FOMC October Meeting Minutes: How Should Investors Respond?

1. Introduction

TradingKey - Amid a U.S. government shutdown and a period of limited economic data, the Federal Reserve’s release of its latest monetary policy meeting minutes and officials’ statements on 8 October will be of paramount importance. As in previous instances, these minutes will detail the Fed’s views on the economic outlook, inflation, employment, and potential directions for future monetary policy. Despite the challenging interplay of a weakening job market and persistent high inflation—raising concerns about stagflation and placing the Fed in a policy dilemma—our analysis of the 17 September FOMC meeting suggests that the upcoming minutes are likely to reflect a predominantly dovish stance among Fed officials. For financial markets, such dovish rhetoric and subsequent policy actions are expected to support U.S. equities and gold prices while exerting downward pressure on the U.S. dollar index.

2. U.S. Stocks

A dovish tone in the Federal Reserve’s meeting minutes, coupled with continued interest rate cuts, will bolster U.S. equities by enhancing liquidity and boosting market risk appetite. While a softening job market and uncertainties surrounding Trump’s policies may pose challenges to the economy, the positive effects of accommodative monetary policy are likely to outweigh the adverse impacts of economic slowdown, providing net support to U.S. stock markets.

If the Federal Reserve’s meeting minutes signal a dovish stance, sectors such as technology and real estate are poised to benefit. Investors should focus on key players in the technology sector, particularly the "Magnificent Seven" (Mag-7), as well as leading real estate companies, including D.R. Horton, Lennar Corporation, and NVR, Inc.

Figure 2: S&P 500 Index

Source: Mitrade

3. U.S. Dollar and Gold

A dovish tone in the Federal Reserve’s meeting minutes is likely to weigh on the U.S. dollar while boosting gold prices. This outlook is driven by three key factors:

· Weaker Dollar Dynamics: In an environment of accommodative monetary policy, non-dollar assets become more attractive, increasing their relative value. Persistent concerns about U.S. fiscal risks and the Federal Reserve’s independence further suggest that the U.S. dollar index will likely remain under pressure.

· Global Monetary Easing and Gold Demand: A dovish Fed stance could encourage broader global monetary easing. Combined with a weakened U.S. dollar credit profile, rising safe-haven demand, and sustained gold purchases by central banks, these factors are expected to drive gold prices to new highs.

· Stagflation as a Catalyst: Emerging signs of stagflation in the U.S. economy inherently favour gold, as its value typically rises in such economic conditions.

After analysing the impact of a dovish Federal Reserve meeting minutes on various asset classes, we now turn to an examination of the current U.S. macroeconomic environment and forecast the tone of Fed officials’ remarks in the October minutes.

Figure 3: Gold Prices

Source: TradingKey

4. Federal Reserve October Meeting Minutes

The Federal Reserve’s meeting minutes, set to be released on 8 October, will serve as a critical focal point for investors this week. We anticipate that Fed officials will continue to express concerns about the employment landscape in these minutes. Following the resolution of the current government shutdown, the U.S. is expected to implement a new round of significant federal workforce reductions. Market consensus suggests that the Trump administration may reduce the federal workforce by hundreds of thousands by the end of this year.

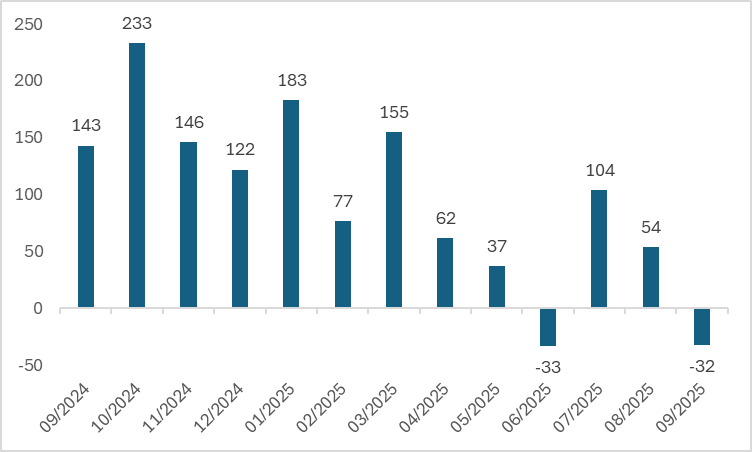

Due to the delayed release of September non-farm payroll data, the ADP employment report has emerged as a key focus. The report indicates a decline of 32,000 private-sector jobs in September, signalling ongoing weakness in the labour market (Figure 4.1). This subdued private-sector employment performance, combined with planned government workforce reductions, is likely to drive a sustained increase in the U.S. unemployment rate over the coming months. Consequently, the labour market outlook is expected to be a central topic in the Federal Reserve’s October meeting minutes.

