U.S. August PCE: Inflation Remains the Market's Greatest Risk

Executive Summary

TradingKey - On 17 September, the Federal Reserve cut interest rates by 25 basis points as anticipated, marking the official restart of its easing cycle. Consistent with the Fed's dot plot, we expect two more 25-basis-point rate cuts by year-end. These, combined with the Treasury’s tax-cut fiscal policy, should create a synergistic effect to counter the economic slowdown. Consequently, our baseline forecast anticipates sustained asset price increases. However, if inflation surpasses market expectations in the coming months, it could hinder further rate cuts and pose the greatest risk to financial markets.

On 26 September, the U.S. will release August Personal Consumption Expenditure (PCE) data. Given the strong correlation between PCE and CPI, and with August CPI remaining largely flat compared to July, markets widely expect the August headline PCE to rise 2.7% year-over-year, slightly above the prior 2.6%, while core PCE is projected to hold steady at 2.9%. If the data meet expectations, U.S. inflation will have risen for four consecutive months since its April low.

Although U.S. inflation currently remains within a manageable range, the risk of inflation exceeding expectations in the coming months cannot be overlooked, given factors such as tariff measures, immigration policies, and a weakening labour market. Should the risk of uncontrolled inflation emerge, the Federal Reserve may be forced to slow its rate-cutting pace or even pause the easing cycle again. In such a scenario, risk assets like U.S. equities and cryptocurrencies are likely to face downward pressure, while Treasury yields and the U.S. dollar index are expected to rise. As for gold, its dual nature suggests that prices may initially decline before rebounding.

1. Introduction

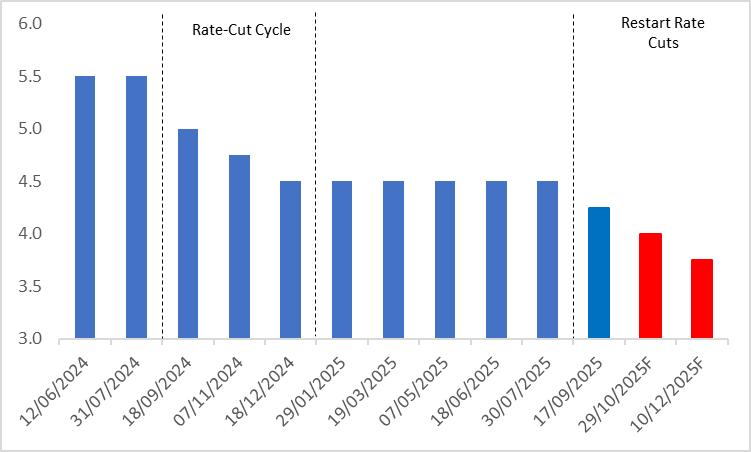

On 17 September, the Federal Reserve cut interest rates by 25 basis points as expected, officially restarting its easing cycle. The current benchmark interest rate range of 4%–4.25% remains historically elevated, indicating that the Fed retains ample monetary policy tools to address the gradually slowing economic growth. In line with the signals from the Fed’s dot plot, we anticipate two additional 25-basis-point rate cuts by year-end (Figure 1).

By then, the Federal Reserve’s accommodative monetary policy, combined with the Treasury’s tax-cut fiscal policy, is expected to create a synergistic effect, effectively mitigating the adverse impacts of an economic slowdown. Consequently, our baseline forecast anticipates continued rises in various asset prices. However, if inflation exceeds market expectations in the coming months, it could obstruct further Fed rate cuts and emerge as the greatest risk to financial markets.

Figure 1: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

2. August PCE

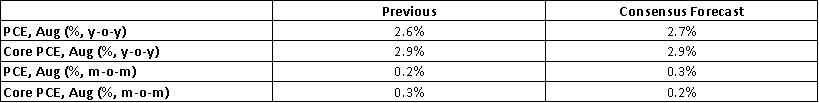

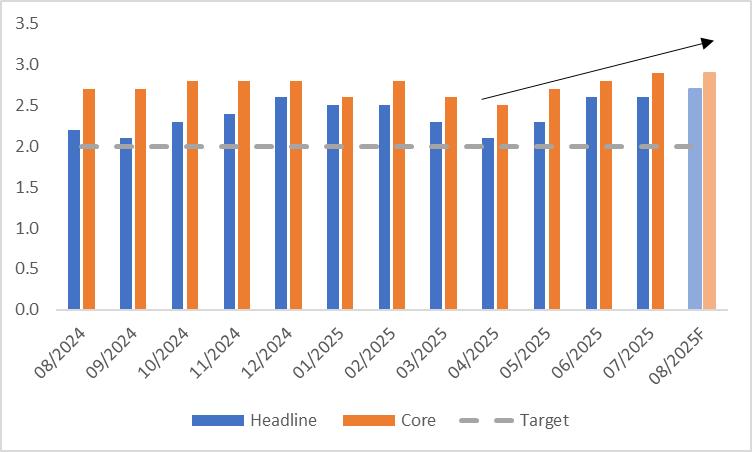

On 26 September, the U.S. will release August Personal Consumption Expenditure (PCE) data. Given the strong correlation between PCE and CPI, and with August CPI remaining nearly unchanged from July, markets widely expect August headline PCE to rise 2.7% year-over-year, slightly above the prior 2.6%, while core PCE is projected to remain steady at 2.9% (Figure 2.1). If the data aligns with expectations, U.S. inflation will have increased for four consecutive months since its April low (Figure 2.2).

