Goldman Sachs 2025 Second Quarter Earnings Comments

Earnings Highlight

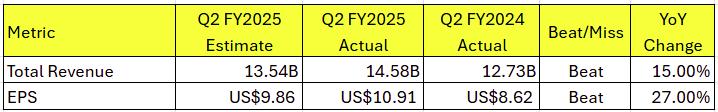

TradingKey - Revenue: Goldman Sachs reported second-quarter revenue of $14.58 billion, surpassing market expectations of $13.54 billion, with a year-over-year increase of 15%, reflecting strong performance primarily driven by a 24% revenue growth in the Global Banking & Markets division, reaching $10.12 billion.

Earnings Per Share (EPS): Goldman Sachs achieved an EPS of $10.91 in Q2, exceeding market expectations of $9.86, with a year-over-year increase of 27%, largely due to effective cost control measures. Additionally, investments in AI and technology have improved efficiency, likely contributing indirectly to EPS growth.

Global Banking & Markets Division: The Global Banking & Markets division generated $10.12 billion in revenue, up 24% year-over-year, delivering a robust performance. Investment banking fees rose 26%, driven by a 71% surge in advisory revenue from increased merger and acquisition activity. Equity trading revenue grew 36% to $4.3 billion, marking the best equity trading quarter in Wall Street history, fueled by market volatility and heightened client activity. Fixed Income, Currency, and Commodities (FICC) revenue increased 9% to $3.47 billion, further supporting performance.

Asset & Wealth Management Division: Revenue in the Asset & Wealth Management division fell 3% to $3.78 billion, impacted by declines in equity and debt investment income, despite an 11% increase in management fees. Assets under management reached $3.3 trillion, up 12% year-over-year, with continued strong net inflows.

Return on Equity (ROE): The second-quarter ROE was 12.8%, above the industry average, reflecting strong core business performance.

Common Equity Tier 1 (CET1) Ratio: At 14.5%, well above regulatory requirements, this demonstrates effective risk management and capital allocation strategies, providing room for stock buybacks and dividend increases.

Dividend: Increased by 33% to $4 per share, signaling confidence in future cash flows and profitability.

Future Outlook

Goldman Sachs management is optimistic about future growth, expecting investment banking to continue benefiting from robust M&A activity. The advisory business backlog has grown for five consecutive quarters, with Q2 2025 M&A transaction volume up 30% year-over-year, far exceeding the five-year average growth of 15%, a trend expected to drive further revenue growth. However, trading revenue performance will depend heavily on market volatility and client activity levels. Goldman Sachs has historically demonstrated strong profitability in volatile markets, showcasing resilience and competitiveness. Nonetheless, the Asset & Wealth Management division may see flat performance in the second half of 2025 due to a challenging financial environment. Goldman Sachs has clear long-term goals for the AWM division, expecting to significantly increase incentive fees to $1 billion annually by 2026 and 2027, reflecting growth potential in alternative asset management.

Looking ahead, Goldman Sachs will continue to invest heavily in AI and technology, such as the GS AI Assistant and its partnership with Cognition Labs, to enhance operational efficiency and client experience, laying the foundation for long-term growth. Additionally, an improved regulatory environment provides greater capital allocation flexibility, particularly with the regulatory capital buffer improving to 3.4% (per CCAR stress tests). The CET1 ratio remains robust at 14.5%, well above regulatory requirements, enhancing financial stability and supporting shareholder value.

In summary, Goldman Sachs is optimistic about its 2025 outlook, driven by reduced economic uncertainty, AI-driven demand growth, an improving regulatory environment, and significant increases in client activity. These factors collectively support the firm’s diversified business performance. Strategic investments in AI and technology, coupled with confidence in future profitability demonstrated through a substantial dividend increase, provide a solid foundation for sustained long-term growth and competitiveness.

Goldman Sachs Group 2025 Second Quarter Earnings Preview

Market Expectations

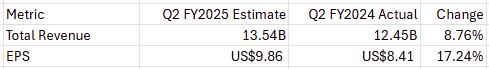

TradingKey - Goldman Sachs is expected to release its Q2 2025 earnings report before the market opens on Wednesday, July 16, 2025, followed by a conference call at 9:30 AM Eastern Time (ET). Below are the market expectations for Goldman Sachs' Q2 revenue and earnings per share (EPS):

· Revenue Expectation: Goldman Sachs' total revenue for Q2 2025 is projected to be $13.54 billion, representing an 8.76% increase from $12.45 billion in Q2 2024.

· EPS Expectation: Goldman Sachs' EPS for Q2 2025 is anticipated to be $9.86, reflecting a 17.24% increase from $8.41 in Q2 2024.

Key Investor Focus Areas

· Trading Revenue: Trading revenue is a core driver of Goldman Sachs' Global Banking and Markets (GBM) division, accounting for a significant portion of the company's total revenue. The volatility of trading revenue is closely tied to market fluctuations and client trading activity, directly impacting Goldman Sachs' overall profitability. In the context of heightened macroeconomic uncertainty, robust trading performance can significantly boost stock prices and enhance market confidence, while weak trading revenue may raise investor concerns, potentially putting pressure on the stock.

· Investment Banking Fees: As a leading global investment bank, Goldman Sachs derives its investment banking revenue primarily from advisory services for mergers and acquisitions, as well as equity and debt underwriting. This performance directly reflects the firm's competitiveness and market share in these areas. Strong growth in investment banking fees not only indicates the firm's success in capturing opportunities in M&A and capital markets but also signals market confidence in economic recovery and activity. Such growth can bolster investor optimism about the company's future revenue potential, particularly in an improving economic environment.

· Asset Management Fees: The growth of asset management fees is directly tied to the expansion of assets under management (AUM), reflecting Goldman Sachs' ability to attract and manage client assets effectively. In the highly competitive wealth management market, sustained AUM growth underscores the firm's brand strength and client trust, which are critical for long-term value creation. In recent years, Goldman Sachs has emphasized diversifying its revenue streams to reduce reliance on volatile trading income. The performance of asset management fees serves as a key indicator of the success of this strategy, with strong fee income enhancing the firm's resilience against market volatility.