U.S. Dollar Index: Assessing Its Future Trend Through Macro Analysis of the U.S., Eurozone, Japan, and U.K.

Executive Summary

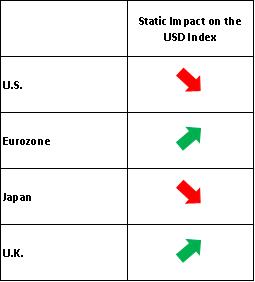

TradingKey - Looking ahead, in the U.S., slowing economic growth combined with ongoing interest rate cuts will exert downward pressure on the dollar. In the Eurozone, weak economic performance and continued ECB rate cuts will likely depreciate the euro, indirectly supporting the U.S. Dollar Index. In Japan, as the policy rate differential between the Bank of Japan and other major central banks narrows, the yen is expected to appreciate steadily, pressuring the dollar index downward. In the U.K., the Bank of England’s persistent rate cuts, coupled with weak economic fundamentals, may weaken the pound, providing some support for the dollar index. Overall, these dynamics suggest the U.S. Dollar Index will likely enter a fluctuation range in the short term.

Source: TradingKey

Source: Mitrade

1. Introduction

In the first half of 2025, the U.S. Dollar Index fell 12.2% from a high of 109.8 on 13 January to a low of 96.4 on 2 July. This decline was driven by global market turmoil from Trump administration tariff policies, lowered economic growth forecasts, expanding fiscal deficits, and a U.S. credit rating downgrade by Moody’s, which weakened the dollar’s appeal. Additionally, global de-dollarisation efforts further pressured the dollar. However, from early July, the dollar index rebounded slightly, rising 1.2% by 22 August, fuelled by progress in trade negotiations. Looking ahead, what will drive the dollar index’s trajectory? This analysis excludes long-term impacts from the Mar-a-Lago Agreement, the Big and Beautiful Act, and stablecoins, focusing instead on short- to medium-term macroeconomic influences from the U.S., Eurozone, Japan, and the U.K. on the dollar index.

* For related information, refer to the article published on 14 August 2025, titled “BOJ Faces Internal and External Pressures as the Underlying Inflation Justification Falters, Bessent Calls Out Inaction”

2. U.S. Macroeconomy

2.1 U.S. Economic Growth

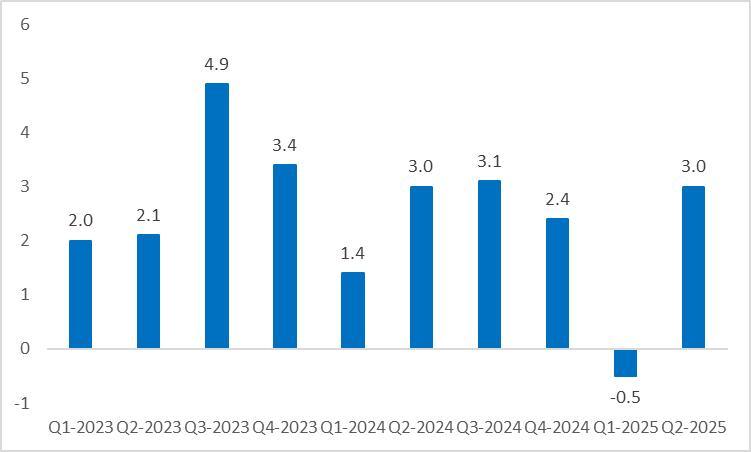

In Q2 2025, U.S. GDP growth exceeded expectations (Figure 2.1), driven primarily by a significant recovery in net exports. In Q1, a large-scale “import rush”, spurred by tariff uncertainties, widened the trade deficit, resulting in negative GDP growth. However, as tariff negotiations progressed in Q2, the rush to import subsided, enabling a substantial rebound in actual GDP growth.

However, this does not indicate an improvement in the U.S. economy’s underlying growth momentum. In fact, real consumption and investment continue to decline. Specifically, consumption in low-income families has been dampened by slowing wage growth in the labour market and increased household savings driven by tariff uncertainties. Additionally, fixed asset investment continues to weaken, keeping the July 2025 manufacturing PMI below the 50 expansion threshold. This suggests that Trump’s manufacturing reshoring initiatives have yet to yield significant results. The gradual economic slowdown is exerting downward pressure on the U.S. dollar.

