UK July GDP Commentary: Can GBP Break Through Its Current Fluctuation?

TradingKey - Currently, the UK economy is grappling with a combination of low growth and high inflation, gradually slipping into stagflation. In the foreign exchange market, this stagflationary environment, coupled with the likelihood of continued interest rate cuts by the Bank of England, is expected to exert downward pressure on the British pound. On the U.S. side, the trend of de-dollarisation, combined with market expectations of the Federal Reserve resuming its rate-cutting cycle on 17 September, will similarly weigh on the US dollar index. After considering multiple factors, given the evident weakness on both sides of this currency pair, we expect the GBP/USD exchange rate to maintain its current fluctuation trend in the short term.

Source: TradingKey

Main Body

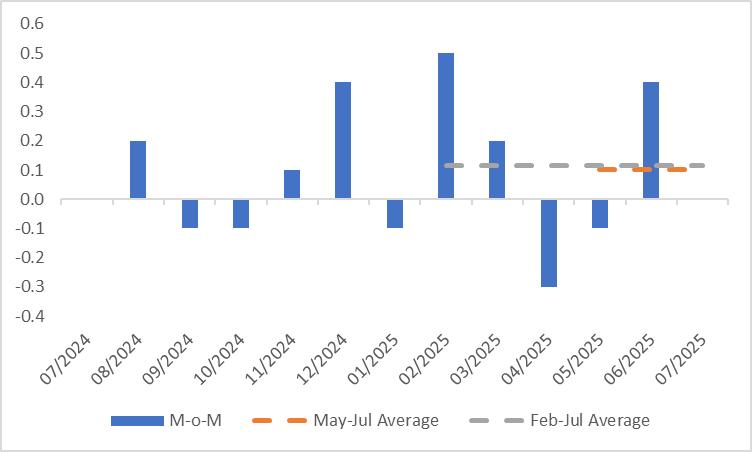

On 12 September 2025, the UK Office for National Statistics released July GDP data, showing economic growth in line with market expectations but effectively stagnant (Figure 1). Growth in the services and construction sectors was offset by a contraction in manufacturing. Specifically, monthly data indicated modest growth of 0.1% in services and 0.2% in construction, while manufacturing output fell by 1.3%, marking the largest decline since mid-last year. This outcome poses a significant challenge for Chancellor Reeves ahead of the autumn budget announcement in November.

Figure 1: UK Real GDP (%, m-o-m)

Source: Refinitiv, TradingKey

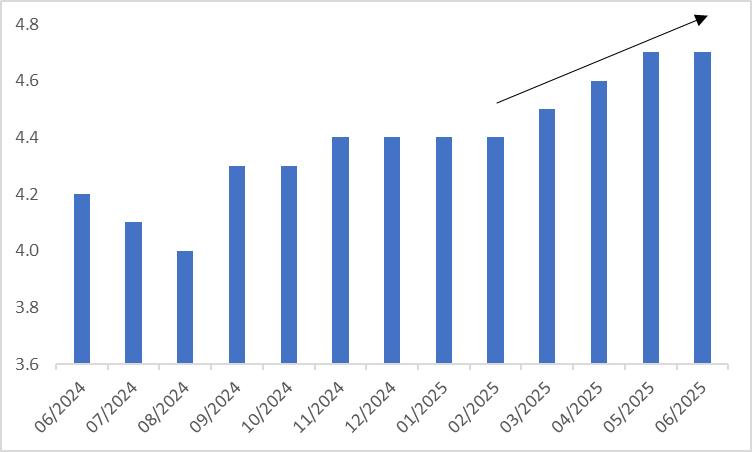

Historical data over a longer period reveals that the UK’s average economic growth over the past three and six months has been a mere 0.1%, signalling a persistent economic slowdown. This sluggish growth is also reflected in the labour market: following a stable period from November 2024 to February 2025, the UK unemployment rate has been steadily rising since March (Figure 2). The Bank of England (BoE) has noted that weak underlying GDP growth, coupled with downward pressure on consumer spending, is driving a downward spiral between consumption and hiring, which is the root cause of the softening labour market.