Figure 2.1: Market Consensus Forecasts

Source: Refinitiv, TradingKey

Figure 2.2: U.S. PCE (%, y-o-y)

Source: Refinitiv, TradingKey

3. Risks of Persistent Inflation

While U.S. inflation currently remains within a manageable range, the risk of it exceeding expectations in the coming months cannot be ignored. This risk stems from three key factors. First, although trade negotiations with U.S. partners have progressed relatively smoothly, tariffs under the Trump administration have risen significantly compared to pre-"Liberation Day" levels. Higher tariffs increase the cost of imported goods, which is likely to be gradually passed on to consumers. Second, stricter immigration policies may reduce labour supply, potentially driving wage increases and, in turn, elevating core services inflation. Third, a weakening labour market could lead to supply-side constraints for goods and services, contributing to broader price increases. Should the risk of uncontrolled inflation materialise, the Federal Reserve may be forced to slow its rate-cutting pace or even pause the easing cycle, significantly impacting various asset prices.

4. U.S. Stocks

If persistent inflation forces the Federal Reserve to shift from a dovish to a hawkish stance, it would significantly weigh on U.S. equities in three key ways. First, corporate earnings would face constraints. A slower pace of rate cuts could intensify pressure on economic growth, with higher interest rates curbing consumer and investment demand, leading to slower revenue and profit growth for companies. Second, rising financing costs would squeeze profit margins, particularly for highly leveraged firms, as increased borrowing costs erode profitability and trigger stock price declines. Third, higher interest rates would amplify valuation pressures, as the present value of future corporate cash flows diminishes, necessitating valuation adjustments.

5. Cryptos

Recently, cryptocurrencies such as Bitcoin and Ethereum have experienced significant declines. This reflects both a correction from the prior market frenzy and profit-taking by investors following the implementation of rate cuts, embodying the classic "buy before the news and sell after the news" market dynamic.

As risk assets, cryptocurrencies share characteristics with equities. If the pace of rate cuts slows, the market could impact cryptocurrencies negatively through three channels: adjustments in liquidity expectations, shifts in risk appetite, and transmission of market sentiment. For instance, when the Federal Reserve unexpectedly maintained high interest rates during its June 2024 meeting, Bitcoin plummeted from $69,538 to $66,035 within days, while Ethereum fell over 8.2% in tandem.

6. U.S. Treasuries and USD Index

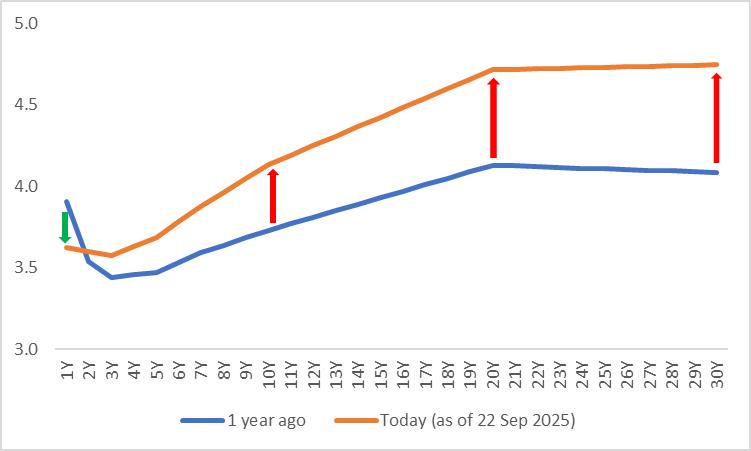

Over the past year, as U.S. economic resilience became evident and the Federal Reserve resumed its rate-cutting cycle, the shape of the Treasury yield curve has significantly improved, with the 3-to-30-year curve returning to a normal shape (Figure 6). However, with markets having priced in expectations of continued Fed rate cuts, signs of reflation could prompt a shift from a dovish to a hawkish monetary policy stance, potentially driving short-term Treasury yields higher.

In a more severe scenario, the yield curve could invert again, leading to losses for holders of short-term Treasuries. Additionally, given the high correlation between Treasury yields and the U.S. dollar index, a hawkish Fed policy would likely bolster the dollar index.

Figure 6: U.S. Treasury Yield Curve (%)

Source: Refinitiv, TradingKey

7. Gold

Gold exhibits a dual nature. On one hand, if the Federal Reserve slows its rate-cutting pace, reducing the speed of liquidity injection, this would exert downward pressure on gold prices. On the other hand, if inflation surges significantly in the coming months, altering medium- to long-term inflation expectations, gold’s role as an inflation hedge would come to the forefront, making higher-than-expected inflation a bullish factor for the gold market.

In an extreme scenario, if persistent inflation forces the Fed to pause rate cuts again and a hawkish monetary policy fails to mitigate economic slowdown, the U.S. economy could face stagflation. Under such conditions, gold prices are expected to rise steadily, repeatedly reaching new historical highs.

8. Conclusion

On 17 September, the Federal Reserve resumed its rate-cutting cycle. However, inflation remains the primary risk to the Fed’s ability to implement accommodative monetary policy and a key factor influencing financial markets. If inflation exceeds expectations in the coming months, compelling the Fed to slow its rate cuts, risk assets such as U.S. equities and cryptocurrencies are likely to face downward pressure, while Treasury yields and the U.S. dollar index are expected to rise. As for gold, its dual nature suggests that prices may initially decline before rebounding.