What is the Future of Stablecoins? Here are Some Stablecoin Stocks to Watch

Introduction: The Rise of Stablecoin-Related Stocks

TradingKey - Recent legislative developments in the U.S. and Hong Kong have thrust stablecoins (Stablecoin) into the financial spotlight. Unlike Bitcoin (BTC) and Ethereum (ETH), which experience high volatility, stablecoins are pegged to fiat currencies (e.g., USD, EUR) or major assets (e.g., gold, government bonds), offering stability as a medium of exchange and store of value.

This rapid expansion is not only transforming the crypto industry but also fueling the rise of stablecoin-related stocks. With major financial institutions and tech companies entering the market, investors are keenly watching these developments. This article explores market trends, key investment opportunities, and strategies for stablecoin-related stocks.

Stablecoin Market Growth Potential

Stablecoins are experiencing record growth, with transaction volumes exceeding traditional payment networks:

- 2024 Stablecoin transaction volume hit $27.6 trillion — outpacing Visa and Mastercard combined.

- By Q1 2025, stablecoin transactions again surpassed Visa, confirming their growing dominance in global payments.

According to CoinMarketCap, the total stablecoin market capitalization now exceeds $260 billion, accounting for 8% of the entire crypto market. The U.S. Treasury predicts the market could reach $2 trillion by 2028, an 8X increase from current levels.

Major Factors Driving Stablecoin Growth

- U.S. GENIUS Act nearing approval – Establishing a comprehensive regulatory framework.

- Hong Kong’s Stablecoin Ordinance takes effect Aug. 1 – Licensed firms can issue stablecoins.

- South Korea’s Digital Asset Basic Law proposed – Paving the way for stablecoin adoption.

- Financial giants entering stablecoins – Deutsche Bank, Santander, JPMorgan, Bank of America are considering stablecoin issuance, reshaping the competitive landscape.

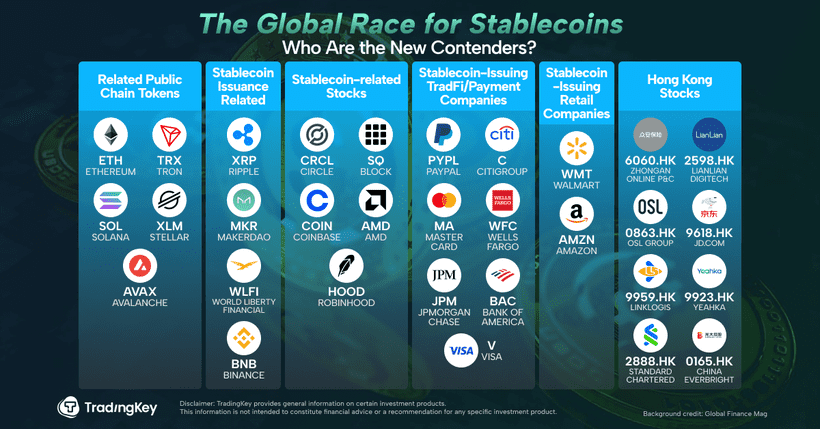

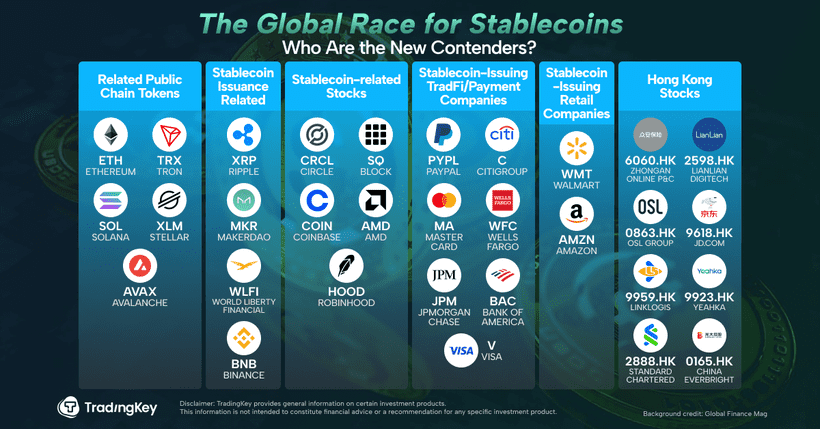

Top Stablecoin Stocks to Watch

1. Stablecoin Issuers & Related Companies

- Circle (CRCL) – Issuer of USDC, went public on June 6, 2025, with its stock surging 230% on debut.

- Coinbase (COIN) – USDC co-issuer & major crypto exchange, holding stake in Circle.

- Robinhood (HOOD) – Supports stablecoin trading, integrates USDC payment solutions.

- PayPal (PYPL) – Launched PYUSD (PayPal USD) in 2023, market cap now at $1 billion, ranked 7th among stablecoins.

- Tether (USDT) – Largest stablecoin issuer, though parent company iFinex Inc. is not publicly traded. Investors can indirectly gain exposure via Bitfinex’s parent company iFinex or Northern Data AG (ETR: NB2).

2. Stablecoin Infrastructure & Technology Providers

- IBM (IBM) – Provides enterprise blockchain solutions for stablecoin issuers.

- AMD (AMD) – Supplies high-performance chips for stablecoin blockchain computations.

- Block (SQ) – Focuses on stablecoin applications & blockchain innovations.

3. Traditional Financial Institutions Moving into Stablecoins

- JPMorgan (JPM) – Launched JPM Coin (institutional stablecoin) for cross-border settlements.

- BlackRock (BLK) – Tokenized U.S. Treasuries backing stablecoins, with deep USDC partnerships.

- Visa (V) & Mastercard (MA) – Supporting USDC & USDT stablecoin payments, enhancing adoption rates.

How to Invest in Stablecoin-Related Stocks

Step 1: Identify Companies with Strong Long-Term Competitive Advantage

- Prioritize firms with stablecoin issuance capabilities, blockchain technology innovations, such as Circle, PayPal, and Coinbase.

- Watch traditional financial players entering the sector (Deutsche Bank, JPMorgan) for strategic impact.

Step 2: Monitor Regulatory Changes & Market Trends

- Regulatory approvals drive market confidence — keep an eye on U.S., South Korea, and Hong Kong policies.

- Track stablecoin adoption rates and transaction volumes, using on-chain analytics for deeper insights.

Step 3: Adapt to Market Volatility

- Stablecoin-related stocks offer long-term growth, but short-term price swings require flexible trading strategies.

- Consider both long-term investments & short-term arbitrage opportunities based on policy shifts and market demand.

Final Words: The Prospect of Stablecoin Investments

With regulations solidifying, institutional money flowing in, and global market expansion accelerating, stablecoin-related stocks could experience unprecedented growth.

Investors should focus on regulatory developments, competitive advantages, and industry shifts — while preparing for potential risks associated with evolving market conditions.