Figure 2: UK Unemployment Rate (%)

Source: Refinitiv, TradingKey

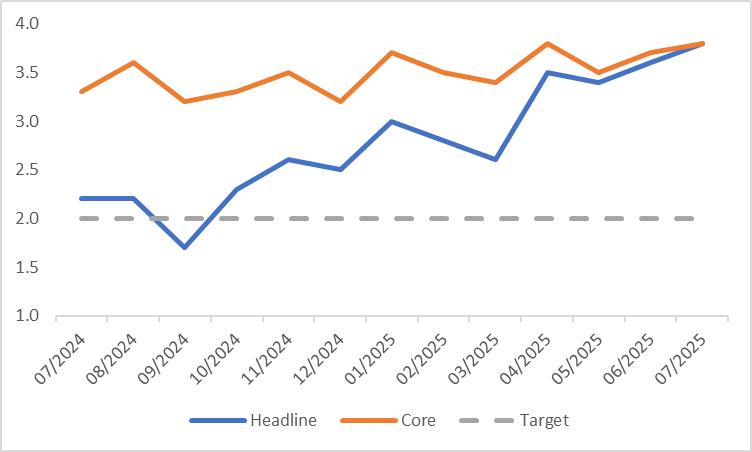

Regarding inflation, both headline CPI and core CPI have been on an upward trajectory since September 2024, currently standing at 3.8%, well above the BoE’s 2% target (Figure 3). According to the latest projections from officials, inflation is expected to rise to 4% by September 2025.

Figure 3: UK CPI (%, y-o-y)

Source: Refinitiv, TradingKey

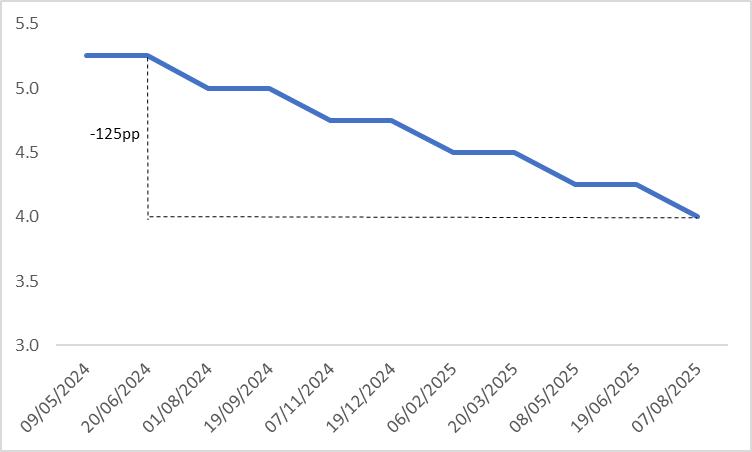

Since the BoE began its rate-cutting cycle in August last year, it has reduced interest rates by a cumulative 125 basis points (Figure 4). Currently, the UK economy is grappling with low growth and high inflation, gradually sliding into stagflation. This stagflationary environment places the BoE in a challenging dilemma. Looking ahead, we expect the bank may slow the pace of rate cuts. However, given the bleak economic outlook and persistent labour market weakness, the overall trend of continued rate reductions is likely to persist.

Figure 4: BoE Policy Rate (%)

Source: Refinitiv, TradingKey

In the foreign exchange market, the GBP/USD exchange rate has retreated from its early July peak and entered a range-bound pattern, driven by the UK’s weak economic growth, rising inflationary pressures, and the BoE’s ongoing rate-cutting policy. Looking ahead, the subdued economic conditions and continued rate cuts are likely to exert downward pressure on the pound. On the U.S. side, the dollar faces challenges from both the ongoing trend of de-dollarisation and market expectations of the Federal Reserve resuming its rate-cutting cycle on 17 September. Considering these factors, with both currencies showing clear signs of weakness, we expect the GBP/USD pair to maintain its current range-bound trajectory in the short term.