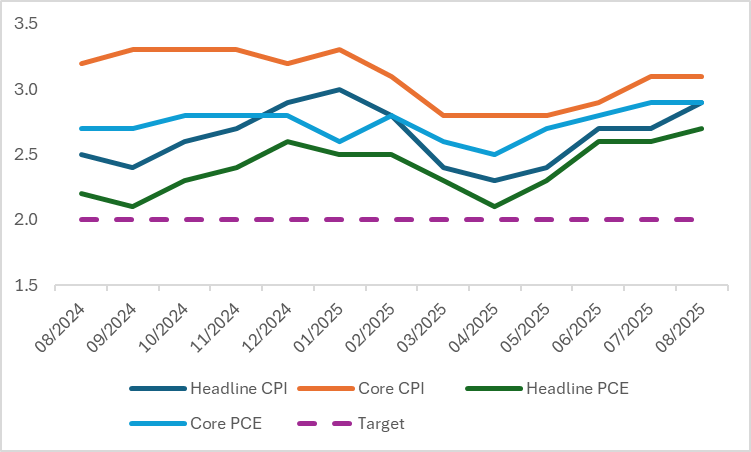

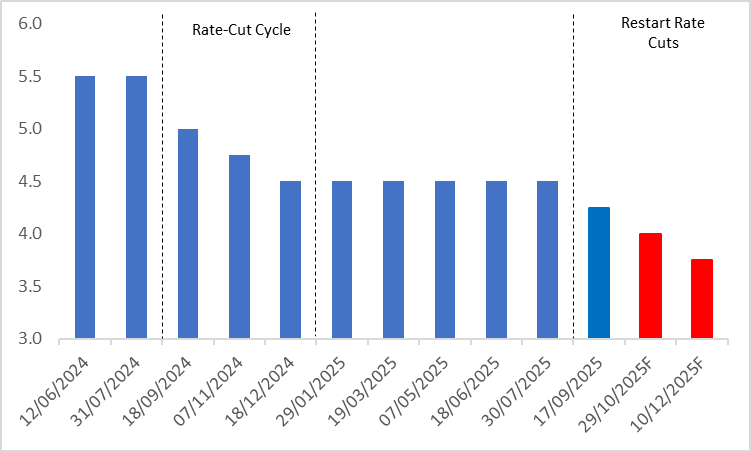

Inflation will undoubtedly be another critical topic in the Federal Reserve’s October meeting minutes. Both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index continue to significantly exceed the Fed’s 2% target, with inflation showing a marked upward trend since April this year (Figure 4.2). The combination of a weakening labour market and persistently high inflation is raising concerns about stagflation, placing the Fed in a challenging policy dilemma. However, based on the 17 September FOMC meeting, we anticipate that the tone of Fed officials in the October minutes will likely lean dovish. We expect the Fed to implement two additional rate cuts of 25 basis points each before the end of the year (Figure 4.3).

Figure 4.1: U.S. ADP Nonfarm Employment Change (000)

Source: Refinitiv, TradingKey

Figure 4.2: U.S. CPI and PCE (%, y-o-y)

Source: Refinitiv, TradingKey

Figure 4.3: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

5. Conclusion

In the context of the U.S. government shutdown and a period of limited economic data, the Federal Reserve’s release of its latest monetary policy meeting minutes and officials’ statements on 8 October will be particularly significant. We anticipate that the minutes will reflect heightened concern among Fed officials regarding the weakening labour market, with their tone likely leaning dovish. Should this occur, such a stance is expected to bolster U.S. equities and gold prices while exerting downward pressure on the U.S. dollar.