2.2 U.S. Inflation

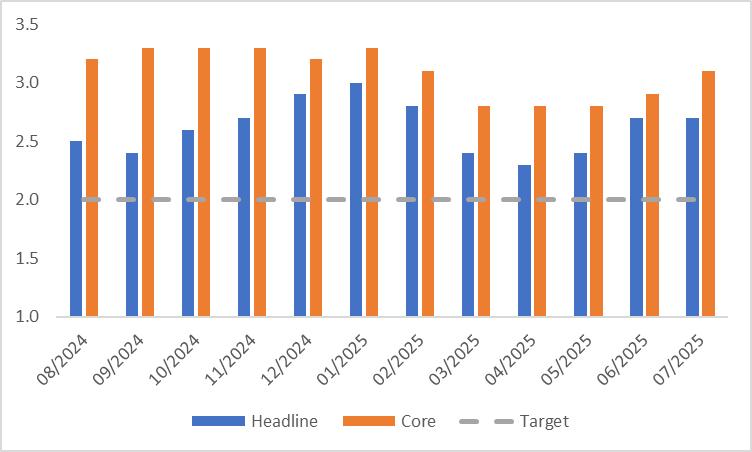

Recent U.S. Consumer Price Index (CPI) data show an upward trend (Figure 2.2), though July 2025 figures largely aligned with market expectations. Headline CPI rose 2.7% year-over-year, slightly below the anticipated 2.8%, while core CPI increased 3.1%, marginally above the expected 3.0%.

Looking ahead, although U.S. businesses are likely to pass tariff costs onto consumers, the milder-than-expected intensity of Trump’s tariffs may slow the pace of cost transfer, leading to a more moderate impact on prices. Additionally, rising housing vacancy rates and a weakening labour market support an optimistic outlook for U.S. inflation in the short term.

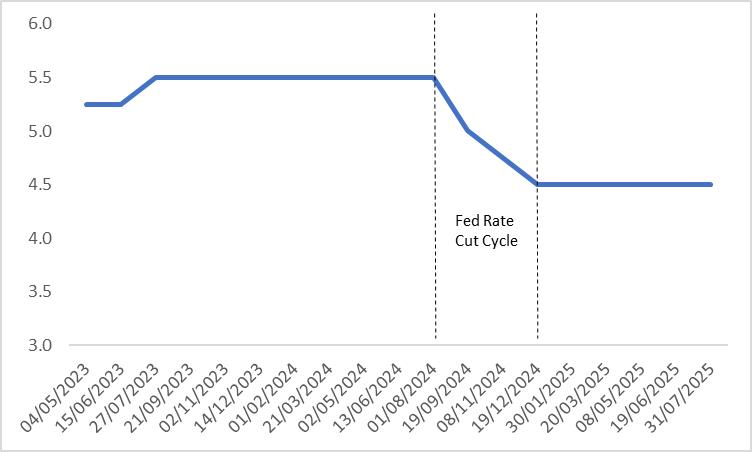

2.3 Federal Reserve

Due to weak economic growth momentum, the Federal Reserve initiated a rate-cutting cycle on 19 September 2024, with a cumulative reduction of 100 basis points by 19 December 2024 (Figure 2.3). In 2025, as the U.S. economy demonstrated some resilience, the Fed paused rate cuts, maintaining the policy rate at 4.5%.

Looking forward, with a weakening U.S. economy and limited upward momentum in CPI and PCE, the Fed is likely to resume rate cuts in September 2025. We anticipate three rate reductions of 25 basis points each within the year. These continued rate cuts are expected to exert downward pressure on the U.S. dollar.

Figure 2.1: U.S. Real Annualised GDP (%, q-o-q)

Source: Refinitiv, TradingKey

Figure 2.2: U.S. CPI (%, y-o-y)

Source: Refinitiv, TradingKey

Figure 2.3: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

3. Eurozone Macroeconomy

The U.S. Dollar Index comprises six freely convertible currencies closely tied to U.S. trade, with the top three by weight being the euro (57.6%), Japanese yen (13.6%), and British pound (11.9%). Consequently, exchange rate fluctuations of these currencies, particularly the euro, significantly influence the dollar’s trajectory. Let us analyse these economies and their currencies one by one.

3.1 Eurozone Economic Growth

The Eurozone’s Q2 2025 real GDP growth slowed slightly to 1.4% year-over-year from 1.5% in Q1. This decline primarily stems from the fading positive impact of European firms’ “export rush” to circumvent U.S. tariff measures, which had previously bolstered growth.

