Investing in Industrial AI & Smart Manufacturing

Industrial AI is driving the new era of smart manufacturing by combining robotics, sensors, automation, and AI analytics.

It delivers efficiency, predictive maintenance, quality control, and resilience against supply chain shocks and labor shortages.

Key players include Siemens, Rockwell, ABB, Honeywell, Fanuc, Nvidia, Microsoft, and Amazon, spanning industrial and tech ecosystems.

Risks include high upfront costs, integration complexity, hype versus reality, and geopolitical supply chain threats; however, the megatrend is undeniable.

The New Industrial Revolution

TradingKey - Manufacturing has always been the heartbeat of the world's economies, from the steam engine to mass production. We are experiencing a new revolution these days: the integration of artificial intelligence (AI) into production processes. It is intelligent manufacturing, and it pairs robotics, sensors, automation, and AI analytics so factories can learn, self-correct, and optimize in real time.

Industrial AI is an investor megatrend at the cross-section of tech and industry. It’s not robotics on the factory floor; its predictive maintenance, self-driving trucks, energy optimization, and self-healing processes. Companies that become masters at these tools are building lasting competitive advantages while cutting costs and getting more done.

Why Industrial AI Matters

Artificial intelligence manufacturing is not anymore nice-to-have but a necessity. Supply chain shocks, volatility in the energy sector, as well as skills gaps, exposed the built-in weaknesses of the old architectures. Intelligent manufacturing tackles all the challenges directly by infusing intelligence at each level of production.

Factories get predictive maintenance for equipment failures so they don't have costly downtime. AI-automated quality control finds defects at a higher level of accuracy than human inspection. Robotics takes on dull or hazardous work so you direct labor on higher-value activities. Logistics systems route shipments in real time if there’s an issue.

Such flexibility on this kind of scale isn't just economical; its strategic advantage. Industry AI-mented businesses hold the flexibility needed to deal with unexpected events and therefore compete more forcefully in investors’ as well as customers’ eyes.

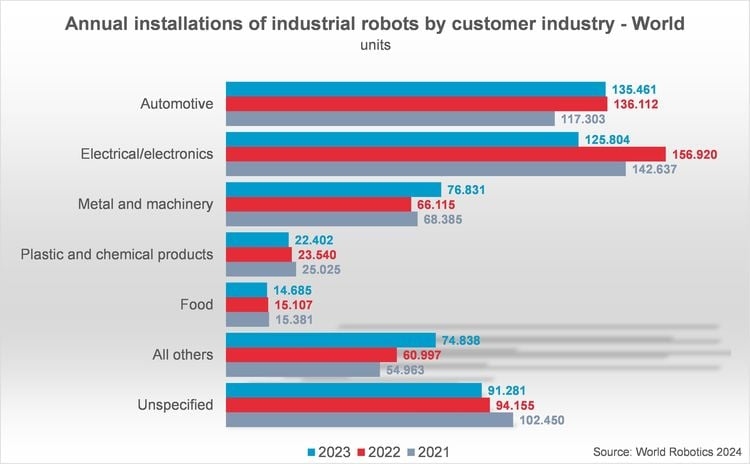

Source: https://www.ifr.org

Investment Environment

The industrial AI landscape encompasses the whole range of industry incumbents to specialized technology vendors. Industry automation leader Siemens (SIEGY) has its Digital Industries division infusing AI at all points in the production and energy supply networks.

Leader in smart-factory offerings Rockwell Automation (ROK) has connected hardware as well as software platforms. Robotics as well as electrification know-how comes from ABB (ABB), and the AI at the very heart of aerospace as well as industrial as well as building solutions sourced by Honeywell (HON).

