U.S. June CPI Preview: Tariff Pass-Through Is No Longer “The Boy Who Cried Wolf” — Could a Hot Print Disrupt the Calm in U.S. Equities?

TradingKey - On Tuesday, July 15, the U.S. Bureau of Labor Statistics will release the June 2025 Consumer Price Index (CPI).

After four consecutive months of inflation coming in below expectations, Wall Street is now bracing for a potential upside surprise — with tariffs finally starting to show up in consumer prices.

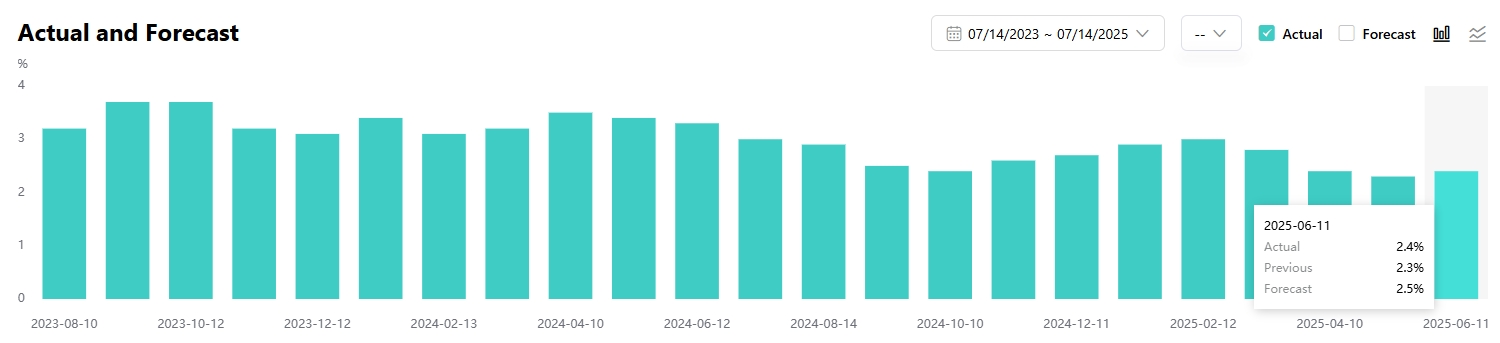

According to FactSet, economists expect:

- Headline CPI to rise 0.23% month-over-month, up from 0.10% in May

- Year-over-year CPI at 2.60%, up from 2.40% in May

U.S. CPI YOY, Source: TradingKey

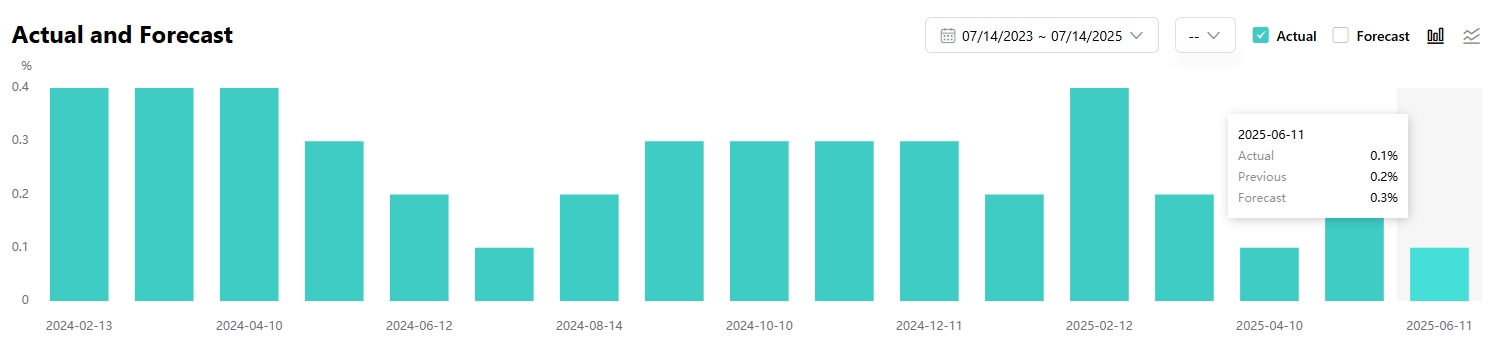

Core CPI (excluding food and energy) is projected to:

- Rise 0.30% MoM, up from 0.10% in May

- YoY increase to 3.0%, from 2.8%

Was June the Real Tariff Impact?

Analysts believe that by June 2025, companies had already absorbed much of the inventory buffers used in April and May — meaning tariff-driven cost increases are more likely to appear in final consumer prices this time.

Economists now forecast the core goods segment — which accounts for about 20% of the CPI basket — to see its strongest monthly gain since February.

U.S. Core CPI MOM, Source: TradingKey

Bank of America analysts indicated this may no longer be a case of “the wolf is coming.” They expect core goods inflation to accelerate, largely due to tariffs.

They also anticipate rising prices in travel-related services — including airfares and hotel rates — as well as medical care costs, following softness in May.

While services account for 57% of the CPI index, the recent rebound in core goods prices could shift market sentiment on inflation — especially if service sector pricing power returns alongside tighter labor markets.

Bloomberg economists noted that price trends may remain mixed — similar to May — where tariff effects were still limited in goods, while services remained weak.

However, categories like appliances and furniture could see upward pressure, while airfare and used car prices may fall.

Macquarie analysts suggested that while tariffs are clearly pushing up core goods prices, if services inflation continues to slow, the market may choose to ignore the overall report.

Fed Policy Outlook Remains Uncertain

Despite occasional speculation over a July rate cut, strong job market data and inflation concerns have kept investors cautious about near-term easing.

Currently, markets expect the Federal Reserve to cut interest rates twice in H2 2025, lowering the federal funds rate by 50 basis points from the current 4.25–4.50% range.

CreditSights analysts warned that the June CPI report could set the tone for both Fed policy and risk appetite in the second half of the year.

Macquarie pointed out that investor inflation expectations have calmed in recent months — not necessarily signaling disinflation, but certainly reducing inflation fears.

However, if the report shows a broad-based pickup in services inflation or demand-driven price pressures, it could force investors to reassess their assumptions — giving the Fed another reason to delay cuts.

Earnings Season and Market Volatility Ahead

For U.S. equities, beyond inflation and Fed policy, the Q2 earnings season could reveal how tariffs are affecting corporate investment and operations — potentially limiting further stock gains after the recent rally.

Jim Smigiel, Chief Investment Officer at SEI, said the key focus of this earnings season remains forward guidance — or the lack thereof.

Only 16% of S&P 500 companies provided earnings guidance in Q1 2025, down from 27% in the same period last year.

Smigiel added that the bigger issue in Q2 may be whether companies can regain confidence in forecasting — and provide meaningful updates to investors.

Former BofA economist David Woo noted that pre-trade war inventory buildup gave many firms a temporary shield from tariff impacts — but now that buffer is fading.

He warned that equity markets may be re-entering a phase reminiscent of early 2022, when large retailers masked weakness under the guise of AI-driven restocking, while smaller firms faced forced price hikes and layoffs.

Woo also highlighted that fiscal stimulus, debt ceiling concerns, and renewed inflation are putting the Fed in a difficult position — and that stagflation risks may finally materialize.