Looking ahead, the Eurozone economy continues to face persistent downward risks. Although the EU recently secured a trade agreement with the U.S., averting a more severe trade war, most EU products still face a 15% U.S. tariff. This will exert significant pressure on the EU economy, with Germany particularly affected. Moreover, the EU’s commitment to increased investment in the U.S. may negatively impact domestic European industries and employment.

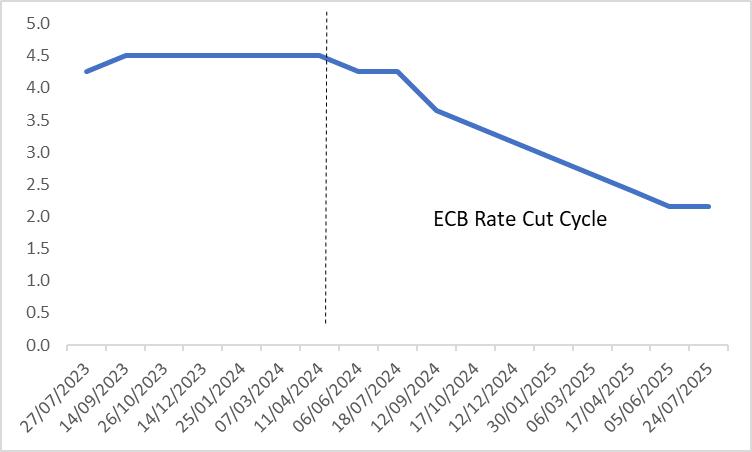

3.2 European Central Bank

Since initiating rate cuts in June 2024, the European Central Bank (ECB) has reduced policy rates by a cumulative 235 basis points (Figure 3). With Eurozone inflation within the target range and no signs of renewed upward pressure, we expect the ECB to maintain its accommodative monetary policy stance. By mid-2026, the Eurozone is likely to enter a low-interest-rate environment. The combination of a sluggish Eurozone economy and sustained ECB rate cuts will exert downward pressure on the euro, which, in turn, is expected to provide support for the U.S. Dollar Index.

Figure 3: ECB Policy Rate (%)

Source: Refinitiv, TradingKey

4. Japan Macroeconomy

Since early 2025, Japan’s national CPI has shown a consistent decline, falling from a high of 4% in January to 3.1% in July. This is mainly due to the decline in energy prices and a significant drop in the CPI in the Tokyo area in July. Looking ahead, while inflation has eased from its peak, it is likely to remain significantly above the Bank of Japan’s 2% target in the near term.

On 30 July 2025, the Bank of Japan (BoJ) maintained its policy rate at 0.5%, signalling a slight softening of its hawkish stance. However, we believe this position is unlikely to persist. Given the still-elevated inflation levels, we anticipate the BoJ will revert to a hawkish posture and resume rate hikes in Q4 2025. As the policy rate differential between the BoJ and other major central banks narrows, we expect the Japanese yen to appreciate steadily, exerting downward pressure on the U.S. Dollar Index.

5. U.K. Macroeconomy

The U.K. economy is sliding toward stagflation, characterised by low growth and high inflation. From a labour market perspective, after a stable period from November 2024 to February 2025, the unemployment rate has been rising since March. The Bank of England (BoE) notes that weak underlying GDP growth and downward pressure on consumer spending are key factors. The spiralling decline between consumption and hiring is the primary driver of the U.K.’s labour market weakness.

Conversely, both headline and core CPI have been on an upward trend since September 2024, currently standing at 3.6% and 3.7%, respectively, well above the BoE’s 2% target. According to recent central bank projections, inflation is expected to climb to 4% by September 2025.

Looking ahead, given the U.K.’s intertwined challenges of a sluggish labour market and high inflation, the BoE is likely to slow its pace of rate cuts. Despite this moderation, the overall trend of monetary easing is expected to persist. Combined with the U.K.’s weak economic fundamentals, this scenario may exert downward pressure on the pound, thereby providing support for the U.S. Dollar Index.

6. Conclusion

In summary, in the U.S., economic trends and policy adjustments continue to exert downward pressure on the dollar. Similarly, Japan’s economic dynamics and policy stance contribute significantly to the dollar’s weakness. Conversely, the Eurozone’s economic performance and policy measures, combined with the U.K.’s economic conditions and policy direction, create upward support for the dollar. With these counteracting forces from different regions, we anticipate the U.S. Dollar Index will enter a fluctuation range in the short term.