-b64adb5b0d7e4a17ad31deac746dc3ed.jpg)

Source: https://www.blog.siemens.com

In robotics, Fanuc (FANUY) and Yaskawa Electric (YASKY) control industrial robots, facilitating the use of intelligent production all over Asia and around the world. Machine vision solutions lead where Cognex (CGNX) dominates the movement toward AI-enabled quality inspections. Giants also help. Intel (INTC) and Nvidia (NVDA) provide chips that energize industrial AI workloads. Microsoft's (MSFT) as well as Amazon's (AMZN) cloud infrastructure provide edge-to-cloud connectivity so producers may manipulate tremendous datasets in real time.

Growth Drivers

Several of the structural advances underpin industrial AI development. Combining the Shanghai market's excess capacity as well as supply chain diversification lead the pack. Western corporations are reshoring production back home after reducing their reliance on exposed global supply chains. Their high-tech factories enable them to retain their efficiencies as well as absorb the added costs of labour.

Trades shortages for skilled labour hasten the acceleration too. Robotics and automation fill in where labour isn't forthcoming, and programmes for AI serve as aides to human decision-making. Sustainability goals provide another catalyst. Economies of production decrease energy use, optimise resource utilisation, and encourage the use of circular economies.

Governments issue additional demands for improvement at the insteps of those for AI-assisted productivity. Finally, Industry 4.0 adoption grows ever larger. Automotive industry, pharmaceuticals, and others digitise procedures so they may compete on the global stage. Each new deployment broadens the ecosystem supporting growth.

-1b9a10ee9c7d482898173870d912af27.jpg)

Source: https://www.ifr.org

Risks and Challenges

Risks remain even when there are spirited tailwinds. While industrial AI projects tend to involve hefty upfront investments, small businesses may not have the finances to fund adoption. Complexity in integration is the second issue; the AI infrastructure has to coexist with old equipment, costly and sluggish.

Volatility brings competition. Each firm claims “AI-driven” offerings but don't promise quantifiable results. Investors will need to wade through actual ability (e.g., MindSphere of Siemens or FactoryTalk of Rockwell) through propaganda. Geopolitics as well as supply chain perils also come into the picture.

Robotics titans such as Fanuc greatly use the supply chain infrastructure of Asia. Rollout delays could occur due to shortages of chips. Export restrictions of higher-end AI chips, most prominently between China and America, might reshape market dynamics.

Portfolio Positioning

Industrial AI stocks can be utilized in growth and stability spaces of a portfolio. Leaders like Siemens, Rockwell, and ABB offer core exposure through mature global footprints. Robot leaders, such as Fanuc and Yaskawa, offer more cyclical but higher growth exposure linked to automation cycles. Cognex offers niche machine vision exposure, and Honeywell offers industrial exposure and recurring software-driven revenues.

Growth investors may combine the world leaders in industries with the enablers of technologies like Nvidia, Microsoft, or Amazon, which supply the underlying infrastructure for smart factories. Exchange-traded funds (ETFs) that invest in robotics and AI, such as the Global X Robotics & Artificial Intelligence ETF (BOTZ), offer diversified exposure.

The time horizon matters here. Industrial AI adoption is not an overnight process; it unfolds over years as factories are upgraded. Long-horizon investors can reap compounding cycles of adoption while avoiding near-term volatility.

Conclusion: The Future Factory

Industrial AI and intelligent production are no longer developments for the future; today's reality is reshaping production, delivery, and use of goods.

Companies embracing these technologies gain access to efficiencies, resilience, and sustainability benefits, while others risk falling behind. It offers investors a unique combination: the strength of industrials and the growth potential of AI. From Rockwell and Siemens' industrial platforms to Nvidia's chips and Cognex's vision solutions, the ecosystem spans blue-chip reliability and growth potential.

Risks, the cost, integration, and hype are real, but nobody can negate the megatrend. As industries get digitized, factories will no longer be static production lines but instead become dynamic, learning systems. Getting a slice of the transformation will mean placing portfolios at the center of the next industrial revolution.

-f910f97a27be433d8afbae0a8e75c8d7.jpg)