June FOMC meeting: Fed Holds Steady Amid Crosscurrents, Why Inaction May Be the Best Policy for Now

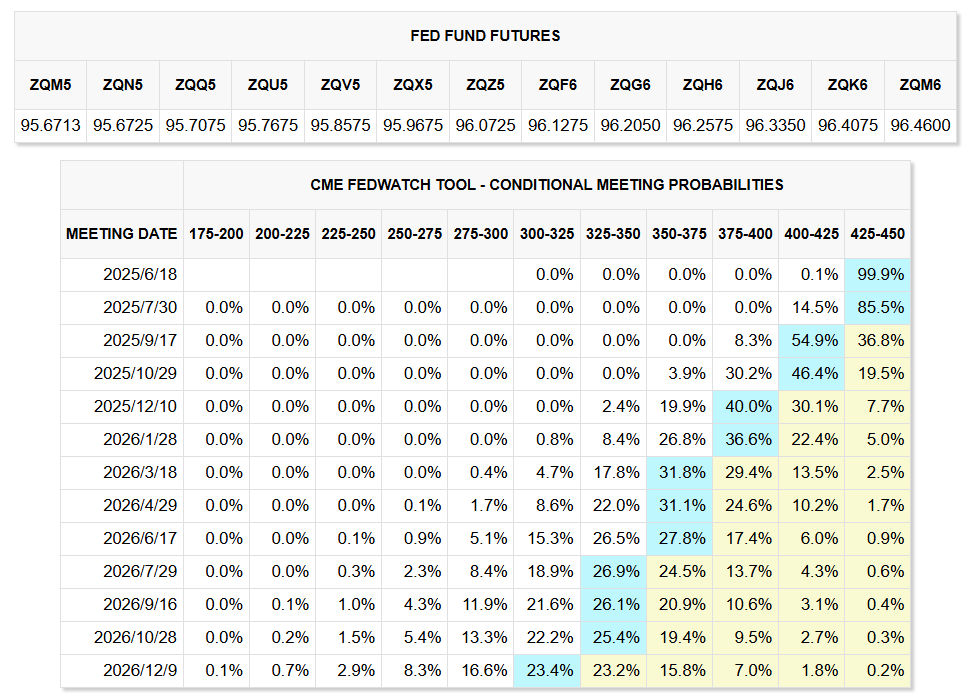

TradingKey - On June 18, the Federal Reserve released the June FOMC statement as scheduled, maintaining the benchmark interest rate at 4.25%–4.50%, in line with market expectations. After Powell's speech, the market quickly digested. The latest dot plot shows that the probability of the Federal Reserve not cutting interest rates in July has increased to 90%, and the annual interest rate cut pricing remains twice, but 7 of the 19 officials believe that there will be no more interest rate cuts this year.

Although the inflation and employment data in May both support the Fed's decision to cut interest rates again, Fed officials released their expectations to the market in advance and repeatedly stated that the uncertainty brought about by tariff policies is the main reason affecting the Fed's decision-making. They are more willing to "wait and see". Therefore, the market has already priced in that the Fed is very likely not to cut interest rates in June.

Data Sources: FedWatch, TradingKey As of: June 18, 2025(Before FOMC was hold)

Fed Maintains Policy Stance but Revises Outlook Wording

In the statement, the Fed revised "uncertainty in the economic outlook has further increased" to "uncertainty has declined, but remains at a high level", which is a significant difference from the FOMC's statement in April. The median U.S. GDP growth projections for 2025 and 2026 were revised down to 1.4% and 1.6%, respectively.

Powell maintained a cautious stance but made dovish-leaning remarks.

At the press conference, Chair Powell expressed overall concerns about short-term inflation and economic uncertainties, yet conveyed a dovish-leaning stance to the market.

- He noted that although April’s tariff policies have "temporarily concluded," the resulting tariff-driven increase in consumer prices will gradually materialize in the coming months.

- The labor market remains "solid," with unemployment consistently low.

- The economy is currently stable, growing steadily at 1.5%-2% despite distortions in GDP structure caused by abnormal net export volatility.

Additionally, Powell explicitly ruled out interest rate hikes, suggesting the Fed may soon reach a position to consider cutting rates.

'Wait and See' becomes the optimal choice

Currently, simmering geopolitical tensions worldwide and escalating political confrontation between U.S. parties make the Fed's "holding steady" arguably the prudent course of action. Domestically, tariff policies will inevitably drive up American living costs. Their delayed reflection in inflation data stems largely from retailers' inventory drawdowns and cooling housing demand suppressing rental prices.

