[HOTSPOT ANALYSIS] U.S. May Nonfarm Payroll Preview: Economic Bad News May Turn Into Good News for Stocks

TradingKey - The May non-farm payroll data is set to be released on 6 June 2025. Market consensus forecasts 130,000 new jobs, a decline from April. Given the unexpected weakness in the ADP report and the bleak outlook for business conditions, we believe the data released on 6 June may fall below market expectations. If so, this could trigger significant market volatility within a day of the release. However, weaker employment data, combined with persistent delays in reflation, is likely to strengthen expectations for Federal Reserve rate cuts, which would be positive for U.S. stocks.

Source: Mitrade

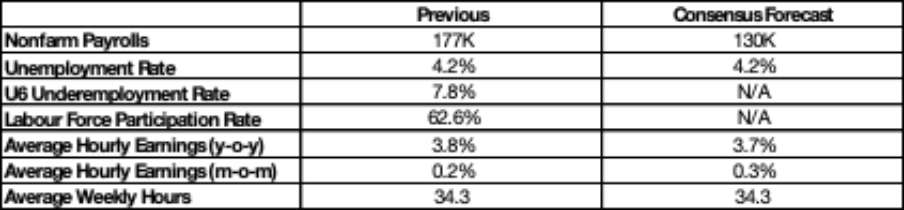

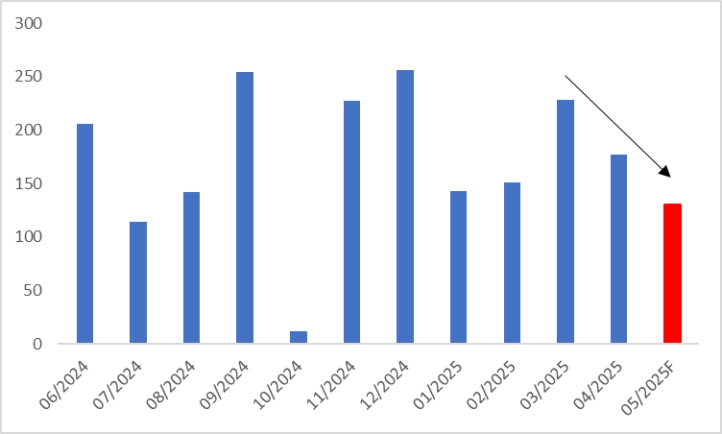

The U.S. Bureau of Labor Statistics will release the May non-farm payroll data on 6 June 2025. Market consensus anticipates 130,000 new jobs, a decrease from April’s 177,000 (Figures 1 and 2). However, we believe the data released on 6 June may fall short of market expectations.

Figure 1: Consensus Forecasts

Source: Refinitiv, TradingKey

Figure 2: U.S. Nonfarm Payrolls (000)

Source: Refinitiv, TradingKey

There are two main reasons for this outlook:

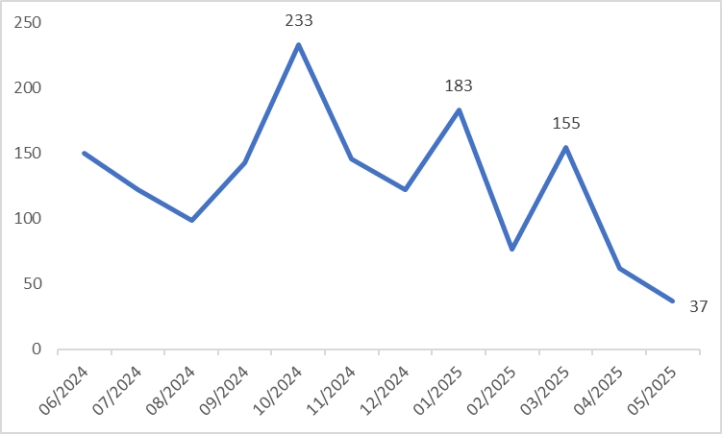

First, the ADP report, often referred to as the "small non-farm", unexpectedly weakened, with May data showing only 37,000 jobs added (Figure 3), well below the market’s expectation of 111,000 and marking the lowest level since March 2023. More specifically, on the goods side, manufacturing and mining were the primary drags. On the services side, professional and business services, education and healthcare, and transportation all saw declines. As a leading indicator for the non-farm payroll, the ADP’s weak performance signals softness in the U.S. labour market, suggesting that the May non-farm data may disappoint.

Figure 3: U.S. ADP Nonfarm Employment Change (000)

Source: Refinitiv, TradingKey

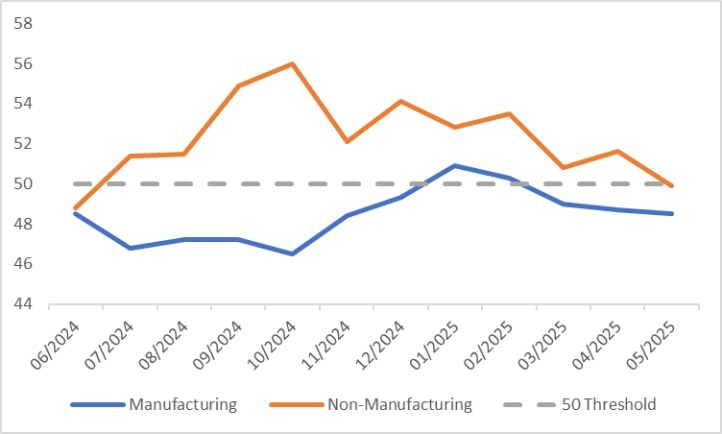

Second, recent high-frequency production data indicates a slowdown in U.S. economic growth. The ISM Manufacturing PMI has remained below the 50 threshold for three consecutive months. The ISM Non-Manufacturing PMI has been declining steadily since its peak in October last year, with May’s latest reading falling back into contraction territory (Figure 4). The bleak outlook for producers is likely to reduce hiring intentions, negatively impacting the labour market.

Figure 4: U.S. ISM PMI

Source: Refinitiv, TradingKey

If the non-farm payroll data falls short of expectations, it could trigger significant market volatility within a day of the release. However, weaker employment figures, combined with delayed reflation, are likely to bolster expectations for Federal Reserve rate cuts. In such a scenario, looser liquidity conditions are expected to outweigh the pressures from a soft labour market, providing a tailwind for U.S. stocks.