unsung facilitators of the global tech ecosystem's infrastructure. Without their gear, fabs such as TSMC, Samsung, and Intel are unable to manufacture chipsets. For investors, that line of business represents one of the strongest and strategically vital sectors of the world's economy.

When compared to consumer-facing tech, the equipment business holds significant pricing power, a high entry barrier, and a core position in an industry with secular growth. As demand for advanced chips surges with the development of AI, 5G, and cloud computing, equipment suppliers are poised to capture a significant share of value.

![]()

Source: https://www.fabricatedknowledge.com

Why Equipment Matters

Semiconductor production features one of the highest degrees of industrial process sophistication. It encompasses lithography, deposition, etching, cleaning, testing, and packaging. All of these steps require specialised equipment that only a few companies are capable of manufacturing. For instance, extreme ultraviolet (EUV) lithography, which is necessary for the highest-end chips, is currently provided by only one company, ASML. It has therefore become one of the world’s most strategically significant companies.

This focus creates a situation in which a few dozen companies wield significant global influence. Any bottleneck at one of the latter companies can upset the entire semiconductor business. That status translates into price resilience and long-term demand certainty, reducing the cycling of equipment makers relative to much of the downstream.

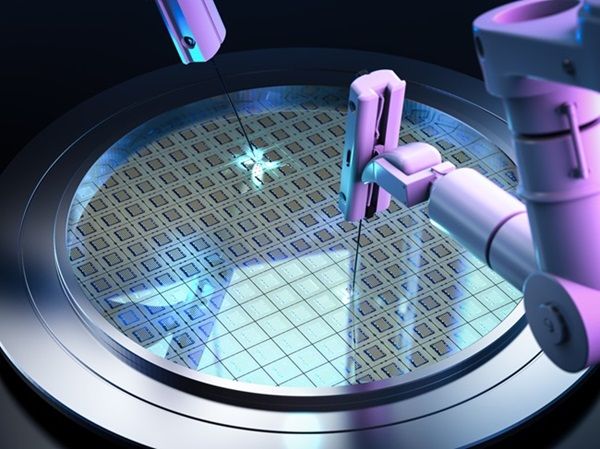

![]()

Source: https://www.semiconductor-digest.com

Growth Determinants

There are, first and foremost, the bottomless appetites for computing power. Artificial intelligence, cloud computing, and edge computing each demand increasingly sophisticated chips. With each successive reduction in the size of a node or each subsequent improvement in next-generation architecture comes the need for state-of-the-art equipment.

The other driver of growth is geographic diversification. Governments are advocating semiconductor sovereignty and are investing billions in domestic fabs in the U.S., Europe, and Asia. A new fab costs billions on the procurement of equipment and goes right into the pockets of suppliers. Laws like the U.S. CHIPS Act or the European Chips Act ensure that investment will continue to pour into this segment for years.

![]()

Source: https://www.skillpointe.com

Another driver of growth is the proliferation of speciality chips. In addition to logic processors, orders for memory, sensor systems, power semiconductors, and analogue chips are steadily increasing. Each segment requires unique equipment, thereby increasing the addressable market for suppliers.

Lastly, equipment replacement and service contracts provide a steady revenue stream. Upgrading nodes as fabs do means tools become obsolete or are refurbished and sold into secondary markets or service streams with greater margins.

Key Players

Highly concentrated equipment space. The dominant player in lithography is ASML, with its costs exceeding $150 million per unit. Specializing in deposition and etch systems with a broad portfolio of offerings, including several stages. Lam Research is the leader in etch and clean technologies. Process control and metrology are key areas of focus for KLA Corporation, a critical component of yield assurance. Tokyo Electron offers yet another comprehensive portfolio of deposition and etch applications, including coater/developer tools.

Each of these companies has high barriers to entry with decades of experience, patented tech, and capital-intensive research and development. Their positions are so solidified that newcomers are stacked against them with almost impossible odds. For investors, this implies an oligopoly-like model with stable price power.

Risks and Challenges

Despite its strength, the sector faces risks. The most prominent is geopolitical. U.S. export controls restrict the sale of advanced equipment to China, impacting the revenue of several suppliers. As geopolitical rivalry deepens, equipment firms may face continued uncertainty in their largest markets.

Cyclicality is another issue. Although secular growth remains solid, chip demand remains volatile. When oversupply conditions exist, equipment orders are slowed. These declines are less intense and of shorter duration for equipment shipper setups compared to chip manufacturers.

Valuation risk also looms. These companies are frequently paid for perfection due to their strategic value. When hopes are rethought, stock prices correct rapidly. Lastly, technical risk should not be overlooked. The business requires ongoing innovation. Next-generation equipment delays, such as high-NA EUV, may impact growth patterns.

Portfolio Positioning

For investors, semiconductor equipment makers are a perfect fit in the long growth category. Dominant positions, recurring revenues, and alignment with megatrends make chip equipment makers ideal anchors for tech-intensive portfolios.

A diversified approach can encompass ASML due to its monopolistic grip on lithography, Applied Materials and Lam Research due to their widespread process exposure, and KLA due to its metrology capabilities. Tokyo Electron offers diversification with exposure to the Asia region. If investors desire more diversification, they can consider ETFs such as the iShares Semiconductor ETF, which includes equipment names alongside chipmakers.

The time horizon matters. Although near-term volatility is a common characteristic of serial cycles in an industry, the long-term direction is upward. Investors should be prepared for corrections, yet remain confident about the ongoing demand for advanced chips and the equipment required to manufacture them.

Conclusion: The Picks-and-Shovels of Tech

If the semiconductors are the oil of the digital age, then chip manufacturers are the drilling rigs and refineries. They power the advance, deliver steady value, and are irreplaceable, no matter what chip designer emerges victorious from the next cycle of innovation, the risks, geopolitical tensions, and cycle. Size pauses and valuation resets are real but containable. The structural imperatives of digital transformation, AI adoption, and international fab growth are significantly more powerful.

For long-term investors, semiconductor equipment manufacturing offers a unique blend of strategic significance, durable development, and inherent competitive advantages. In a world increasingly characterised by silicon, the firms that manufacture the machines behind the silicon may become the best investment of the coming decade.

-0e7a45d5f0e04122b31375181b53565c.jpg)