Data Sources: Reuters, TradingKey As of: June 19, 2025

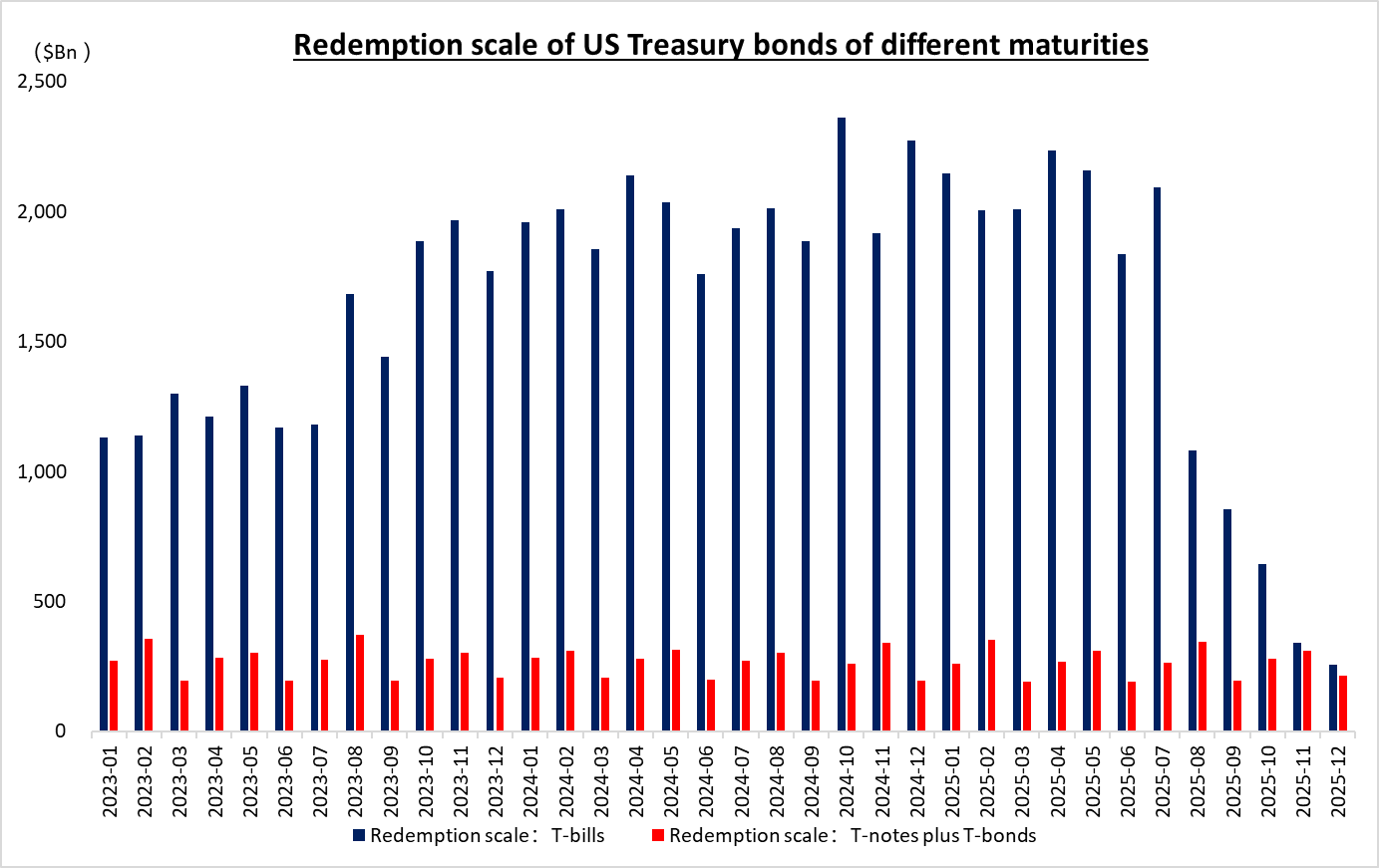

On the other hand, U.S. fiscal discipline has not improved. The "Big Beautiful Bill" vigorously promoted by Trump, if passed, would completely offset the deficit-reduction effects brought about by tariff policies and the Government Efficiency Department. Although Trump has repeatedly criticized and even threatened Powell, the latter must not only consider inflation and employment issues but also maintain the attractiveness of U.S. Treasuries and the dollar. As the scale of U.S. national debt continues to expand, after taking office, Yellen alleviated pressure from maturing interest payments through "borrowing short-term to repay long-term debt." This year, the scale of maturing U.S. Treasuries is enormous, with short-term debt constituting the vast majority. Short-term bond yields are more sensitive to rapid interest rate changes; swift interest rate cuts could reduce market demand for medium- and short-term Treasuries, potentially leading to term mismatches, rising financing costs, and even events similar to the 2023 Silicon Valley Bank incident.

From an external perspective, the risks in the Middle East are rising rapidly, and the war is expected to expand further. The United States, Israel and Iran have a tough attitude. Even if Trump chooses "TACO" again, the escalation of the conflict between Israel and Iran will make oil prices more likely to rise than to fall. In this context, if the Federal Reserve chooses to cut interest rates, it will push up the prices of international bulk commodities, mainly oil, and then domestic inflation in the United States will become difficult to control, and the US economy will move further towards "stagflation."

From an external perspective, risks in the Middle East are currently escalating rapidly, with hostilities likely to expand further. The US, Israel, and Iran maintain hardened stances. Even if Trump were to again opt for “TACO”, escalating conflict between Israel and Iran would keep oil prices more likely to rise than fall. Against this backdrop, should the Federal Reserve choose to cut interest rates, it would further accelerate the surge in international commodity prices — particularly oil — potentially rendering US domestic inflation unmanageable and pushing the American economy deeper into stagflation.